Focused Trend Breakout Trader

- Experts

- Moses Ebiakpoyerimowei Waritimi

- Version: 2.0

- Activations: 5

Here's a detailed description of your EA, explaining how it works and how best to use it.

Overview

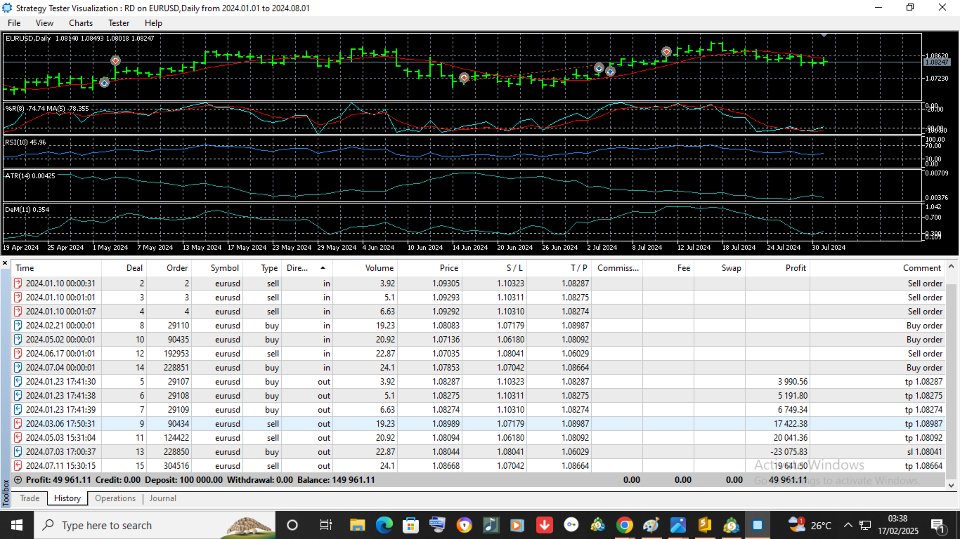

This Expert Advisor (EA) is designed to trade multiple symbols using a trend-following and momentum-based strategy. It utilizes Williams %R (WPR), Moving Averages (MA), Relative Strength Index (RSI), DeMarker, and ATR to identify optimal trade entries and exits. The EA dynamically calculates lot size based on risk percentage and manages stop-loss (SL) and take-profit (TP) using the ATR (Average True Range) multiplier.

It also includes requote handling, lot size adjustments, and retry logic to improve execution reliability.

How the EA Works

1. Trade Entry Conditions

The EA scans multiple symbols ( EURUSD, USDJPY, XAUUSD ) and executes trades when all conditions align:

📈 Buy Conditions:

- confirming an uptrend.

- confirming bullish momentum.

📉 Sell Conditions:

- confirming a downtrend.

- confirms bearish momentum.

If these conditions are met, the EA executes a trade using ATR-based SL/TP placement.

2. Stop Loss & Take Profit Calculation

- Stop Loss (SL): Calculated using the ATR multiplier and must be greater than the broker's minimum stop level.

- Take Profit (TP): Set using a Reward:Risk ratio (default 1:1).

Both values adjust dynamically based on market conditions.

3. Lot Size Calculation

- The EA automatically calculates lot size based on the risk percentage of the account equity (default 2%).

- It considers minimum and maximum lot sizes allowed by the broker.

- If margin is insufficient, the EA reduces lot size or does not enter a trade.

4. Execution & Trade Management

- Trades are executed with a 5-point slippage allowance, which increases if a requote occurs.

- If an error occurs (e.g., price change, off quotes, or broker busy), the EA retries up to 3 times before skipping the trade.

- Trades are exited when:

- Price crosses the MA Filter in the opposite direction.

- Stop Loss or Take Profit is hit.

How to Use the EA Effectively

✅ Recommended Settings

- Risk Percentage: Set between 1-2% per trade for account safety.

- ATR Multiplier: Default is 2; increase for larger SL/TP in volatile markets.

- DeMarker Period: Keep between 10-14 for effective trend filtering.

- MA Filter: Default is 9-period SMA; adjust based on market trends.

✅ Best Market Conditions

- Works best in trending markets with strong momentum.

- Avoid using in low volatility or ranging markets, as signals may be weak.

🚀 Advantages of This EA

✅ Fully Automated – Scans multiple symbols & executes trades automatically.

✅ Risk Management – ATR-based SL/TP & lot size calculation prevent overexposure.

✅ Robust Execution – Includes requote handling, margin checks, and slippage adjustments.

✅ Multi-Symbol Trading – Trades EURUSD, USDJPY, XAUUSD simultaneously.

❌ Limitations & Precautions

⚠️ Not suitable for low-liquidity pairs due to slippage sensitivity.

⚠️ Does not trade in sideways markets – Avoid using in ranging conditions.

⚠️ Requires a broker with tight spreads & low slippage for optimal execution.

🛠️ Final Recommendations

- Use on an ECN account with low spreads and fast execution.

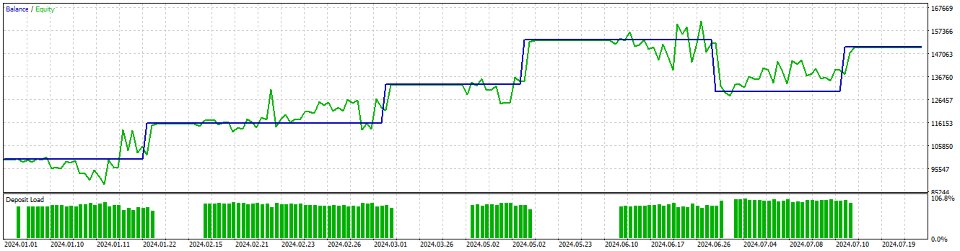

- Backtest before live trading to find the best settings for your strategy.

- Monitor trade execution logs to ensure proper order placement.

Conclusion

This EA is a powerful trend-following tool for traders who want automated execution, precise risk management, and multi-symbol support. By filtering trades with WPR, MA, RSI, and DeMarker, it ensures high-quality trade entries in trending markets.

For best results, test settings on a demo account before using real funds.