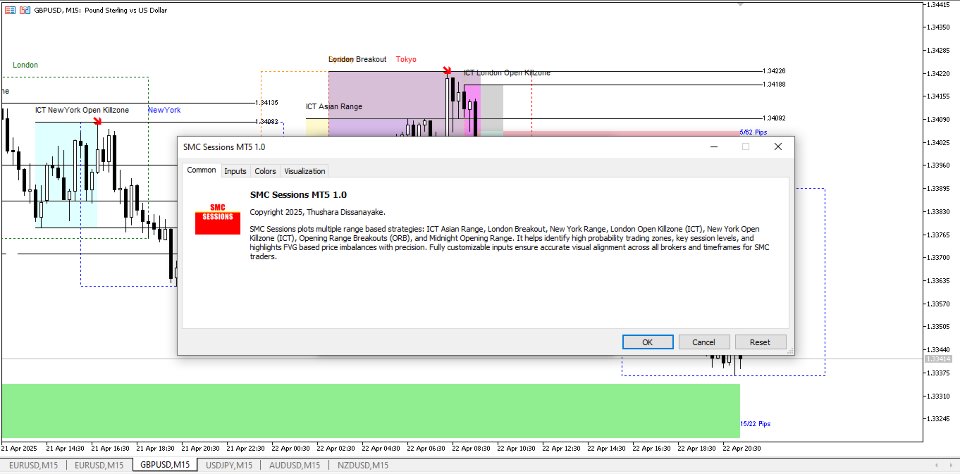

SMC Sessions MT5

- Indicators

- Thushara Dissanayake

- Version: 1.0

- Activations: 20

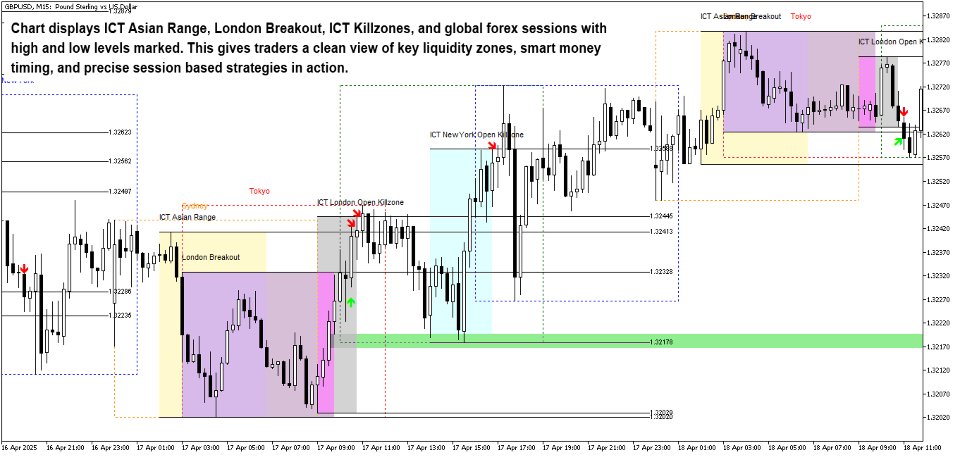

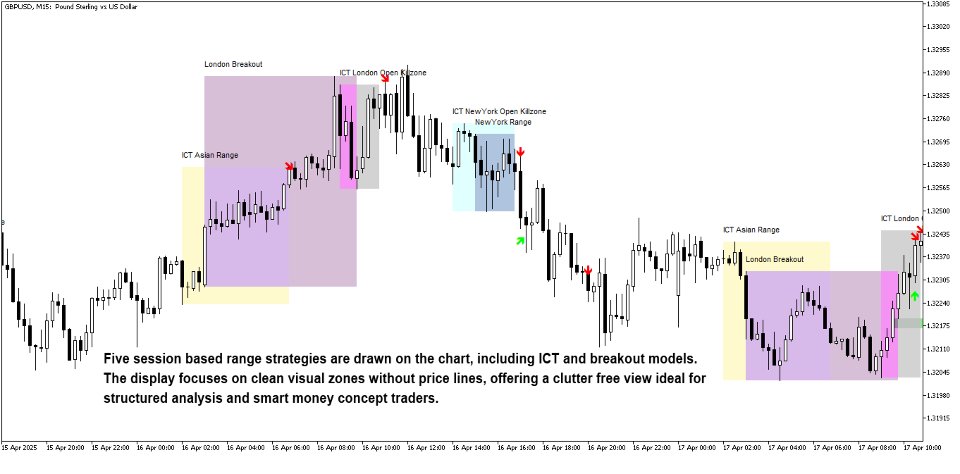

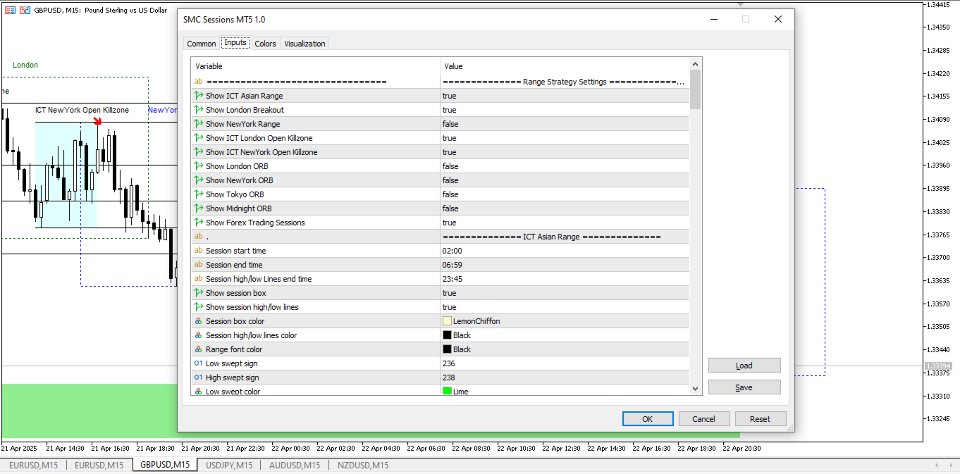

The SMC Sessions Indicator is a precision tool crafted for Smart Money traders who rely on ICT concepts, liquidity hunts, and session based strategies. It seamlessly maps out critical session based trading zones using the most proven and popular concepts used by institutional level traders. This all in one session indicator overlays your chart with the most effective and high probability range strategies, including: ICT Asian Range, London Breakout, New York Range, ICT London Open Killzone, ICT New York Open Killzone, Opening Range Breakouts (ORB) (covering London, New York, Tokyo), and the powerful Midnight Opening Range. It also highlights main Forex trading sessions including Sydney, Tokyo, London, and New York. Each range is drawn with maximum accuracy using TimeBox methodology, helping identify key FVGs (Fair Value Gaps), range sweeps, session highs/lows, and potential market maker manipulation zones. Designed for serious SMC traders, this indicator is highly customizable to align with any broker’s server time, enabling precision execution on any chart or timeframe.

ICT Asian Range Strategy: The ICT Asian Range is a foundational strategy within Smart Money and ICT frameworks. It identifies accumulation and consolidation zones between 23:00 and 04:00 GMT, often setting up liquidity traps and enabling traders to anticipate the London or New York session expansions. This tool visually represents the session box and the high/low sweep areas, giving visual confirmation of price rejections or liquidity runs. These zones often act as liquidity magnets, preparing setups for daily bias confirmation and killzone entries.

London Breakout Strategy: The London Breakout is one of the most popular retail and institutional entry methods. Ranging from 00:00 to 07:00 GMT, this session captures volatile moves driven by London market open liquidity influx. The indicator plots breakout signs and session boxes, allowing traders to identify false breaks, stop hunts, or real market maker intent. Breakout symbols help confirm bullish or bearish continuation patterns, ideal for breakout and trap traders focused on pre NY setups.

New York Range Strategy: New York Range is key for spotting retracement entries or reversal setups after major sessions like London. Covering 12:00 to 14:00 GMT, this session overlays the market structure shift around the NY open and overlap with London. The tool plots highs and lows of this range and supports detection of FVG formations, liquidity sweeps, and market maker accumulation patterns. Perfect for those trading reversal setups, late session breakouts, or ICT PM sessions.

ICT London Open Killzone: This zone, between 06:00 and 08:00 GMT, often precedes high probability liquidity raids. It highlights the Killzone logic taught in ICT mentorships. Traders can observe if price sweeps the Asian high/low and returns into premium/discount zones, confirming entry models. The indicator automatically marks the range and notes if highs/lows are swept using clear symbolic markers.

ICT New York Open Killzone: Spanning 11:00 to 14:00 GMT, this session mirrors institutional volume shifts during NY open. It aligns with macro timeframe bias, supporting entries based on liquidity raids, FVGs, and range sweeps. Traders use this killzone to build trades around news releases, market opens, and volume driven displacements.

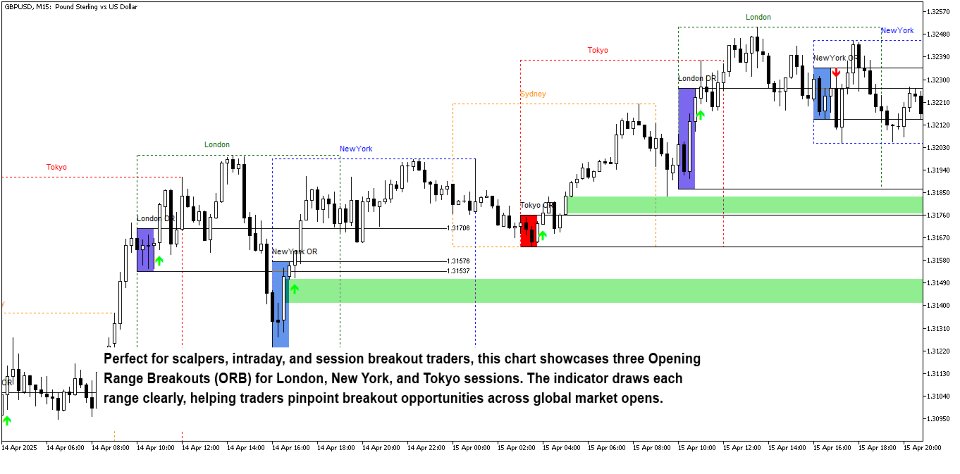

London Opening Range Breakout (ORB): Running from 07:00 to 08:00 GMT, the London ORB maps key range breakouts for intraday traders. It defines high and low anchors of the hour post London open, allowing identification of trapped volume, breakout continuation, or false moves. Especially useful for traders using volume clusters, order flow, or range expansion tools.

New York Opening Range Breakout (ORB): This range 13:00 to14:00 GMT captures breakout moves from the NY market open. Ideal for spotting initial balance shifts, fake breakouts, and liquidity runs before London close. The indicator tracks range reactions, ideal for combining with ICT breaker blocks, order blocks, and smart money reversal zones.

Tokyo Opening Range Breakout (ORB): From 00:00 to 01:00 GMT, Tokyo ORB assists in detecting overnight liquidity collection. Often overlooked, this session helps identify Asia driven liquidity traps that later fuel London and NY moves. It’s useful for traders who monitor global session flow, looking for Asia induced support/resistance sweeps.

Midnight Opening Range (Midnight OR): The Midnight OR from 00:00 to 01:00 GMT marks the start of the trading day, serving as a key anchor for daily bias determination. It is commonly used by SMC traders to define the initial market maker range for the day. This box, combined with liquidity sweep logic and FVG zones, helps map potential Asia London crossover setups.

In addition to range based strategies, the indicator maps core forex trading sessions: Sydney, Tokyo, London, and New York, using fully customizable colors and styles. These boxes allow traders to visually align price action with institutional order flow cycles and see where price accumulates, manipulates, or expands within key time windows.

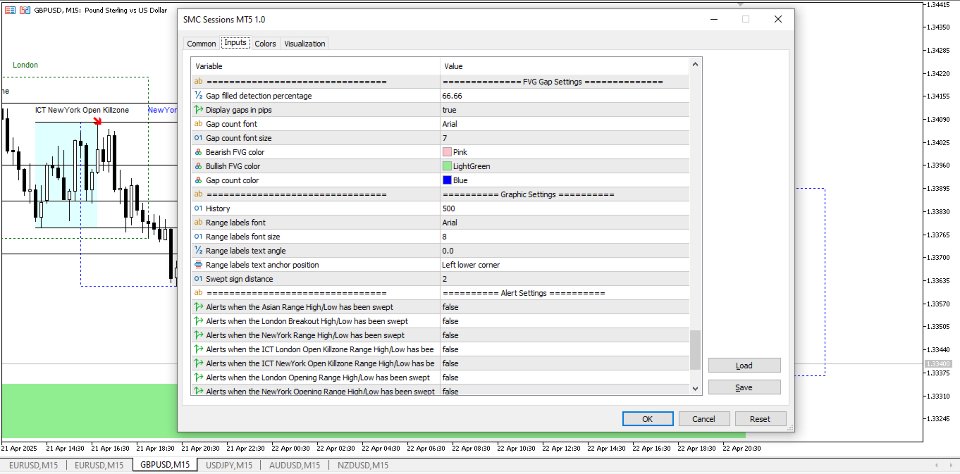

The indicator includes FVG gap plotting, displaying both bullish and bearish imbalances with precise detection based on the 66.66% gap fill logic. Users can track unfilled gaps, gap sizes in pips, and use this confluence with range breakouts or liquidity sweeps for powerful setups. FVGs are highlighted with unique coloring and include customizable alerts when price enters these areas.

Each session has an optional liquidity sweep alert that notifies the trader when session highs or lows are breached, a typical Smart Money target. Alerts can be enabled for mobile, email, and popup, keeping traders informed of market maker range violations or session expansion events, even while away from the charts.

All time settings are in server time logic built in, ensuring clean alignment on any broker or platform. From session start times, end times, color schemes, font settings, line styles, and labels, the indicator is fully customizable to suit your unique trading workflow. The drawing method supports both filled boxes and outlined styles, giving full control over chart aesthetics.

Whether you're trading London reversals, Asian liquidity traps, or New York FVG expansions, the SMC Sessions Indicator is designed to give institutional grade market insight, fully aligned with Smart Money Concepts, market maker manipulation theory, and ICT trading strategies. From scalpers to swing traders, this tool bridges the gap between raw price action and structured session based planning, providing the clarity you need to identify key market turning points, trapped liquidity zones, and order flow driven reactions with confidence.

Future Enhancements: Future updates are planned to include automatic drawing of Break of Structure (BOS) and Order Block (OB) levels. These additions aim to assist users in identifying key areas of interest on the chart based on commonly used market structure concepts.