Golden Algo

- Experts

- Ramethara Vijayanathan

- Version: 2.1

- Updated: 19 April 2025

- Activations: 12

Golden Algo – The Ultimate AI-Powered Expert Advisor for Gold Traders

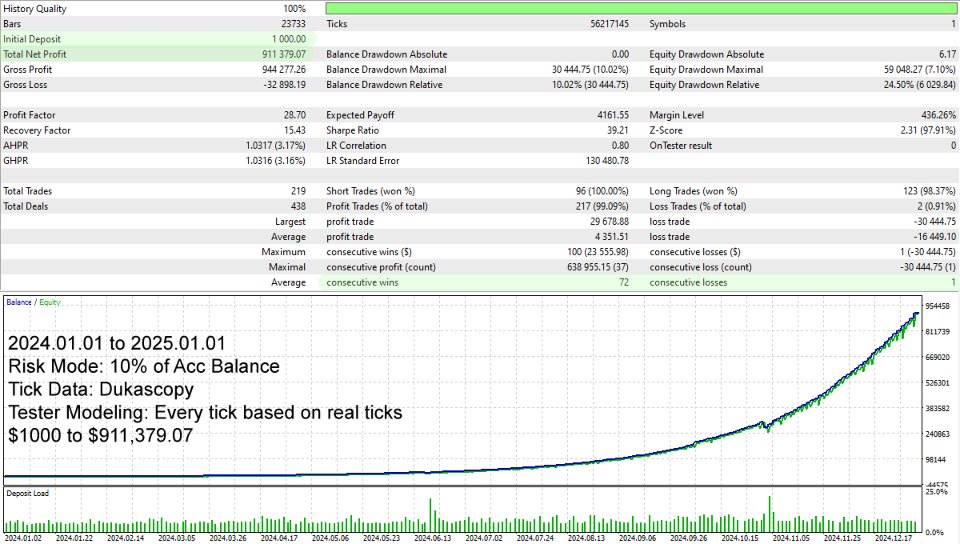

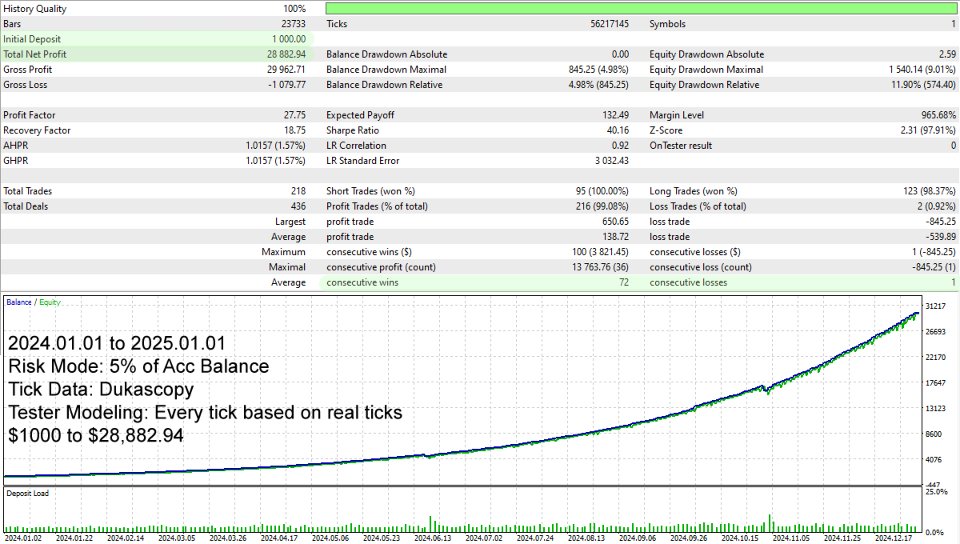

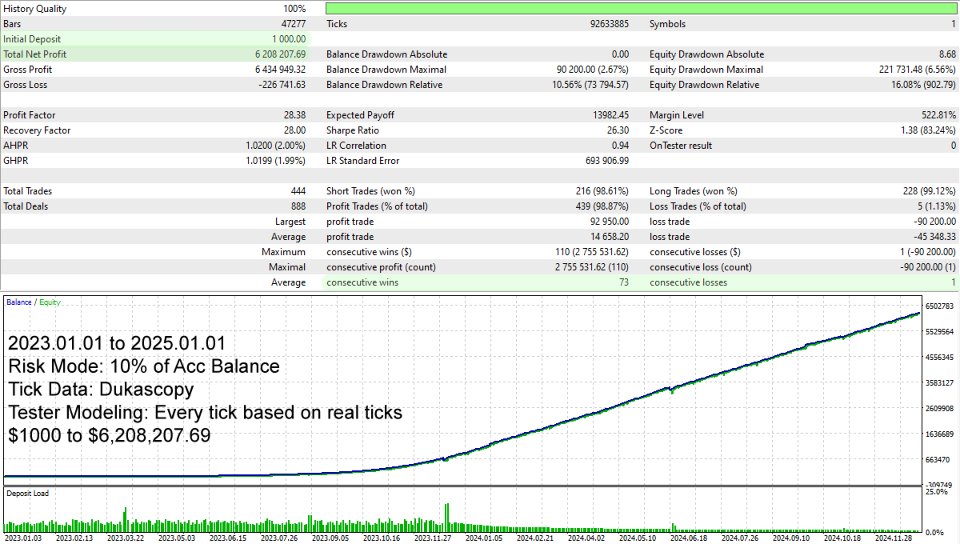

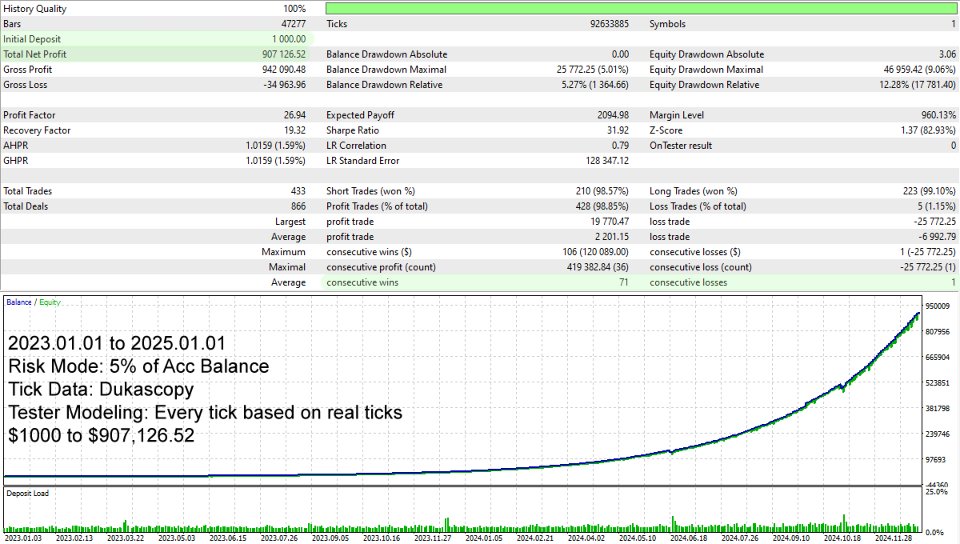

Golden Algo Expert Advisor is a powerful trading system designed specifically for XAUUSD (Gold). It combines technical indicators with real-time market data—including the US Index and market sentiment—to generate precise trade signals. Each signal is then filtered through an advanced OpenAI-powered process to ensure only high-probability trades are executed. By blending technical analysis, fundamental insights, and artificial intelligence, this EA delivers a smart, strategic, and adaptive approach to trading in the live market.

Price will go up soon!

Last price: $399.00

Next price: $699.00

The price of the EA increases based on the number of copies sold. Only few copies will be sold at this price

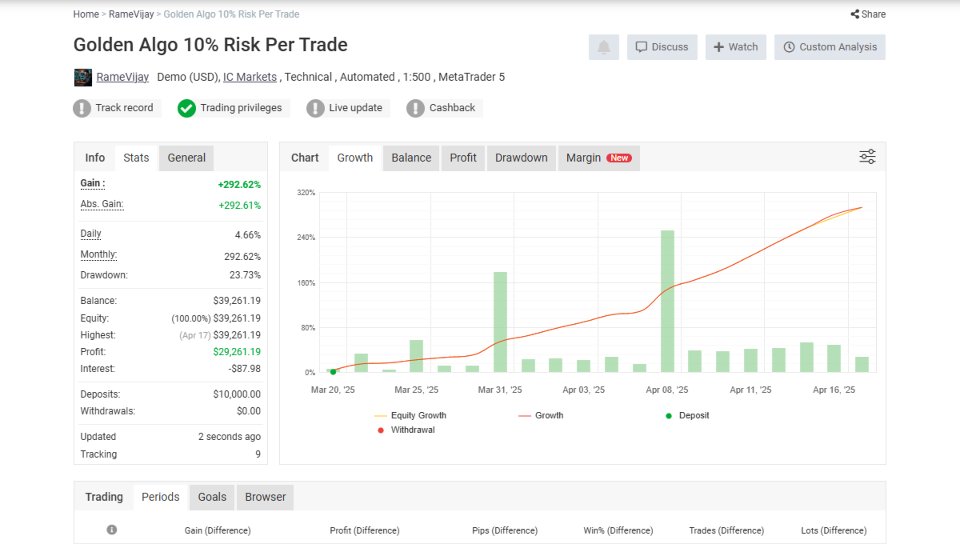

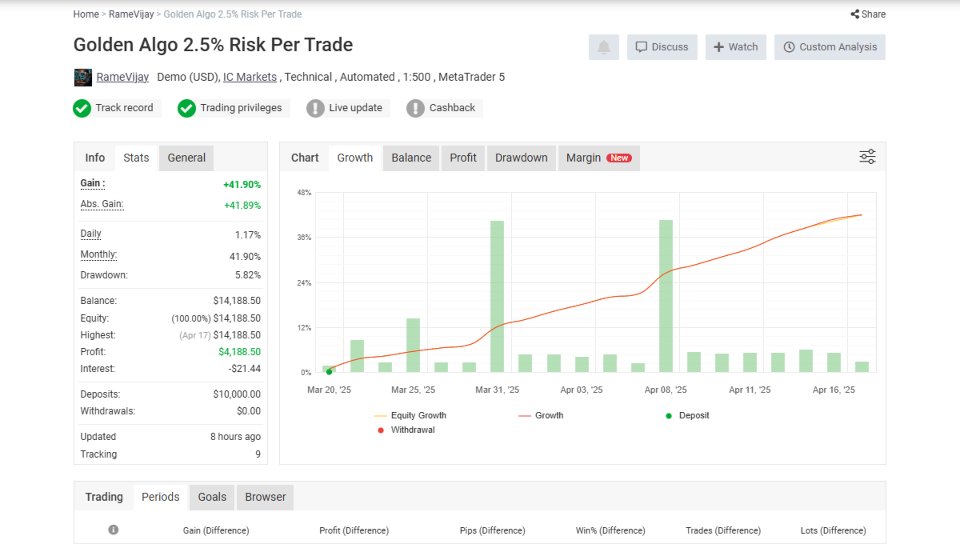

Signal : Please visit www.goalai.live

Why Golden Algo Stands Out?

- Tailored for Gold & Serious Traders: Specifically designed for the fast-moving nature of XAUUSD, Golden Algo suits traders who seek consistent results, moderate trade frequency, and controlled risk.

- Market-Adaptive Logic: Continuously adjusts to real-time US Index movements and sentiment data, ensuring trades are always in sync with dominant market conditions.

- AI-Enhanced Execution: Combines OpenAI signal validation with intelligent algorithmic logic for fast, accurate, and high-quality trade entries.

- Strict Risk Management: Every position follows a disciplined 3:1 risk-to-reward ratio with clearly defined stop loss and take profit—no wide stops or guesswork.

- Precision Recovery System: Handles losses with calculated, risk-aware strategies focused on recovery without compromising long-term capital protection.

- No Dangerous Strategies: Completely avoids risky tactics like Martingale, grid, or averaging—built on sustainable trading principles for long-term stability.

- Honest Execution: Executes trades exactly as backtested—no overfitting, no unrealistic tuning, and no surprises between test results and live performance.

Golden Algo isn’t just another EA—it’s a professional-grade trading system built for traders who take their strategy seriously.

Common Questions & Concerns from Users

Why are you using demo accounts instead of live trading accounts?

Due to regulatory restrictions in the U.S., it's not possible to open live trading accounts with high leverage. For this reason, we are currently using demo accounts. However, all trades in the signal account can be fully verified, as they match the backtest exactly in terms of open/close times, entry price, stop loss, take profit, and trade comments. This allows users to confidently cross-check every trade.

How do you handle live data in backtests, considering MetaTrader doesn't allow web requests in tester mode?

You're right—web requests are blocked in tester mode. To work around this, we release a weekly update containing real-world data from the previous week, including the US Index, market sentiment, and OpenAI confirmations. This lets users run backtests with accurate, historical live data. No other EA offers this level of realism because most don’t rely on external data in the first place.

Is the EA based on a martingale or recovery system?

No, the main strategy is not martingale-based. However, there is an optional recovery mode, which can multiply a previous loss by a recovery coefficient to attempt to recoup it. This is fully customizable—or can be completely disabled—depending on your risk tolerance.

How accurate is the backtest compared to the signal account?

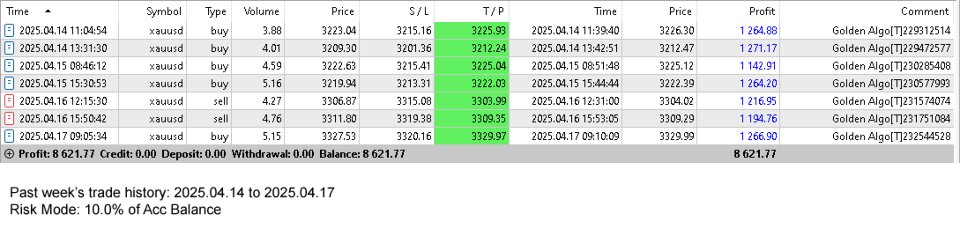

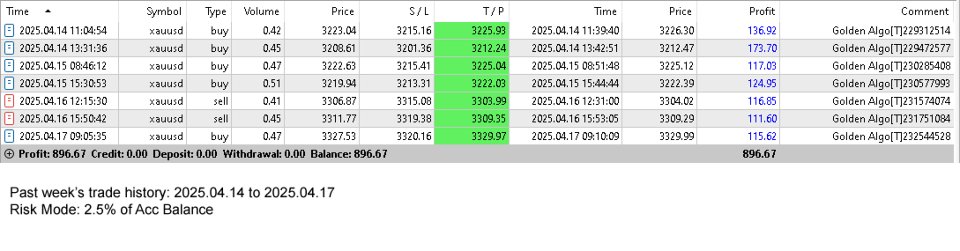

The signal account is still relatively new, so it’s too early to make definitive win rate comparisons. That said, every trade in the backtest has a one-to-one match with the signal account trades. Over time, a longer performance record will provide a more meaningful comparison between live results and backtest performance.

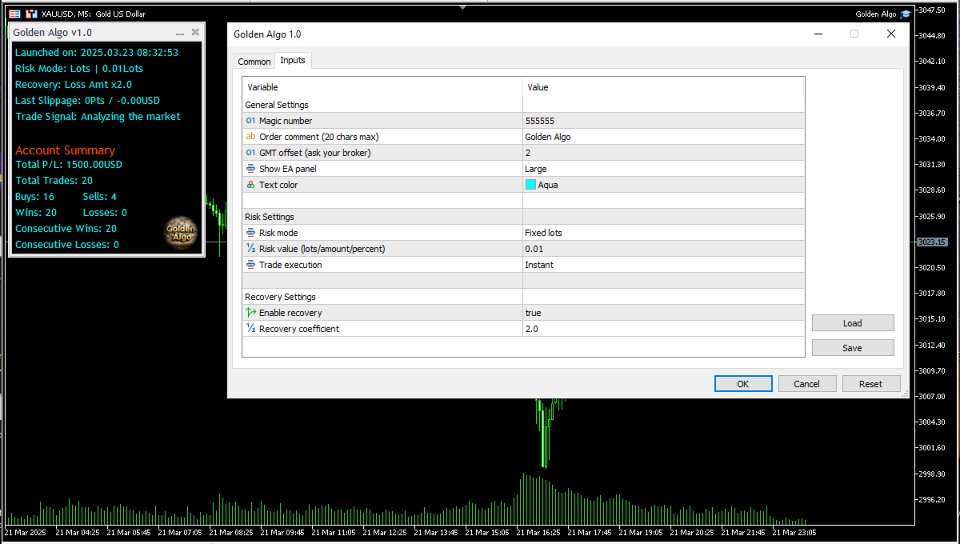

Using the Expert Advisor is designed to be straightforward and user-friendly. Simply attach it to one XAUUSD/GOLD chart, choose your desired risk level, and let it trade accordingly. Avoid placing it on multiple charts to prevent potential conflicts.

Recommendations:

- Working symbol: XAUUSD/GOLD

- Timeframe: Any

- Deposit: $300.00 or above

- Leverage: 1:100 or above

- Broker: Not sensitive. But please use a low commission, low spread broker for best results

- VPS Recommended for the EA to work 24/7

Specifications:

- Every trades are protected with SL and TP

- Risk to Reward: 3:1

- SL points: 500Pts to 1500Pts

- TP points: SL Points / 3

- Live trade history updated to the EA on a weekly basis

- No Martingale/ No Grid/ No Averaging/ No Over-optimization

Must Read disclaimer:

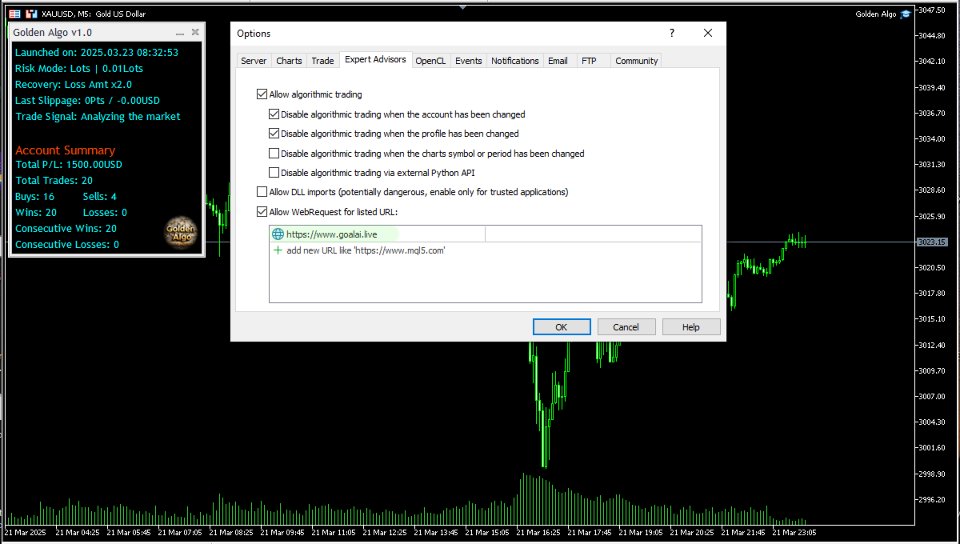

- This EA integrates external data sources as part of its strategy. Users are required to add a link to our website 'www.goalai.live' in order to access US Index and market sentiment data, as well as utilize the OpenAI API for signal filtration.

- Trade Execution Modes:

- Instant: Trades are executed immediately when a trade signal is generated. This mode ensures that you enter the market without delay, making it suitable for accounts with wider spreads.

-

Wait for Better Price: For buy trades, the EA waits for the price to go down before executing, and for sell trades, it waits for the price to go up. This gives a better risk-reward ratio. This mode is suitable for accounts with tight spreads. Choosing this option on accounts with wider spreads may result in missed trading opportunities due to the delay in execution.

- Before purchasing the Golden Algo EA, it’s essential to understand the risks of trading. Past performance does not guarantee future success, as market conditions can change. Testing the EA across various market scenarios is crucial to gauge its effectiveness. It’s wise to start with small positions or use a demo account to minimize potential losses while getting familiar with its performance. Being cautious, informed, and practicing sound risk management is key to navigating the markets successfully.

If you have any questions, please feel free to contact me before making a purchase

The EA has been performing exceptionally well on my end, so I’m genuinely puzzled as to why others are facing issues or blowing their accounts. It’s important to understand that the EA comes with risk parameters, and if those aren’t set correctly based on your account size, the fault lies in the setup—not the system. Two stop-loss hits should not be enough to blow an account unless there's serious over-leveraging involved. Please don’t do an injustice to the developer by blaming the EA when it’s actually due to mismanaged risk or improper configuration. Also, keep in mind the recovery feature is optional—you can turn it off from the start for a more conservative approach.