Momento

- Experts

- Gurneet Singh

- Version: 1.0

- Activations: 5

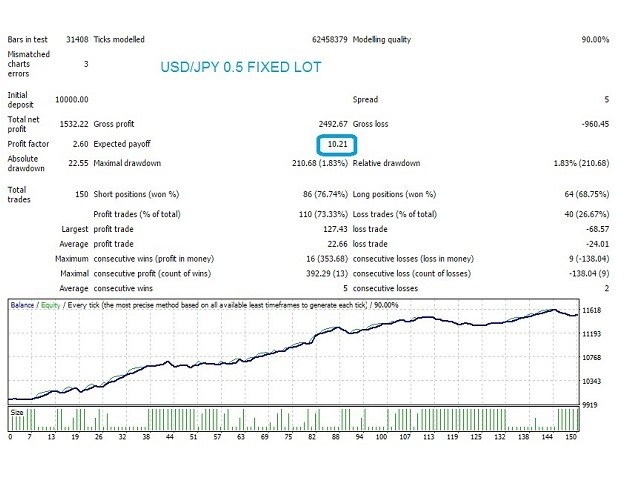

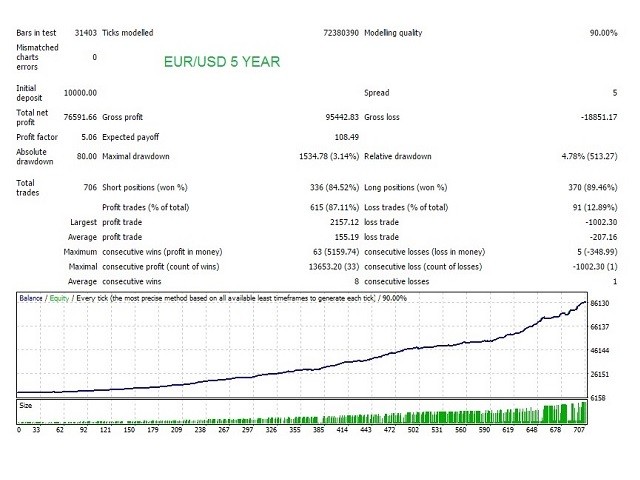

The Expert Advisor itself uses anomalies in momentum to identify short term bursts within the market to capture profit. With the use of the standard deviation and variance, the EA looks for changes in the Average True Range in order to place trades at peaks and troughs within the market that have the highest probability of establishing a new trend. It uses a number of different mathematical principles as well as embedded custom indicators.

When using this expert advisor, there are four requirements in order to allow it to work to its full capability:

You must ensure you are using a PRIME broker, many brokers that are ECN or STP institutions may appear to provide the necessary latency (speed) and execution, however, many of these brokers use a single liquidity provider as opposed to liquidity aggregation. This will result in constant slippage and poor performance of the BOT.

Trading environment – it is imperative that the broker charges a maximum 1 pip fee. For example, on EURUSD trade of 100,000 bought the maximum fee incurred should be 10 USD. It is important to have RAW Spreads, this means the interbank spread not a broker spread with a fee on top. A broker server speed of 5m/s or less is essential, this EA trades on fine margins and a slip above two pips on a constant basis would not maximise the EA’s potential capabilities.

VPS (virtual private sever) – in order for the EA to be as profitable as possible. It is strongly advised that you use a VPS allowing it to run uninterrupted, in a data centre close to the point of execution with a 99.9% uptime. A home internet connection will not be sufficient in order to maximise execution speed.

Economic calendar – this EA needs particular attention during important economic events; although there is a spread filter it trading that would prevent it from trading in high volatility manual intervention is necessary. Just as with automated driving if you take your eyes off the road for too long, you are likely to crash.

Parameters:

- Order Amount = Number of pieces the trade closes in. Proper values between 1-8

- Use dynamic lot calculator = Adapted money management.

- Lot Percent = amount of margin used per trade.

- Volume = Fixed lot size.

- Use volume multiplier = non usd based currencies for 1 pip to equal 1 pip of USD. This has to be off for all non JPY based currencies.

- SL Pips = stop loss - proper values range between 6-12

- TS Step = how often the trailing stop moves.

- TS Jump = Pip amounts it must exceed.

- Pending order expiration minute – number of minutes before pending order expires. Proper values between 1-12

- Running order expiration – number of minutes an open trade will expire. Proper values between 1-12

- Confirmation Bars - number of bars needed before high/low/zigzag is confirmed.

- Frequency tuner – rate at which pending orders follow the market and skip between peaks and troughs. Proper values between 1-18.