SMT Divergence for Crypto Indicator MT4

- Indicators

- Eda Kaya

- Version: 1.11

Smart Money Technique Divergence for Crypto Indicator MT4

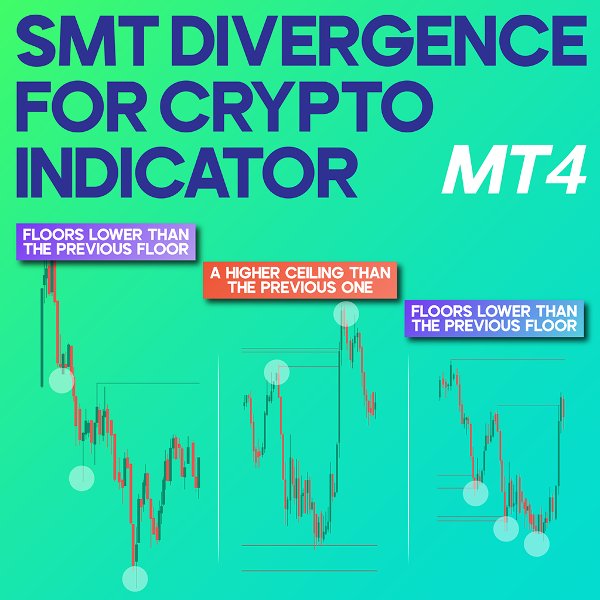

The Smart Money Technique (SMT) Divergence Indicator for MetaTrader 4 is crafted based on divergence analysis and Smart Money principles. It identifies divergence patterns when three or more correlated financial instruments, including currency pairs, indices, or digital assets, exhibit varying price behaviors. Such discrepancies often indicate shifts in institutional money flow, hinting at potential trend reversals or diminishing momentum.

«Indicator Installation & User Guide»

MT4 Indicator Installation | SMT Divergence for Crypto Indicator MT5 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Money Management: Easy Trade Manager MT4 | Trade Copier: Free Fast Local Trade Copier MT4

Smart Money Divergence Indicator Specifications Table

The table below outlines the key specifications of the Smart Money Technique Divergence for Crypto Indicator MT4:

| Category | ICT – Smart Money – Currency Strength |

| Platform | MetaTrader 4 |

| Skill Level | Advanced |

| Indicator Type | Range – Breakout |

| Timeframe | Multi Timeframe |

| Trading Style | Day Trading |

| Market | All Markets |

Indicator Overview

This SMT Divergence Indicator focuses on detecting unusual movement discrepancies between three correlated assets. For instance, if Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) generally move in tandem but one starts deviating from the pattern, it could signal Smart Money involvement and a potential trend shift in the market.

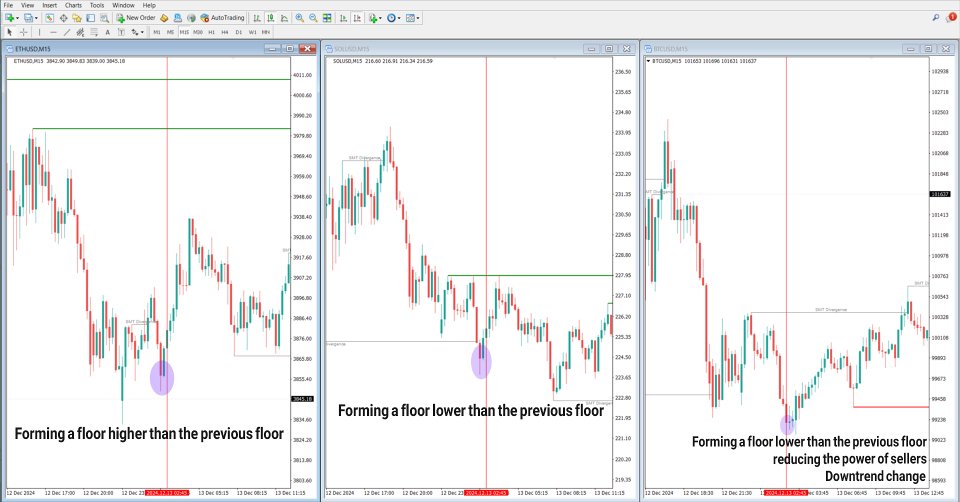

Uptrend Conditions

A 15-minute timeframe chart displays BTC/USD, ETH/USD, and SOL/USD. In this scenario, Bitcoin registers a lower low at $99,084, while Ethereum forms a higher low at $3,849, showing resilience against selling pressure. Solana, however, aligns with Bitcoin's lower low, marking $225. This divergence suggests weakening bearish momentum in BTC, potentially indicating a shift toward an upward trend.

Downtrend Conditions

On a 5-minute timeframe, a divergence pattern appears among BTC/USD, ETH/USD, and SOL/USD. Bitcoin forms a higher high, reflecting bullish strength. However, Ethereum and Solana fail to confirm this move by not establishing new highs. This signals a lack of sustained buying pressure, increasing the probability of a downward reversal.

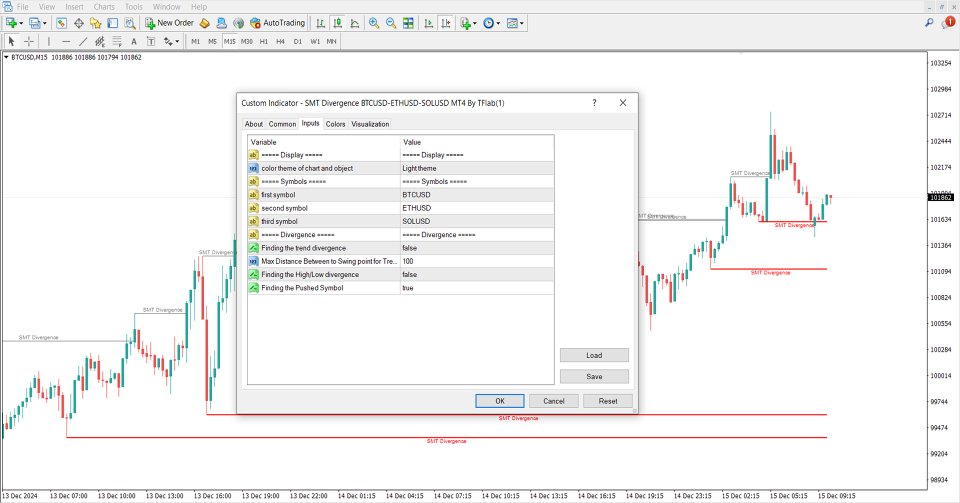

Indicator Settings

The settings for the Smart Money Technique Divergence Indicator are outlined below for fine-tuning its performance:

- Chart and object color theme: Customizable for clarity.

- Primary asset selection: Choose the first trading pair.

- Secondary asset selection: Define the second instrument.

- Tertiary asset selection: Select the third correlated asset.

- Trend divergence detection: Enables spotting divergence patterns.

- Max allowable distance between swing points: Adjust for precision.

- High/Low divergence detection: Identifies critical price level shifts.

- Identification of dominant asset: Recognizes the asset driving price action.

Conclusion

The SMT Divergence Indicator is a powerful tool for recognizing divergence across key cryptocurrencies such as BTC, ETH, and SOL. By assessing their price correlations, traders can pinpoint high-probability entry and exit points while gaining insights into institutional money movements. This strategic advantage helps traders anticipate both bullish and bearish reversals effectively.