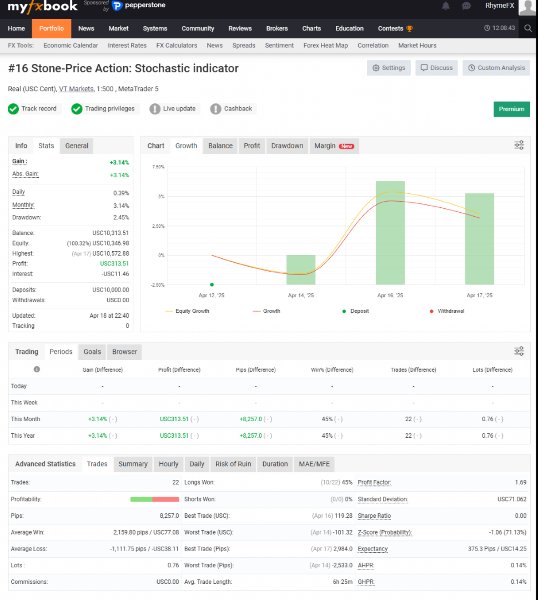

Price Action Stochastic indicator

- Experts

- Thawinchai Waharam

- Version: 1.0

- Activations: 5

Price Action Stochastic indicator

🔍 1. Utilizing the Stochastic Indicator Signal

This system detects crossover signals from the Stochastic Indicator within specific thresholds and uses the EMA (Exponential Moving Average) as a trend filter to identify high-probability entries:

-

Buy Entry: When Stochastic Main < 20, crosses above the Signal line, and price is above EMA → Enter Buy

-

Sell Entry: When Stochastic Main > 80, crosses below the Signal line, and price is below EMA → Enter Sell

🧱 2. Signal Filters for Enhanced Accuracy

-

EMA Filter: Only enter Buy when price is above EMA / Sell when price is below EMA

-

ADX Filter: Avoid trades in non-trending markets (no entries if ADX < 10)

-

Spread Control: Prevent entries when spread is too high

-

Price Distance from EMA: Avoid trades if price is too far from EMA to reduce volatility risk

🚀 Core Features of the EA

-

Customizable Timeframes: Supports M1–H4 with adjustable filter parameters

-

Risk Management System: Lot size based on equity, Max Drawdown settings

-

Adjustable SL & TP: Support for Risk-Reward ratios like 1:2, 1:3, or user-defined

-

Trailing Stop System: Lock in profits as price moves in favorable direction

-

24/7 Automation: Enables consistent passive income generation

🧭 Recommended Usage of Stochastic EA

-

Platform: MetaTrader 4/5 (MT5 recommended)

-

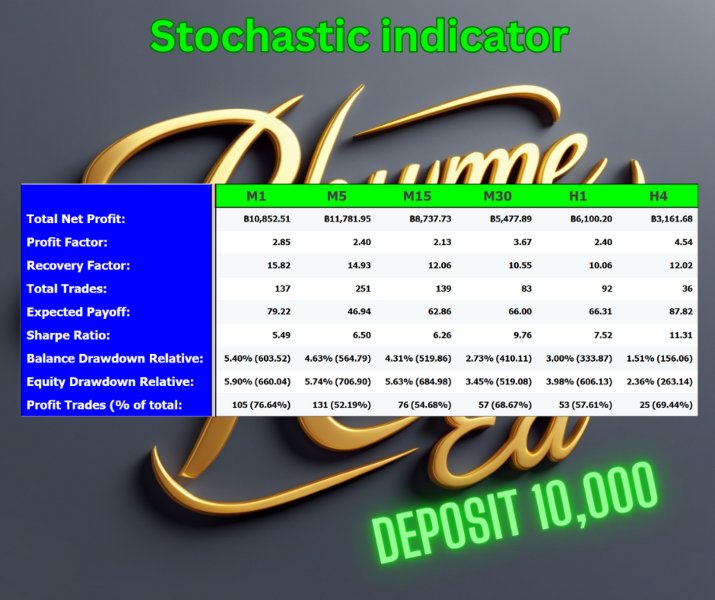

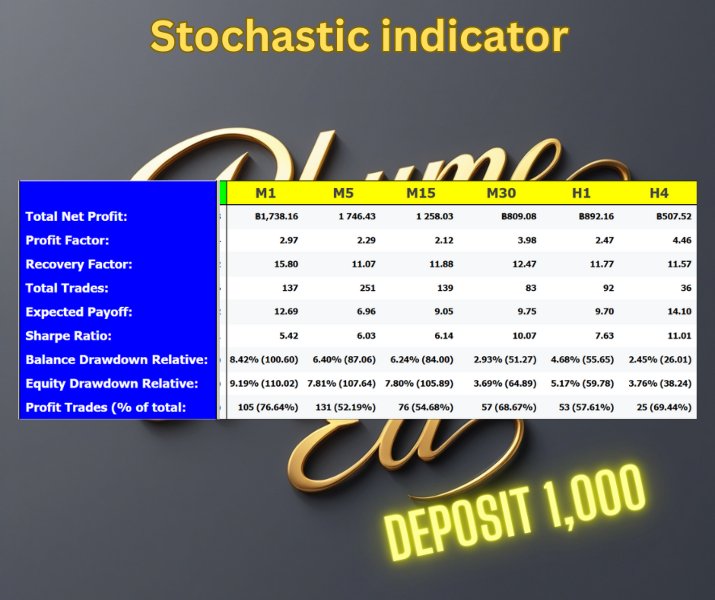

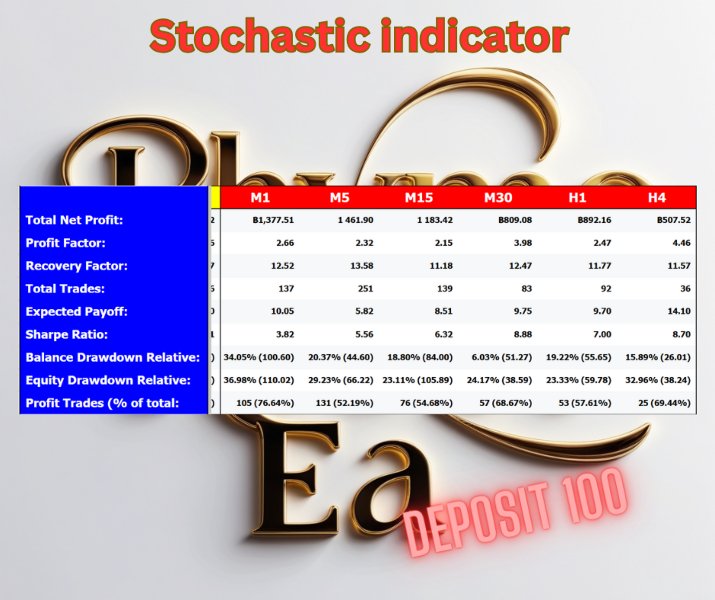

Timeframe: M30 (30 minutes), 6 set files avilable for M1, M5, M15, M30, H1 and H4

-

Currency Pair: XAUUSD (Gold vs. USD)

-

Minimum Capital: Atleast $100 (>$1,000 recommended for optimal performance)

-

Broker: Trusted broker with low spread

✅ Pros & ❗ Cons

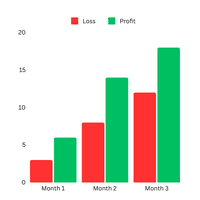

✅ Strengths:

-

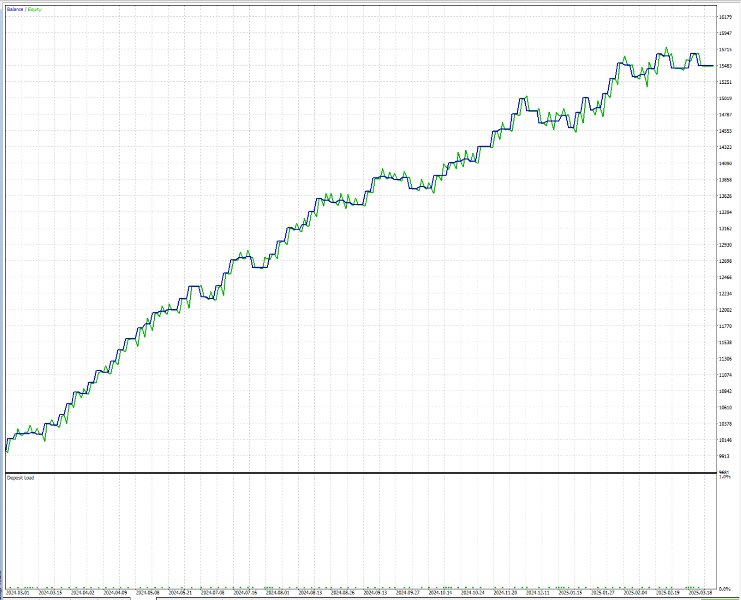

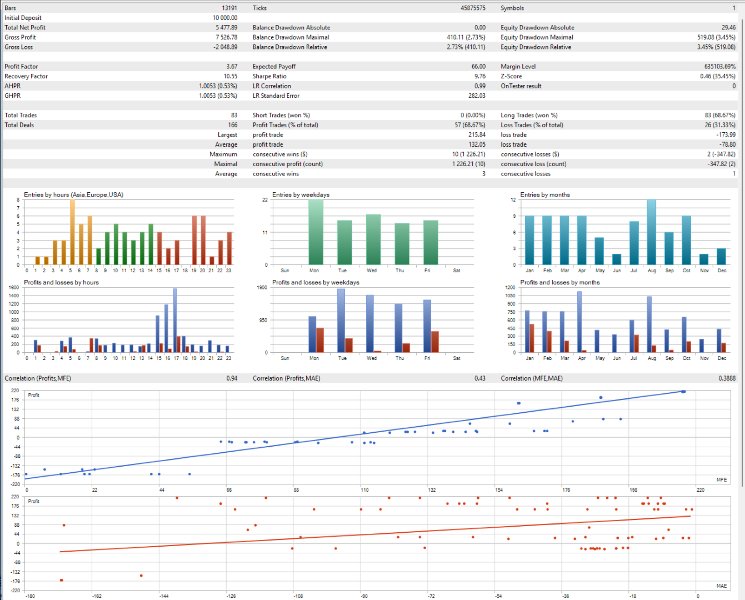

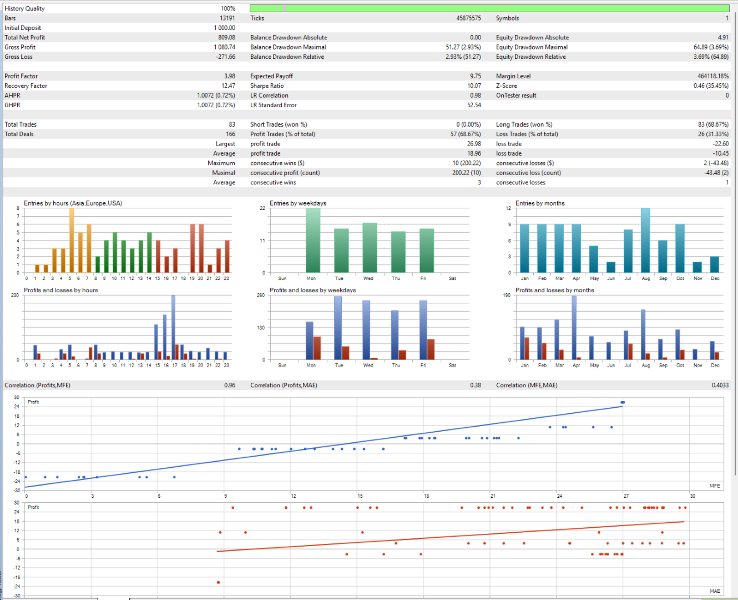

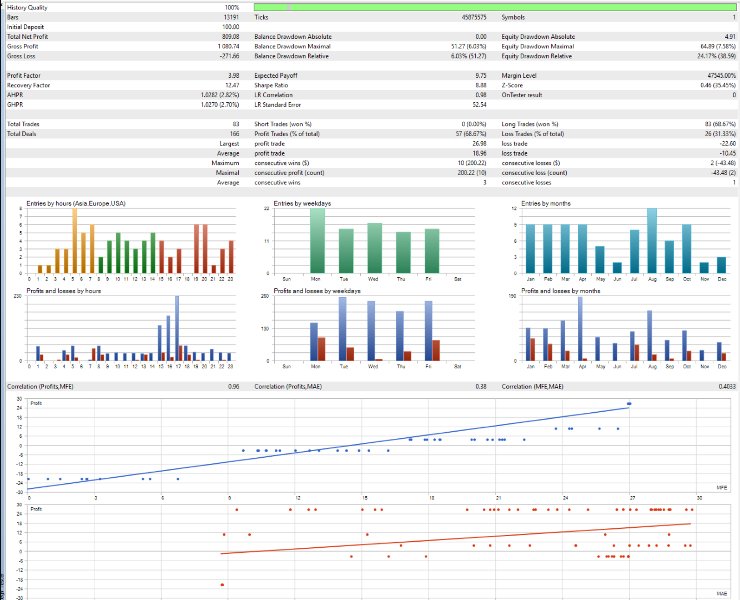

Win rate: 65-93%(depended on timeframe), Drawdown < 4% (on $10,000 capital)

-

$8,613 profit in 1-year backtest

-

Effective risk control and verified real tick-level backtest results

❗ Limitations:

-

Low-frequency entries (capital preservation focus)

⚙️ EA Parameter Overview

Core Strategy

-

TimeFrame = 30M

-

EMA_Period = 319

-

STO_Precent_K = 16

-

STO_Score_Buy = 22

-

STO_Score_Sell = 100

Signal Filters

-

Spread = 40

-

ADX_Period = 44

-

ADX_Score = 12

-

Distance_near_EMA = 5800

-

Distance_far_EMA = 0

Risk Management

-

Lot_Devided = 200,000

-

SL = 2130 pips / TP = 2690 pips

-

Trailing Stop = 1290 pips, Step = 700, Start = 980

Advanced Options

-

On_Recovery = false

-

Consecutive_losses = 2

-

Recovery_Lot = 2.0

💡 Example of Lot Calculation Based on Capital

-

Capital $10,000 → 10,000 / 200,000 = 0.05 Lots

-

Capital $1,000 → 1,000 / 100,000 = 0.01 Lots

-

Capital $100 → 100 / 200,000 = 0.01 Lots (rounded up)

📌 Professional, algorithmic trading powered by precise signal filtering and adaptive risk control.