Daily Reversal MT5

- Experts

- Ridgestone Capital Ltd

- Version: 1.2

- Updated: 20 April 2025

- Activations: 5

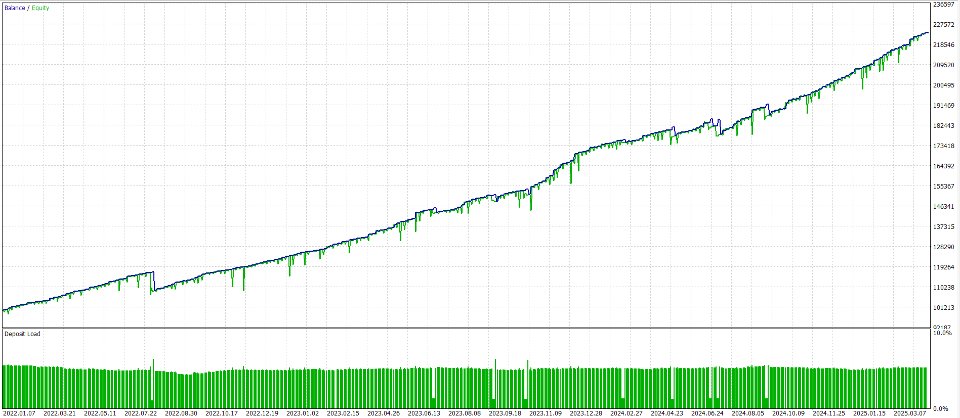

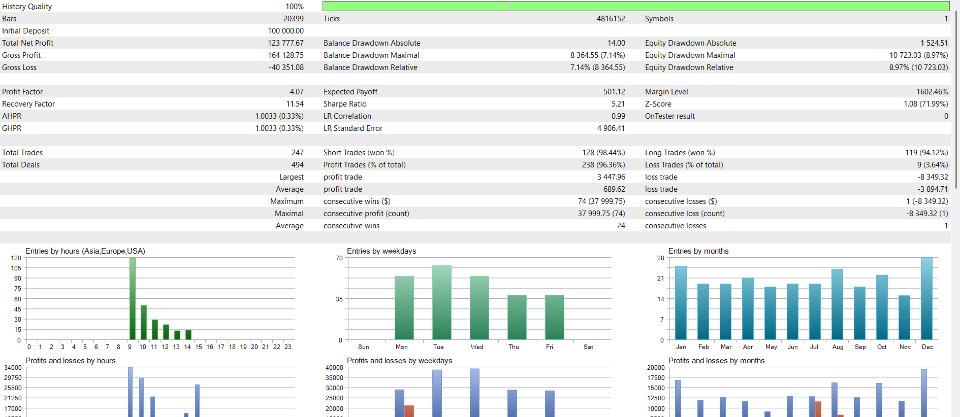

Daily Reversal is a reliable scalping strategy which takes advantage of larger trend reversals. It draws a range every day of the body of the previous daily candle and places pending orders according to whether the previous day was bullish or bearish. Then, it uses multiple trailing stop losses to manage all of the positions. Daily Reversal includes a prop firm mode, our recovery system and also has a news filter to further protect your capital against volatile events.

We care about trying to provide a consistent edge in the market for our clients, using proven strategies and techniques, rather than using buzzwords like ‘AI’ or ‘neurons’ and showing perfect equity curves. We offer lifetime support for verified customers in order to ensure everyone can get the most out of our products.

Across all our algorithms, we recommend using the IC Markets Raw Spread account for the best results due to the very low spreads and strong reputation. You can create an account here. If you’re in the United States and can’t access IC Markets, we recommend the OANDA One account here or a lower spread account if available.

A VPS must be used in order to manage all the positions 24/7 and for faster execution times. We recommend the MetaTrader VPS due to the ease of set up. There are other options available.

Download the full set up guide here.Chart:

Pair - GBPUSD

Timeframe - H1

Inputs:

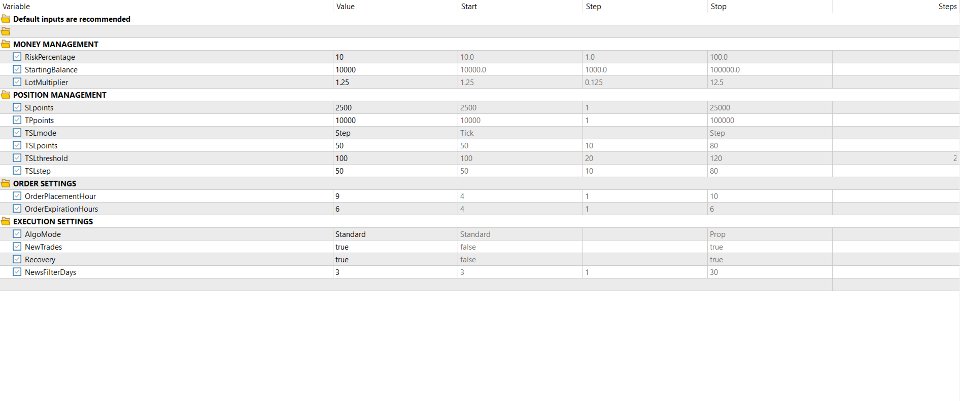

IMPORTANT - we recommend using the default inputs. Read disclaimers below.RiskPercentage – the total risk of the first set of trades

StartingBalance – the starting balance of the account for the chart visual data

LotMultiplier – the multiplier applied to the risk of the second set of trades

SLpoints – the size of the stop loss in points

TPpoints – the size of the take profit in points

TSLmode – the way the trailing stop loss moves with price | Step = TSL updates after the TSLstep amount | Tick = TSL updates after every tick

TSLpoints – the size of the trailing stop loss in points after price goes into profit

TSLthreshold – the distance in points that price has to move into profit for the trailing stop loss to start

TSLstep – the size of the step in points if the TSLmode ‘Step’ is selected

OrderPlacementHour – the time in hours that the daily orders will be placed

OrderExpirationHours – the time in hours until the pending orders are cancelled, after the OrderPlacementHour

AlgoMode – the amount of sets of trades the algorithm is allowed to place | Standard = 2 sets | Prop = 1 set

NewTrades – whether or not the algorithm is allowed to place trades

NewsFilterDays – the amount of days the algorithm won’t trade before a volatile news event, including the day of the event

(10 points = 1 pip)

Disclaimers:

- The time settings are in GMT time and therefore no adjustments are needed

- Use the 1 Minute OHLC setting for faster backtests.

- Daily Reversal doesn't place trades on Fridays due to low volume.

- The news filter has no effect on backtests as the MQL calendar can’t be accessed.

- Prop firm mode only allows one set of positions in each direction with equal risk meaning the trades are hedged. However, prop firms typically don’t offer very low spreads so expect Daily Reversal to be slightly less effective. We recommend 3-4% risk max for a 5% daily drawdown account.

Download the full set up guide here.

Please reach out if you have any questions.