Liquidity Pools MT4

- Indicators

- Duc Hoan Nguyen

- Version: 2.10

- Updated: 27 February 2025

- Activations: 10

New tools will be $30 for the first week or the first 3 purchases!

Trading Tools Channel on MQL5: Join my MQL5 channel to update the latest news from me

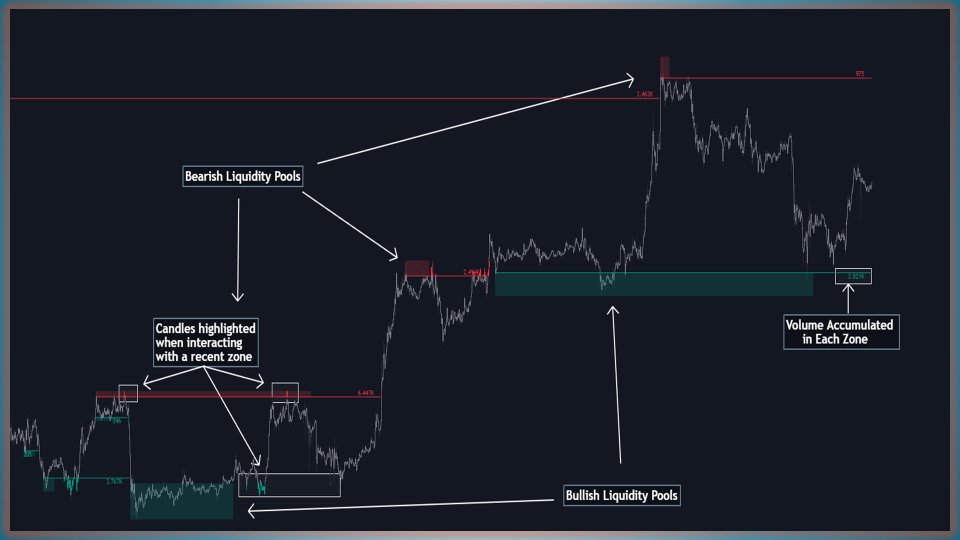

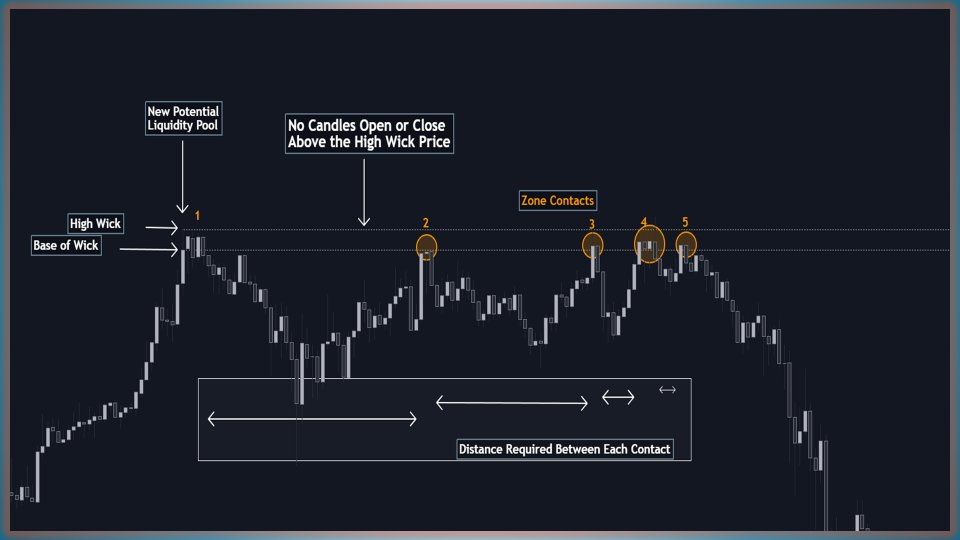

The Liquidity Pools indicator is an advanced tool that identifies and marks potential liquidity zones on the chart by analyzing high and low areas with frequent wick touches, along with the number of revisits and the volume traded within each zone. This tool provides traders with a comprehensive view of market dynamics where liquidity accumulates, helping them anticipate potential turning points and identify significant support and resistance levels.

See more MT5 version at: Liquidity Pools MT5

See more products at: All Products

Key Features & Benefits1. Accurate Liquidity Zone Identification

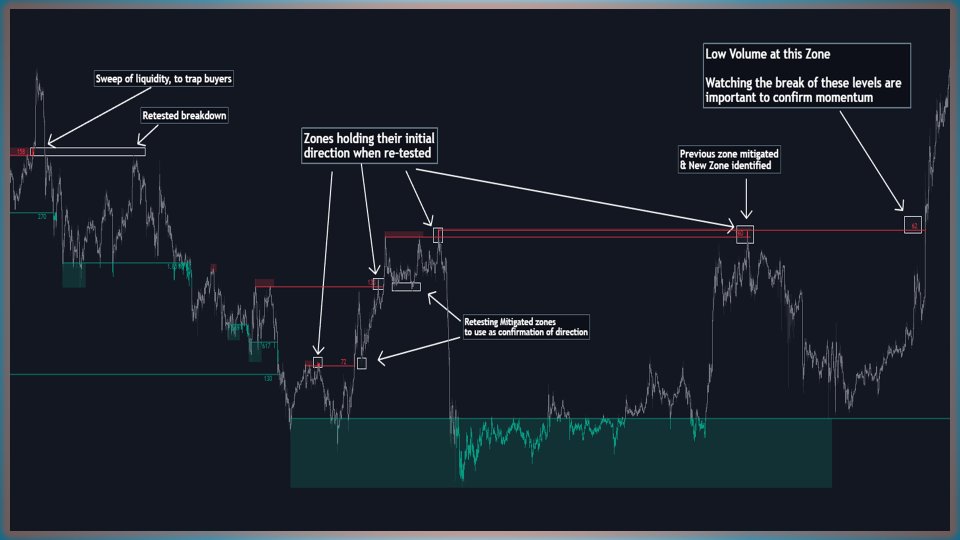

- Highlighting High-Impact Zones: The Liquidity Pools indicator identifies zones where smaller traders are likely to place stop-limit orders, creating attractive liquidity areas. Large institutions often use these zones to fulfill their larger orders, potentially influencing market movements. By monitoring these zones, traders can anticipate significant market reactions and make timely trading decisions.

- Strengthening Support and Resistance Levels: These liquidity zones often serve as natural support and resistance areas, with price action repeatedly interacting with them. Traders can rely on these zones to confirm support and resistance levels, optimizing entry and exit points.

2. Adaptive Liquidity Zone Tracking

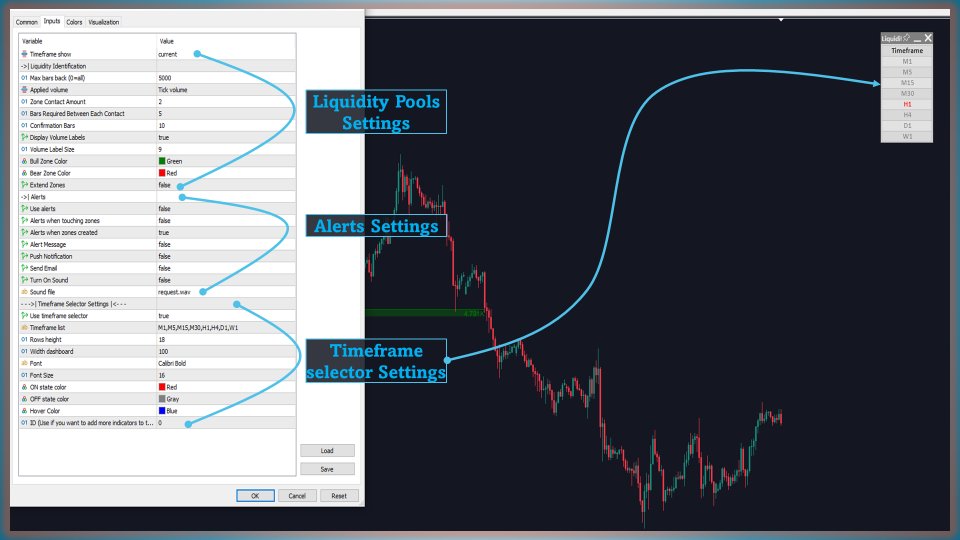

- Zone Identification Parameters: The Liquidity Pools indicator uses three main customizable parameters to fine-tune liquidity zone detection according to each trader's strategy:

- Zone Contact Amount: Sets the number of times price must interact with a zone to qualify as a liquidity pool. For example, when a zone first appears, it counts as having one interaction. Each subsequent retest of the zone increases the contact count.

- Bars Required Between Each Contact: To avoid noise from consecutive candles, this setting creates a separation length between zone contacts, ensuring calculated zones are more precise. For instance, if set to “2,” the script will ignore contact points unless at least two bars separate them.

- Confirmation Bars: After meeting the contact amount, this parameter requires the indicator to wait a specified number of bars before confirming a zone, ensuring its validity within market context.

3. Real-Time Zone Visualization

- Dynamic Zone Extension: Once a liquidity zone is identified, the indicator extends its boundary to the current price level, keeping it in view until the price moves beyond the zone, allowing traders to track liquidity pools conveniently.

- Indication When Price Surpasses: When price moves decisively beyond a liquidity zone, the extension stops, indicating that the zone has been mitigated or is no longer relevant.

4. Detailed Volume Accumulation Analysis

- Volume Overlay on Zones: Each time a candle overlaps an unmitigated liquidity zone, a portion of its volume is accumulated to the total volume for that specific zone. This volume data can help traders assess the importance of individual zones based on the volume traded within each area.

- Proportional Volume Allocation: If a candle partially overlaps a zone, only a proportional volume is added to the zone. For instance, if a candle overlaps 50% of a zone, the zone receives 50% of that candle’s volume.

The Liquidity Pools indicator is fully customizable to suit a variety of trading strategies. Key settings include:

- Zone Contact Amount: Sets the number of times price must bounce off a zone before considering it a liquidity pool.

- Bars Required Between Each Contact: Determines the number of bars needed between each zone interaction to ensure precision in zone detection.

- Confirmation Bars: Sets a waiting period to confirm zone validity after meeting the contact requirements.

- Display Volume Labels: Optionally display the volume data for each liquidity pool.

The Liquidity Pools indicator offers a strategic advantage by highlighting zones with concentrated liquidity, helping traders identify potential price reversal points and critical market levels. By using this indicator, traders can:

- Anticipate support and resistance levels.

- Visualize where institutional players may exploit liquidity to impact price movement.

- Use volume data to gauge the significance of each zone, supporting more informed trading decisions.

With the Liquidity Pools indicator, traders gain a powerful tool to predict market trends and make precise trading decisions based on liquidity dynamics. Whether for short-term, long-term trading, or comprehensive analysis, this indicator helps traders navigate price behavior at critical levels.

Liquidity Pools is an excellent indicator that effectively consolidates all liquidity points into a single location on the chart, eliminating the visual clutter of numerous individual lines. a big thanks for making it available on MT4 platform!