MeanAI

- Experts

- Manh Viet Tien Vu

- Version: 1.7

- Updated: 13 March 2025

- Activations: 10

Signal: Live MeanAI

Price: The price increases based on the number of licenses sold. The starting price for this EA was $199.

Available copies: 10

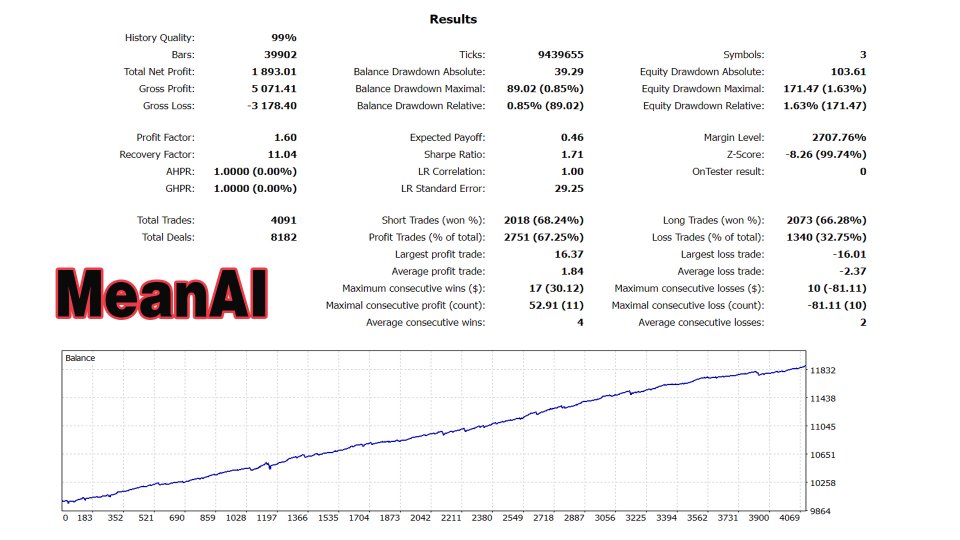

This is an EA designed to generate steady profits at the cost of tail risk. It is built on the principle of mean reversion.

It is suitable for investors seeking quick profits and lacking the patience required for trend trading.

This EA employs a trading style that is entirely opposite to all my other EAs.

Frankly, it is quite risky as it involves tail risk, meaning it can be dangerous when encountering large market trends.

This type of strategy is also commonly employed by the majority of EAs in the market today. They often take on significant tail risk in pursuit of consistent profits.

This becomes evident when you observe that the Equity curve is always lower than the Balance curve.

As I emphasize in all my products, trading with tail risk is akin to playing Russian roulette — eventually, you may pull the trigger on the chamber with the bullet.

Nevertheless, it remains a viable strategy to diversify your trading style, complementing trend-following strategies (which avoid tail risk but require patience).

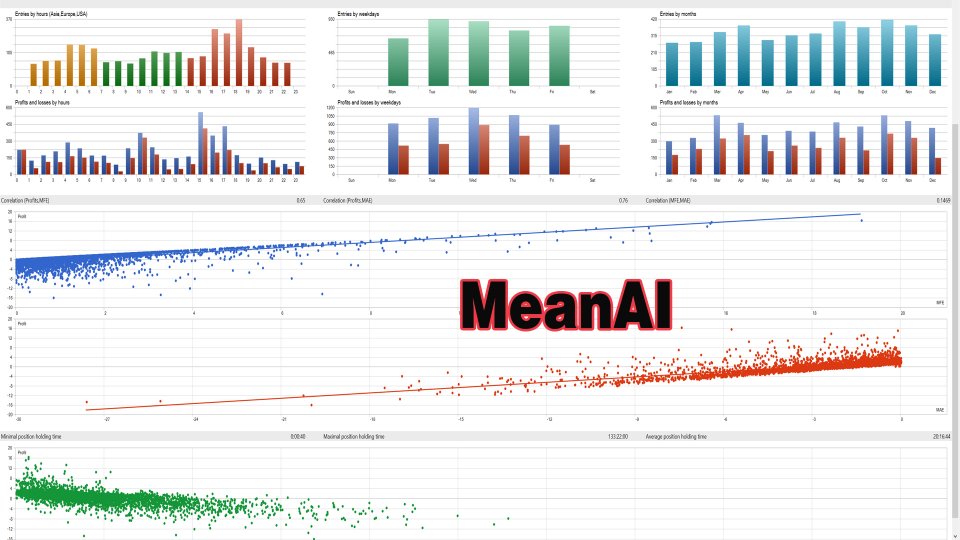

| Asset | AUDCAD, NZDCAD, AUDNZD |

| Time frame | H1 |

| Capital | Minimum $500 |

| Broker | Any broker |

| Risk | 0,01 lot / $ 500 |

| Leverage | từ 1:20 |

| Type | Mean Reversion, grid |

This EA can be effective when applied to assets with strong mean reversion characteristics and minimal trending behavior. It should be traded only with small position sizes.

This strategy is an excellent addition if you are already using trend-following strategies (a more robust approach).

It can help smooth out your equity growth curve. However, always remain mindful of the inherent risks.

The EA performs particularly well in ranging markets without significant tail risk during the trading period. With favorable conditions, such a market environment can last for several years.

To mitigate potential risks, limit the amount of capital you deposit into your account. At the same time, ensure your account balance is sufficient for the EA to handle withdrawals and avoid margin calls.

Recommended pairs: AUDCAD, NZDCAD, AUDNZD.

Secondary pairs (usable but with higher tail risk): EURUSD, GBPUSD, USDCAD, AUDUSD.

EA User Guide:

To get started, open your trading platform (MT5) and drag the EA from the Expert Advisors folder onto the chart of your desired trading pair.

Enter a fixed lot size in the Fixed Lot field and assign a unique Magic Number to distinguish this EA’s trades from others.

If you want the EA to trade on multiple symbols, set Trade on multiple symbols? to True and enter a list of symbols in the Map Of Symbol field. Ensure the symbols are entered correctly (case-sensitive), separated by commas, and added to the Market Watch window. If you prefer to limit trading to the current chart, set this option to False.

During backtesting, manually enter the broker’s GMT time in the Broker in GMT field. For live trading, the EA automatically adjusts the timing, requiring no manual input.

To enable the EA, ensure the Auto Trading button on your platform is activated.

When using multi-symbol mode (Trading on multiple symbols? = True), make sure that the symbol names exactly match the broker’s naming convention, are case-sensitive, and are added to Market Watch to avoid errors. If multi-symbol mode is not enabled (Trade on multiple symbols? = False), the Symbol Map field will not be used.

Importance: Check the Experts tab in the Toolbox to ensure the EA is not encountering any errors; otherwise, it will not function properly. A common issue when using multi-symbol mode is error 4302, which occurs if you haven’t added the symbols to the Market Watch. To resolve this issue: Restart the terminal, in the Market Watch, right-click and select Show All Symbols, then reattach the EA.

For time conversion, the EA handles this automatically during live trading, but for backtesting, you must manually input the broker's GMT time.

The manual trade direction setting feature allows you to define the trading direction of the EA based on your own market outlook. For instance, if you believe the market is in an uptrend and want the EA to only execute buy trades, you can select the "Trade_OnlyLong" mode in the Trade Mode field. Conversely, if you want the EA to only execute sell trades, you can choose the "Trade_OnlyShort" mode.

This feature should be used when the EA is set to trade on the current chart only, meaning the "TradeOnMultiSymbol" function is not enabled. Otherwise, the EA will trade in the specified direction across all pairs in the MapOfSymbol.

It is advisable not to use this feature if you lack experience. A better approach is to let the EA trade in all directions, as it has already demonstrated long-term edge.

Although EAs do not manage trades based on Magic Numbers, assigning a number is essential to prevent conflicts with other EAs, ensuring no interference with the trades this EA manages.

Since my EA manages orders based on comments, it’s best to keep the input comment set to the default. If you want to change it, make sure it’s distinct from the comments of other EAs. Additionally, if you’re upgrading the EA version or adding the EA back to the chart, ensure you input the exact same comment as before.

To monitor trades, check the Trades tab and verify the Magic Number in the Account History tab to ensure EA trades are not confused with other trades.

If issues occur, verify that the symbol names in the Symbol Map field are correct, confirm no Magic Number conflicts, and ensure all required symbols have been added to Market Watch.

Good luck and happy trading!

Bot hàng tuyển nhé a e :D