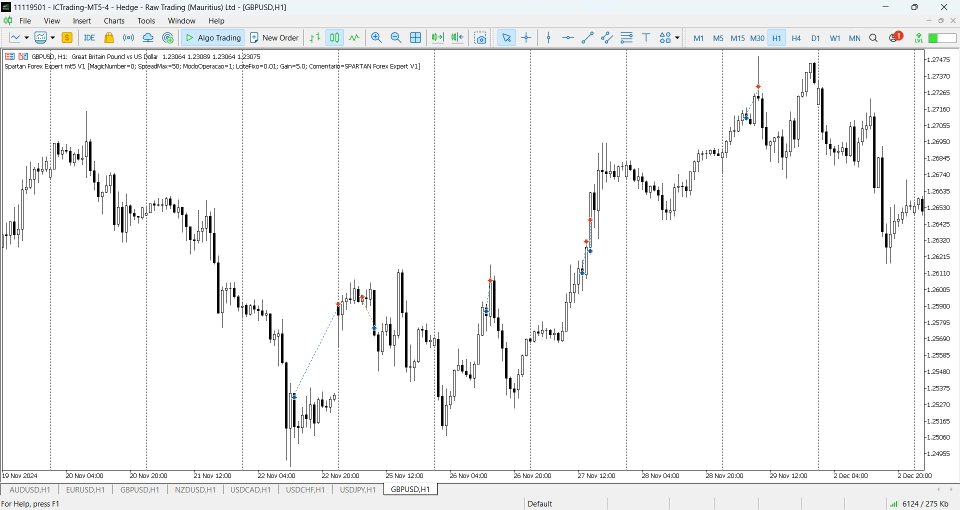

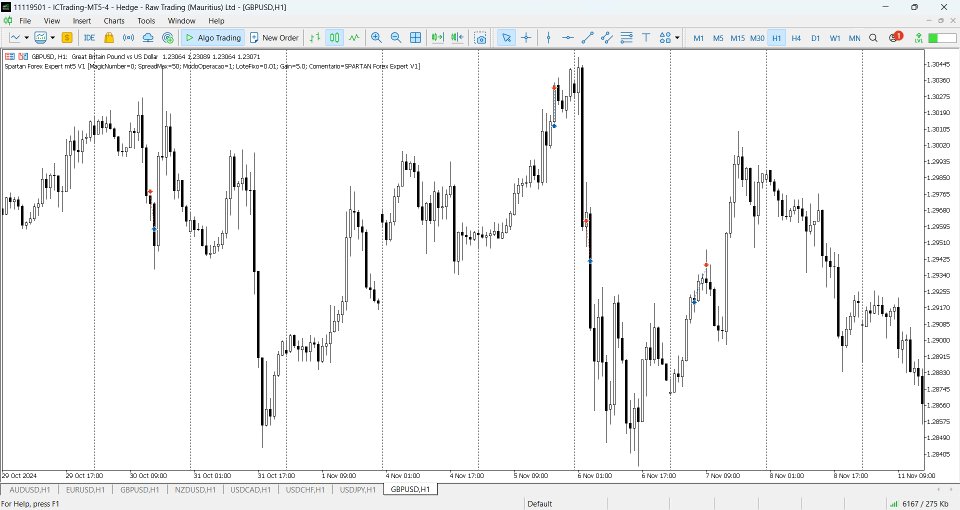

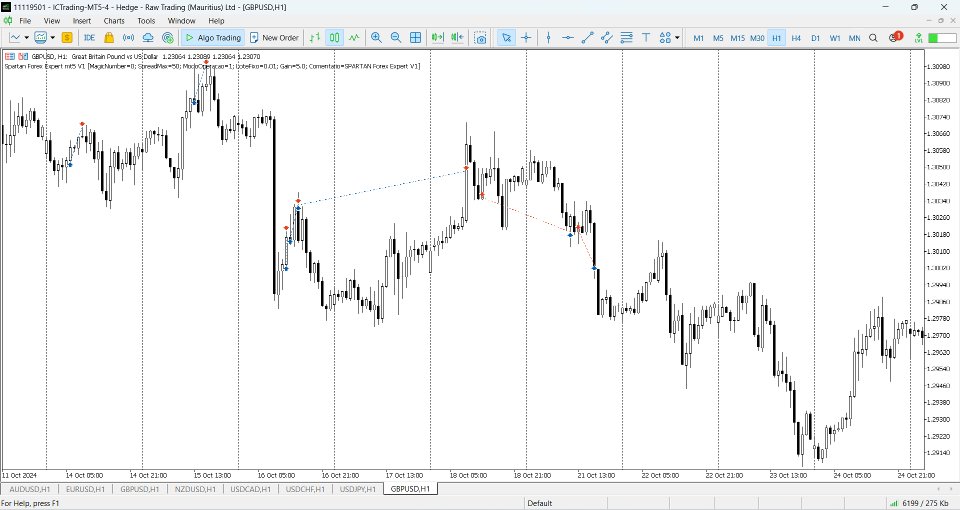

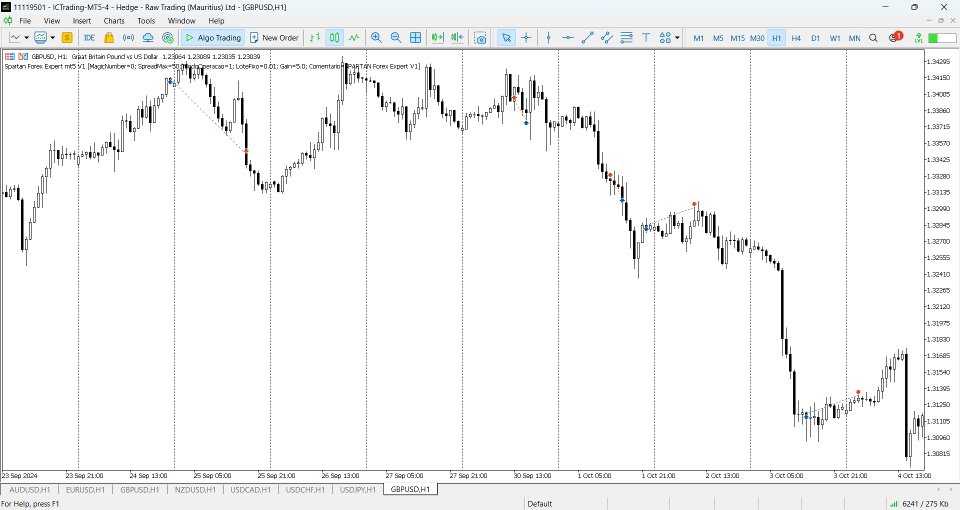

Spartan Forex Sword expert mt5 gbpusd

- Experts

- Damiem Marchand De Campos

- Version: 4.0

- Updated: 14 April 2025

- Activations: 10

Catch the best trend movements from the start with your cutting-edge trading expert designed to elevate your trading performance.

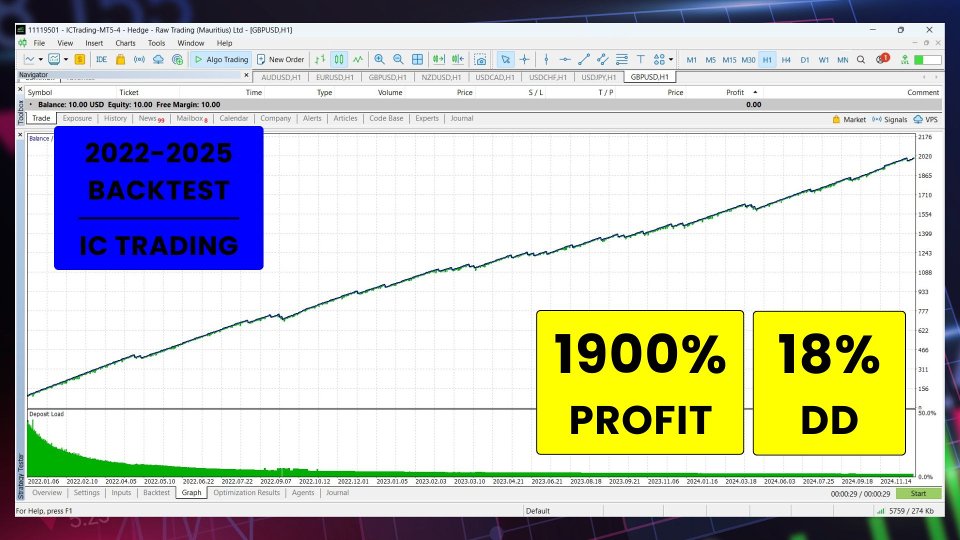

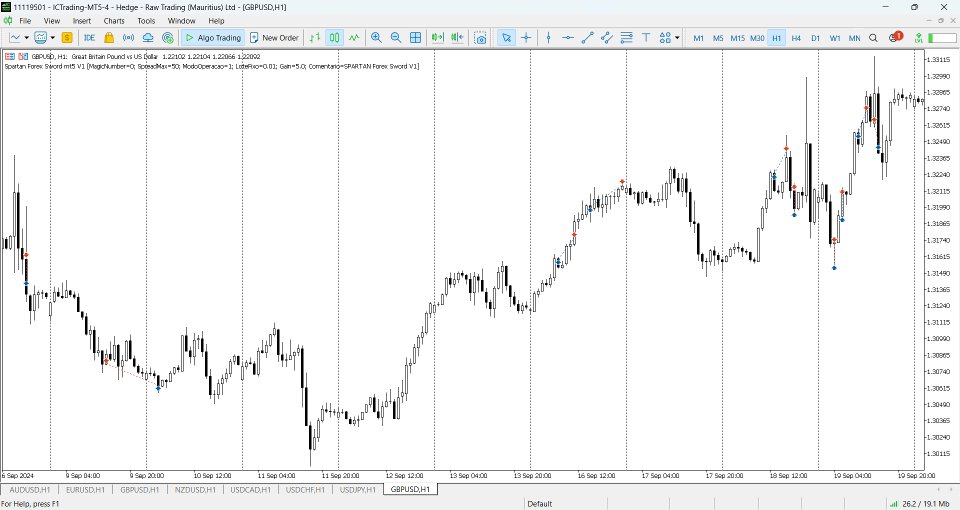

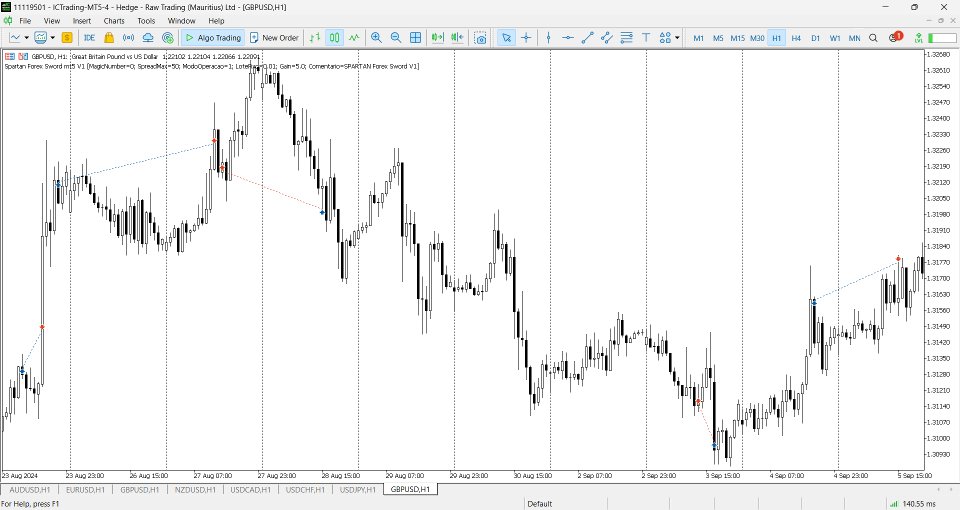

This is a powerful Expert Advisor for taking advantage of the best trend opportunities, right from the start, on the H1 timeframe and on the MT5 platform, with a minimum deposit of $100 and impressive accuracy and performance. This EA works like a hunter, analyzing the price movement, its strength and trend, patiently waiting for the best opportunities to perform its work extremely effectively. The EA is based on ICT INNER CIRCLE TRADING strategies, looking for the biggest movement trends and seizing the best opportunities.

Key features:

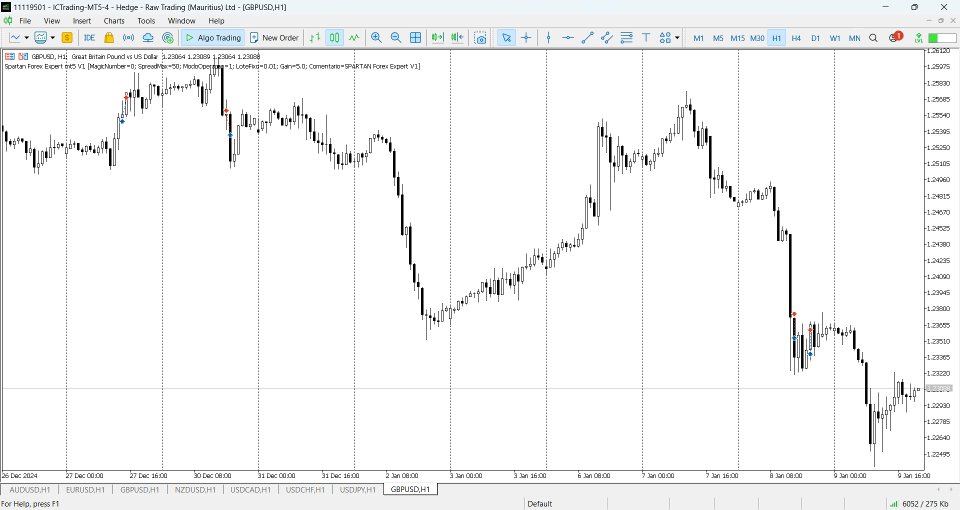

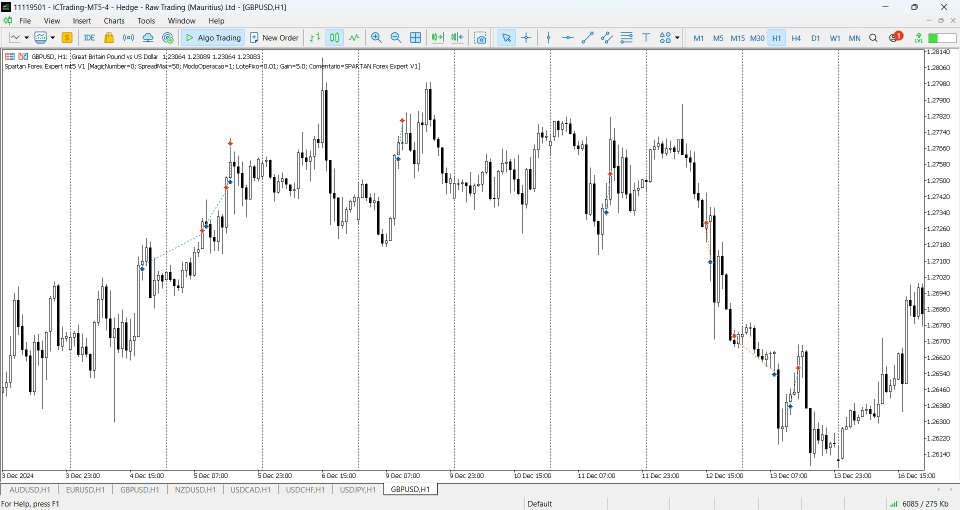

Traded Symbol: GBPUSD.

This EA continuously analyzes the price movement and when it identifies the best opportunities, it sends a single limited order, thus opening a position.

Every position has a fixed Target and a fixed Stop Loss set from the beginning.

The lot is also calculated and determined automatically from the inputs.

This EA is very SAFE, it does NOT use Grid, Martingale or Hedge strategies. All trades have only one entry per trade and are protected by a hard stop loss.

All trades are day trades or swing trades, are not scalper.

This EA is its very strong RESILIENT to high-impact NEWS (FOMC, FED, Payroll, ECB, BOE, SNB, BOC, BOJ, RBA or RBNZ) or any other abrupt price movements. You don't need to do anything, the EA protects itself.

Recommendations:

- Symbol: GBPUSD,

- Timeframe: H1,

- Minimum Deposit: $100.

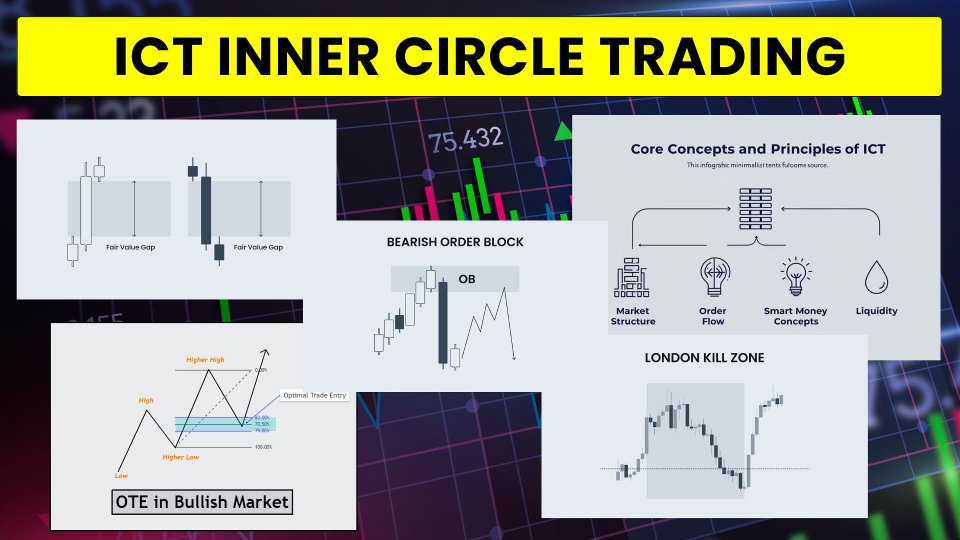

The main strategy of this expert is - ICT INNER CIRCLE TRADING - by Michael J. Huddleston

The ICT strategy is a structured method for trading forex that brings technical analysis together with an emphasis on market behavior. With this strategy, the expert will be looking for key price levels and patterns that signal potential opportunities to deal. The strategy also incorporates knowledge of institutional trading movements, which helps traders anticipate where major players are likely to position themselves.

ICT is sophisticated approach to forex trading that represents the actions of large institutional players on the market, it enables retail traders to gauge market movements by learning and mimicking the forex trading strategies used by these institutions.

ICT strategies include a number of components that are necessary for spotting potential trading setups and projecting market behavior. These collectively represent several frameworks for traders, including order blocks, fair value gaps, liquidity pools, and much more.

The ICT trading strategy covers a number of concepts: market structure, optimal trade entry points, and the significance of various trading sessions.

FGV FAIR VALUE GAP

The fair value gap (FVG), also known as imbalance, is critical to the ICT forex trading strategy. The term refers to a price gap created by an imbalance in buying or selling, often leading to a robust price movement away from its fair value. These gaps typically get filled as the market seeks a balance and gives traders possible entry and exit strategies.

OTE OPTIMAL TRADE ENTRY

Optimal trade entry is another crucial component of the ICT strategy. This concept involves identifying the balanced price range — a zone that the market will retest before resuming its trend. These levels are significant in that they matter to institutional participants. For example, the price impulsing at a given level suggests that a large trade was executed, or significant stop-loss or take-profit order types were triggered. Prices often return to these impulse points, which makes them optimal entry points.

OB ORDER BLOCKS

Order blocks are supply and demand zones where institutional market participants and retail traders place large orders. Since a large order can cause a robust price change, it is broken down into smaller order blocks executed as counter orders accumulate liquidity. These steps allow institutional traders to fully execute a large order without significantly affecting the price.

KILL ZONES

Kill zones represent a specific time period of the day when the market is especially likely to demonstrate certain predictable movements. These periods include the Asian Session, the London Open, and the New York Open.

The Asian session range, from 3:00 a.m. to 12:00 p.m. (GMT+3), is a very important period in the ICT strategy because it often shows a market consolidation, which sets up potential trade opportunities for the more volatile London and New York sessions.

The London Open is well known for its high volatility and significant price movements, especially during the London open kill zone from 09:00 a.m. to 12:00 p.m. (GMT +3).

From the volume analysis perspective, the New York kill zone, from 1:00 p.m. to 4:00 p.m. GMT in winter and from 12:00 p.m. to 3:00 p.m. GMT in summer, is crucial for USD-paired currencies and almost all the markets.

This expert also uses a basket of indicators as a basis, the main one being a unique and exclusive indicator, created and optimized by the developer.

How to install:

- Download this EA,

- Make sure that all pairs (GBPUSD) are in the Market Watch (Ctrl+M),

- Have the (GBPUSD) chart on the H1 timeframe,

- Place this EA on the (GBPUSD) chart,

- Check and adjust the parameters as shown below,

- Click OK to activate,

- Done!

- [#01] Magic Number,

- [#02] Spread Max,

- [#03] Operation Mode (Fixed Lot or Target),

- [#04] Fixed Lot,

- [#05] Target (USD),

- [#06] Comment.

I am committed to continuously optimize and improve all my EAs to give you and me the best possible trading experience. You will receive all UPDATES for FREE and I will also add new features to the EA based on customer suggestions.

If you have any questions or need help, please contact me.

Download now and enjoy this powerful EA.

TOP