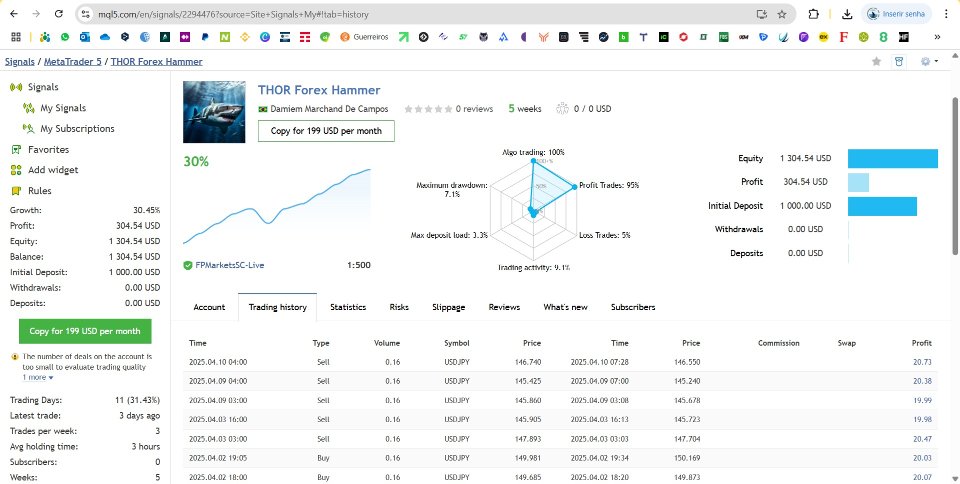

THOR Forex Hammer usdjpy mt5 ict power of three

- Experts

- Damiem Marchand De Campos

- Version: 1.0

- Activations: 10

EXPERT for YOUR OWN ACCOUNT - This Expert Advisor has been designed, developed and optimized especially for your own use.

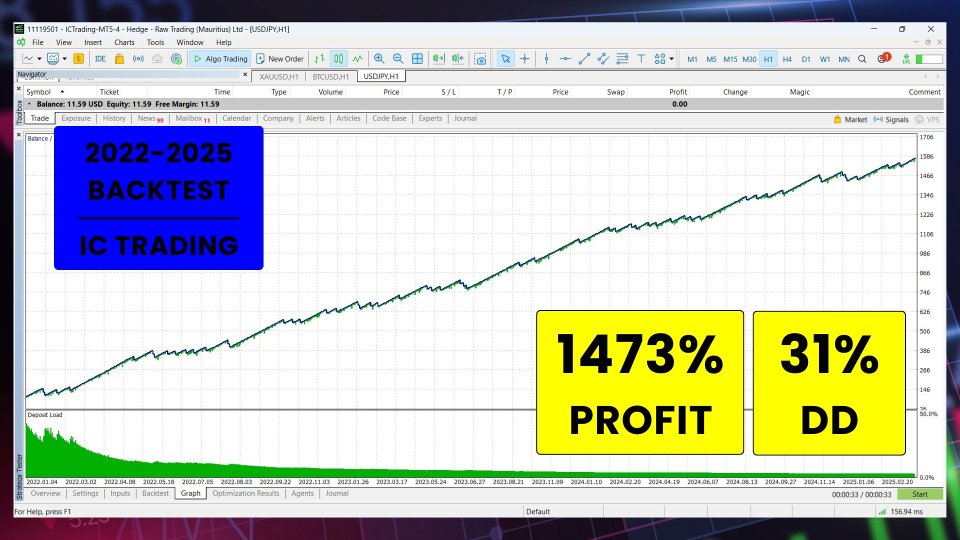

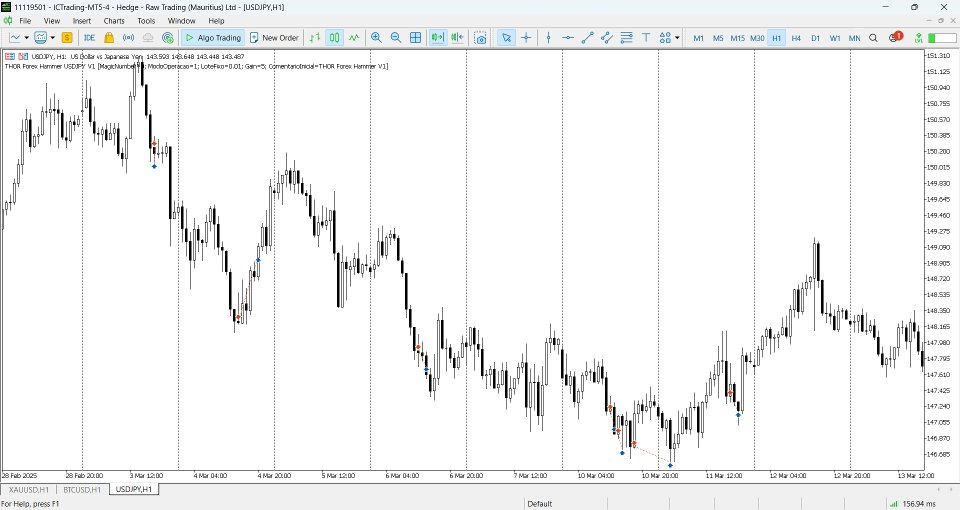

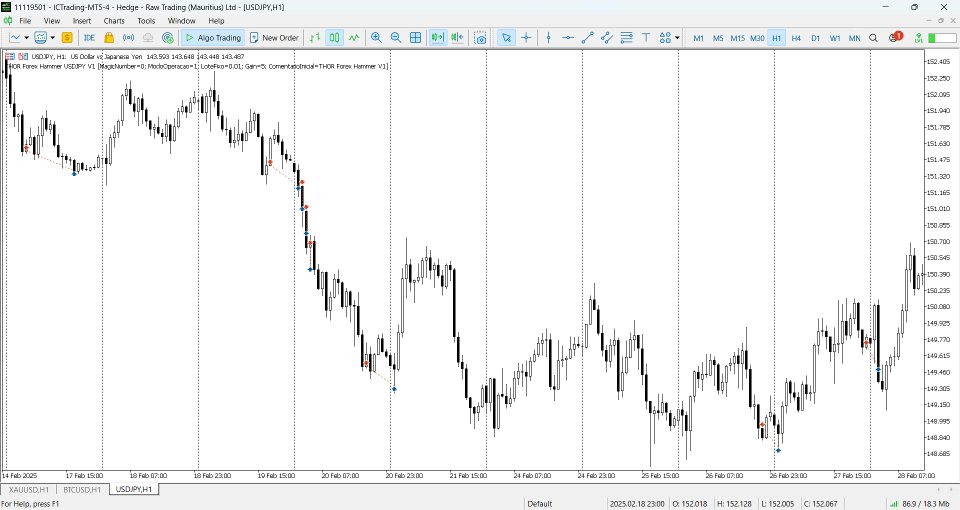

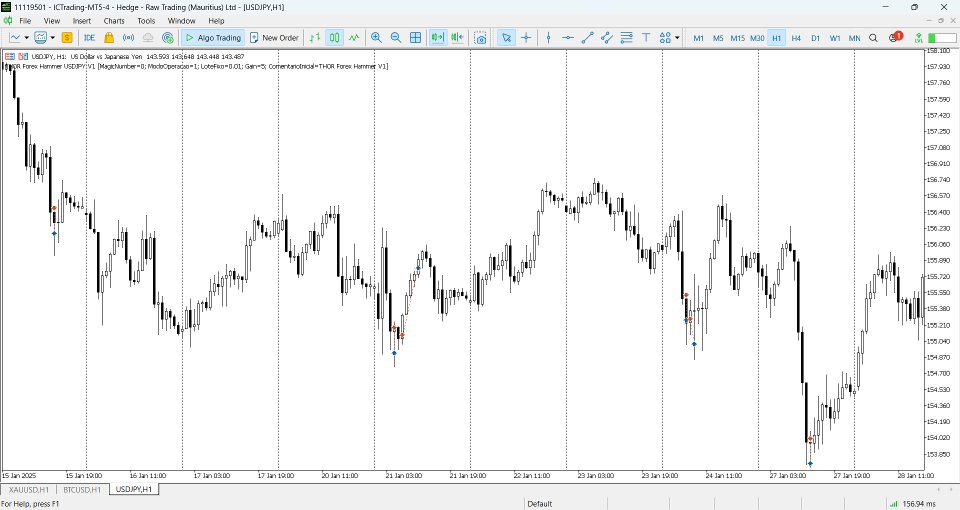

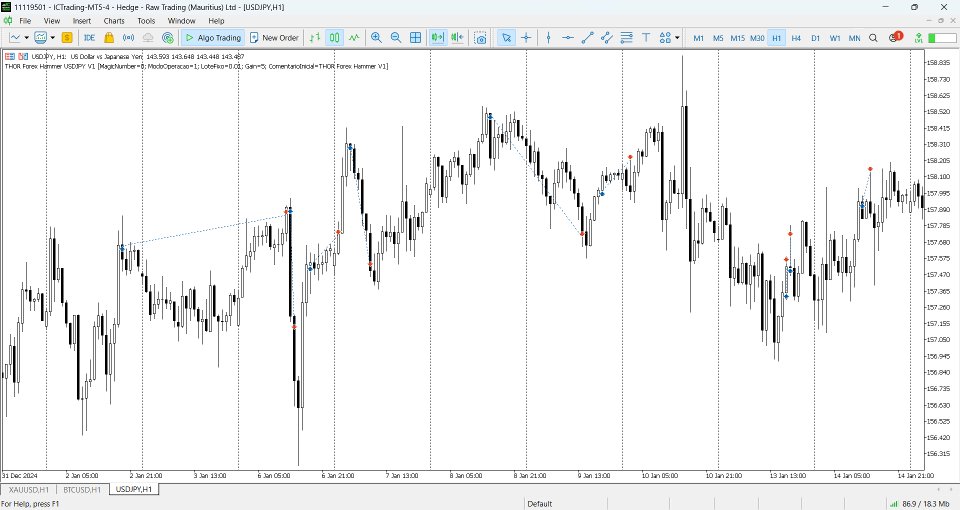

This is a powerful Expert Advisor (EA) for taking advantage of the best and biggest opportunities in the USDJPY symbol, in all phases of the trend, from start to finish, on the H1 timeframe and on the MT5 platform.

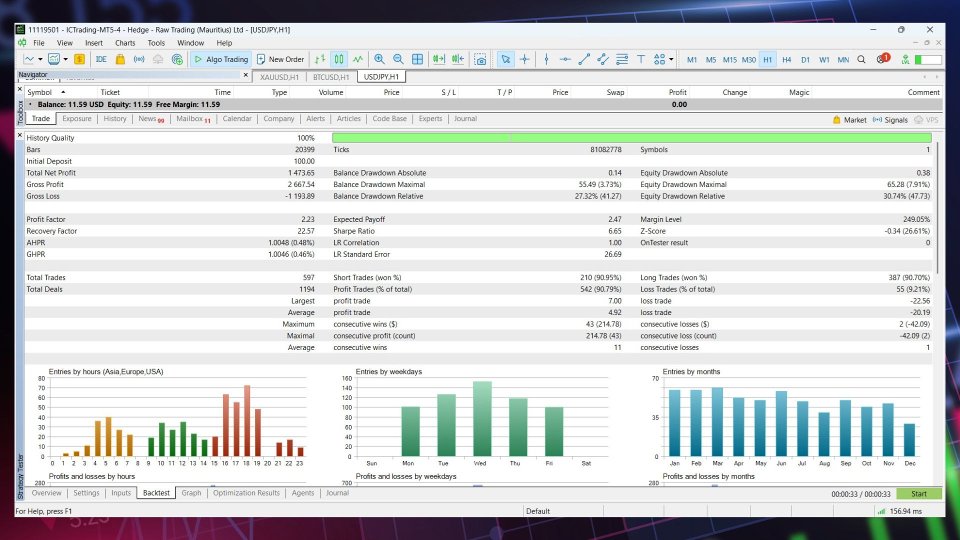

Impressive accuracy, performance and consistency in backtests over the last 3 years.

The EA works like a hunter, a sniper, analyzing the price movement, its strength and trend, patiently waiting for the best opportunities to do its job with extreme precision.

The EA is based on the ICT POWER OF THREE (PO3) strategies and uses many native and proprietary indicators as well.

Key features:

This EA continuously analyzes the price movement and when it identifies the best opportunities, it sends a single limited order, thus opening a position.

Every position has a fixed Target and a fixed Stop Loss set from the beginning.

The lot is also calculated and determined automatically from the inputs.

Security Always: This EA is very SAFE, it does NOT use Grid, Martingale or Hedge strategies. All trades have only one entry per trade and are protected by a hard stop loss.

This EA is its very strong RESILIENT to high-impact NEWS (FOMC, FED, Payroll, ECB, BOE, SNB, BOC, BOJ, RBA or RBNZ) or any other abrupt price movements. You don't need to do anything, the EA protects itself.

How to install:

- Download this EA,

- Make sure that all pairs (USDJPY) are in the Market Watch (Ctrl+M),

- Have the (USDJPY) chart on the H1 timeframe,

- Place this EA on the (USDJPY) chart,

- Check and adjust the parameters as shown below,

- Click OK to activate,

- Done!

INPUTS for YOUR OWN ACCOUNT - If you want to customize, there are these parameters:

- [#01] Magic Number,

- [#02] Spread Max,

- [#03] Operation Mode (Fixed Lot or Target),

- [#04] Fixed Lot,

- [#05] Target (USD),

- [#06] Comment.

I am committed to continuously optimize and improve all my EAs to give you and me the best possible trading experience. You will receive all UPDATES for FREE and I will also add new features to the EA based on customer suggestions.

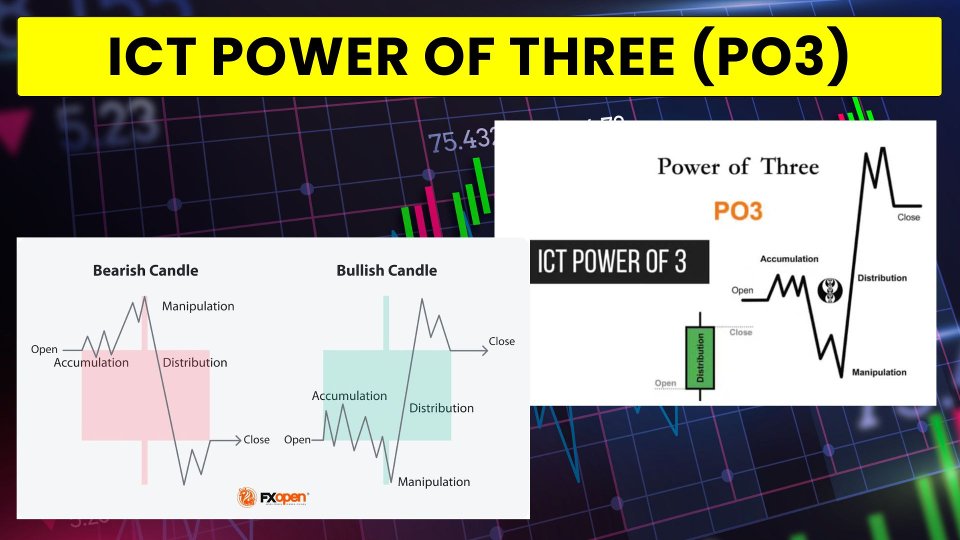

The main strategy of this expert is - ICT POWER OF THREE (PO3) - by Michael J. Huddleston

The ICT Power of 3 is a strategic trading method that helps traders identify behaviour of ‘smart money.’ It dissects market movements into three distinct phases: accumulation, manipulation, and distribution. This article explores the intricacies of the Power of 3 strategy and its practical application in trading.

The ICT Power of 3 (PO3), or the AMD setup, is a strategic trading framework developed by Michael J. Huddleston, better known as the Inner Circle Trader. This approach revolves around three critical phases: accumulation, manipulation, and distribution, which collectively help traders understand and anticipate market movements.ACCUMULATION PHASE

The accumulation phase is a crucial initial stage within the Power of 3 trading strategy. It represents a period where institutional investors, often referred to as smart money, quietly build their positions in a particular asset. This phase is characterised by relatively low volatility and sideways price movement, typically near key support or resistance levels.

During accumulation, the market tends to range within a narrow band as large players gradually buy into the asset without significantly driving up its price. This steady acquisition reflects their confidence in the asset's future appreciation. Recognising the accumulation phase involves monitoring for signs such as low-volatile, ranging price action and potential increases in trading volume without major price changes.

Specifically, this range is also intended to trap retail traders on both sides of the market. In a bullish accumulation, for example, where the price will eventually break upwards, the range will trap bullish traders buying from the support level inside of the range. Given that these traders will most likely set their stop losses below the range, this paves the way for the next stage: manipulation of liquidity.

However, some traders will also take a short position in this range, anticipating that price will continue to break lower. These traders add fuel to the distribution leg discussed later.

MANIPULATION PHASE

The manipulation phase is a pivotal part of the ICT PO3 trading strategy. This stage is marked by deliberate actions from institutional investors to create market conditions that mislead and trap retail traders. It follows the accumulation phase, where positions are built, and precedes the distribution phase, where these positions are realised.

For example, in a bullish market, after a period of accumulation where prices have stabilised within a range, a sudden drop might occur. This drop triggers stop-loss orders and panics retail traders into selling. It also encourages some to trade what appears to be a bearish breakout. Smart money then buys these positions at lower prices, preparing for the distribution phase where they push the prices up sharply.

DISTRIBUITION PHASE

The distribution phase is the final stage in the Power of 3 trading strategy, where smart money begins to offload their positions built during the accumulation phase. This phase follows the manipulation phase, and it is characterised by strong price movements in the direction opposite to the manipulation.

For example, in a bullish market, smart money begins to buy aggressively after the price has been manipulated downwards to create liquidity. This buying pressure pushes the price up sharply, signalling the start of the distribution phase. Traders can look for increased volume and price action breaking above previous resistance levels as confirmation.

This expert also uses a basket of indicators as a basis, the main one being a unique and exclusive indicator, created and optimized by the developer.