Version 1.2

2024.12.18

趋势交易指标 – 助力捕捉市场最佳趋势

指标优势

精准的趋势捕捉:

该指标通过清晰的信号帮助您快速了解市场趋势的变化,无需复杂的分析,让交易决策更加高效。

灵活的参数选择:

支持自定义计算周期、移动平均方法(如SMA、EMA、LWMA等)以及应用的价格类型(如收盘价、开盘价、最高价等)。无论是短线交易还是长线布局,该指标都能轻松适配。

直观的信号显示:

蓝色柱状图提示上升趋势信号。

红色柱状图提示下降趋势信号。

多场景适用:

适合外汇、股票、大宗商品等多个市场,满足不同交易者的需求。

使用指南

在您的交易平台中加载该指标。

设置适合您的计算周期(例如:23、50、144、369)。

根据交易策略选择移动平均方法(如SMA、EMA等)以及价格类型(如收盘价、最高价)。

根据图表中的信号柱,及时判断趋势强弱并作出相应的交易决策。

我们期待您的反馈!

该指标旨在为交易者提供简单易用且高效的工具。您的建议是我们不断优化和改进的重要依据!欢迎下载使用并分享您的体验。让我们一起打造更完善的交易工具!

Version 1.1

2024.11.25

Selecting Higher Timeframes

To enhance signal reliability, you can choose higher timeframes (such as H1, H4) and enable the "UseHTFForBuy" option. Utilizing data from higher timeframes helps filter out market noise, providing more robust trading signals and strengthening the confirmation of buy signals.

Configuring Risk Management Parameters

Adjust the ATR multiplier and the styles of stop loss and take profit lines according to your risk tolerance. Proper risk management settings ensure that your trading strategy aligns with risk control measures, protecting your investments and minimizing potential losses.

Executing Trades

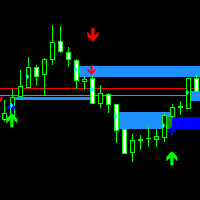

Entry Timing: When the indicator displays buy or sell signal arrows, consider entering a trade after confirming with other technical analysis tools (such as support and resistance levels or chart patterns). This multiple confirmation approach helps increase the success rate of your trades.

Setting Stop Loss and Take Profit: The indicator automatically draws multiple stop loss and take profit levels. You can select appropriate levels based on your trading strategy, for example, using the first stop loss level as the initial stop and the second and third levels as trailing stops to lock in profits.

Risk Management: Ensure that each trade's risk is within your acceptable range to avoid overtrading. Utilizing the automatically drawn stop loss and take profit lines helps maintain good risk management practices, protecting your investment returns.

Monitoring and Adjusting

Regularly Evaluating Indicator Performance: Periodically adjust the indicator parameters based on historical trading results and market changes to maintain its effectiveness and adaptability. This ensures the indicator continues to provide reliable signals under different market conditions.

Combining Other Analysis Tools: While the indicator provides reliable buy and sell signals, combining it with other technical analysis tools (such as Relative Strength Index RSI, Bollinger Bands, etc.) can further enhance the accuracy of your trading decisions and strengthen your overall trading strategy.

Maintaining Discipline: Adhere to your established trading plan and risk management rules, avoid emotional trading, and ensure long-term stable trading performance. Disciplined trading helps reduce erroneous decisions and improves overall profitability.

Summary

The Trend Filtered MA Cross Indicator offers traders a comprehensive and user-friendly tool through intelligent signal generation and automated risk management. By configuring it appropriately and integrating it with your personal trading strategies, you can significantly improve the accuracy and efficiency of your trades, helping you navigate the complex and volatile markets with confidence. Download and apply the indicator now to make your trading decisions more scientific and efficient!

还挺不错的