CrossPair Spiral

- Experts

- DRT Circle

- Version: 2.1

- Activations: 15

Multi-Pair Fibonacci Precision EA for AUDUSD, USDCAD, and USDCHF

Strategic. Analytical. Volume-Aware. Built for Prop Firm Trading.

This Expert Advisor is an advanced algorithmic trading system that combines technical precision with dynamic adaptability, crafted specifically for trading the AUDUSD, USDCAD, and USDCHF pairs. It operates using a core strategy centered around Fibonacci levels, enhanced by multi-layered indicator confirmations and a sophisticated volume analysis engine to improve decision-making at every stage of a trade. Its design is particularly well-suited for prop firm accounts, thanks to its consistent logic, intelligent risk handling, and non-aggressive trade behavior.

Buy CrossPair Spiral EA and get PipSpiral EA for free! Only limited to the first 5 buyers. Message in private for more details

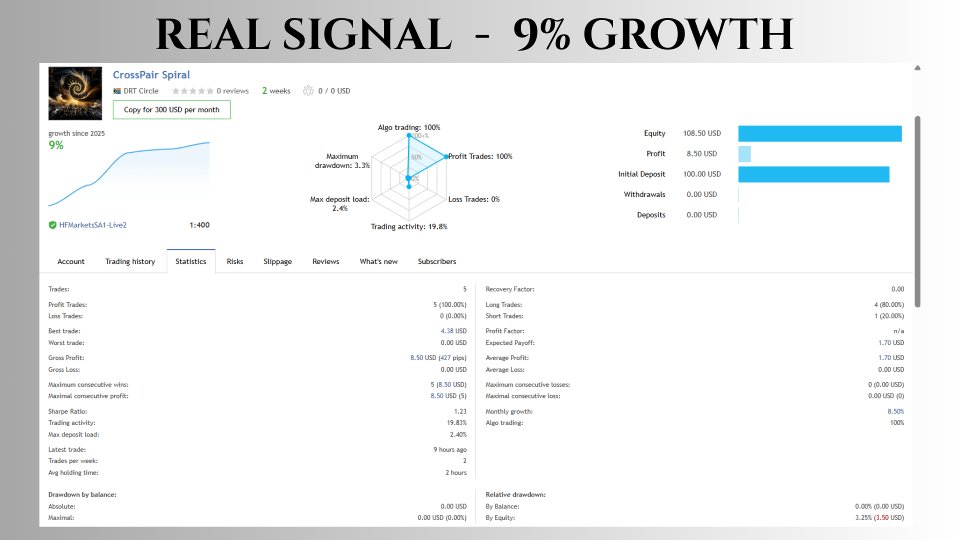

Live Signal 9% Growth: Click here

View our other products: Click Here

Price will increase with $50 after every 5 copies sold, final price $600

Core Logic: Fibonacci-Based Entry and Exit Framework

At the heart of this EA lies a powerful Fibonacci strategy, implemented with meticulous precision. The system automatically identifies key retracement levels based on recent market swings, allowing it to define areas of high-probability entries. These zones are evaluated dynamically in real-time, ensuring that the EA adapts to current market structure rather than relying on fixed or outdated parameters.

Fibonacci Retracement Levels are used to time trade entries after pullbacks within a trend or corrective structures. Once a valid retracement is detected, the EA looks for alignment with its internal indicator set to validate the trade before execution.

To exit positions, the EA utilizes Fibonacci Extension Levels, which help project realistic and technically appropriate price targets. The extensions aren’t arbitrarily selected — they’re filtered and confirmed through volume pressure, market condition, and signal confluence, ensuring that exits occur at structurally logical points in the market, rather than fixed pip distances.

Multi-Indicator Confirmation System: Signal Quality over Signal Quantity

The EA avoids blind trades by implementing a multi-indicator confirmation system, which plays a crucial role in filtering out weak or false signals. Rather than relying on one indicator, this EA uses a blend of time-tested technical indicators that together build a robust signal confirmation environment.

Each potential trade must pass through a series of confirmations that may include but are not limited to:

-

Trend indicators to establish directional bias (e.g., Moving Averages, MACD)

-

Momentum oscillators to prevent trading in overbought or oversold zones (e.g., RSI, Stochastic)

-

Volume-weighted metrics to determine market commitment and signal strength

-

Volatility measures to avoid entering during low-liquidity or erratic spikes

This layered approach means the EA avoids impulsive trades and focuses only on setups with a statistically higher likelihood of success.

Volume Analysis: Measuring the Strength Behind the Move

Volume is a key factor in this EA's decision-making process. Many strategies overlook volume — this one doesn't. The EA integrates volume analysis to assess market conviction, using it both at entry and exit points. Volume serves as the heartbeat of the market, revealing whether price movement is supported by real participation or simply noise.

Volume is used in three primary ways:-

Entry Confirmation: Low-volume pullbacks are filtered out to avoid entering trades lacking momentum. Conversely, high-volume reversals within retracement zones are treated as signals of strong interest.

-

Exit Optimization: The strength of the move toward a Fibonacci Extension level is evaluated in real-time. If volume begins to wane or if the market enters a low-liquidity period, the EA adjusts the take-profit levels accordingly.

-

Dynamic Filtering: The EA may cancel trades altogether if volume diverges from price, preventing entries during potential traps or news-related distortions.

This system ensures that both entries and exits are not just based on price but on the weight behind that price movement.

Additional Features and Logic Enhancements

While Fibonacci and volume confirmation form the core, the EA is also loaded with supporting systems and refinements to boost performance and ensure adaptability across various market environments. These include:

- News Filter – Avoids trading during high-impact economic releases that could disrupt technical structure.

Take Profit Logic: Not Just a Number, But a Context

Take Profit levels in this EA are context-sensitive, not predefined or rigid. The TP level is a product of:

-

Fibonacci Extension Alignment

-

Volume Strength and Market Participation

-

Overbought/Oversold Conditions

-

Technical Signal Agreement

This allows the EA to take profits when the market provides optimal exit points rather than arbitrary levels. If market conditions suggest an extension beyond the first target, the EA will adapt — if conditions weaken, it will scale down TP targets or close early.

Designed for Prop Firm Environments

One of the key design goals of this EA is compliance with the rules and risk limitations of proprietary trading firms. Many EAs overtrade or use aggressive methods like martingale or grid strategies — this one does not.

Features that make it prop firm friendly:

-

Risk-conscious trade sizing and frequency

-

No martingale, no grid, no hedge stacking

-

Consistent logic with steady trade volume

-

High trade quality with conservative exposure

-

Avoids major drawdowns and unrealistic spikes