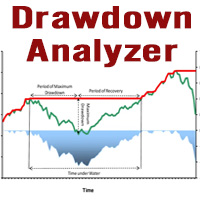

Drawdown Analyzer

- Utilities

- Manh Viet Tien Vu

- Version: 1.0

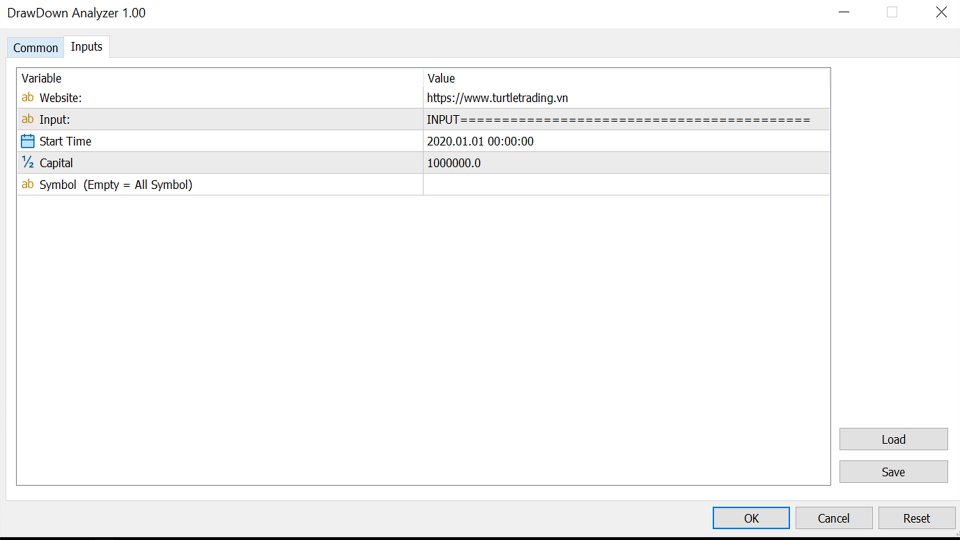

This tool is specifically designed to calculate drawdowns in a trading or investment account, expressed as a percentage, by using user-input balance figures. In essence, it allows users to track how much their account dips from a peak balance to a subsequent low point, a metric that is instrumental in understanding risk exposure. By supporting the option to choose a specific timeframe, it empowers traders and investors to pinpoint the start date of their measurement, ensuring that the data reflects their desired trading window or market conditions. Furthermore, the tool goes beyond a broad overview by enabling calculations for individual symbols as well as for the entire account. This added flexibility lets individuals see precisely which assets are driving their largest losses or gains, ultimately helping them to make more informed decisions about risk management and portfolio allocation.

Drawdown, by definition, refers to the decline in account balance or equity from a peak to a subsequent low. It is typically expressed as a percentage, with larger percentages indicating higher risk or exposure to potential losses. Traders often consider the magnitude of a drawdown when determining the viability of a particular strategy or asset, because a significant drawdown can pose substantial threats to an account’s overall health—especially if the position sizes are large, or the market is highly volatile. By providing a clear calculation of drawdown, this tool helps users understand not just the raw loss figures, but also the context of how those losses compare to their account’s peak balance.

With the possibility to compute drawdown for each individual symbol, users can isolate problem areas in their portfolios. For instance, if a trader holds positions in multiple currency pairs, stocks, or commodities, the tool will break down how each of these instruments contributes to the overall drawdown. This granular approach can highlight which specific trades or assets are creating the greatest risk. Conversely, by calculating drawdown at the account level, users can see an aggregated snapshot of total losses over their chosen timeframe. Such a holistic view is essential for investors seeking to understand how the entirety of their capital is performing rather than focusing solely on one asset.

An additional benefit of this tool is its capacity to foster effective risk management practices. Once an investor or trader sees the extent to which their account can draw down, they can begin implementing protective measures—such as adjusting position sizes, setting more conservative stop-loss levels, or diversifying their holdings to reduce concentrated risk. For example, if a particular symbol frequently results in significant drawdowns, it might be prudent to reduce exposure to that asset or re-evaluate the underlying strategy driving the trades.

Ultimately, the core purpose of this drawdown calculation tool is to support more informed, disciplined trading and investment choices. By clarifying the risks involved, highlighting potential trouble spots within a portfolio, and providing a means to measure drawdown across different time periods and symbols, it empowers both novice and experienced market participants to protect their capital more efficiently. In doing so, it plays a pivotal role in preserving account health and enhancing the overall process of managing financial risk.