MSL Trailing

- Utilities

- Lamont Simone Reynecke

- Version: 1.0

- Activations: 5

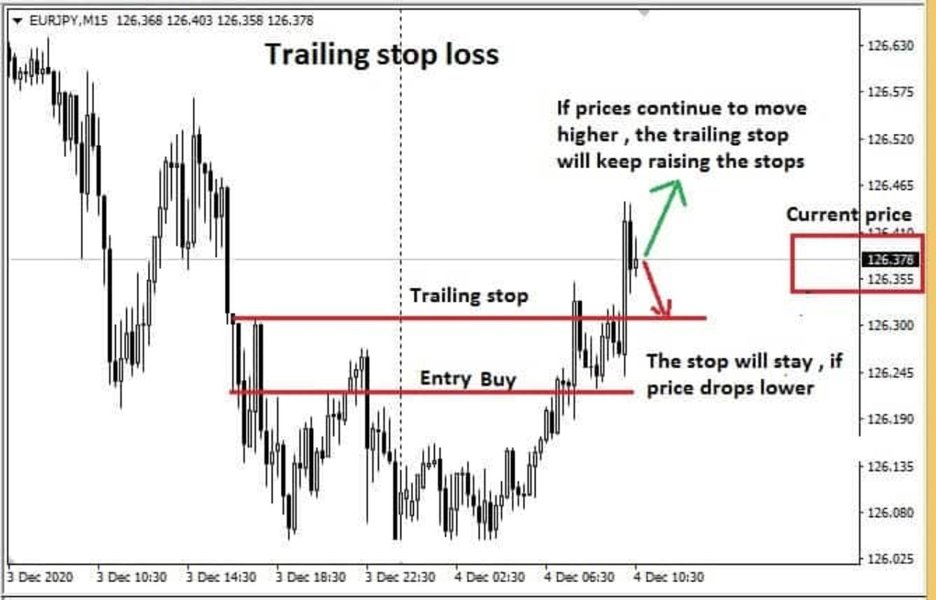

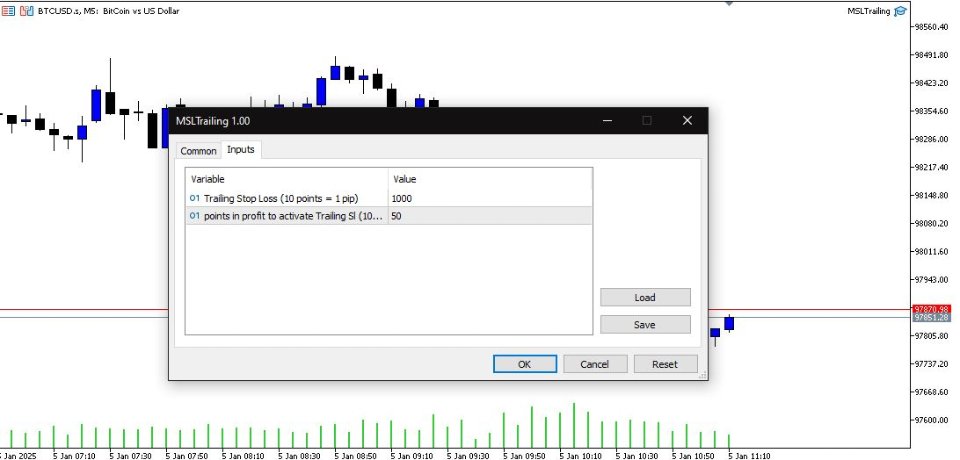

A trailing stop loss is a risk-management tool that automatically adjusts the sell trigger point for a financial instrument as its price rises or falls and by using this trailing sl program it insures that your trades will be risk free each and every time

How it works

A trailing stop loss is set at a fixed distance from the current market price, either as a percentage or a fixed dollar amount. When the price moves in a favorable direction, the stop price moves with it to maintain that distance.

Purpose

A trailing stop loss helps investors protect profits and limit potential losses. It allows traders to take profits until the market turns against them.

When to use it

A trailing stop loss can be a useful exit strategy for traders who want to follow the trend.