Neurolite EA gbpusd

- Experts

- Aliaksandr Salauyou

- Version: 1.4

- Updated: 16 June 2017

- Activations: 7

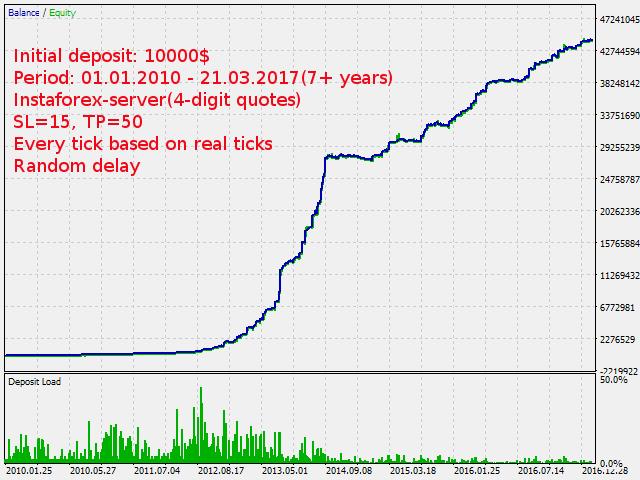

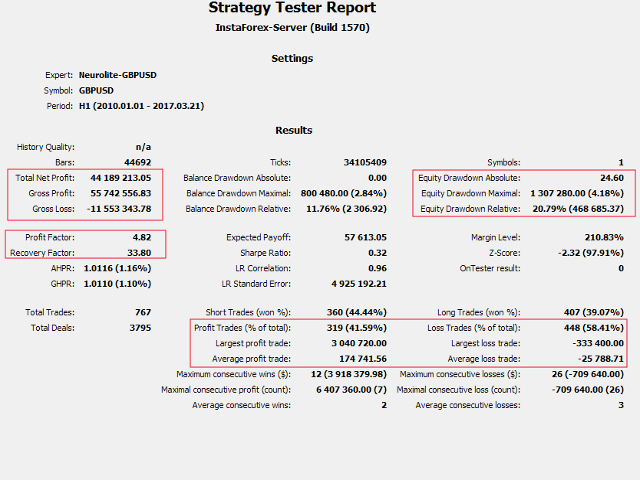

The Neurolite Expert Advisor offers trade decisions based on a neural network trained using a 10-year history of real tick data. The trading is performed only on GBP/USD. Its main peculiarity is a small amount of input parameters so as to facilitate the working process of users. The Neurolite EA will fine-tune all the parameters for you.

Trading Strategy

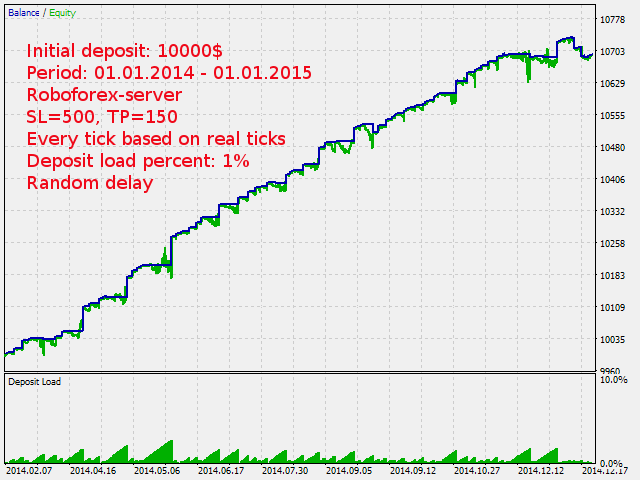

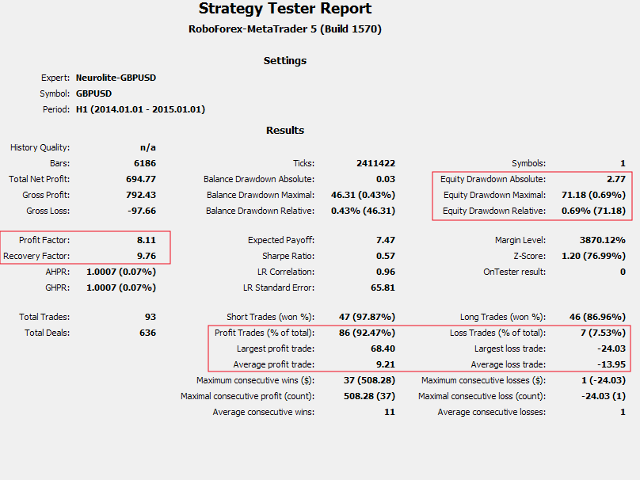

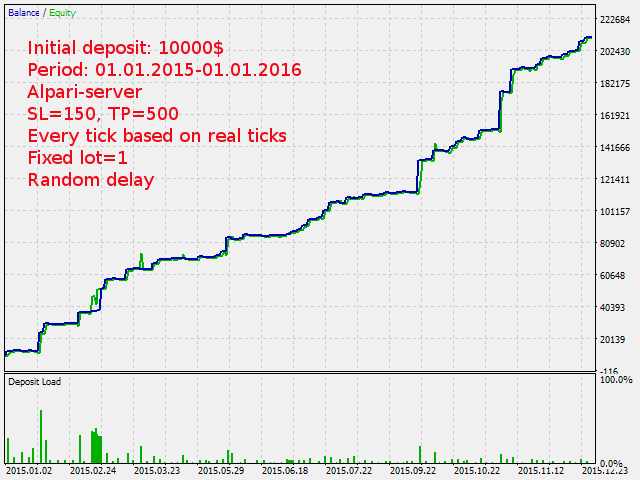

The system does NOT use dangerous strategies such as averaging or martingale, but strictly adheres to the neural network instructions. Stop loss is set for each trade. There is an ability to set both trailing stop and take profit. The EA implements a system of avoiding numerous market entries when positions are closed in a loss. Trading can be carried out with different frequency, depending on the market situation: from 10 trades per day to 1 or 2 trades in a few weeks.

The maximum drawdown depends on the ‘volume_deposit_load_percent’ parameter. You are free to choose favorable risk/profit ratio, although it is also possible to set a fixed lot. You can use the EA on both 5-digit and 4-digit quotes (for 4-digit quotes, decrease the default TP and SL by 10 times). Minimal deposit requirement starts from $100, however, do not forget that the minimal trade volume of your broker might be risky for such a small deposit. The recommended initial deposit is $1000 and higher.

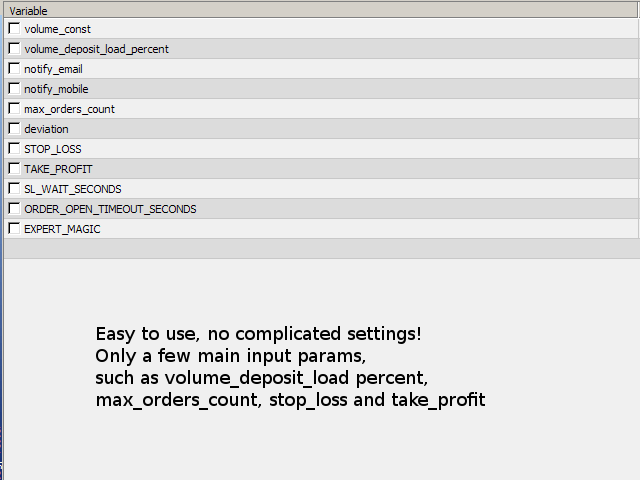

Input parameters

- volume_const - lot size (for using a fixed volume)

- volume_deposit_load_percent - estimated deposit load for the system to follow (set to 0 for fixed volume)

- notify_email (true/false) - email notification about opening or closing a trade

- notify_mobile (true/false) - push-notification to a mobile device about opening or closing a trade

- stop_loss - desired stop loss in points

- take_profit - desired take profit in points (set to 0 to trade without take profit)

- trailing_stop - desired trailing stop in points (set to 0 to trade without trailing stop)

- deviation - maximum acceptable deviation from the requested price, specified in points

- max_orders_count - desired number of positions opened at a time. This parameter together with deposit load influences the lot volume in a trade.

- sl_wait_seconds - the number of seconds to pause trading in the case of an unsuccessful trade. (Already configured, just as order_open_timeout_seconds - change only to experiment)

- order_open_timeout_seconds - the delay in seconds between opening two adjacent trades. (Already configured, just as sl_wait_seconds - change only to experiment)

- non_loss_level - the difference in points between the opening price and the current price, upon which the stop loss is moved to a breakeven (choose 0 to disable this feature)

Made by:

Mikhail Astashkevich and Alexander Solovev – programmers, algorithm and data structure specialists, carrying out research in the field of neural networks and machine learning. Feel free to contact us if any clarification is needed.

User didn't leave any comment to the rating