Overall Trend Channel

- Indicators

- Mateusz Winter

- Version: 1.0

- Activations: 5

Using the Overall Trend Channel in Manual Trading

The Overall Trend Channel (OTC) indicator significantly enhances manual trading strategies by:

-

Identifying Strong Trends: The OTC indicator consolidates data from various timeframes, providing a comprehensive view of the prevailing trend. This helps traders identify strong, sustained trends, improving the accuracy of their trades.

-

Filtering Noise: By considering multiple timeframes, the OTC indicator filters out short-term market noise, allowing traders to focus on genuine trend movements. This reduces the risk of false signals and enhances decision-making.

-

Timing Entry and Exit Points: The OTC indicator helps in precisely timing entry and exit points. Traders can enter trades when the overall trend aligns across multiple timeframes and exit when a reversal is detected, maximizing profits and minimizing losses.

-

Enhancing Confidence: With the OTC indicator, traders gain confidence in their strategies. Knowing that the trend is supported by data from various timeframes reassures traders about the reliability of their decisions.

Glossary of Strength Categories

-

1 Minute Chart (Trend 1): 2 hours of trend.

-

5 Minute Chart (Trend 2): 10 hours of trend.

-

15 Minute Chart (Trend 3): 30 hours or 1.25 days of trend.

-

30 Minute Chart (Trend 4): 2.5 days trend.

-

1 Hour Chart (Trend 5): 5 days or 1 week's trend.

Each category includes the previous. For instance, Trend 2 (10 hours) includes Trend 1 (2 hours), and so on.

Trend Category Chart Examples

By observing different timeframes, traders can spot trends and potential reversals:

-

Trend 1: 1 minute chart, 2 hours of trend.

-

Trend 2: 5 minute chart, 10 hours of trend.

-

Trend 3: 15 minute chart, 30 hours/1.25 days of trend.

-

Trend 4: 30 minute chart, 2.5 days of trend.

-

Trend 5: 1 hour chart, 5 days of trend.

Identifying Trends and Reversals

To identify an established trend or a reversal:

-

Flick through the 1 minute to 1 hour charts.

-

Note the TILT of the MDTDC (Domino Channel) in each timeframe.

Example of Trend 5 Long:

-

Trend 1 (Long) - 2 hours

-

Trend 2 (Long) - 10 hours

-

Trend 3 (Long) - 1.25 days

-

Trend 4 (Long) - 2.5 days

-

Trend 5 (Long) - 5 days

The MDTDC tilts up, indicating a positive trend.

Change in Intraday Trend from Long to Short

Initially, we have the original Trend 5 Long, where the MDTDC is tilting up from left to right across all five timeframes: 1 minute, 5 minutes, 15 minutes, 30 minutes, and 1 hour. The sequence looks like this: / / / / /.

When the price starts to drop over the next two hours, the Trend 1 channel (1 minute chart) will start tilting down from left to right. A Trend 1 Short is extremely weak, being only two hours of trend and can be attributed to simple profit-taking from the predominant long trend direction. The tilt in the MDTDC sequence will look like this: \ / / / /.

If the price continues to drop over the following eight hours (ten hours inclusive), the Trend 2 channel (5 minute chart) will start tilting down. This is the Trend 1 knocking down the Trend 2 – hence the Domino Effect. A Trend 2 Short (ten hours of inclusive trend, identifiable by the MDTDC in both the 1 and 5 minute charts tilting down) is still weak, being only 10 hours of trend/sentiment and having no real momentum. The tilt in the MDTDC will look like this: \ \ / / /.

On many occasions, when we have a Trend 2 Short at the UK open, the Trend 1 short can sometimes flip to being long again (/\ / / /). This would then become a Trend 5 Mix Long - 2 short, where the Trend 2 (5 minute chart, 10 hours of trend) is the only counter trend. This mix category is still classed as a very strong long trend, and trading would follow accordingly. If the Trend 1 continues long from this mix example, it will eventually flip the Trend 2 from short back to long again (/ / / / /), and the relentless long would continue further. However, we will continue with the change of trend from long to short for this exercise.

We now come to a Trend 3 Short. We are now looking at 30 hours or 1.25 days of trading, sentiment, and trend in the short direction. This is identifiable by the tilt of the MDTDC in the 15 minute chart (120 bars x 15 minutes = 30 hours/1.25 days), inclusive of Trends 1 & 2. The sequence will look like this: \ \ \ / /.

The 15 minute Trend 3 is the most important of all the trends, along with this particular timeframe. Even though the Trends 4 & 5 are still long, the Trend 3 is the definitive pivot and confirmation from a long to a short intraday trend (and vice versa), presenting solid and safe opportunities to trade short. All trade entries originate from the 15 minute chart, and this is the timeframe you should always exit from when selecting different instruments. Anything beyond a Trend 3 is only important if it matches the 3; otherwise, they are disregarded.

The 15 minute timeframe is popular among day traders. As more traders get involved in short opportunities at this point, collectively they push the price further down, strengthening the short trend. This doesn’t necessarily mean the start of a relentless short trend all the way to Trend 5. For example, profit-taking from short contracts could cause the Trend 1 to flip back long again within a 2 hour period, resulting in a sequence like this: / \ \ / /.

We now have a Trend 3 Mix Short - 1 Long, where the 1 long is the counter-trend to the overall short direction. Here, we ignore the fact that Trends 4 & 5 are long, alongside Trend 1. We will still be looking at short trades even though Trend 1 is long, mainly through profit-taking.

Strong fundamentals and/or large positions being taken/liquidated can disrupt this downward flow, sending the price long again if high volatility-rated news is positive in relation to the primary currency. However, for this exercise, we will continue with the change of trend from long to short.

Next is a Trend 4 Short. We are now looking at 2.5 days of trend and sentiment, identifiable by the tilt of the MDTDC in the 30 minute chart (inclusive of all previous). This trend is now well underway, and the sequence will look like this: \ \ \ \ /.

Finally, we have a Trend 5 Short. This now represents 5 days or 1 full week of trend and sentiment, identifiable in the 1 hour chart.

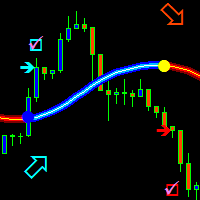

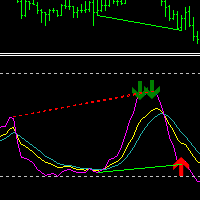

Note: I have attached a before and after screenshot of a trade as to how one can use the stochastic indicator with the overall trend channel for entry. The trade is this case was the GBPJPY taken on the 11th November 2024. These scalps are usually available on different trading instruments.