Oil SMT Divergence ICT Indicator MT4

- Indicators

- Eda Kaya

- Version: 2.3

- Updated: 19 April 2025

SMT Divergence ICT Oil Indicator MT4

The SMT Divergence Oil Indicator is a specialized MetaTrader 4 tool designed to identify divergence patterns between correlated assets. It assists traders in detecting price discrepancies across Crude Oil (XTIUSD), Brent Crude (XBRUSD), and the USD/CAD pair, offering insights into possible trend shifts or reversals.

This indicator visually marks divergence areas on the chart, making it easier to recognize opportunities for buying or selling based on institutional trading behavior.

«Indicator Installation & User Guide»

MT4 Indicator Installation | Oil SMT Divergence ICT Indicator MT5 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Money Management: Easy Trade Manager MT4

Specifications of the SMT Divergence Oil Indicator

The following table outlines the main features of this indicator:

| Category | ICT - Smart Money - Trading Utility |

| Platform | MetaTrader 4 |

| Skill Level | Advanced |

| Indicator Type | Leading - Range - Trend Continuation |

| Timeframe | Multi-timeframe |

| Trading Style | Day Trading |

| Market | Forex - Cryptocurrency - Stocks |

Overview of the Indicator

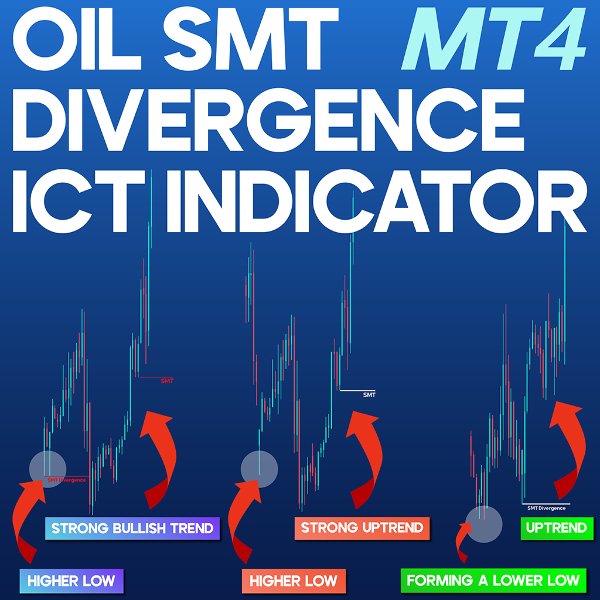

This tool examines the price movements of related assets to highlight potential reversal zones. By analyzing price variations across different instruments, it reveals divergences that signal market imbalance.

- Red Highlights: Indicate a bullish SMT divergence, suggesting upward momentum.

- Green Highlights: Indicate a bearish SMT divergence, signaling a possible downtrend.

These divergence signals help traders interpret market sentiment shifts and strategically adjust their positions.

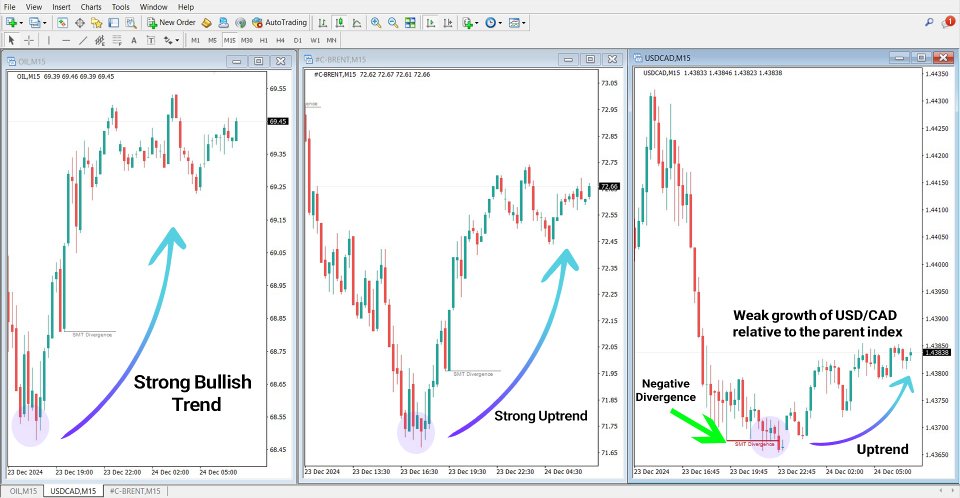

Example of Bullish SMT Divergence

The image below illustrates a bullish SMT divergence scenario. In this case, Crude Oil, Brent Crude, and USD/CAD display inconsistent price movements. The USD/CAD pair forms a Lower Low, while the other assets remain stable or rise.

This divergence suggests a weakening downtrend, potentially creating a buying opportunity as the market prepares to reverse direction.

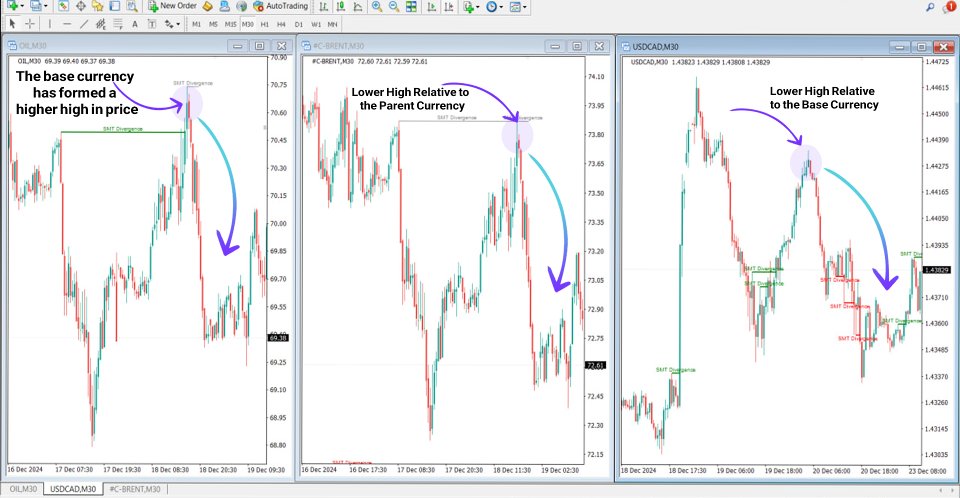

Example of Bearish SMT Divergence

In a bearish divergence case, the primary asset (Crude Oil) forms a Higher High, while Brent Crude and USD/CAD display Lower Lows. This behavior signifies a possible trend reversal, suggesting that the price may soon decline.

Traders who spot these signals in advance can prepare for a potential downtrend, positioning themselves accordingly.

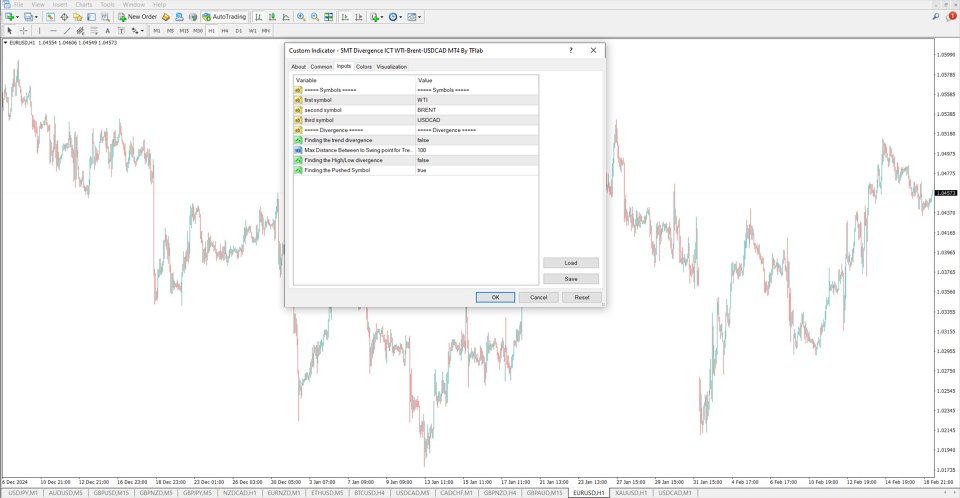

Indicator Settings & Customization

The SMT Divergence Oil Indicator includes several adjustable parameters to tailor its functionality to individual trading strategies. The settings panel allows users to configure:

- Primary Asset: Select the main asset for analysis.

- Secondary Asset: Choose a comparison asset for divergence detection.

- Tertiary Asset: Define an additional correlated asset.

- Trend Divergence Finder: Detect divergence setups efficiently.

- Swing Point Range: Adjust the distance for divergence validation.

- High/Low Divergence Detection: Identify key SMT divergence zones.

- Symbol Push Detection: Locate areas where SMT lines overlap for high-probability setups.

Conclusion

The SMT Divergence Oil Indicator is an essential tool for traders using Smart Money Concepts (ICT) in MetaTrader 4. By analyzing divergences between Crude Oil, Brent Crude, and the USD/CAD currency pair, it enhances traders' ability to detect trend shifts and institutional movements.

This indicator provides valuable insights into market reversals and liquidity imbalances, giving traders an edge in spotting high-probability trade setups.