Boilinger Bands and RSI by Gerega

- Experts

- Illia Hereha

- Version: 1.6

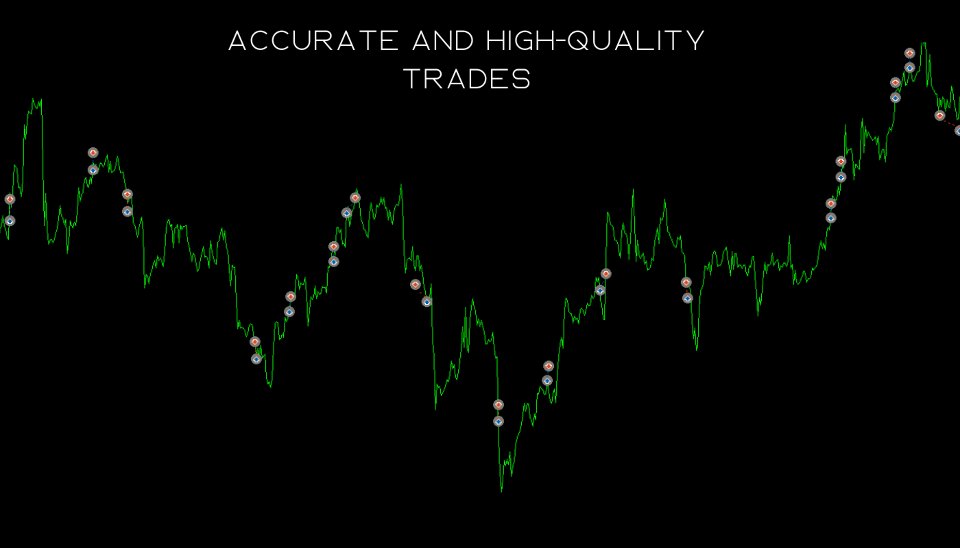

This strategy uses Bollinger Bands and the Relative Strength Index (RSI) to identify potential trade opportunities. It is designed for both mean-reversion and trend-following approaches, making it suitable for various market conditions.

How It Works:

-

Bollinger Bands assess volatility and identify overbought/oversold conditions.

-

RSI gauges momentum and confirms potential market reversals.

Trade Entry:

-

Buy: When the price reaches or falls below the lower Bollinger Band, and the RSI is below 30 (indicating oversold conditions).

-

Sell: When the price reaches or exceeds the upper Bollinger Band, and the RSI is above 70 (indicating overbought conditions).

Trade Exit:

-

Positions are closed when the RSI moves back to a neutral zone (between 40-60), or when the price returns to the middle Bollinger Band.

Key Features:

-

Volatility & Momentum Combination: Offers strong confirmation signals for trade decisions.

-

Adaptable to Various Market Conditions: Works well for both trending and ranging markets.

-

Suitable for Scalping & Swing Trading: Flexible across different timeframes.

-

Customizable Parameters: Fine-tune Bollinger Bands and RSI settings to enhance performance.

This strategy is suitable for traders who seek dependable entry and exit signals, based on market conditions.