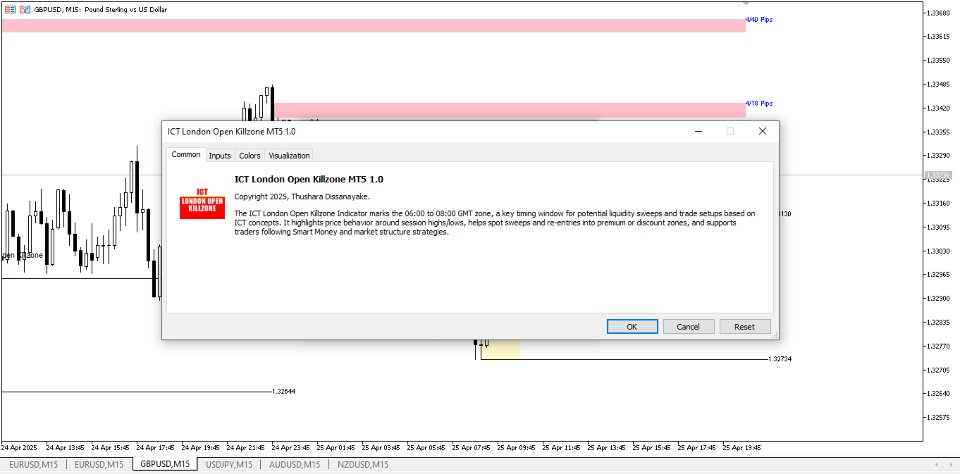

ICT London Open Killzone MT5

- Indicators

- Thushara Dissanayake

- Version: 1.0

- Activations: 20

The ICT London Open Killzone Indicator is a Smart Money based trading tool designed for forex traders who follow institutional concepts such as ICT, SMC (Smart Money Concepts), and liquidity based market structure strategies. This indicator highlights the London Open Killzone, specifically from 06:00 to 08:00 GMT, a session known for its volatility and price displacement due to overlapping liquidity flows between the Asian session and the London market open.

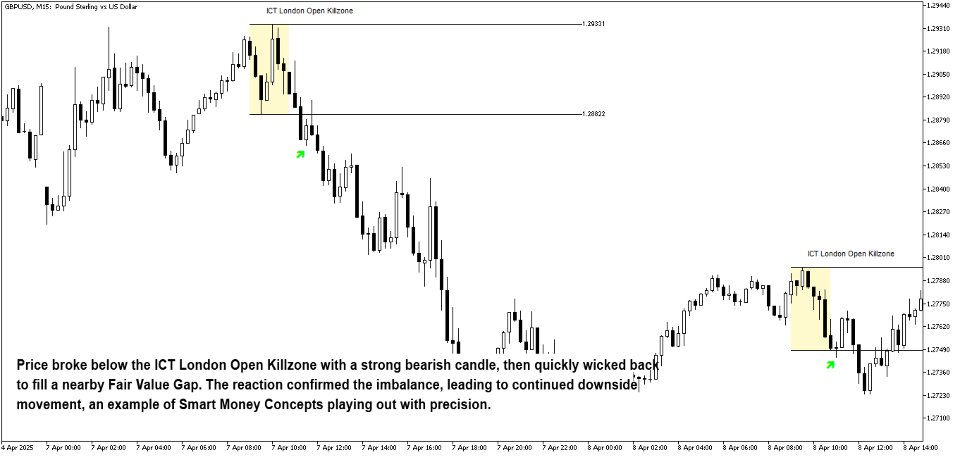

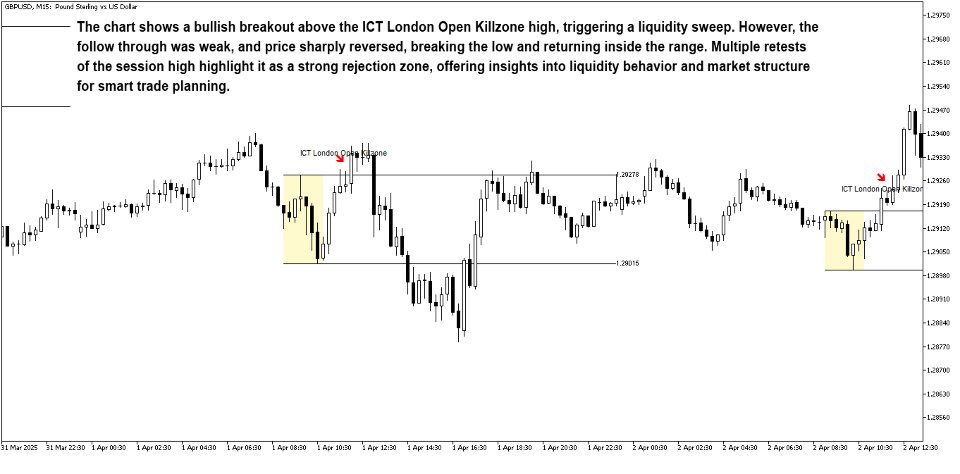

This time window often acts as a trigger zone for high probability setups where market makers conduct liquidity hunts. The indicator automatically marks the Killzone range and identifies sweeps of the previous session's highs and lows, particularly the Asian session range. These liquidity sweeps are critical components of many ICT entry models. The tool helps users analyze whether price has reached premium or discount zones after a sweep, making it easier to align with entry patterns like MSS (market structure shift), break of structure, and FVG (Fair Value Gap) alignment.

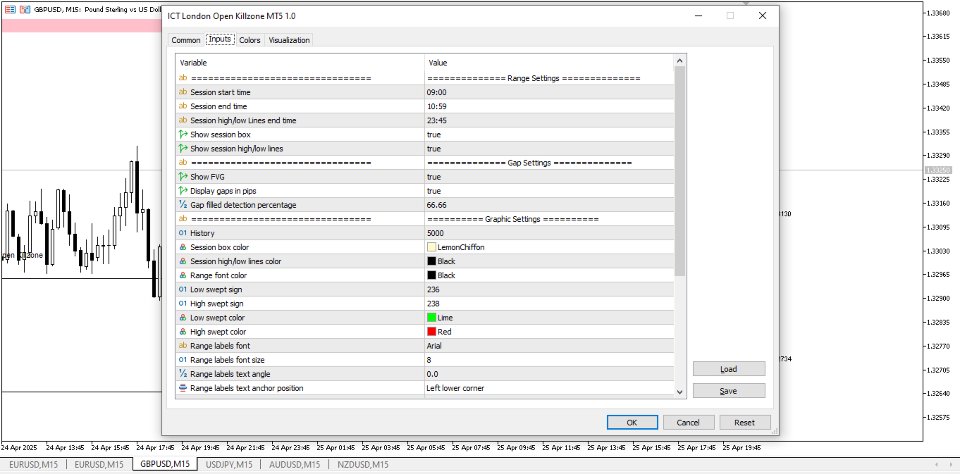

The tool visualizes the session using clearly defined timeboxes, range high/low levels, and symbolic markers that indicate whether price has swept liquidity above or below the range. This provides a high level of clarity when identifying trade opportunities based on session timing, liquidity raids, and price rejections. The inclusion of FVG zone detection further supports those using imbalance based entries within key market sessions.

The ICT London Open Killzone Indicator fits well within a full session trading model, particularly for those applying Smart Money methods during the volatile London open. It complements concepts like order blocks, inducement zones, displacement candles, and engineered liquidity. For traders focusing on session based setups, this tool is useful for identifying market maker ranges, recognizing trap moves, and confirming directional bias after a sweep.

This indicator works best on major forex pairs such as EURUSD, GBPUSD, USDJPY, AUDUSD, and NZDUSD. These pairs typically show strong reaction during the London open, providing cleaner market structure and more consistent liquidity behavior. Traders can use it in conjunction with Asian range indicators, New York range tools, or ICT Killzone strategies to build a complete session model.

It also includes FVG zone plotting, pip gap visibility, and optional gap fill detection to give users a detailed breakdown of price inefficiencies around the Killzone window. Traders can optionally receive alerts when the session high or low is swept, providing real time signals for reentry confirmation or liquidity hunt detection.

This tool is ideal for:

- Forex traders using ICT and SMC based models

- Session traders looking to capture London volatility

- Market structure and liquidity sweep analysts

- Traders focusing on FVG gaps, BOS/MSS, and sweep to reject setups

Key Features:

- Marks ICT London Open Killzone (06:00 to 08:00 GMT)

- Detects liquidity sweeps above/below range

- Visualizes session range with symbolic sweep markers

- Supports FVG zone plotting and gap analysis

- Configurable time inputs and alert system

- Works with major pairs showing session volatility

Use this indicator to assist in finding high quality session entries, filtering out false breakouts, and aligning trades with market maker behavior and institutional activity. Always confirm with your own risk management and trading rules.