Gold Galaxy Express

- Experts

- Tetsushi O-nishi

- Version: 2.0

- Updated: 20 March 2025

- Activations: 20

■ Target Currency Pair: XAUUSD

■ Timeframe: 1 Hour

- No Martingale, no grid trading. No scalping.

- A stop loss is set for all positions.

- Enter trades upon detecting breakouts.

- One single loss will not wipe out the account balance.

This EA, "Gold Galaxy Express," is an automated trading system that employs a blend of momentum indicators and dynamic risk management, characterized by the following features:

-

Indicator-Based Entry Signals

- It uses momentum indicators such as Bulls Power and Bears Power to determine entry signals, triggering long entries when bullish strength falls below a neutral threshold and short entries when bearish strength rises above it.

- It uses momentum indicators such as Bulls Power and Bears Power to determine entry signals, triggering long entries when bullish strength falls below a neutral threshold and short entries when bearish strength rises above it.

-

Order Placement and Execution

- Orders are executed at levels determined by recent highs or lows over a specified lookback period, ensuring entries are placed at significant price levels.

- Orders are set with a validity period, and the system prevents duplicate trades or replacing pending orders.

-

Risk Management and Exit Strategies

- Risk management is handled through dynamic, volatility-based techniques, including ATR-based stop losses and trailing stops.

- A profit target is defined as a percentage gain, and once a certain pip movement in profit is achieved, the stop loss is adjusted to breakeven.

- Additionally, positions are automatically exited if they remain open beyond a set number of bars.

-

Trading Time Rules

- The EA incorporates specific trading time restrictions, such as managing positions around weekends and at predetermined times on certain days, to account for market conditions during less liquid periods.

In summary, "Gold Galaxy Express" integrates indicator-based trade signals with adaptive risk controls and time-sensitive trade management to provide a robust automated trading solution.

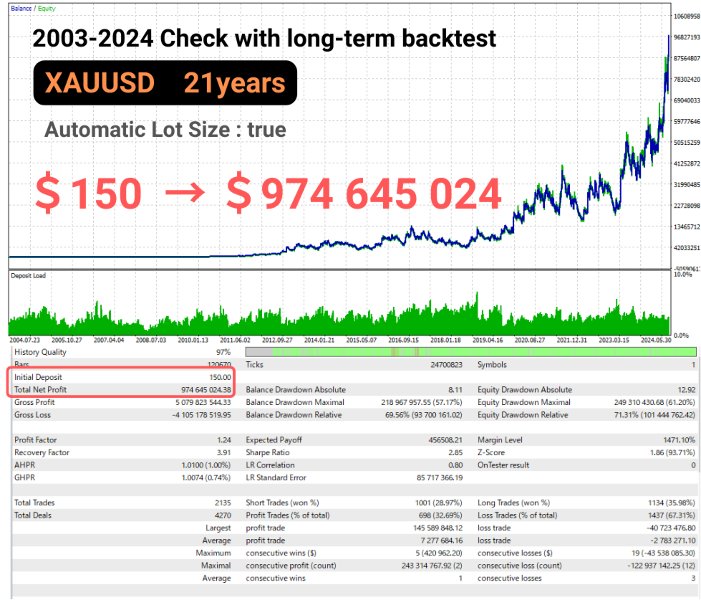

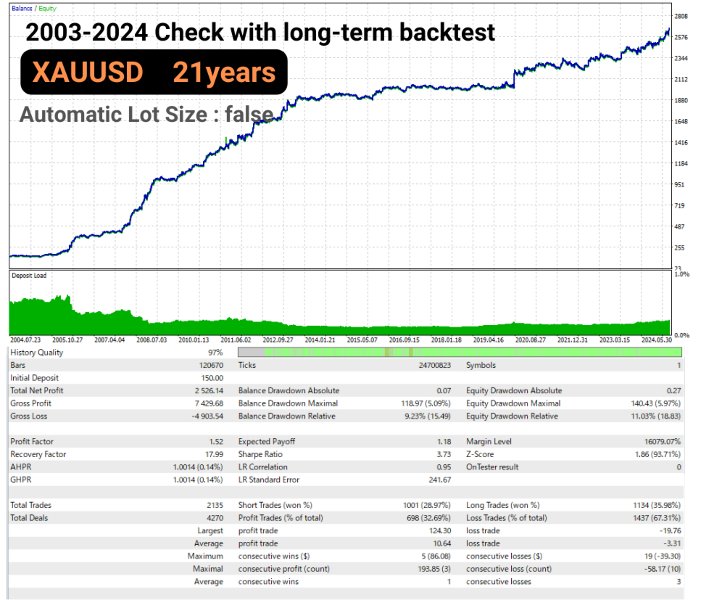

Lot Size Parameter Setting

"Use Money Management" Parameter: When set to true, the EA automatically adjusts the lot size according to the account balance. If set to false, it trades with the fixed lot size specified by "mmLotsIfNoMM".

"mmRisk Percent" Parameter: This parameter adjusts the risk on a percentage basis when"UseMoneyManagement" is set to true. A recommended value is about 0.5 to 2.0.

"mmDecimal" Parameter: When "UseMoneyManagement": true is set, this defines the decimal precision for lot size adjustments. Setting it to 1 adjusts to one decimal place (e.g., 0.1 → 0.2), and setting it to 2 adjusts to two decimal places, making it compatible with many brokers dealing with XAUUSD.

"mmMaxLots" Parameter: Specifies the maximum lot size available. The lot size will not exceed this value.