Spiral Ascend MT4

- Experts

- DRT Circle

- Version: 2.1

- Activations: 15

Spiral Ascend EA – Smart Automated Trading for XAUUSD

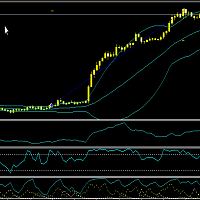

The Spiral Ascend EA is a powerful, fully automated trading solution tailored for the XAUUSD (Gold) market, combining classical Fibonacci methodologies with modern technical analysis and advanced volume-based logic. Developed with flexibility and precision in mind, this EA is ideal for traders seeking a disciplined and logic-driven approach to algorithmic trading—including those working under the conditions of prop trading firms.

Buy Spiral Ascend EA and get CrossPair Spiral EA and PipSpiral EA for free! Only limited to the first 5 buyers. Message in private for more details

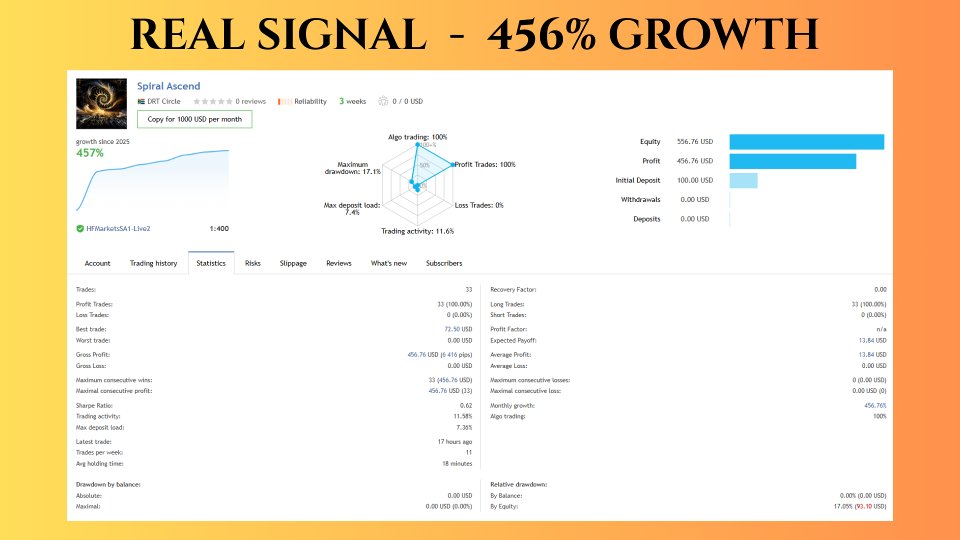

Live Signal 457% Growth: Click here

View our other products: Click Here

Price will increase with $50 after every 5 copies sold, final price $1100

Core Trading Logic:

Fibonacci-Based Strategy

At the heart of this EA is a Fibonacci trading model that enhances both trade entries and exits:

-

Fibonacci Retracements for Entries:

The EA identifies significant price movements and plots Fibonacci retracement levels to locate potential reversal zones. These levels are used to determine optimal trade entries, aiming to improve timing and reduce the impact of false breakouts or premature trades. By anchoring trades at technically significant levels, the EA brings structure and consistency to its decision-making process. -

Fibonacci Extensions for Exits:

Exit points are calculated using Fibonacci extension levels, allowing the EA to target price zones that reflect realistic market expansions rather than arbitrary targets. These levels dynamically adapt to price action, enhancing the EA’s ability to ride profitable trends while maintaining logical and disciplined exits.

Confirmation Through Indicators and Market Context

To avoid trades based solely on Fibonacci levels, the EA incorporates a multi-layered confirmation system using well-established indicators. These indicators work together to validate each potential entry by analyzing:

-

Momentum and Trend Strength

-

Market Conditions: Overbought and Oversold States

-

Price Action Patterns in Relation to Fibonacci Zones

This layered confirmation system filters out noise and improves trade accuracy by only engaging in setups that align across multiple technical conditions.

Volume-Based Decision Making

Unlike many conventional EAs, this system takes a deeper look at the volume structure of the market to evaluate the strength behind price movements. Volume is not just used to confirm trade entries, but also plays a key role in determining exit strategies:

-

If market volume is weak, the EA may tighten targets or avoid entries altogether, recognizing low conviction behind price moves.

-

If volume is strong and trending, the EA may extend take-profit levels toward higher Fibonacci extension zones.

This volume-based adaptation allows the EA to scale its expectations based on real-time market participation and avoid trading into weak or uncertain environments.

Take Profit & Exit Logic: Dynamic and Context-Aware

Take Profit levels are not fixed. Instead, they are intelligently determined by a mix of:

-

Fibonacci extension zones

-

Volume intensity

-

Market being overbought or oversold

-

Additional confirmation from trend-following and momentum indicators

This dynamic exit logic aims to adapt to the market’s behavior rather than relying on rigid or pre-set values, which may not be effective across varying volatility conditions.

Additional Features & Performance Enhancements

While the core logic is centered on Fibonacci and indicator-confirmed entries, the EA includes many additional features designed to support consistency and longevity in trading performance:

-

News Filtering: Avoids trading during major economic news events, reducing exposure to unpredictable volatility.

-

High Compatibility with Prop Firm Rules: Built with a focus on low drawdown, disciplined entries, and controlled exposure—making it well-suited for prop trading environments.