Bands Martin Hedge MA Trend

- Experts

- Qing Zhang

- Version: 1.0

Introduction to the Bollinger Bands Hedging Moving Average Trend EA

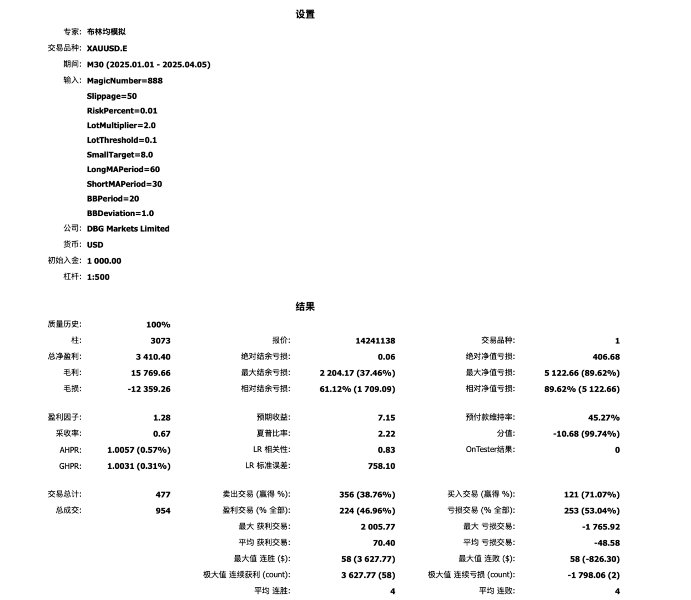

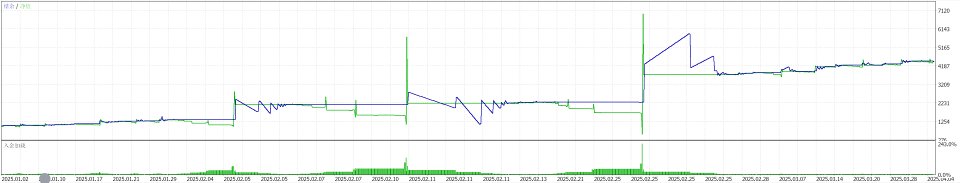

"Be sure to set the parameters properly before using it, and make sure that the trading platform allows hedging." If you are really unsure about the parameter settings, you can use a capital amount of $2000 as a reference, conduct tests on the XAU/USD instrument with a time frame of M30. The parameters are as follows:

Slippage = 50 (For US30, it needs about 500 to open and close positions smoothly), RiskPercent = 0.1, LotMultiplier = 2, LotThreshold = 0.3, SmallTarget = 5, LongMAPeriod = 60, ShortMAPeriod = 30, BBPeriod = 20, BBDeviation = 1.0.The specific optimal parameters should be backtested and improved by yourselves.

I. Core Strategy Concept

The Bollinger Bands Hedging Moving Average Trend EA applies the concept of Martingale retracement hedging following the trend in market analysis. This concept combines market trend tracking with a risk hedging mechanism, aiming to adapt to the complex and changeable market environment, effectively improve the tolerance to market changes, and capture potential profit opportunities at the same time.

II. Application of Key Indicators

1. Bollinger Bands Indicator: The Bollinger Bands is a widely used technical analysis tool that can intuitively reflect the fluctuation range and trend changes of market prices. Through the analysis of the Bollinger Bands, the EA can identify the overbought and oversold areas of the market, as well as the signals of price breaking through or returning to the boundaries of the Bollinger Bands, providing important references for trading decisions.

2. Double Moving Averages: The double moving averages consist of a short-term moving average and a long-term moving average. By comparing the relative positions of the two moving averages, the EA can determine the market trend. When the short-term moving average is greater than the long-term moving average, it indicates that the market is in an uptrend; conversely, it is in a downtrend. This analysis method of double moving averages can more accurately capture the changes in the market trend.

III. Trading Execution Mechanism

1. Initial Order Opening: When entering a trade, the EA will open a position based on the percentage of the net value of the first order. This parameter of the capital risk ratio is crucial, as it directly affects the degree of risk exposure in subsequent hedging trades. It is recommended that investors conduct multiple backtests according to their own capital amounts to set a reasonable risk ratio value, ensuring that the trades are carried out within a controllable risk range.

2. Parameter Optimization: In addition to the capital risk ratio parameter, other parameters of the EA also need to be backtested and optimized for multiple rounds according to different trading instruments. Different market instruments have different price fluctuation characteristics, slippage situations, and their own trading rules. Through targeted parameter optimization, the EA can better adapt to various market environments and improve risk control and trading profitability.

3. Retracement Hedging and Hedging: When there is an unexpected market retracement, the EA will automatically open an opposite position for hedging operations. This strategy can effectively prevent the expansion of losses caused by short-term market fluctuations and give investors more time to wait for the market trend to become clear.

4. Trend Position Adding: Once the market moves in a reliable direction, the EA will add positions according to the preset rules to follow the market trend and further expand the profit space. This strategy of adding positions with the trend can make full use of the power of the market trend to maximize profits.

IV. Strategy Advantages

The Bollinger Bands Hedging Moving Average Trend EA effectively eliminates the situation of the market reversing against the trading direction by combining the analysis methods of the Bollinger Bands and double moving averages, as well as the strategy of Martingale retracement hedging following the trend. At the same time, it seizes the opportunities of the market trend to bring continuous profits to investors. Whether in the trend market where the position direction is correct or wrong, this EA can demonstrate good adaptability and profitability.

If you have further questions about the specific parameter settings, backtesting methods or other aspects of the EA, you are welcome to consult at any time.