Anchored VWAP indicator

- Indicators

- Ahmad Kazbar

- Version: 1.5

- Updated: 1 March 2025

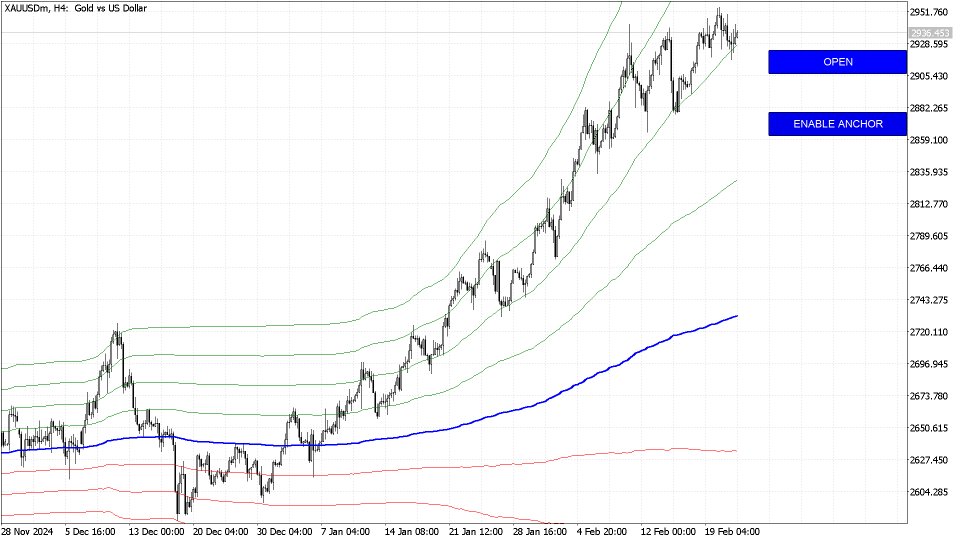

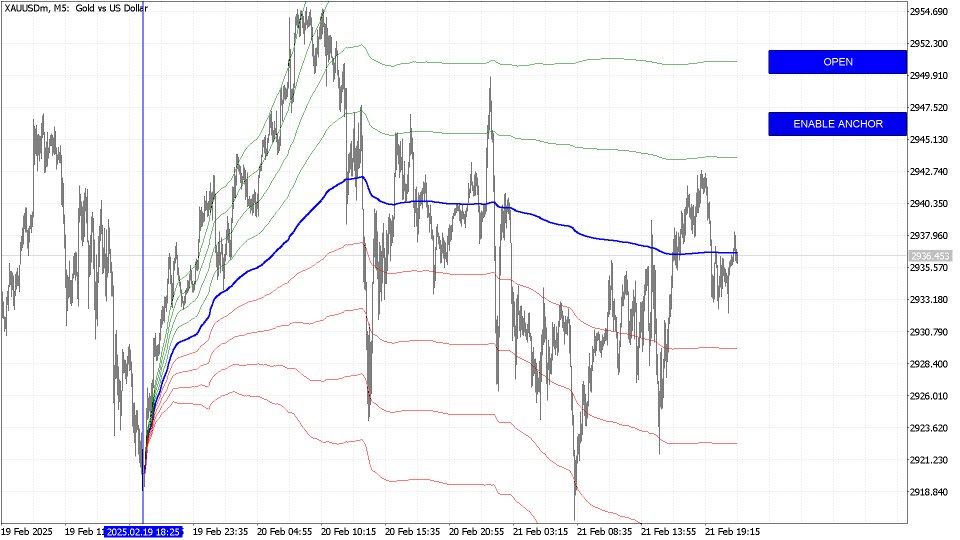

Anchored VWAP (Volume-Weighted Average Price) Indicator

The Anchored VWAP (Volume-Weighted Average Price) is a technical analysis tool that calculates the average price of an asset, weighted by volume, from a specific user-defined starting point. Unlike traditional VWAP, which resets daily, the Anchored VWAP allows traders to select a significant event, such as earnings reports, swing highs/lows, or other key price levels, to analyze price trends and market sentiment.

By anchoring the VWAP to a chosen date or price level, traders can gain deeper insights into institutional activity, support/resistance zones, and trend strength. The indicator helps identify fair value areas and potential entry/exit points based on how price interacts with the anchored VWAP line.

Key Features:

- Customizable anchor point to analyze price action from critical events

- Helps determine trend direction and fair value areas

- Useful for spotting dynamic support and resistance levels

- Applicable across multiple timeframes for enhanced market analysis

The Anchored VWAP is widely used by technical traders, portfolio managers, and algorithmic strategists to refine their trading decisions by combining price, volume, and time into a single, insightful metric.

User didn't leave any comment to the rating

When using the VWAP, it must be fixed at a certain point, and the price deviation is calculated based on this point. In the future, I will work on updating or approximating the starting point every 200 candles (example) or more.