Delta Pairs

- Indicators

- Anatolii Zainchkovskii

- Version: 1.3

- Updated: 5 February 2019

- Activations: 5

Delta Pairs is an indicator for pair trading, it displays the divergence of two currency pairs. Does not redraw. A useful tool for the analysis of the behavior of two currency pairs relative to each other.

Purpose

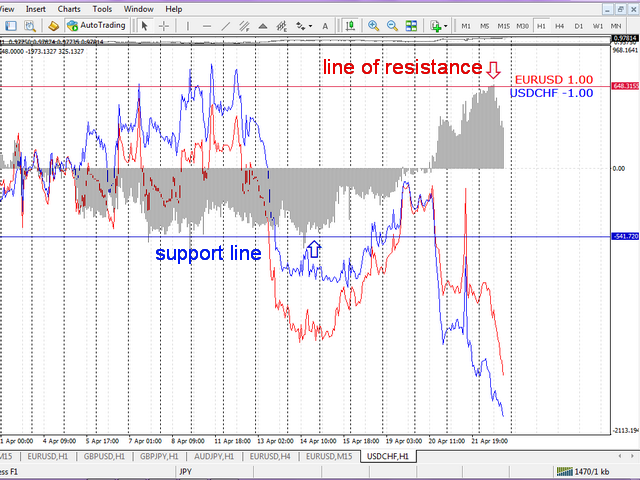

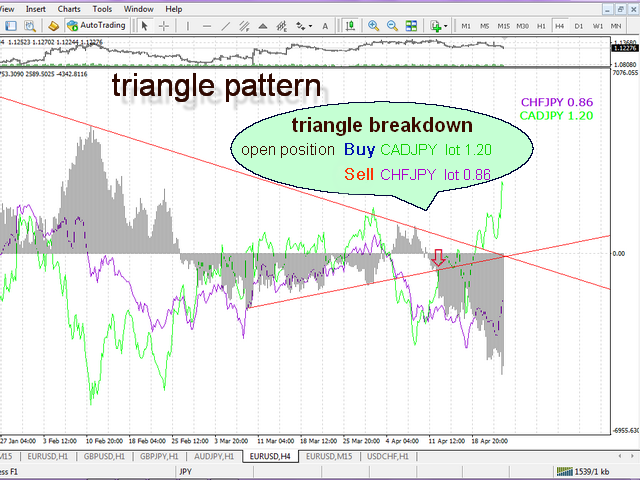

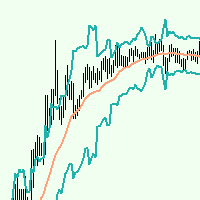

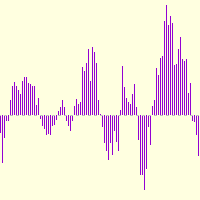

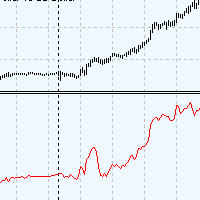

The Delta Pairs indicator is designed for determining the divergences in the movements of two currency pairs. This indicator is displayed as two line charts and the difference (delta) between these charts in the form of a histogram. The Delta Pairs indicator will be useful for those who practice pair trading. This method is based on trading two financial instruments simultaneously, in this case the currency pairs. The point of such trading is to open opposite trades when seeing the maximum divergences of the two currency pairs, and to close the trades when the currency pairs converge. The indicator does not guarantee the currency pairs converging back, this decision is up to you.

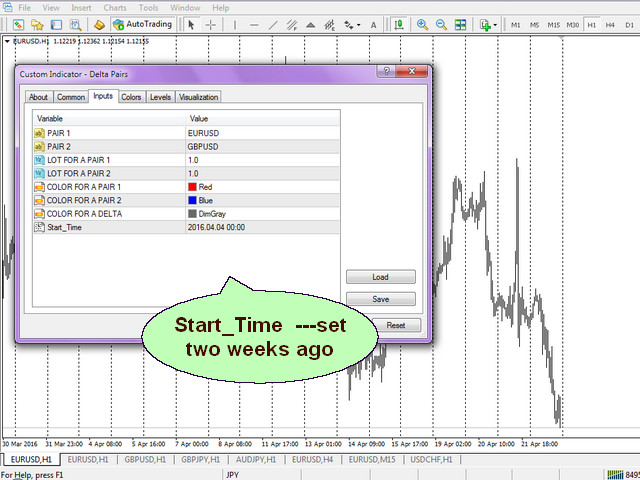

Indicator input parameters

- PAIR 1- currency pair number one (specify the first currency pair, it is important to set it the way it is presented by your broker in the Market Watch in the terminal, for example EURUSD all capitals).

- PAIR 2- currency pair number two (specify the second currency pair, it is usually a currency pair that contains a same currency as in the first pair, specify all in capitals as well, such as USDCHF as the second pair).

- LOT FOR A PAIR 1- lot for the first pair (one lot is set by default, and the line of this currency pair mimics the behavior of the currency pair chart itself).

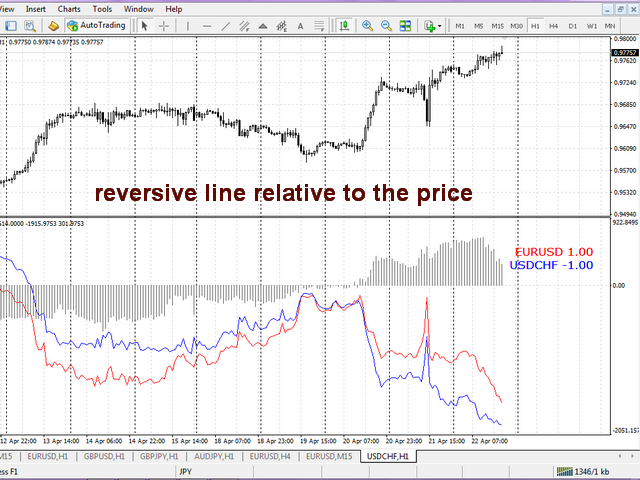

- LOT FOR A PAIR 2- lot for the second pair (one lot is set by default, and the line of this currency pair mimics the behavior of the currency pair chart itself. But sometimes the chart needs to be mirrored, in that case specify a lot of minus one, for example for the USDCHF currency pair).

- Start_Time - the date of origin of the divergence of two currency pairs. Usually a two week old data is used for the hourly chart.

Usage

- Attach the indicator to the chart, specify the currency pairs you want to work with in the Market Watch in advance.

- It is recommended to use the chart timeframe from M15 to H4. Optimally H1.

- Select the lots for the currency pairs, this will provide a histogram of a different nature. The screenshots show a version of a downtrend, a channel version, a triangle version.

Advantages of the indicator

- Does not redraw, i.e. the histogram values do not change over time, except the zero bar.

- The histogram displays the divergence not in points, but in the deposit currency, i.e. each bar of the histogram displays the sum of two open positions with the lots specified in the indicator settings.

User didn't leave any comment to the rating