RSI abcd

- Indicators

- Francisco Gomes Da Silva

- Version: 1.0

RSI ABCD Pattern Finder: Technical Strategy

1. How the Indicator Works

Combines the classic RSI with automatic detection of ABCD harmonic patterns.

Key Components

- Standard RSI (adjustable period)

- Peak and Trough Markers (arrows)

- ABCD Patterns (green/red lines)

- Overbought (70) and Oversold (30) Filters

2. MT5 Setup

period = 14; // RSI period size = 4; // Maximum pattern size OverBought = 70; // Overbought level OverSold = 30; // Oversold level Filter = USE_FILTER_YES; // Confirmation filter

3. Trading Strategy

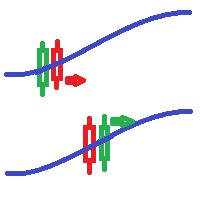

3.1. Buy Entry (Bullish ABCD)

Conditions:

- RSI forms:

- Trough (A) → Peak (B) → Higher trough (C)

- D above Oversold (30) but below C

- Confirmation: Green line connecting A-B-C-D

Targets:

- TP1: 61.8% of B-C

- TP2: 100% of B-C

Stop Loss: Below D

3.2. Sell Entry (Bearish ABCD)

Conditions:

- RSI forms:

- Peak (A) → Trough (B) → Lower peak (C)

- D below Overbought (70) but above C

- Confirmation: Red line connecting A-B-C-D

Targets:

- TP1: 61.8% of B-C

- TP2: 100% of B-C

Stop Loss: Above D

4. Practical Example (EUR/USD H1)

- Bullish ABCD Pattern detected after RSI exits Oversold.

- Confirmation with green line.

- Entry at D, SL below the last trough.

- TP1 reached at 61.8%.

5. Risk Management

- Risk per trade: 1-2% of capital.

- Avoid major news events.

- Use trailing stop after TP1.

6. Conclusion

Effective indicator for traders combining RSI and harmonic patterns. Test on a demo account before live trading.

Next Steps:

- Adjust parameters per asset.

- Combine with moving average for confirmation.