Extreme Breakout Signa MT5

- Indicators

- Yonggang Shang

- Version: 1.41

- Updated: 4 February 2025

- Activations: 10

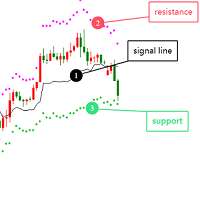

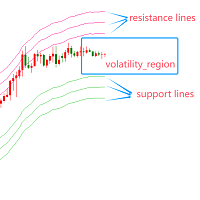

Extreme Breakout Signal is a trading strategy based on price breaking through key support or resistance levels. It indicates potential trend shifts, allowing traders to capture new upward or downward movements.

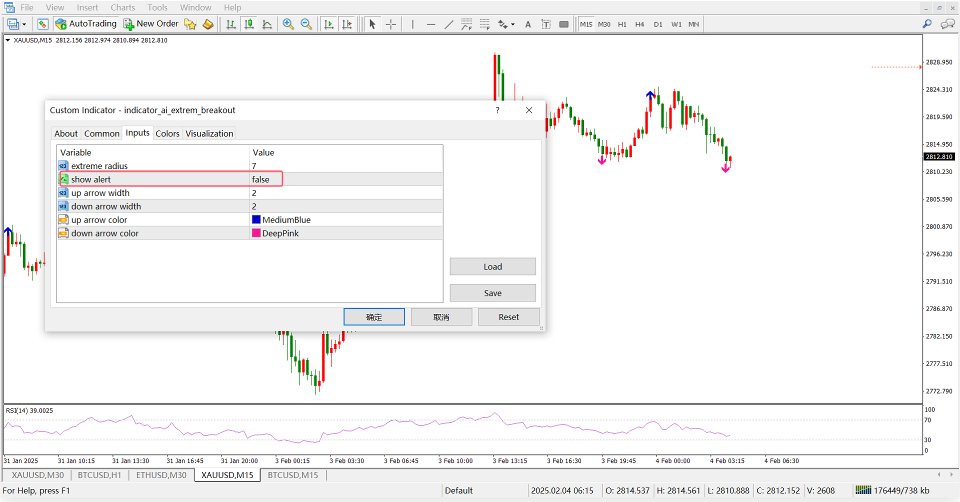

Parameter - extreme radius: extreme radius

Key Principles

- Support & Resistance: Prices often reverse near these levels; breaking them may signal a new trend.

- Confirmation: Use volume or other indicators to verify the breakout's validity.

Signal Types

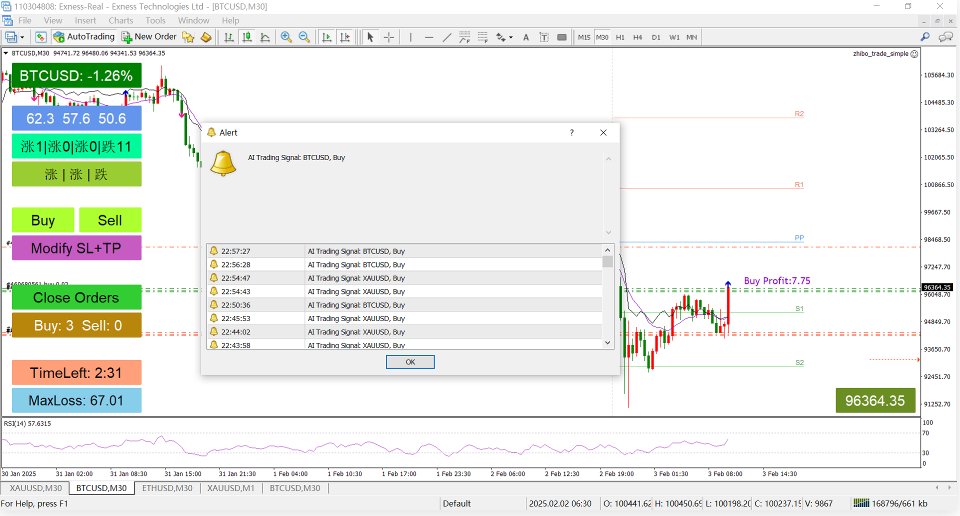

- Buy Signal: Price breaks above resistance, suggesting an uptrend.

- Sell Signal: Price breaks below support, suggesting a downtrend.

Application

- Breakout Confirmation: Combine with indicators like volume, RSI, or MACD.

- Stop Loss & Take Profit: Place stop loss near the previous level and adjust take profit based on market conditions.

Pros and Cons

- Pros: Helps capture early trends and works across various markets.

- Cons: High risk of false breakouts, less effective in ranging markets.

Conclusion: Breakout signals are powerful tools for identifying new trends but should be used with confirmation to avoid false signals.