PipSpiral

- Experts

- DRT Circle

- Version: 2.1

- Activations: 15

Advanced Multi-Pair Fibonacci EA for GBPUSD, EURUSD, and USDJPY

This expert advisor is a sophisticated, multi-layered trading system specifically developed for three major currency pairs: GBPUSD, EURUSD, and USDJPY. Designed with precision and strategy in mind, it integrates the power of Fibonacci analysis, technical indicators for confirmation, and volume-based market assessment to identify high-probability trade setups while carefully avoiding overbought and oversold conditions.

Buy PipSpiral EA and get CrossPair Spiral EA for free! Only limited to the first 5 buyers. Message in private for more details

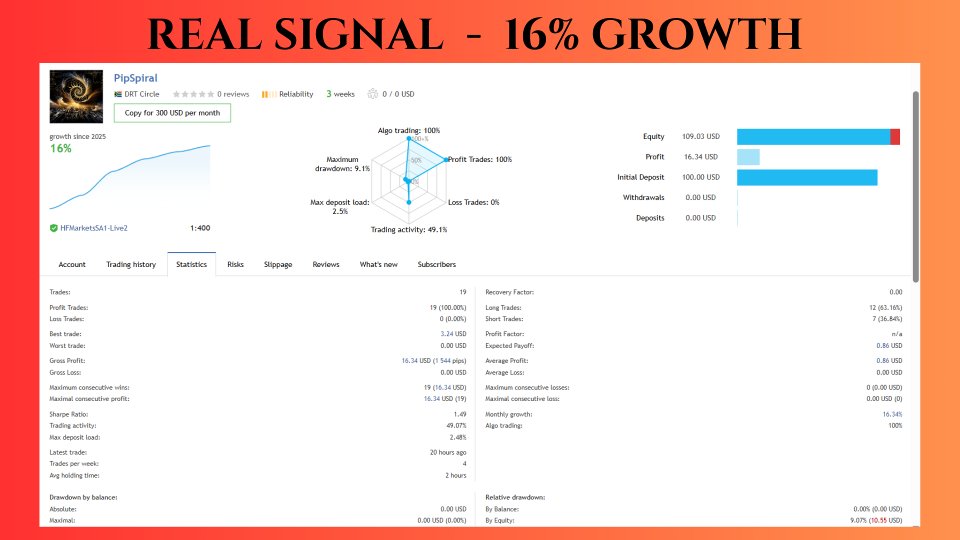

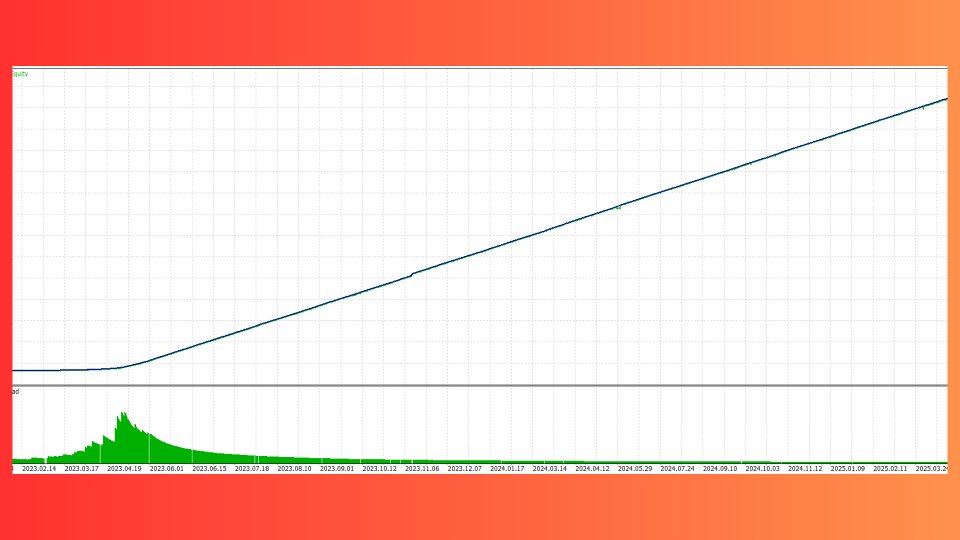

Live Signal 16% Growth: Click here

View our other products: Click Here

Price will increase with $50 after every 5 copies sold, final price $600

Core Logic & Strategy

At the heart of this EA lies the Fibonacci retracement and extension methodology. Fibonacci retracement levels are utilized to identify precise and strategic entry points based on pullbacks within trending markets. This enables the EA to capitalize on price reversals and continuations with improved timing accuracy. To manage trades, the EA employs Fibonacci extension levels as dynamic exit points. These are recalculated in real-time and are used to determine optimal Take Profit targets based on current market momentum.

The use of Fibonacci is not standalone — instead, it forms the backbone of a confirmation-based strategy that incorporates:

-

Technical indicators such as trend oscillators and momentum filters

-

Volume analysis, assessing the underlying market strength before entering or exiting a trade

-

Dynamic overbought and oversold filtering, using both traditional oscillators and adaptive signal analysis to avoid trades during unstable or exhausted market phases

Volume-Driven Take Profit Targeting

One of the EA’s key features is its ability to adjust its Take Profit levels based on the current volume and momentum of the market. Rather than relying on fixed TP levels, it evaluates whether the volume confirms the directional strength and whether the market conditions are aligned with continuation or possible reversal signals.

-

If the volume is strong and trending is confirmed, the TP may extend further.

-

If the market shows signs of exhaustion or divergence, the EA will dynamically adapt and secure exit around more conservative Fibonacci extensions.

The system intelligently avoids entries when volume is thin or when indicators detect price action that is overly extended in either direction, helping to reduce exposure to false signals.

Multi-Indicator Confirmation

To further refine entry and exit decisions, the EA uses a multi-confirmation approach. Before entering any position, the EA checks confluence across several technical layers. These may include moving average alignment, oscillator readings, and other internal custom-built logic modules.

The EA is also equipped to:

-

Detect short-term volatility spikes

-

Confirm trend continuation through internal filters

-

Avoid ranging or choppy market zones based on historical price behavior and volume thresholds

Prop Firm Friendly

This EA has been structured with prop trading firm conditions in mind. Its risk-conscious architecture, combined with a measured and adaptive strategy, makes it suitable for use under typical prop firm constraints such as drawdown limits, lot size regulations, and trading session restrictions. Users have the flexibility to adjust key parameters to tailor the strategy to specific funding firm rules or personal account goals.

Complex Logic, Simplified Execution

Though the internal strategy is advanced and multi-faceted, the EA has been designed for ease of use. Once attached to the chart, it performs all the heavy lifting — analyzing, filtering, confirming, and executing — allowing traders to focus on monitoring and optimizing their broader strategy.

Whether you're an experienced trader looking for a logic-rich tool or a prop firm participant seeking a consistent and structured EA approach, this system offers a well-rounded balance of technical analysis, volume dynamics, and adaptive strategy logic.