Vortex Gold MT4

- Experts

- Stanislav Tomilov

- Version: 1.92

- Updated: 25 March 2025

- Activations: 10

Vortex - your investment in the future

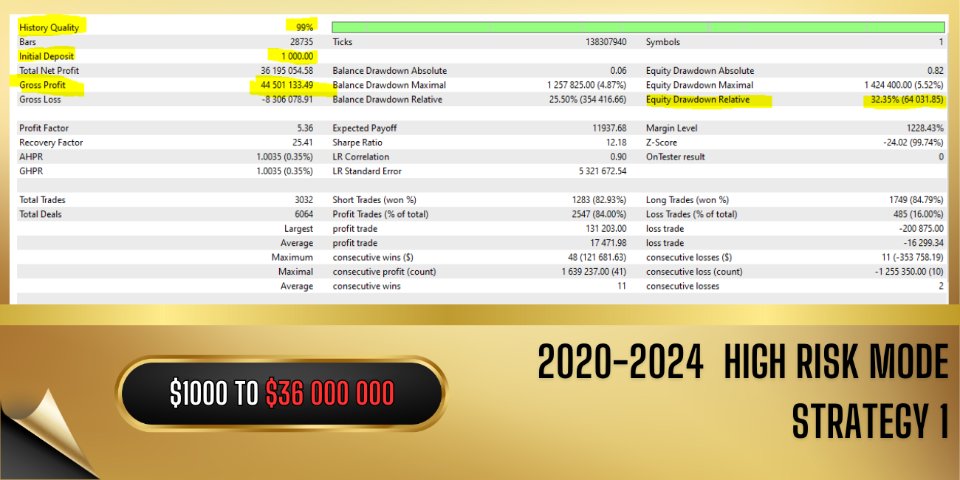

The Vortex Gold EA expert Advisor made specifically for trading gold (XAU/USD) on the Metatrader platform. Built using proprietary indicators and secret author's algorithms, this EA employs a comprehensive trading strategy designed to capture profitable movements in the gold market. Key components of its strategy include classic indicators as CCI and Parabolic Indicator, which work together to accurately signal ideal entry and exit points. At the heart of Vortex Gold EA is advanced neural network and machine learning technology. These algorithms continuously analyze both historical and real-time data, allowing the EA to adapt and respond to evolving market trends with greater accuracy. By leveraging deep learning, Vortex Gold EA recognizes patterns, adjusts indicators parameters automatically, and improves its performance over time. The Vortex Gold EA’s powerful combination of proprietary indicators, machine learning, and adaptable trading algorithms. Invest in your future with Vortex Gold EA.

Price $675 (7/10 left), next price $795

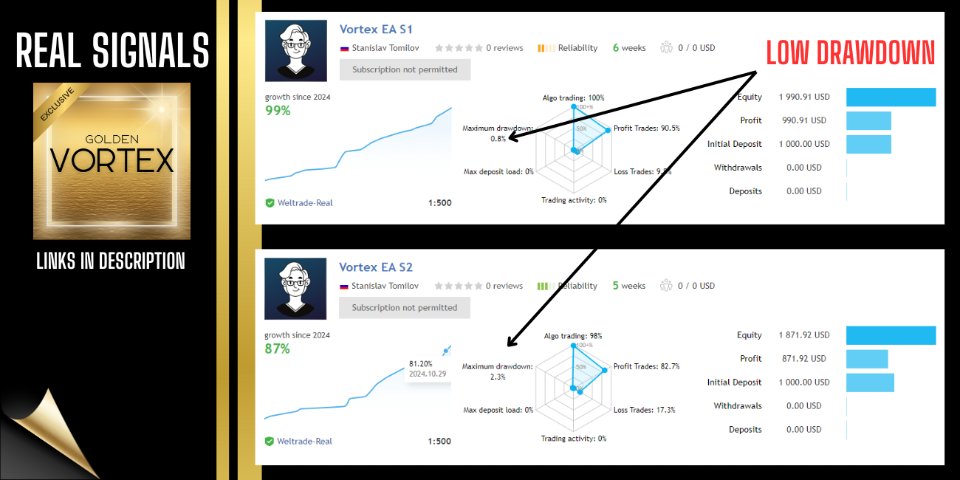

Live Signal (Strategy 2) https://www.mql5.com/en/signals/2269077

Live Signal (Strategy 1) https://www.mql5.com/en/signals/2289709

Specification:

- Working symbols: XAUUSD(GOLD)

- Working Timeframe: H1

- Minimum deposit $250 (Recommended $500 and more)

- 1:30 for Conservative, Low and Normal Risk trading (For higher risks need leverage 1:100 and more)

- Account type: Any

- Good ECN broker is required (Ask the author for a broker recommendation)

- VPS is highly recommended

Benefits:

- No martingale

- No dangerous methods of money management are used

- Stop loss and take profit for each position

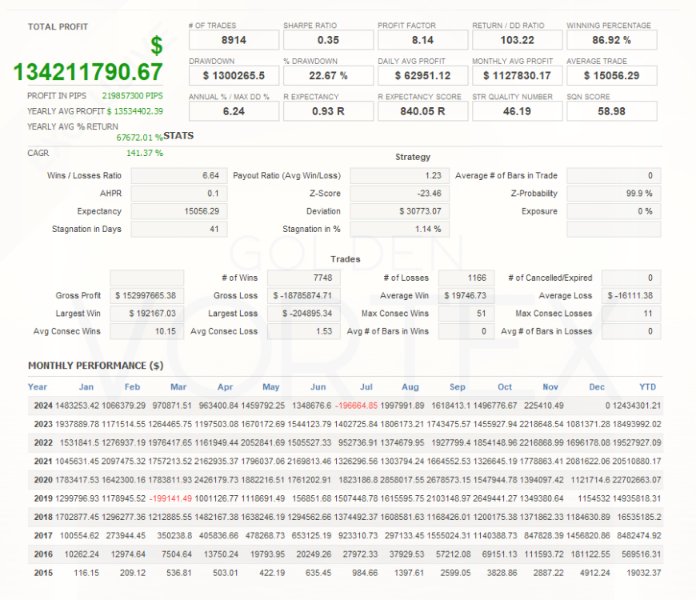

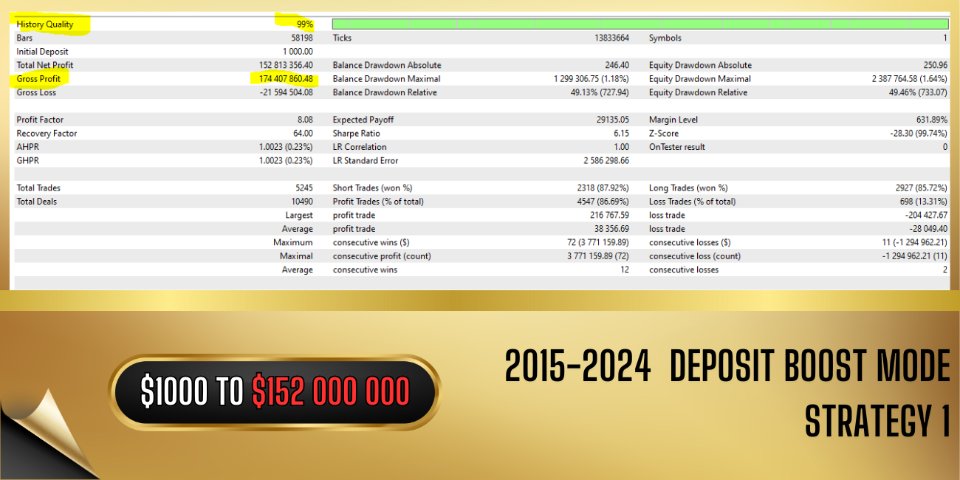

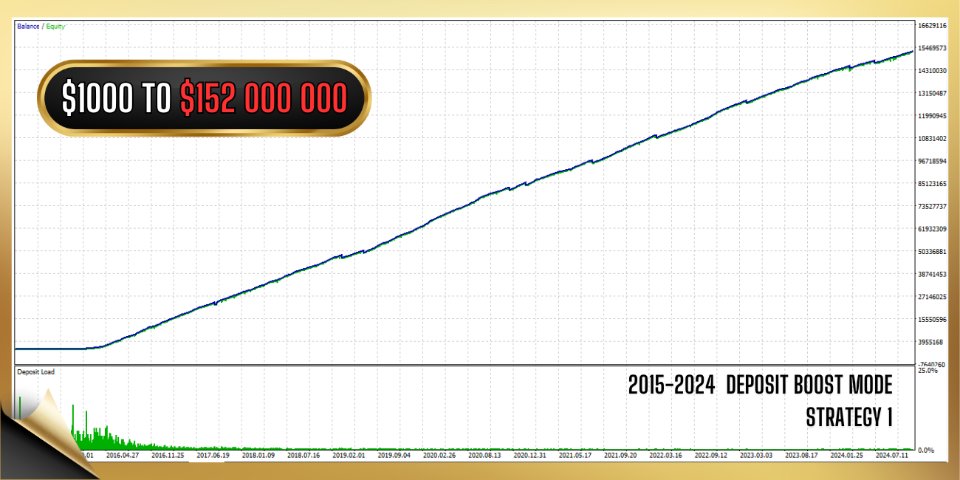

- Stable testing results with 99.9% quality quotes

- Not sensitive to broker conditions

- Easy to install

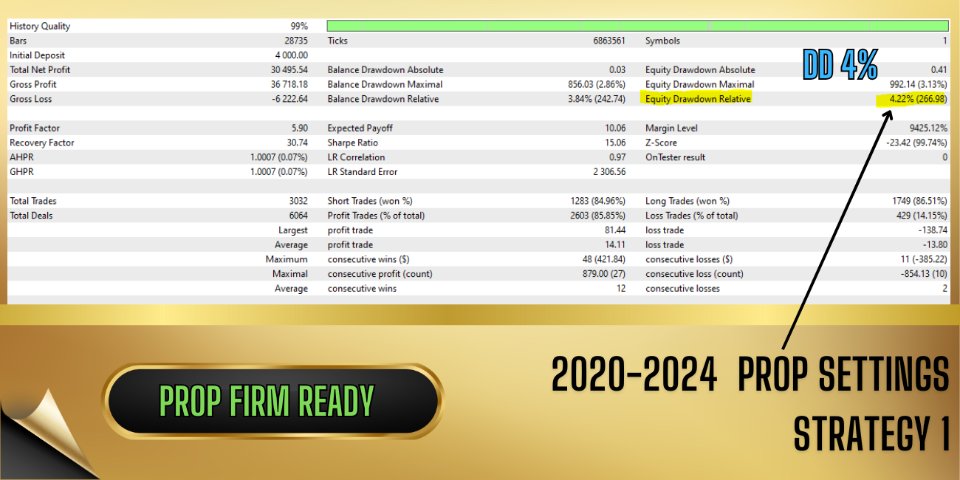

- FTMO and Prop firm ready

Vortex Advisor offers the following

Prop firm trading-ready:

- The EA has been engineered with an extensive focus on risk management, from real-time drawdown control and adaptive lot sizing. This makes it fully compatible with most Prop Firms requirements, aligning with all major risk standards for secure and compliant trading.

Indicators:

- CCI (Commodity Channel Index): Helps identify overbought and oversold levels, enabling precise entries and exits based on trend direction and strength.

- Parabolic SAR: Sets dynamic stop levels that adjust to market trends, providing effective risk management and profit maximization in trending markets.

Machine Learning & Neural Networks:

- Adaptive neural network technology enables dynamic response to changes in market conditions.

- Constant learning from market data to refine trading decisions and improve trade accuracy.

Risk Management Tools:

- Adjustable stop-loss and take-profit settings to manage risk for each trade.

- Trailing stop feature to lock in profits as trades move favorably.

- Spread and slippage filters to avoid entering trades under unfavorable market conditions.

Customizable Parameters:

- User-friendly settings allow traders to adjust risk levels, lot sizes, and other parameters based on their trading style and risk tolerance.