HMM a Hidden Markov Model EA

- Experts

- Better Trader Every Day

- Version: 1.10

- Updated: 26 March 2025

- Activations: 5

HMM

Latest version: v1.1

FEATURES

- HMM uses the famous Hidden Markov Model to predict the price trend.

- It uses the algorithms of Baum-Welch and Viterbi to train the model and predict price trend.

- This implementation of Hidden Markov Models is a self-adjusting online learning algorithm that processes up to 160 bars from the latest data to readjust its parameters at the arrival of every new bar.

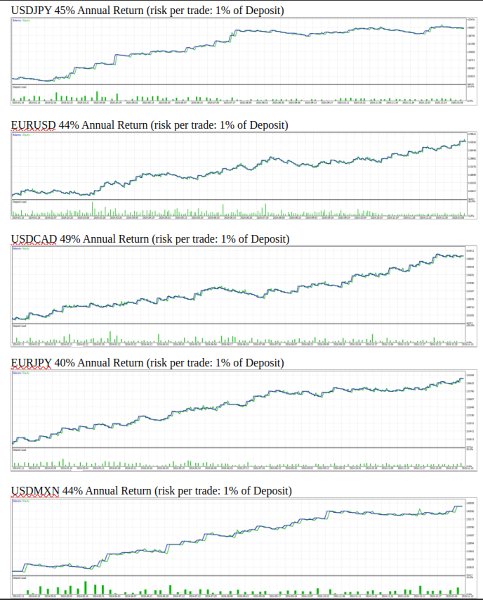

- It trades ANY Forex pair, ANY metal symbol. We recommend major ones: combinations of USD,GBP,JPY,EUR,AUD,CAD,XAU.

- User may run any number of symbols in parallel.

- It does not use grid, martingale, or hedging strategies.

- Account type: Netting or Hedging. It always use Netting rules.

- User level required: from beginner to expert traders. It requires user to know the Metatrader 5

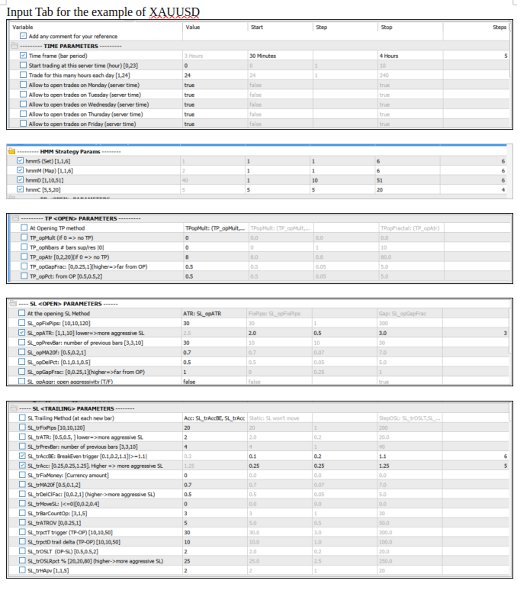

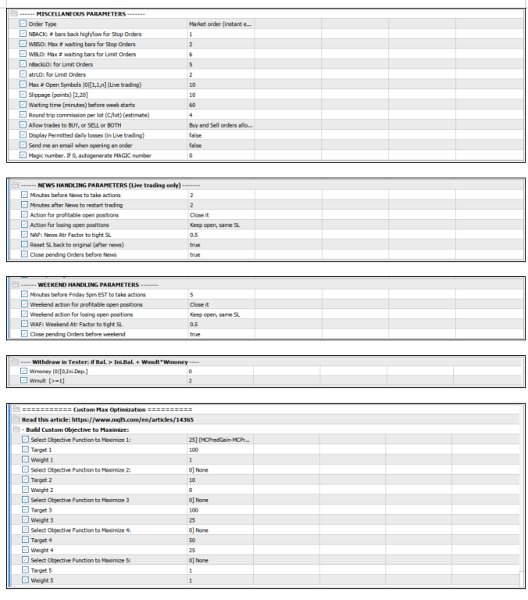

Optimization tools as we recommend to optimize parameters before running live.

- All other time frames are also available.

- All trades are opened with a Stop Loss automatically. Never lose more than what you risked in a given trade.

- User may select which days of the week the EA trades.

- User may select a time window for trades (start/end hours).

- Multiple methods for opening Take Profit (TP) calculation, including no TP.

- Multiple methods for the opening and trailing Stop Loss (SL) calculation.

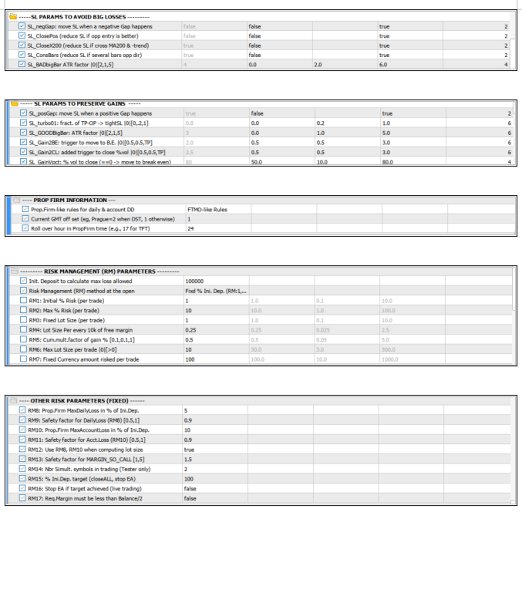

- Multiple methods to handle large changes in price (positive or negative).

RISK MANAGEMENT

- Multiple ways to calculate money at risk, and lot size. You don’t need to calculate anything.

- Proprietary Firm friendly: at every tick, it checks max daily loss and max account loss limits.

- It closes positions and suspends trading until next day if daily loss limit is approaching.

- It closes positions and stops trading if account loss limit is approaching.

- It stops trading when Prop. Firm target is achieved (optional).

HANDLING NEWS and WEEKENDS

- It handles high importance news (it ignores low and medium priority news).

- It handles open positions and pending orders before and after the news.

- It handles open positions and pending orders before weekend starts.

OPTIMIZATION

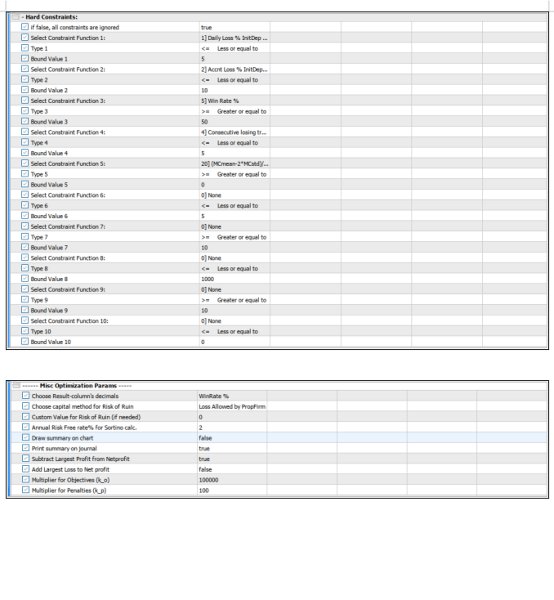

- We recommend to run the MT5 optimization tool on the symbol of your interest. This optimization is to adjust the Stop Loss parameters.

- We recommend to optimize with the "Custom Max" objective using the Generic Optimization Formulation (GOF) explained in this article: https://www.mql5.com/en/articles/14365

THE TRADER’S ENVIRONMENT: A CRITICAL FACTOR IN BACKTESTING

Every trader operates within a unique environment, defined by three key components:

1. Broker : Prices, spreads, leverage, fees, and commissions vary across brokers, impacting trading outcomes.

2. Network : Local internet connection speeds influence execution speeds, affecting entry and exit prices.

3. Computer : Processing power and internet connection speed combine to determine delays and slippage.

These environmental differences mean that two traders using the same:

- Expert Advisor (EA)

- Input set file

- Symbol

- Time frame

- Dates

will never achieve identical backtest results. While results may be similar, variations in environment ensure that outcomes will always differ. Therefore, running optimization of the input parameters before you start trading in your environment is critical. This step helps ensure that your trading strategy is tailored to your unique environment, maximizing its potential for success.

Risk Warning

Before purchasing this (or any) EA, be aware of the risks involved.Past performance is not a guarantee of future profitability (EA could also incur losses).

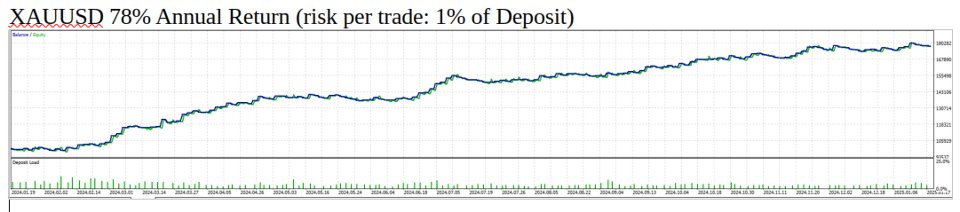

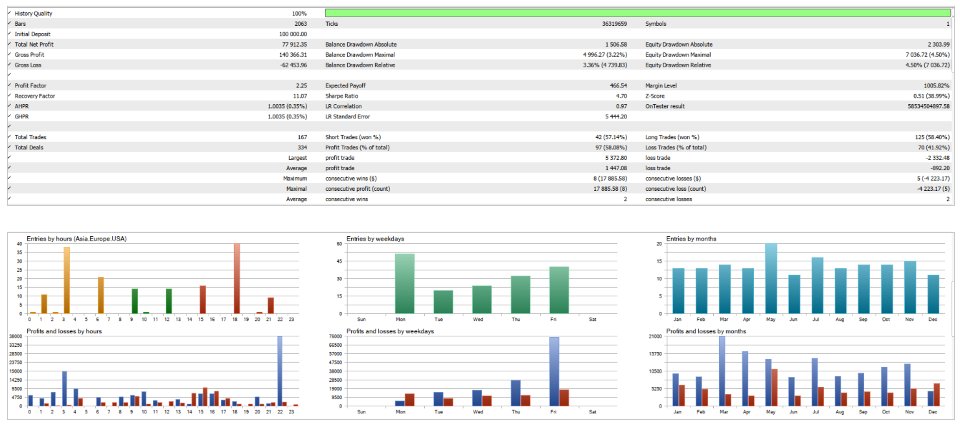

Backtests shown (e.g., in screenshots) are optimized for the training data, and the performance cannot be directly applied to live trading.

There is a probability (although small) when using any EA that you may lose money in all your trades.

Hence, risk the amount of money you are comfortable losing.