London Session Breakout Strategy MT5

- Indicators

- Thushara Dissanayake

- Version: 1.0

- Activations: 20

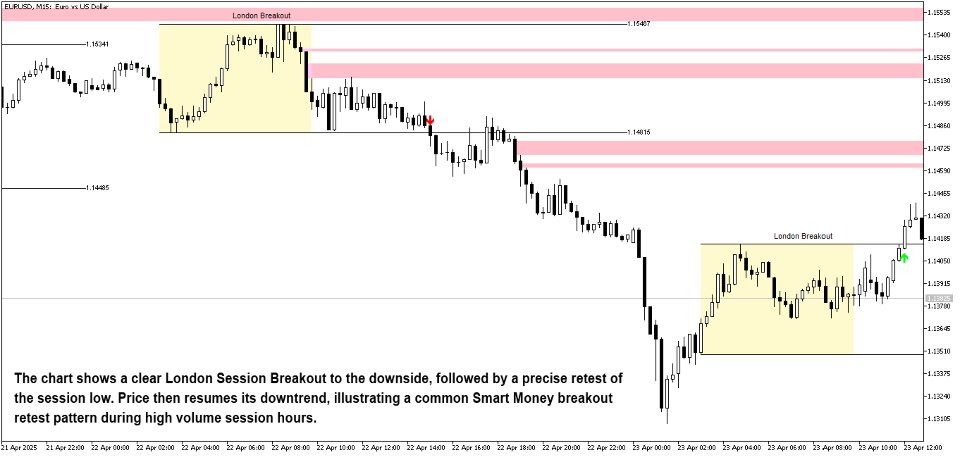

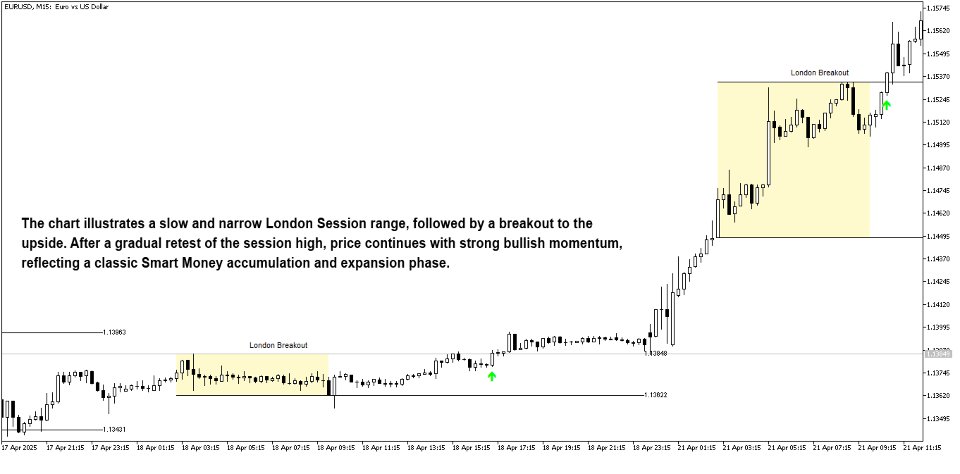

The session high/low lines and breakout signals offer a clear framework for identifying setups based on market structure, breaker blocks, liquidity voids, and imbalance zones. This strategy is particularly useful for traders who look for range formation during the Asian session and wait for price to break out or sweep the range during the London open. Traders can anticipate movement by watching for bullish or bearish sweeps of liquidity and reactions to key institutional price levels.

This tool is ideal for:

- Traders using Smart Money Concepts (SMC)

- ICT strategy followers

- Scalpers and day traders active during London session hours

- Those analyzing Forex session volatility and breakout timing

- Traders focusing on EURUSD, GBPUSD, USDJPY, and other London active pairs

Key Features:

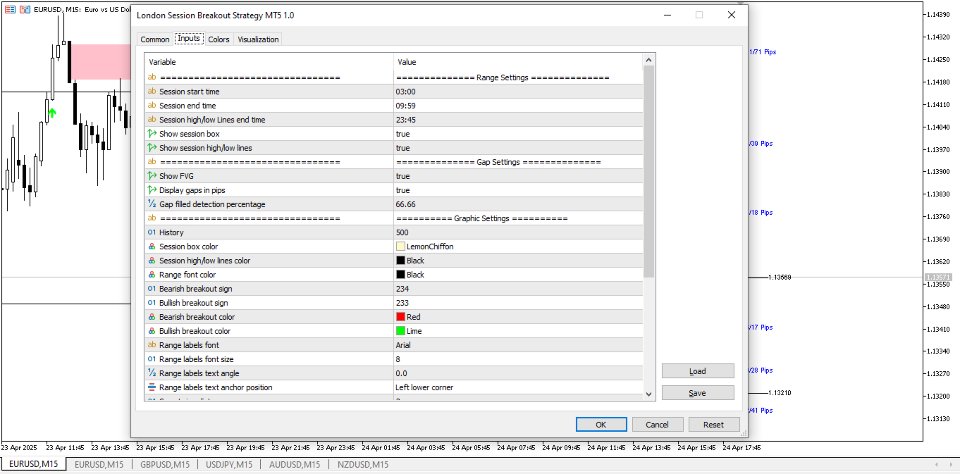

- Defines the London session range from 00:00 to 07:00 GMT

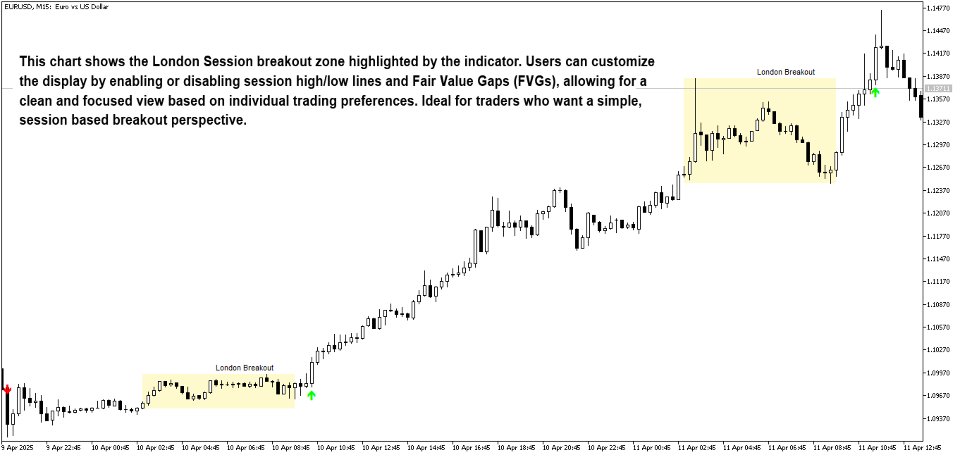

- Marks session high/low levels and session box (TimeBox)

- Detects Fair Value Gaps (FVG) and displays fill progress in pips

- Highlights breakout direction with signs and color coded visuals

- Detects liquidity sweeps and breakout confirmations

- Customizable alert options for mobile, popup, or email notifications

- Configurable session time, color schemes, and label styles

How to Use:

- Observe the Asian session range and market maker behavior before the London open.

- Use the indicator to mark the London session box and monitor the high and low.

- Watch for liquidity hunts and FVGs within or near the session box.

- Wait for breakouts or sweeps and observe price reaction.

- Confirm direction using Smart Money confirmations such as market structure shifts (MSS), breaker blocks, or displacement candles.

- Manage your risk with the help of range boundaries and FVG zones.

- Entry techniques may include:

- Entering on a confirmed breakout after a liquidity sweep

- Using FVG or breaker block levels as entries after price displacement

- Waiting for candle body closures beyond the session range

- Exit techniques may involve:

- Closing partials at pre defined range extensions or FVG completions

- Exiting at opposite liquidity pools or previous session highs/lows

Best used with major currency pairs that are highly active during London hours such as EURUSD, GBPUSD, USDCHF, and USDJPY. Cross pairs like EURGBP or GBPAUD can also offer clean setups, especially when aligned with Smart Money Concepts.

This indicator supports structured, repeatable setups based on institutional trading behavior. It offers clarity through its clean display of session range, breakout zones, and price imbalances. By combining session analysis with market structure and liquidity principles, this tool enhances decision making without relying on lagging indicators.

The London Session Breakout Strategy Indicator offers a balanced view of price action during one of the most volatile trading windows, supporting traders in building high quality setups using ICT, SMC, and liquidity driven strategies.