CosyTrader

- Utilities

- Chung Hsin Shih

- Version: 1.0

- Activations: 6

Main Features

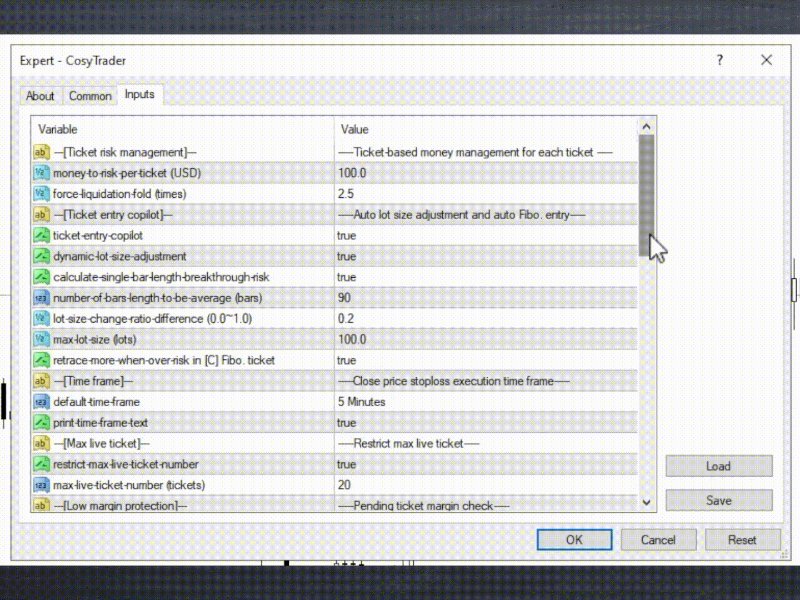

- Automatic Position Size Calculation: Automatically determines lot size based on stop-loss distance and ticket-based risk amount.

- Automatic Fibonacci Retracement Entry: Tracks market waves and enters trades during pullbacks at specified retracement levels.

- Multiple Time Frame Close Price Stop-Loss Execution: Executes stop-losses based on the bar close of your selected time frame.

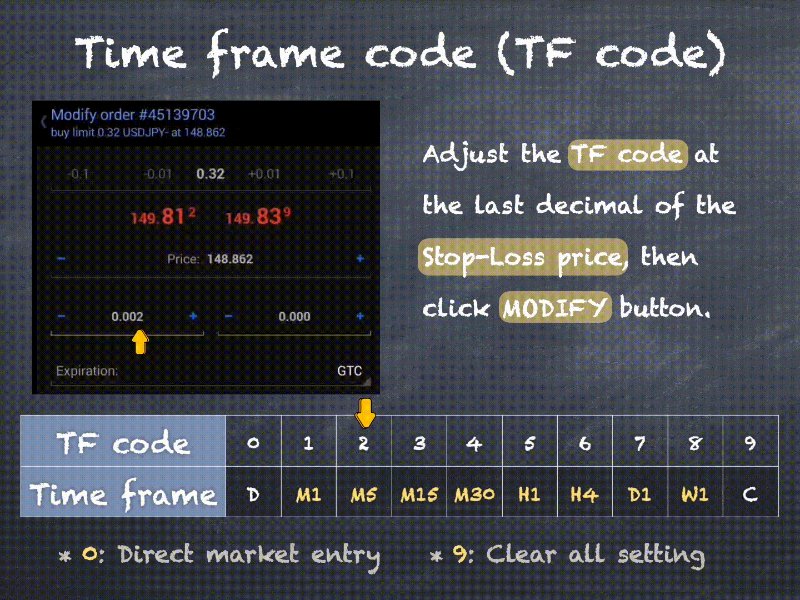

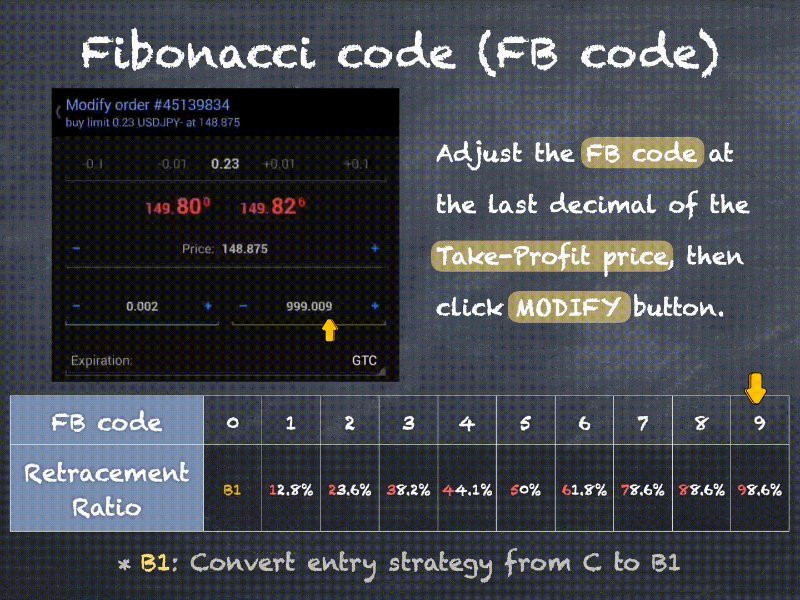

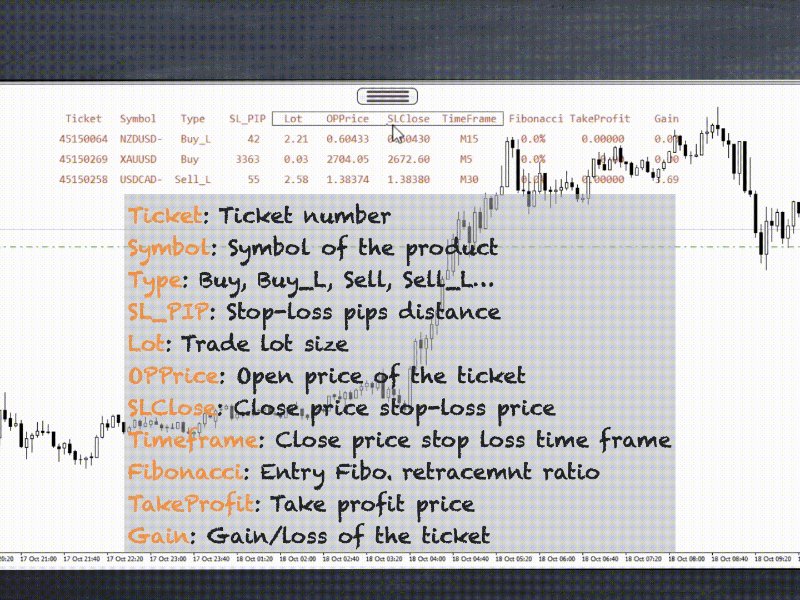

- Time Frame Code and Fibonacci Retracement Code: Control your trades with precision using TF and FB codes, which correspond to the last decimal of your Stop Loss and Take Profit prices for close price execution and Fibonacci retracement levels entry, respectively.

Introduction

The CosyTrader EA is a powerful tool designed specifically for mobile traders. It automates lot size calculation, Fibonacci retracement entry, and close price stop-loss execution across multiple time frames. By simplifying these critical trading tasks, the EA empowers traders to make informed decisions while minimizing screen time.

Background Information

This trading utility is ideal for mobile traders who want to stay active in the market while enjoying life away from their screens. Whether you're trading during gaps in your workday or traveling the world, CosyTrader EA has you covered. With just your mobile phone, you can set entry target strategies and configure stop-loss and take-profit levels in your spare time. The EA acts as a "man in the chair," automating repetitive and time-consuming tasks like calculating ticket-based risk and executing stop-losses. Your mobile MT4 app effectively becomes a remote control, allowing quick and easy setup of your entry and exit strategies. For added convenience, you can use Fibonacci codes (FB codes) and time frame codes (TF codes) to optimize your trades. An FB code of '6,' for instance, corresponds to a 61.8% Fibonacci retracement entry level, while a TF code of '1' indicates stop-loss execution based on the close price of the 1-minute chart. To run the EA, you'll need a VPS (Virtual Private Server) with MetaTrader installed. A VPS ensures continuous operation, even if your personal device is offline, providing stable and reliable trade execution. With this setup, the CosyTrader becomes a reliable partner in your trading journey, saving you valuable time and enabling you to enjoy both trading and life.

The CosyTrader is your trusted trading companion, helping you achieve consistency and efficiency in your trading strategies while freeing up time for the things that matter most.

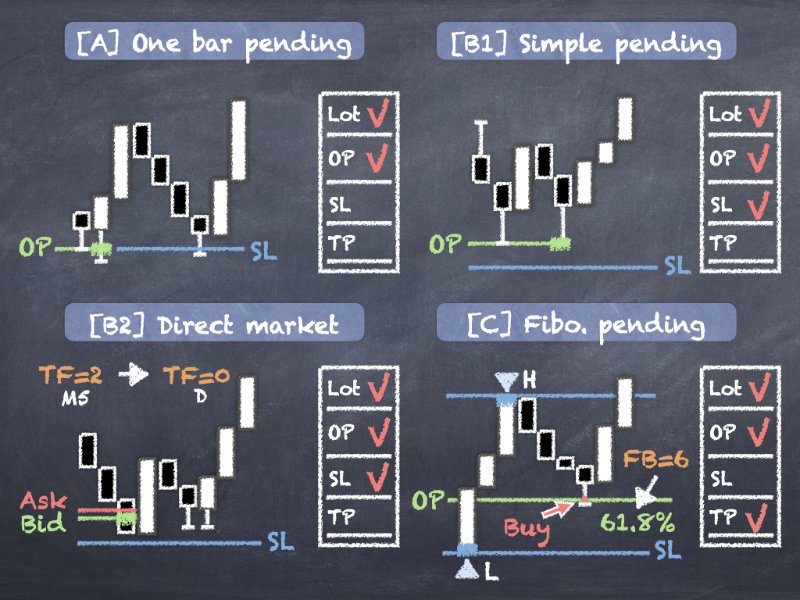

Entry Tools

- Automatic Lot Size Calculation Based on Risk Amount

- Automatic Fibonacci Retracement Entry control by FB code.

Automatic Lot Size Calculation Based on Risk Amount

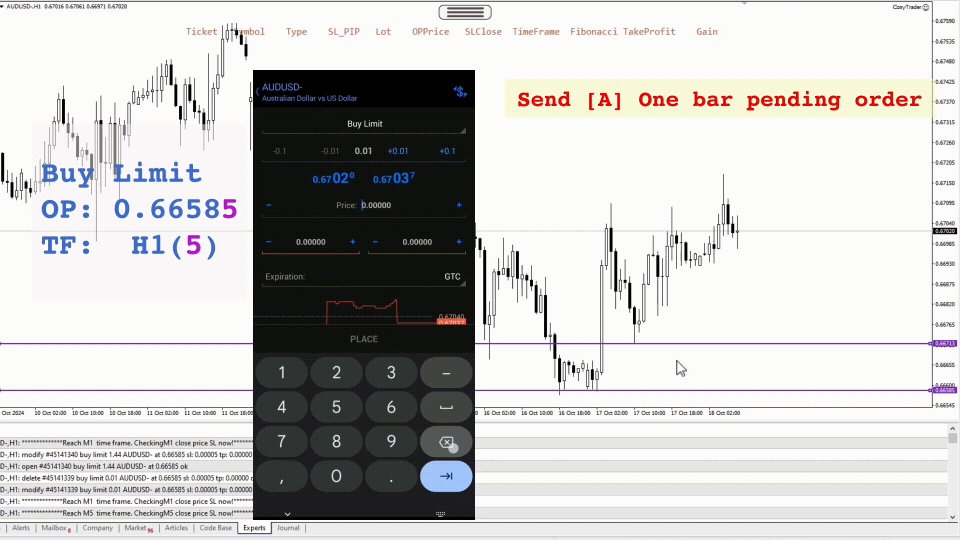

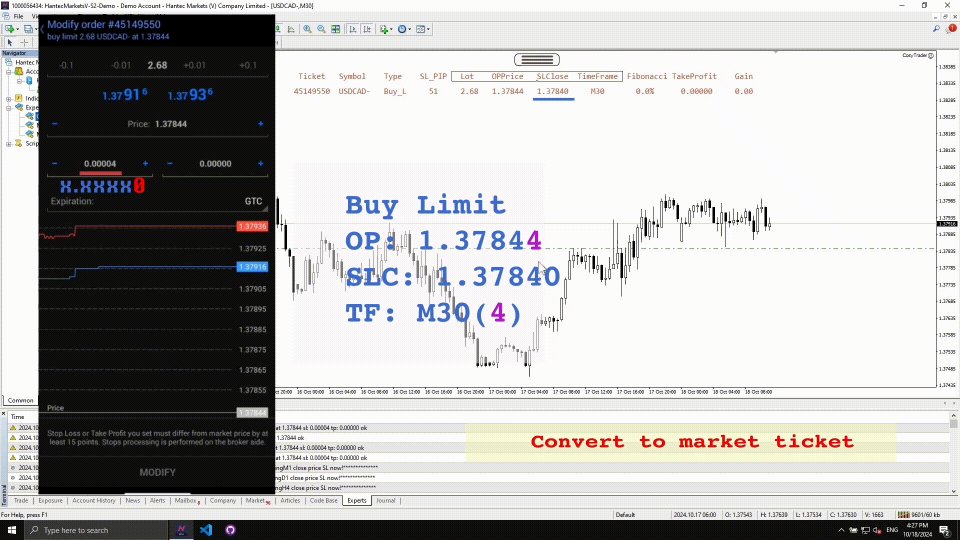

Send a pending limit order with any arbitrary lot size, along with your target entry price and stop-loss level. This EA will automatically adjust the lot size based on the stop-loss distance and the amount of money you are willing to risk per trade. Since changing the lot size of an existing order is not allowed in MT4 due to platform restrictions, this EA will delete the original order sent by you. It will then create a new one with the adjusted lot size, resulting in a new ticket number.

Automatic Fibonacci Retracement Entry

Waiting for the price to pull back to a certain retracement ratio can be time-consuming. This EA allows you to define your desired Fibonacci retracement ratio and automatically enter a trade at that pullback level. The pullback ratio can be set by sending the Fibonacci code (FB code), which is represented by the last decimal of the take-profit price.

Exit Tools

- Close Price Stop Loss Execution control by TF code

- Floating-Point Over-Loss Protection

Close Price Stop Loss Execution

Executing the stop-loss at the close of a bar can help minimize the impact of price fluctuations at critical levels. By setting the timeframe code (the last decimal of the stop-loss), this EA will execute the stop-loss when a new bar opens, and the previous bar closes below the stop-loss price you set for the timeframe you are trading.

Floating-Point Over-Loss Protection

The disadvantage of the Close Price Stop Loss execution is its slower reaction time. This delay can expose trades to higher risk during volatile periods. The market can move rapidly at certain times (e.g., during news events), leading to significant losses during highly volatile periods if the stop-loss is only executed at a close price. To address this issue, we've added a feature that allows the trade to be closed immediately before the bar closes during high-volatility periods. This feature closes the trade when the floating loss reaches a certain threshold (adjustable parameter, default = 2.5 times the risk amount).