Triple MA Trader MT4

- Experts

- Francisco Gomes Da Silva

- Version: 1.0

- Activations: 20

Automated Trading in MetaTrader: Investment Robots and Simple Strategy for Beginners

Automated trading has been gaining more space in the financial market, mainly because it offers a practical way to trade without the need for advanced knowledge. With the advancement of technology and the popularization of investment robots, investors of all levels can benefit from automated trading through platforms like MetaTrader. In this article, we will explore how an expert advisor works, the importance of backtests, and how a simple trading strategy can be an excellent gateway for those who want to trade automatically.

Introduction

The world of trading has evolved significantly with the introduction of robots that execute trades automatically, eliminating the need for constant human intervention. These programs, known as expert advisors, are developed to identify entry and exit opportunities in the market based on predefined parameters. This automated approach allows investors to benefit from market fluctuations even without a deep understanding of technical aspects, offering a practical way to trade automatically.

Additionally, conducting backtests – historical tests that simulate the strategy's performance with past data – is essential to validate the effectiveness of any investment robot. These tests help identify the best conditions and assets to apply the strategy without the need to invest real capital initially. This way, even beginners can experiment and adjust their trades safely.

Investment Robot Description

The investment robot presented here was carefully developed to detect price consolidations in different assets, primarily operating in currency pairs. The idea is simple: identify moments when prices stabilize and, from there, take advantage of the natural market fluctuations.

Key Features

- Versatility: The robot can be tested on various assets, allowing users to identify those with the best performance.

- Proven Efficiency: Through extensive backtests, the robot has demonstrated consistent results in most analyzed scenarios, providing a solid foundation for investors looking for a practical solution.

- Ease of Use: Ideal for beginners, the expert advisor operates with clear and objective rules, allowing even those without advanced experience to follow and understand the results.

The key advantage of this robot is its ability to operate autonomously, capturing natural price fluctuations and providing a practical automated trading experience without technical complications.

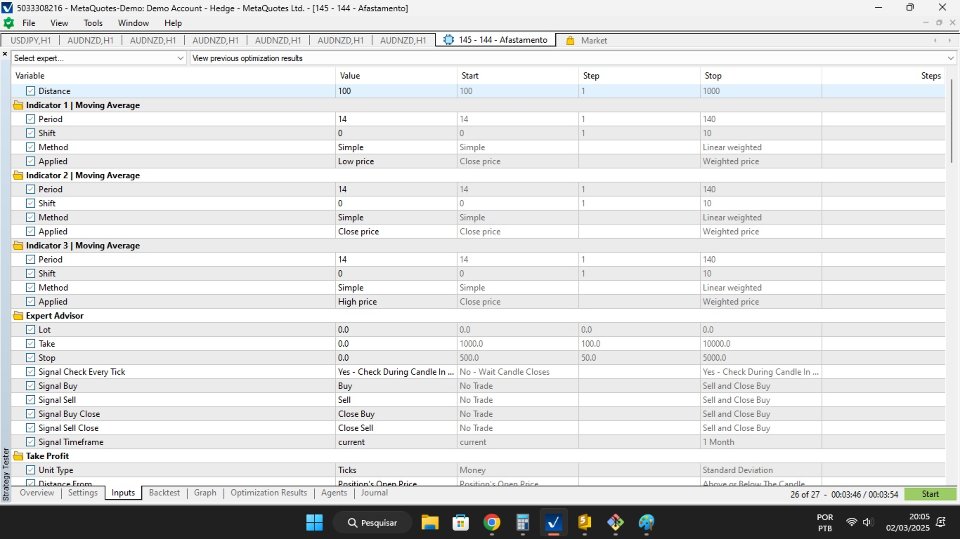

Strategy Details

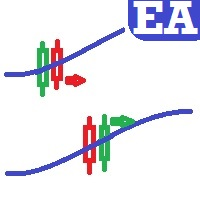

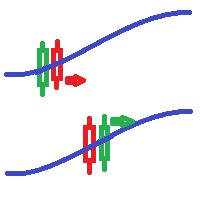

The strategy implemented in the robot is based on three moving averages, applied specifically to capture price variations. This simple and effective approach aims to identify reversal points where market fluctuations become evident.

Strategy Components

- Moving Average on Low: Calculated based on the minimum price of the analyzed period.

- Moving Average on Close: Based on the closing price, providing a more stable reference.

- Moving Average on High: Applied to the maximum price, helping to identify exhaustion points in the movement.

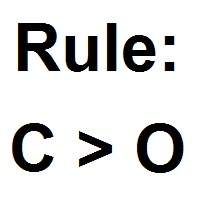

How the Strategy Works

-

Buy Entry:

When the price reaches a level 100 points below the low moving average, the robot executes a buy entry. The idea is to take advantage of a potential price recovery, which should close above the close moving average, confirming the trade. -

Sell Entry:

In the opposite scenario, when the price exceeds 100 points above the high moving average, the robot executes a sell trade. The goal is to capture the pullback, expecting the price to drop and close below the close moving average, signaling the exit point.

This methodology allows the robot to capture natural price fluctuations, making the strategy robust and easy to understand for those starting in the market. This approach stands out by demonstrating how to trade with a simple strategy, without the need for complex analysis or constant market monitoring.

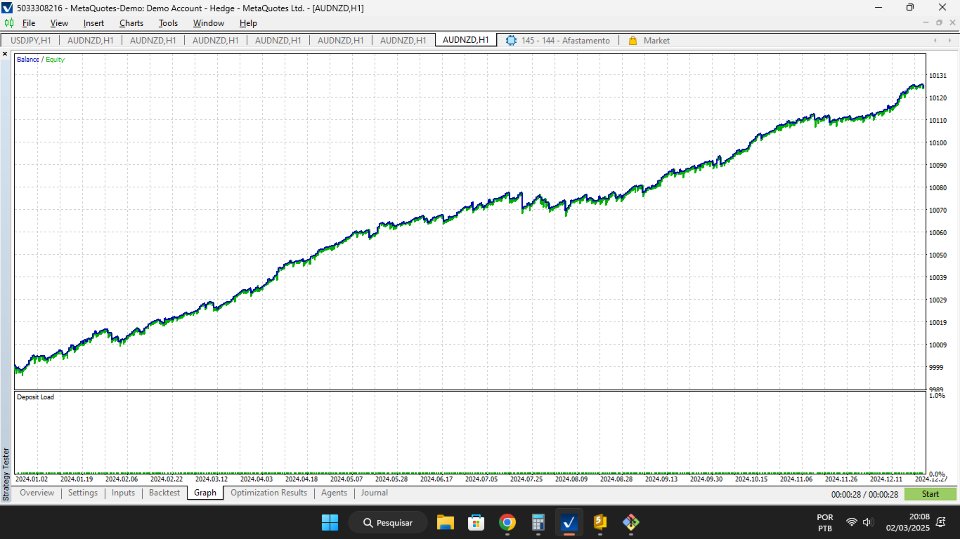

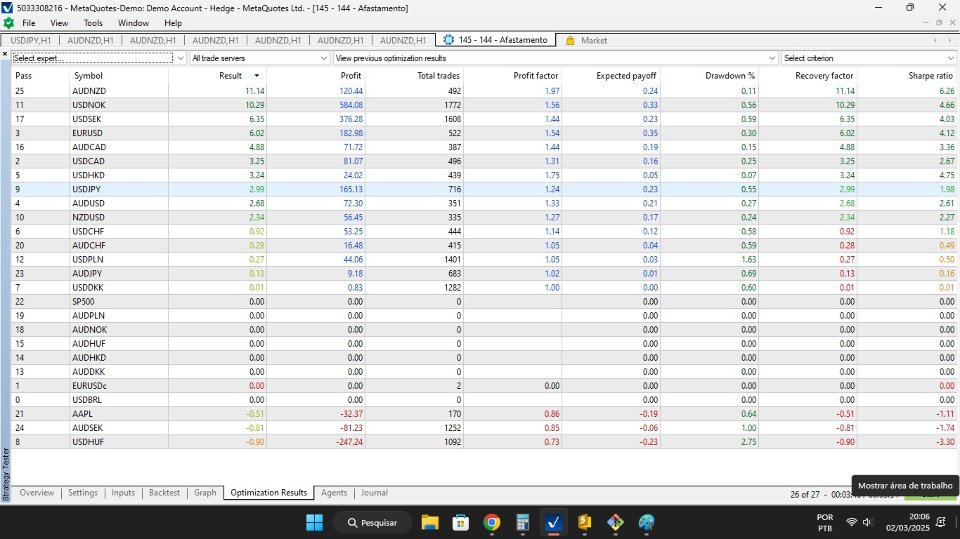

Backtest Analysis

The backtests conducted with the investment robot are a crucial step to validate the strategy before implementing it in real trades. These tests simulate the expert advisor's performance with historical data, allowing a detailed analysis of results in different market scenarios.

Key Backtest Observations

-

Consistency:

Results indicate that the strategy performs consistently across most tested assets. This shows that, even being a simple trading strategy, it can adapt to various market conditions. -

Operational Efficiency:

The trades executed by the robot show a good relationship between entries and exits, taking advantage of natural market movements. This efficiency is crucial for those looking to understand how automated trading works while minimizing manual intervention. -

Asset Variety:

One of the robot’s strengths is the ability to test the strategy on different assets. This allows investors to identify which markets offer the best conditions to apply the technique, reinforcing the idea of how to start trading even without advanced knowledge.

Important Considerations

Although backtests indicate promising performance, it is essential to remember that these results are based on historical data simulations. Therefore, there are no guarantees that results will be repeated in the future. Investors should always consider the risks involved and test the strategy cautiously before committing real capital.

Final Considerations and Applicability

The trading strategy presented in this article is an excellent option for beginners who want to explore the world of automated investments. With clear rules and an approach based on three moving averages, the investment robot provides a practical and accessible solution for trading on MetaTrader.

Benefits for Beginners

-

Simplicity:

With a strategy that uses only three moving averages, it is easier to understand entry and exit points, eliminating the need for advanced technical knowledge. -

Automated Operation:

By using an expert advisor, investors can “let the robot run” and track the backtest results without constantly monitoring the market. This autonomy allows even those without time or experience to trade automatically. -

Flexibility:

The ability to test the robot on different assets helps identify the best markets to apply the strategy, offering a personalized and adaptable market approach.

Final Thoughts

It is important to note that while backtest results are encouraging, they are based on simulations and historical data analysis. Therefore, no future gains or profit guarantees should be promised. The strategy should be seen as a support tool for trading development, helping investors learn and adapt to market movements.

If you are a beginner looking for how to trade even without knowing the technical details, experimenting with this approach can be the first step to better understanding the financial market. Explore the tool, conduct your own tests, and discover how automated trading can be an ally in your investment journey.