TSageHuz Gold

- Experts

- Nguyen Trung Khiem

- Version: 10.0

- Activations: 5

Important Note:

“This EA is designed for Gold as our testing focused primarily on Gold. You may use it on other forex symbols, but you will need to find suitable settings for them. It may not work effectively on indices or other commodities.”

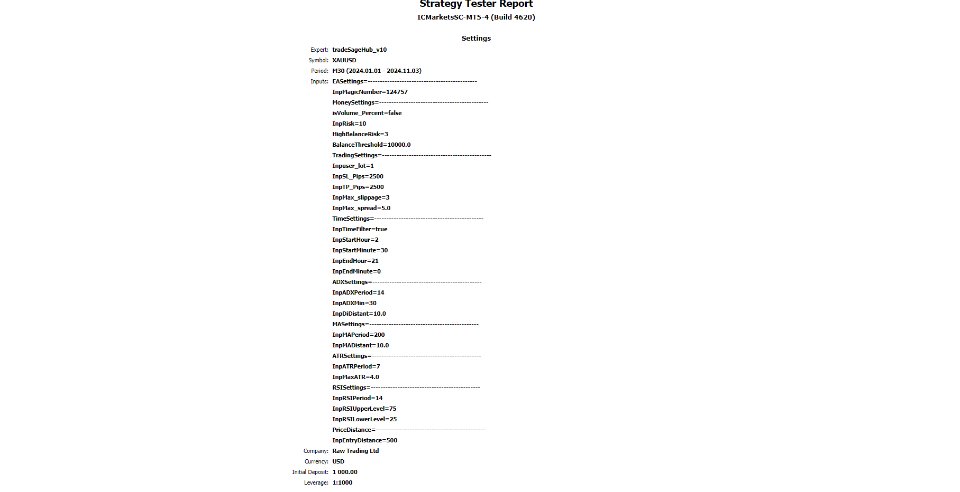

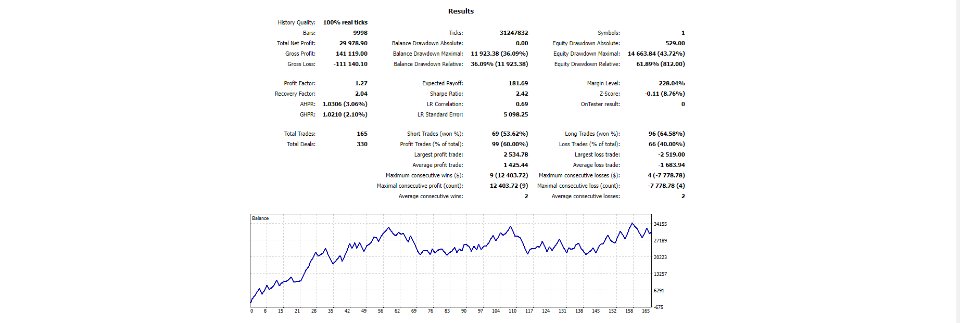

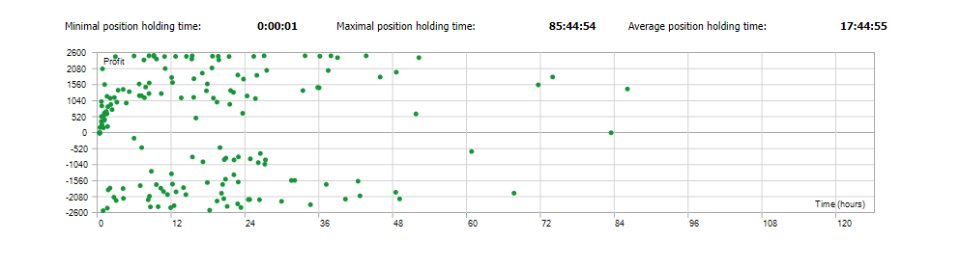

No Expert Advisor (EA) can guarantee consistent long-term profits. However, "tSageHuz v10 - Scalper Trading EA for Gold" has been rigorously backtested from January 1, 2024, to October 31, 2024, showing consistent profitability. Starting with a $100 balance and using a stable 0.1 lot size, the EA turned $100 into $3,000. With a $1,000 balance and a stable 1 lot size, the EA achieved $30,978. For enhanced flexibility, users can set dynamic lot sizes in the input parameters.

The settings file will be available in the comments section for download. These settings showed losses in 2023 but turned profitable in 2024, indicating that periodic updates to the settings may be necessary to adapt to market conditions.

*The tested Modeling: Every tick based on real ticks - MT5, Delay 273ms.*

-----------------

tSageHuz v10 - Scalper Trading EA for Gold

Overview:

Designed for high-precision scalping on Gold (XAU/USD), tSageHuz v10 provides automated trading that adapts to market trends. This EA employs a blend of technical indicators and market state analysis to deliver an effective scalping strategy with built-in risk controls.

Key Features:

-

Dynamic Lot Sizing:

Easily adjustable lot size, with options for fixed or dynamic risk percentage based on account balance, enabling better alignment with user preferences and risk tolerance. -

Indicator-Based Scalping Logic:

Incorporates ADX, Moving Average, ATR, and RSI for trade filtering, helping to capture favorable entry points and manage exits effectively. -

Market State Analysis:

Assesses market trends (flat, trending, volatile) to adapt strategies based on current conditions, aiming for optimal positioning in the Gold market.

Input Parameters Guide:

-

EASettings:

Customizable parameters specific to the EA’s core functionality. -

MoneySettings:

- isVolume_Percent: Selects whether to use a percentage-based lot size. If true, lot size scales with account balance.

- InpRisk: Sets the risk percentage of balance when isVolume_Percent is enabled.

- HighBalanceRisk: Risk percentage for accounts over the defined balance threshold.

- BalanceThreshold: Balance level at which HighBalanceRisk takes effect, allowing lower-risk trading for smaller balances.

-

TradingSettings:

- Inpuser_lot: Fixed lot size when isVolume_Percent is false.

- InpSL_Pips: Stop-loss in pips to protect positions.

- InpTP_Pips: Take-profit in pips (0 means no take profit).

- InpMax_slippage: Maximum allowed slippage in pips.

- InpMax_spread: Max spread permitted; EA will avoid trading if spread exceeds this value.

-

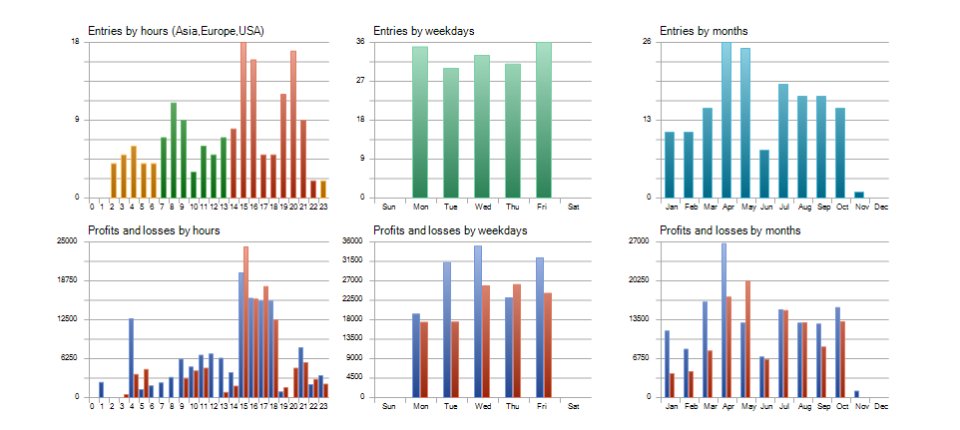

TimeSettings:

- InpTimeFilter: When true, EA only trades during specified hours.

- InpStartHour / InpStartMinute & InpEndHour / InpEndMinute: Defines the active trading window.

-

ADXSettings:

- InpADXPeriod: Period for the ADX indicator, which measures trend strength.

- InpADXMin: Minimum ADX level to consider a trend valid.

- InpDiDistant: Distance setting for DI+ and DI- values, providing additional trend confirmation.

-

MASettings:

- InpMAPeriod: Moving Average period to define trend direction.

- InpMADistant: Distance in points from the MA to trigger trades, controlling entry sensitivity.

-

ATRSettings:

- InpATRPeriod: ATR period for volatility-based decisions.

- InpMaxATR: Max ATR level allowed; EA will avoid trades when volatility is high.

-

RSISettings:

- InpRSIPeriod: RSI period for momentum analysis.

- InpRSIUpperLevel: Overbought level; EA may exit or avoid buys above this.

- InpRSILowerLevel: Oversold level; EA may exit or avoid sells below this.

-

PriceDistance:

- InpEntryDistance: Distance (in pips) to initiate order entries relative to the market price.

Additional Features:

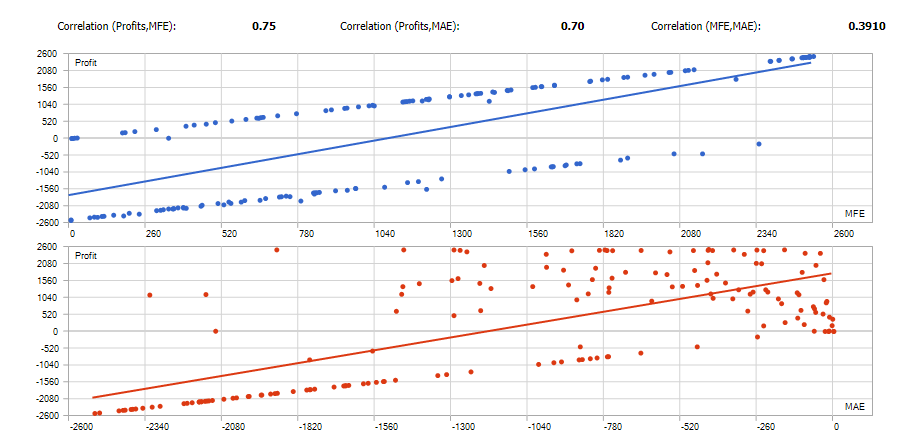

- Position Management:

- Automatic stop loss, take profit, and trailing stop adjustments to manage open positions.

- Comprehensive Market Monitoring:

Continuously updates position status, spreads, and account balance, dynamically adjusting to market changes.