MartingaleFusionT

- Experts

- Christos Iakovou

- Version: 1.0

- Activations: 15

MartingaleFusion EA: Intelligent Adaptive Grid Trading System

Frustrated by simplistic EAs failing in dynamic markets? MartingaleFusion is a sophisticated automated trading system designed for enhanced performance through advanced analysis and adaptive execution.

This EA utilizes a multi-indicator confluence entry protocol, requiring alignment from EMAs, RSI, and MACD to identify higher-probability initial trade setups and reduce false signals.

When managing open positions, MartingaleFusion employs an adaptive martingale averaging grid. It strategically adds positions during adverse market movements using a configurable multiplier and parameters, aiming to optimize the average entry price for potential recovery or profitability upon market reversal.

Furthermore, it features a selectable exit strategy: choose between closing the entire grid at a fixed Take Profit target based on the average entry price, or utilizing a classic Trailing Stop (also based on the average price) to potentially capture larger trends while securing accrued profit.

MartingaleFusion offers extensive customization of entry, averaging, and exit parameters, allowing traders to tailor its behavior to specific instruments, timeframes, and individual risk tolerance. Achieve fully automated trade management, handling complex logic consistently and without emotion.

MartingaleFusion provides a robust, adaptive alternative to basic automated strategies.

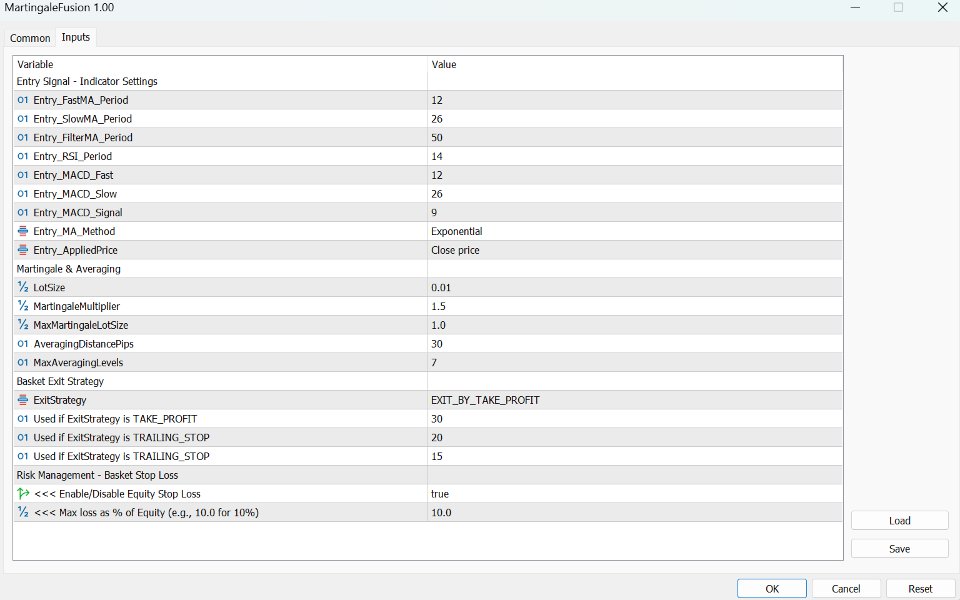

--- Input Parameter Guide ---

(GROUP: Entry Signal - Indicator Settings)

Defines conditions for the initial trade entry.

-

Entry_FastMA_Period: Period for faster entry EMA. (Shorter = Faster)

-

Entry_SlowMA_Period: Period for slower entry EMA. (Longer = Smoother)

-

Entry_FilterMA_Period: Period for long-term trend filter EMA. (Longer = Stricter Filter)

-

Entry_RSI_Period: Period for RSI momentum oscillator.

-

Entry_MACD_Fast/_Slow/_Signal: Standard MACD indicator periods.

-

Entry_MA_Method: Moving Average calculation method (EMA recommended).

-

Entry_AppliedPrice: Price source for indicator calculations (PRICE_CLOSE standard).

(GROUP: Martingale & Averaging)

Controls how the EA adds subsequent trades to the grid.

-

LotSize: Size of the initial trade in the series.

-

MartingaleMultiplier: Factor by which to multiply the last lot size for the next grid trade (e.g., 1.5). Use with caution.

-

MaxMartingaleLotSize: Hard cap on the maximum size of any single trade within the grid.

-

AveragingDistancePips: Pips the market must move against the last entry before adding the next grid trade.

-

MaxAveragingLevels: Maximum number of trades allowed in a single series (initial + averaging trades).

(GROUP: Basket Exit Strategy)

Determines how a profitable series is closed.

-

ExitStrategy: Choose exit logic:

-

EXIT_BY_TAKE_PROFIT: Closes basket at fixed profit target. Ignores Trailing inputs. (Default)

-

EXIT_BY_TRAILING_STOP: Closes basket via trailing stop only. Ignores TP input.

-

-

TakeProfitPipsFromAvg: Fixed profit target in pips from the average entry price. (Used if ExitStrategy = TAKE_PROFIT).

-

TrailingActivationPipsFromAvg: Pips profit from average price required to activate the trailing stop. (Used if ExitStrategy = TRAILING_STOP).

-

TrailingDistancePips: Pips the trailing stop follows behind the best price after activation. (Used if ExitStrategy = TRAILING_STOP).

(GROUP: Risk Management - Basket Stop Loss)

Controls the overall safety net for the entire grid based on account equity.

-

UseBasketStopLoss: Enable Equity Stop Loss? Set to true to activate the basket stop loss feature, or false to disable it.

-

StopLossPercentEquity: Max Basket Loss (% Equity). If UseBasketStopLoss is true, this defines the maximum floating loss the entire series is allowed to reach, expressed as a percentage of your account equity (e.g., 10.0 means 10%). If the loss hits this level, all trades in the series are immediately closed.

Timeframe Considerations:

The Timeframe used is critical. Settings optimized for one timeframe (e.g., H1) will perform differently on another (e.g., M15).

-

Lower Timeframes (e.g., M5, M15): More frequent signals/averaging, higher sensitivity to noise. Generally require tighter pip distance settings (AveragingDistance, TP/Trailing).

-

Higher Timeframes (e.g., H1, H4): Fewer, more filtered signals. Generally require wider pip distance settings.

Action Required: You must test and optimize input settings specifically for your chosen Instrument AND Timeframe. Defaults are generic starting points.

M15 Defaults Note: The standard indicator periods (e.g., 12/26 EMA, 14 RSI) are reasonable starting points for M15 testing. However, pip distance inputs (AveragingDistance, TP/Trailing Activation/Distance) likely need adjustment (potentially downwards) compared to H1 defaults. Focus optimization on these distances first for M15.