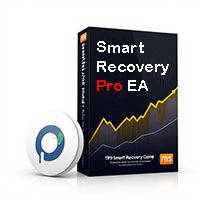

Smart Recovery Pro MT5

- Experts

- KO PARTNERS LTD

- Version: 1.0

- Activations: 10

Smart Recovery Pro is a cutting-edge Expert Advisor designed to manage and recover losing trades with precision and efficiency. Built for traders seeking a reliable and intelligent solution to minimize drawdowns and maximize profitability, this EA combines advanced recovery mechanisms with innovative correlation strategies to pair trades effectively.

Key Features:

- Smart Recovery Algorithm: Automatically identifies and manages losing orders, implementing calculated recovery techniques to return your trading account to profitability.

- Correlation Strategies: Utilizes market correlations to open paired trades, reducing overall exposure and balancing risk across positions.Drawdown Reduction: Focuses on minimizing drawdowns while strategically recovering losses to protect your capital.

- Flexible Parameters: Highly customizable settings allow you to adapt the EA to your unique trading style and market conditions.

- User-Friendly Interface: Intuitive setup process ensures traders of all experience levels can optimize the EA with ease.

Whether you're managing a challenging market environment or simply looking to enhance your trading strategy, Smart Recovery Pro offers a robust and reliable solution. Take control of your trades, minimize losses, and achieve smarter recovery with this powerful EA.

NOTE: This is not an immediate plug and play EA due to its many features and settings, you have to extensively back test it using your drawdown tolerance and risk. This is also a non-aggressive Recovery EA, so the recovery process may take some time. However, it is effective in achieving its purpose. You also have the option to manually close all positions once your profits exceed your losses. For set files or assistance, feel free to contact me.

Back Testing: 15 Mins - 1hr Timeframe (chart)

When conducting back tests, please ensure that the appropriate settings are used and adjusted as needed. For optimal accuracy, select the "Every tick based on real ticks" option or download real market data via Dukascopy from Tickdata Suite.

Pivot Point Super Trend Setting Recommended Input:

Signal Timeframe confirmation for Hedge Orders: 1min, 2 mins, 15Mins or 1Hr

Pivot Point Period - 2

ATR Factor - 3 or 5

ATR Period - 10 or 100

Note: The higher the ATR Factor and Period the more refined the signal. The lower the ATR Factor Period the more signals are taken.

Correlation input example: (Optional)

Note: Please ensure you check the latest correlation tracker on Myfxbook or any correlation tracker website to ensure the current best correlated and non correlated pairs in relation to your primary settings.

Two Pairs: Lower drawdown

GBPUSD against EURUSD (opposite Direction)

EURUSD against GBPUSD (opposite Direction)

Two Pairs: Higher drawdown

GBPUSD(Primary) against EURUSD (same Direction)

EURUSD(Primary) against GBPUSD (same Direction)

Three Pairs: Lower drawdown

GBPUSD (Primary) against EURUSD (opposite Direction) against AUDUSD (same direction as primary)

EURUSD (Primary) against GBPUSD (opposite Direction) against AUDUSD (same direction as primary)

Three Pairs: Higher drawdown

GBPUSD (Primary) against EURUSD (opposite Direction) against AUDUSD (opposite direction as primary)

EURUSD (Primary) against GBPUSD (opposite Direction) against AUDUSD (opposite direction as primary)

Recovery TP and SL Settings: Please back test to ensure the right amount of risk per drawdown

TP Settings:

TP dif btw all magic numbers: True

TP diff btw all magic numbers: 5 (Varies)

TP subtract from losing orders: True

TP subtract from profitable orders: True

SL Settings:

SL dif btw all magic numbers: False (Usually false but you can select True, dependent on your drawdown during back test to reduce overall loss)

SL diff btw all magic numbers: 5 (Varies)

SL subtract from losing orders: False (Varies)

SL subtract from profitable orders: True (Varies)

Please note: Backtesting is an essential component of any recovery strategy. Before purchasing this EA, ensure you thoroughly backtest it using your preferred drawdown and risk parameters in relation to your account size and balance.