Gohan EA

- Experts

- Domantas Juodenis

- Version: 1.1

- Activations: 20

Description

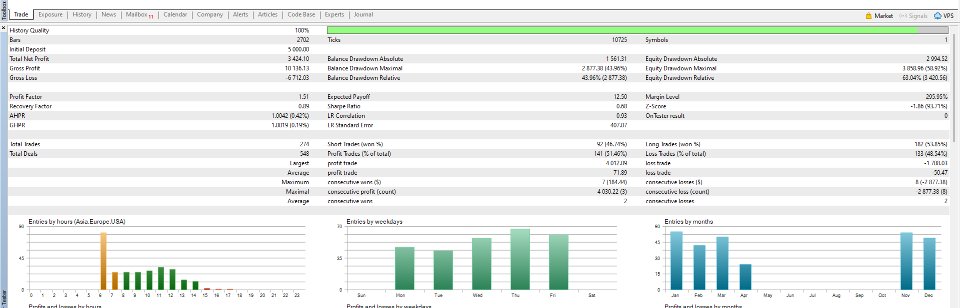

- The First Strategy consist in time and range of first hour that is detected on chart before the first news with shape of rectangle that is drawn in that momentum that helps to identify the upper and lower limits of price fluctuations on 5 minute chart that is show as a signal for two lines to appear as entry points for top or down brake out on pending orders in sessions, that usually leads the price action to follow the trend till the first news are taking place.

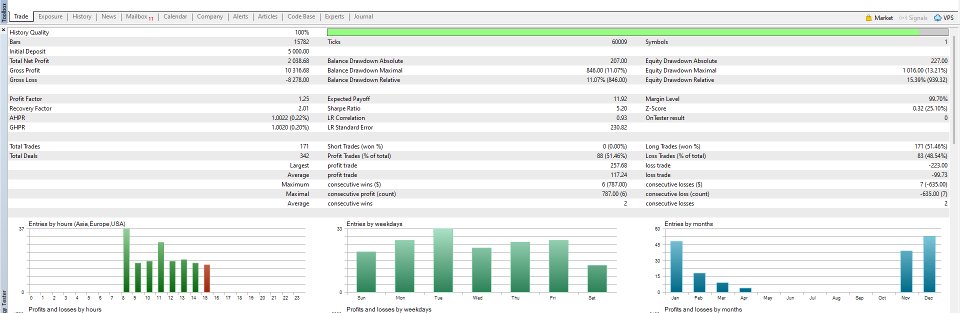

- The second strategy incorporates a methodology for financial market speculation which consists of the analysis of basic price movement across time. It’s used by many retail traders and often by institutional traders and hedge fund managers to make predictions on the future direction of the price of a security or financial market. In this particular strategy is decipher potential reversal points or continuation patterns in price movements.

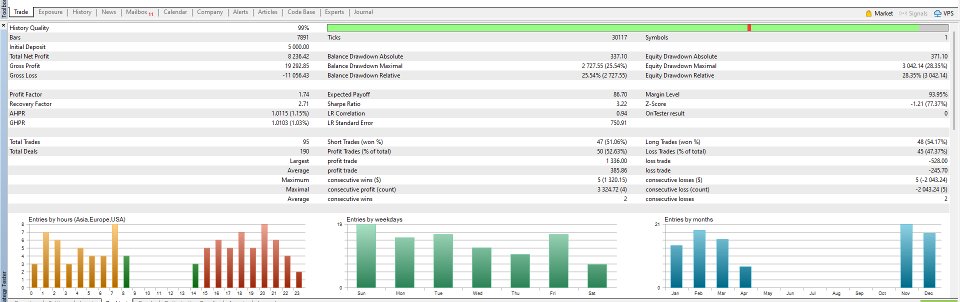

- The third strategy combines a dual EMA system (of 100 periods) with the RSI momentum indicator. It identifies market trends and entry points through EMA crossovers and RSI overbought conditions, the strategy is particularly effective in trending market conditions, capitalizing on trend continuation patterns.

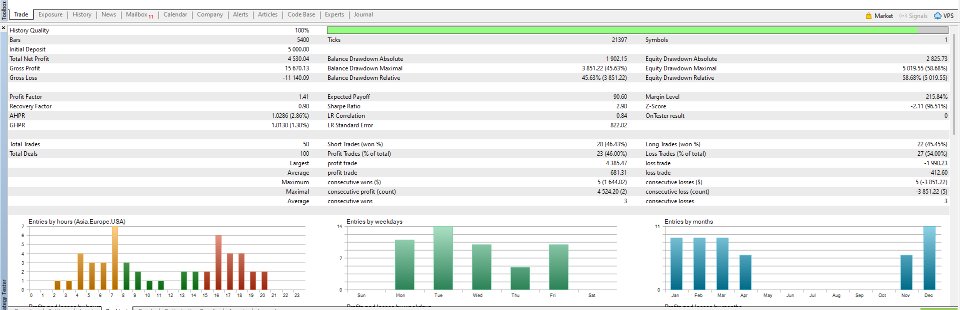

- The fourth strategy is based on inflation trade strategy trading that seeks to profit from rising price levels influenced by inflation or expectations of inflation, guided by Convergence and Divergence momentum, for potential reversals in the market, that identifies market trends and provides buy and sell signals based on recent price data.

- Take profit % from stop loss

- (A common practice is to set the stop-loss level between 1% to 3% below the purchase price. For example, if you buy a stock at Rs. 300 per share, a 2% stop loss would be triggered at Rs. 294, helping you limit potential losses while accommodating normal market fluctuations).

- Stop loss level

- For a short trade, and with the price moving lower, the stop loss is moved to just above the high of the most recently completed price bar/candle. It only moves down, never up.

- For a long trade, and with the price moving higher, the stop loss is moved to just below the low of the most recently completed bar/candle. It only moves up, never down.

- Bid/Ask manufacturer

- (Fixed amount of money that bids on money amount)

- London Session Time

- Europe Session Times

- American Session Time

- Asian Session Start that ends with Australian Session.

- EMA

- RSI

- MACD

- Envelopes

- Candles

- Trailing Stop

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

| Pairs | Type 1 | Type 2 | Type 3 |

|---|---|---|---|

| Crypto | Other | Raw | - |

| Forex | Majors | Minors | - |

| Indices | Major | Minor | - |

| Commodities | Commercial | Energies | Metals |

| Timeframe & Strategy | Strategy | Timeframe |

|---|---|---|

| [Crypto DSHUSD,SOLUSD],[Forex Majors] [Indices GER40,F40,DJ30,US2000] | Time & Range | 5M |

| [Crypto XLMUSD,DOTUSD,ARWUSD],[Forex Majors & Minors] [Metals XAGUSD,XAGEUR] | Price Action Wicks | 15M |

| [Crypto EOSUSD,XRPUSD,LTCUSD,SOLUSD,TRXUSD] [Forex Majors & Minors],[Indices NAS100,SP500,AUS200,HK50,SWISS20],[Metals XAUUSD,XAGEUR] [Energies UKBRENT] | EMA & RSI brake out | 30M |

| [Forex Majors & Minors], [Indices Majors], [Metals ZYNC,XAUAUD,COPPER,XAUGBP,XAUGBP] [Crypto BTCUSD,ETHUSD] | Ultimate Inflation | 1H |

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Recommendations

- Use of more then one strategy for same pair ( Not recommended )

- Change of settings that are created for strategies ( Not recommended on live account )

- Timeframes that are shown ( Recommended )

- Different Timeframes ( Not Tested )

- Different Pairs that aren't shown ( Not recommended )

Recommended Brokers

https://icmarkets.com/?camp=71812 (Fast standard spread)

https://portal.blueberrymarkets.com/sign-up?referralCode=eqabqli06n (Low Spread)

https://www.fpmarkets.com/en/refer-a-friend-terms-and-conditions/ ( Ultra Low Spread)

----------------------------------------------------------------------------------------------------------------------------

Recommended Prop firms

https://trade.audacitycapital.co.uk/user-auth/register?referral_code=5b9996&utm_source=client&utm_medium=referral ( Low Spread, Low pairs, challenge by choice )

https://blueberryfunded.com/?utm_source=affiliate&ref=3160 ( Low Spread, High pairs, Cheap Contracts )

https://ofpfunding.com/?aff=7jaXwD7G ( Standard Spread-High pairs, No MT5 No Challenge, Cheap Contracts )

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

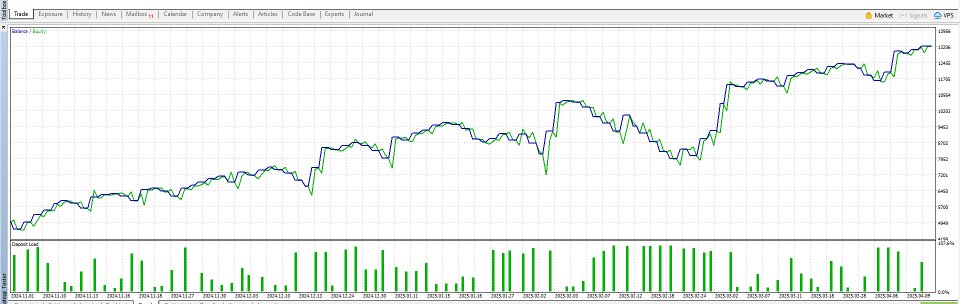

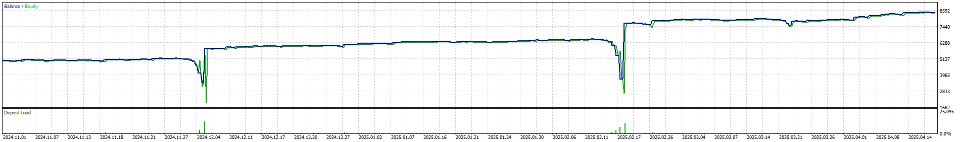

Full EA Presentation

Link Below