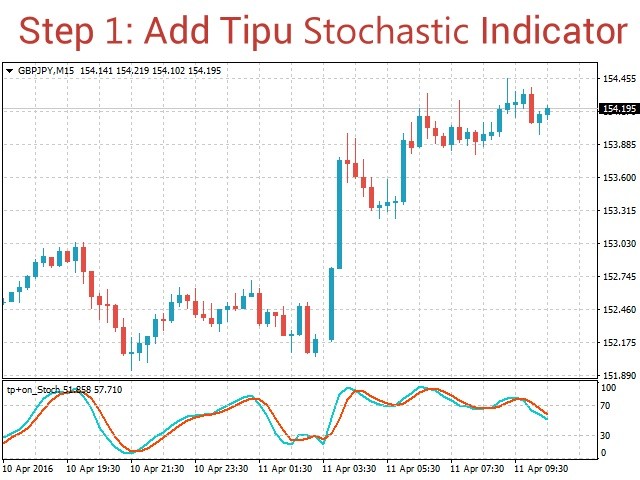

Tipu Stochastic

- Indicators

- Kaleem Haider

- Version: 1.40

- Updated: 29 August 2017

- Activations: 10

Tipu Stochastic is the modified version of the original Stochastic Oscillator published by MetaQuotes here.

Features

- Choose three types of signals (Reversals, Main Signal Cross, and Overbought/Oversold Cross).

- Customizable Buy/Sell alerts, push alerts, email alerts, and visual on-screen alerts.

- Marked overbought and oversold levels.

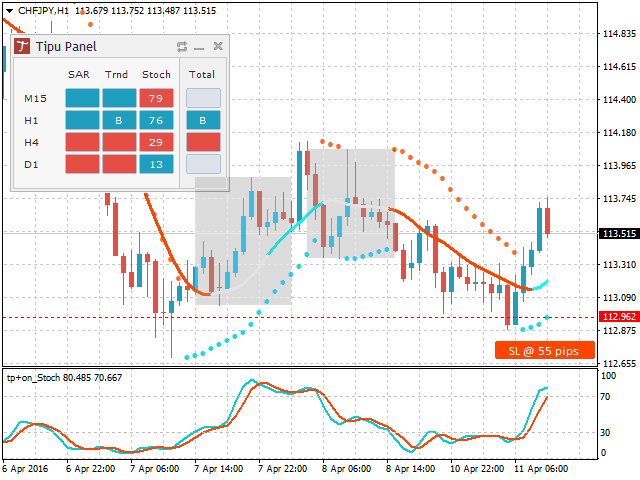

Add Tipu Panel (found here) and unlock the following additional features:

- An easy to use Panel that shows the trend + signal of the selected time frames.

- Show Stochastic values for the selected time frames.

- Customizable panel. The panel can be moved to any place on the chart or minimized to allow more space.

Stochastic Oscillator was devised by George C. Lane in 1950s. It is a momentum indicator that compares the security price close relative to it price range (high - low) over a period of time. According to George Lane, the Stochastic Oscillator does not follow price, it doesn't follow volume or anything like that. It follows the speed or the momentum of the price. As a rule, the momentum changes direction before the price.

How to use

The Stochastic Oscillator goes up when the security price closes in the upper ranges (meaning close is near the high of the period). In a strong trending market, the stochastic can stay in overbought/oversold conditions for a extended period of time. A trade signal may be generated when the stochastic crosses overbought/oversold levels. It may also be generated when the main line reverses direction and starts trending in opposite direction. Stochastic may also be used for the divergence signals. Divergence occurs when the Stochastic directional movement is not confirmed by the price action. For example, a bullish divergence occurs when EURUSD makes lower low but the Stochastic makes higher low. This means that EURUSD is losing momentum and a bullish correction is possible.

The Stochastic crossovers give powerful trading signals when used in conjunction with the trend-line violation, the candle formation, and the support and resistance levels.

Calculation

%K = (CLOSE-LOW(%K))/(HIGH(%K)-LOW(%K))*100

%D = SMA(%K, N)

Full description of Stochastic is available here.

Parameters

- Show Panel? - visibility settings, select true/false to show panel (need Tipu Panel added to the chart).

- Short Name for the Panel - short name for the panel heading on Tipu Panel.

- Panel Display - settings for what to display in Tipu Panel.

- Buy/Sell signal - will display "B" for the buy and "S" for the sell.

- Stochastic plot - will display the Stochastic values on the chart.

- K Period - settings for Stochastic.

- D Period - settings for Stochastic.

- Slowing - settings for Stochastic.

- Average Method - settings for Stochastic.

- Price - settings for Stochastic.

- Overbought - settings for Stochastic.

- Oversold - settings for Stochastic.

- Signal Types

- Mark Buy/Sell Signals - choose Arrow or Vertical Lines or nothing.

- Arrow offset (pips) - (works only if mark buy/sell signals = Arrow) select value to offset Arrows from high (if sell), and low (if buy). Increasing Arrow Offset (pips) move arrows away from the high/lows.

- Buy/Sell Colors - Colors for the marks.

- Reversal - will generate a trade signal when the Stochastic reverses direction. For example, a buy signal will be generated if stochastic was down at previous analyzing candle and is up in the current analyzing candle.

- Main Signal Cross - will generate a trade signal when the main line crosses the signal line.

- OS OB Cross - will generate a trade signal when the main line crosses either the overbought or the oversold level.

- Alert Shift - candle delay for the signal, enter 1 if you want the alert sent after one candle to be passed.

- Alert Mobile - select true/false to get push notification on your device, make sure the device settings are correct here.

- Alert onscreen on change - select true/false to get alert on the terminal, this alert is shown in a separate window.

- Alert email on change - select true/false to get email alerts, make sure email settings are correct here.

Reference

1 Lane, G. (1986) Using Stochastic, Cycles, and R.S.I to the Moment of Decision. Watseka, I.L.: Investment Educators.

我的主打指标就是这个