R trend sync indicator

- Indicators

- Ekaterina Saltykova

- Version: 1.0

- Activations: 5

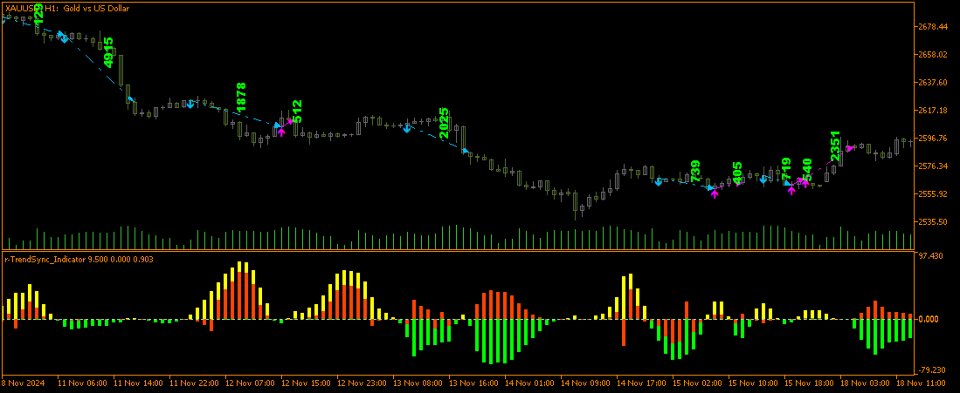

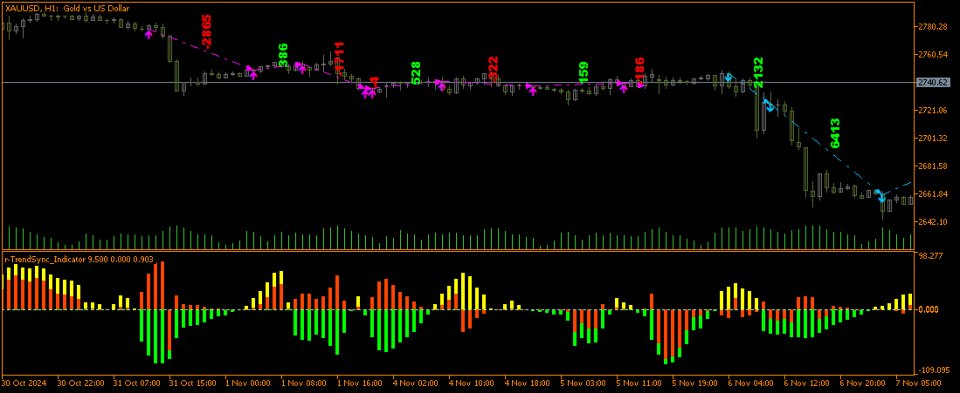

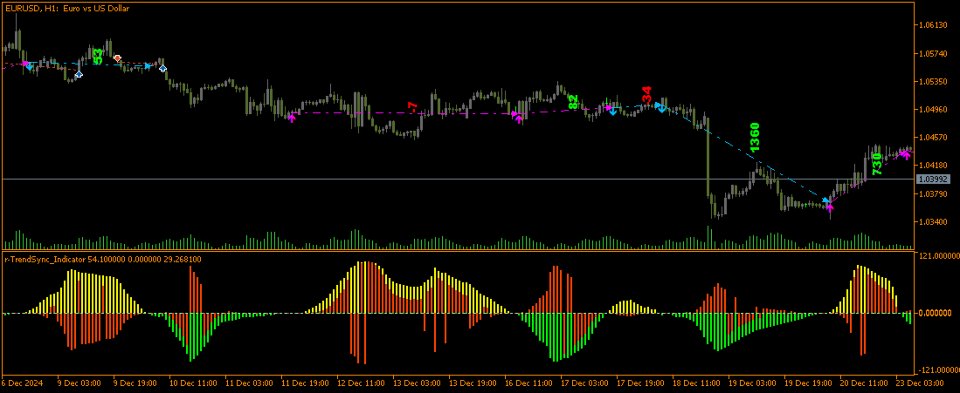

r-Trend Sync indicator is manual trading system for extra volatility markets.

Main System features :

-

The indicators's algorithm is based on the analysis of an extensive array of historical data (from 1995 for EURUSD & EURJPY and from 2004 for XAUUSD), which ensured the identification of general patterns in the behavior of these pairs across a wide range of timeframes.

-

The analysis of historical data helped the system learn to recognize market triggers for medium-term trends and cycles, as well as respond appropriately to their repetitions, contributing to more balanced trading decisions when opening positions.

-

The trading system generates signals for long and short positions when the internal base indicator detects unusual market dynamics that predict the beginning of a pronounced trend phase. This allows timely entry into the market before significant price movements, ensuring maximum profitability of trades.

-

Minimum signal delay: Since the base indicator is based on the latest available data, trading signals are generated with almost no delay, allowing faster reactions to changes in the market situation.

-

Scalability of the strategy: The system can operate on multiple timeframes: H1, H2, H3 & H4, enabling the final strategy to diversify investments and reduce overall portfolio risk.

-

Universality and parameter optimization for different markets and timeframes: flexible settings allow adapting the strategy to various market conditions and instruments, increasing its universality and effectiveness. This approach suits highly volatile pairs such as XAUUSD, EURUSD, EURJPY within the H1-H4 timeframe range, making strategy applicable under diverse market conditions. Additionally, the ability to trade simultaneously on several pairs and in different "time zones" creates an effect similar to hedging, reducing risks by minimizing potential losses since positions often offset each other, and stabilizing profits: even during periods of high market uncertainty, when some pairs show losses, others may generate profits, ensuring stability of the overall result.

-

Adaptation to changing market conditions: Thanks to adjustable parameters and consideration of price dynamics, the system can adapt to evolving market conditions, ensuring stable operation even in times of high volatility.