RSI Breakout Dashboard

- Utilities

- Dominik Mandok

- Version: 2.0

- Updated: 22 June 2020

- Activations: 10

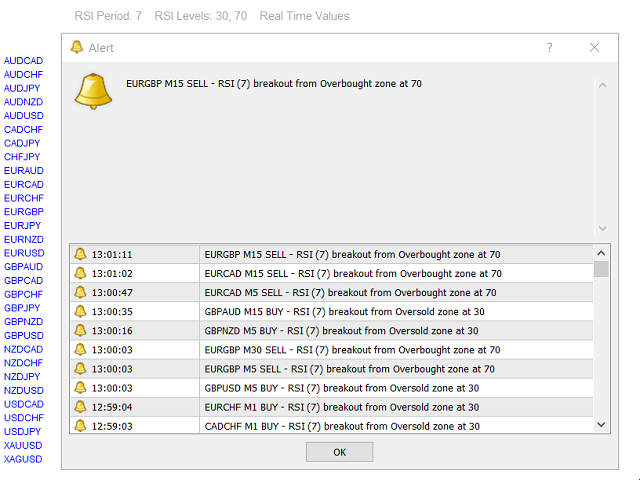

RSI Breakout Dashboard is a tool for multiple currency pairs analysis at the same time in terms of breakout (return) from Oversold or Overbought Zone to Neutral Zone.

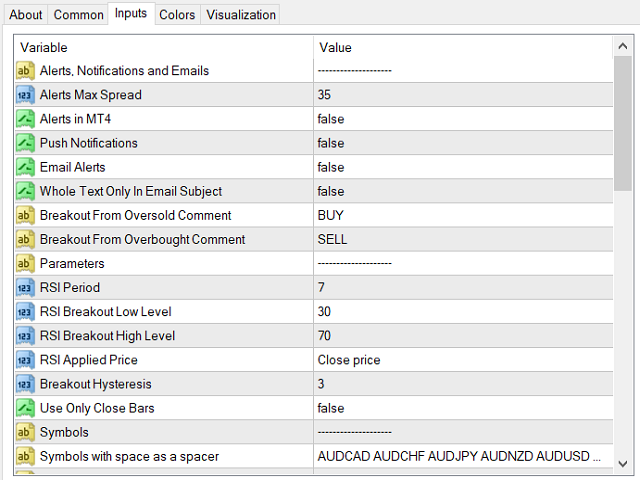

All displayed and used by indicator symbols are free to choose and are specified using a space separated list in parameters, so you're able to analyze not only predetermined ones, but everything that your broker offers, also commodities, equities, indices, ones with prefixes, suffixes etc.

You can choose 3 types of alerts: alert notifications in the MT4 terminal, push notifications to mobile device and email alerts, e.g. sent from VPS.

The most important parameters are period of RSI ("RSI Period"), 2 levels ("RSI Breakout Low Level", "RSI Breakout High Level") and hysteresis ("Breakout Hysteresis"). We get notifications above low and below high level if the value of RSI previously touched high or low level increased or decreased with value of hysteresis (specified in "Breakout Hysteresis" parameter). That gives us opportunity to filter bad/false signals from fluctuations of the RSI value.

The best explanation will be a simple example:

We set three parameters: RSI Breakout Low Level to 30, High Level to 70 and Breakout Hysteresis to 5,

- if the value of RSI touches area below 25 or is equal to (25 comes from "RSI Breakout Low Level" minus "Breakout Hysteresis") indicator saves a fact of oversold state in memory and waits until "RSI Breakout Low Level" (=30) is crossed,

- if RSI goes above Low Level (>30) it triggers alert to BUY (immediately or after closing the bar on specified timeframe, depending on "Use Only Closed Bars" - if "False" it alerts immediately),

- if the RSI goes up further and touches 50, the alert state is reset (>=50) and another alert may occur when the RSI touches overbought or oversold zone and returns to neutral zone again.

In case of overbought it's similar, but inverted - the price goes down and crosses the hysteresis zone back to the neutral zone and gives SELL.

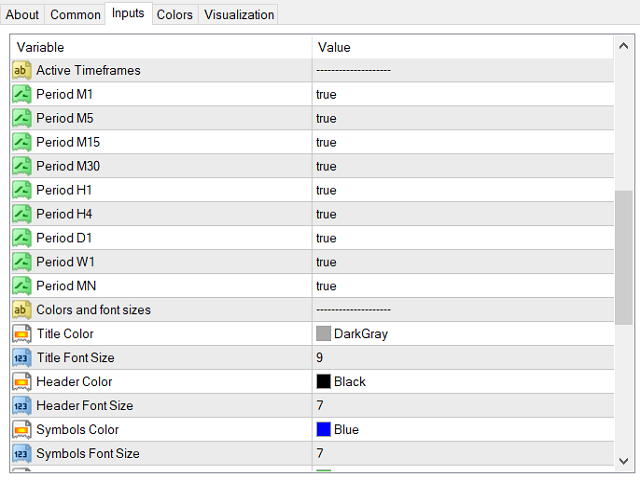

All available timeframes in MT4 are possible to choose in the parameters of indicator, from M1 (1 Minute) to MN (1 Month). On the screen you'll see (as columns) only selected TFs and they will be used for alerts, notifications, emails etc.

For every alert you can add comments: "Breakout From Oversold Comment" (default: "BUY") and "Breakout From Overbought Comment" (default: "SELL"), which are embedded between timeframe and RSI period. Information received in the alerts are: symbol, timeframe, comment, RSI (with given period) breakout from Oversold/Overbought zone at RSI level, eg.: EURUSD M15 BUY - RSI (14) breakout from Oversold zone at 30.

We can also choose whether the whole text of email alert is in the body or in the subject of email message ("Whole Text Only In Email Subject"). When set to False alerts look like:

Subject: GBPUSD

Body (comments on): M15 SELL - RSI (14) breakout from Overbought zone at 70

If we set "Whole Text Only In Email Subject" to True - whole text will be in subject.

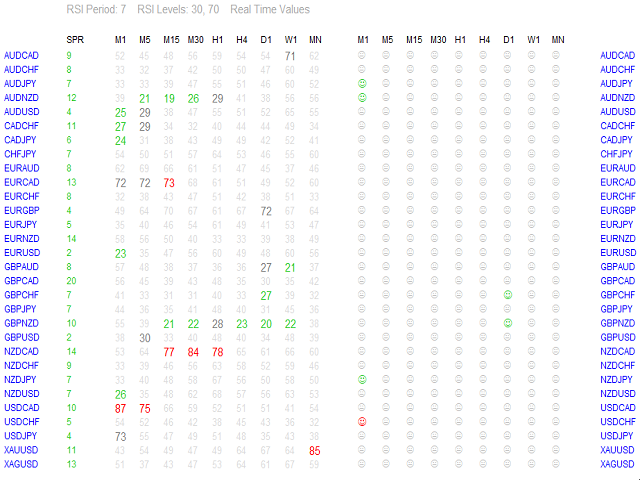

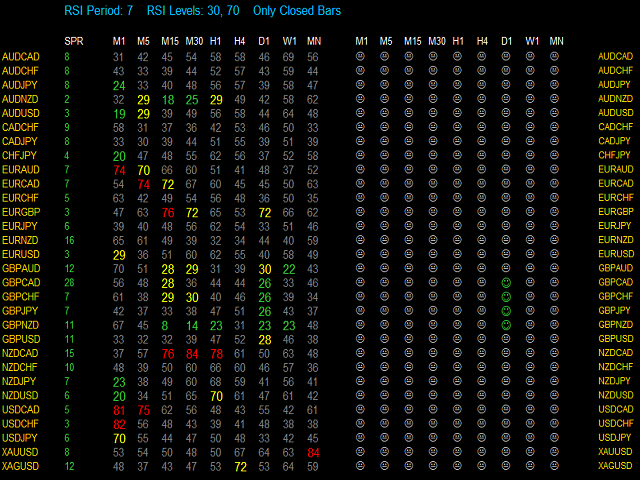

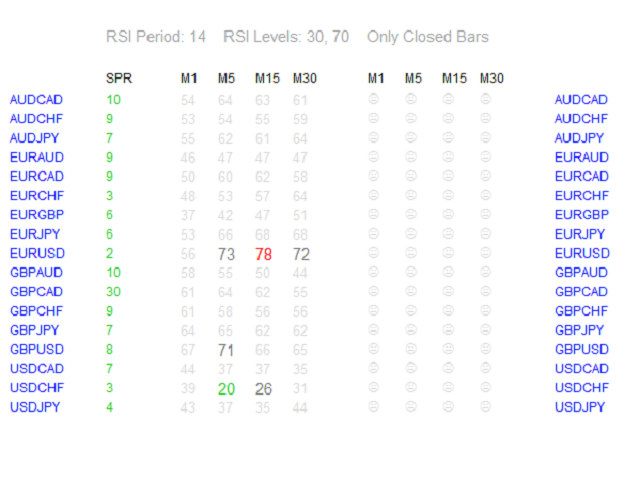

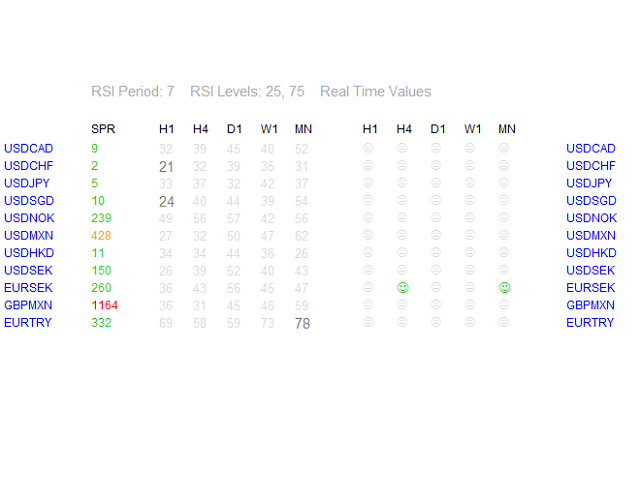

In the header of RSI Breakout Dashboard are displayed 4 actual parameters: RSI Period, 2 RSI Levels and "Real Time Values" or "Only Closed Bars" (depending on parameter "Use Only Closed Bars").

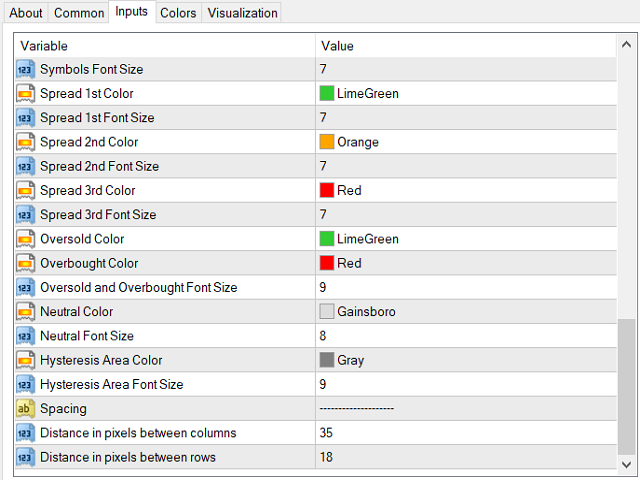

Every color and font size of an indicator is modifiable.

Default colors mean:

Green - RSI is below RSI Breakout Low Level decreased with Hysteresis (Oversold Zone), e.g. 30-5=25.

Red - RSI is above RSI Breakout High Level increased with Breakout_Hysteresis (Overbought Zone), e.g. 70+5=75.

Gray - RSI in Hysteresis area (e.g. between 25 and 30 or 70 and 75).

Gainsboro - RSI in Neutral Zone, e.g. between 30 and 70.

All the smileys show the last state that was triggered (green = BUY or red = SELL) so long as it is not reset to neutral (Gainsboro).

You can set maximum spread at which the alerts will come ("Alerts Max Spread").

Spread values also can have different colors:

a) when it's lower or equal to "Alerts Max Spread",

b) between 1 and 1.5 times higher than parameter,

c) above 1.5 times higher than parameter.

I suggest to make a new template with "RSI Breakout Dashboard" and scheme without colors ("None"), only Background and Foreground set to "White".

Remember, no one except yourself is responsible for any investment decision made by you.

You are responsible for your own investment research and investment decisions.

Good luck!

Dominik's projects and tools are among the most interesting and valuable over here, and the price is fair. First 5 trades using this dashboard were winners. But I still need to build a precise system as regard to SL and TP, and test on the long term. Thank you Dominik.