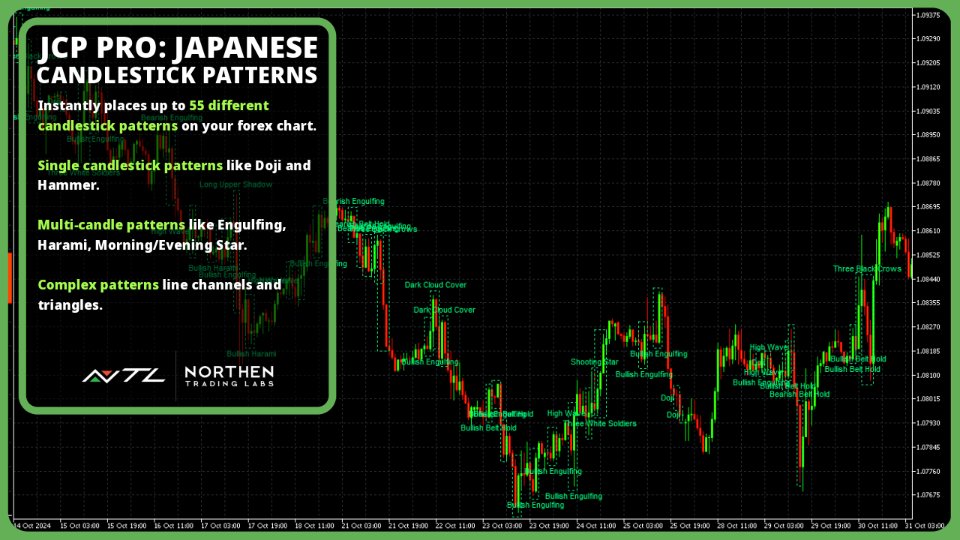

NTL Japanese Candle Patterns

- Indicators

- Northen Trading Labs

- Version: 1.0

- Activations: 5

Japanese Candle Patterns (JCP) User Guide

Overview and Features

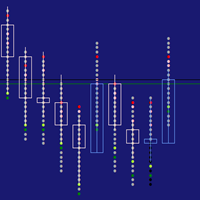

Japanese candlestick patterns, a foundational element of technical analysis, provide traders with visual insights into market psychology. Each pattern represents the battle between bulls and bears, encapsulating critical information about market sentiment, potential reversals, and continuation signals. Developed centuries ago and later popularized by Steve Nison in Japanese Candlestick Charting Techniques, these patterns are now widely recognized tools for assessing market conditions.

This indicator, leveraging the power of the JCP (Japanese Candle Patterns) methodology, assists traders in identifying and acting upon these vital patterns, enhancing both strategy formulation and execution.

Key Features

-

Comprehensive Pattern Recognition: Detects 55 well-known candlestick patterns such as the Doji, Hammer, and Engulfing patterns, each marked on the chart for clear visibility and immediate interpretation.

- Single-Candle Patterns: Patterns like the Hammer, Shooting Star, and Doji.

- Multi-Candle Patterns: Patterns that unfold over several candles, such as the Engulfing, Harami, and Morning/Evening Star.

- Complex Patterns: Channels, Triangles, and support/resistance-based patterns which provide insights into broader market structures.

- Trend Reversals: Patterns like the Hammer, Engulfing, or Doji Star are known for signaling possible reversals in price direction.

- Continuation Signals: Patterns such as the Rising Three Method or Falling Three Method can indicate that a trend is likely to continue, which is valuable for trend-following strategies.

- Confirmation of Market Strength: Patterns like the Marubozu, which lack shadows, show strong conviction by buyers or sellers, confirming strength in a given direction.

-

Multi-Timeframe Scanning: Whether trading on the 1-minute chart or the monthly chart, the JCP indicator adapts seamlessly, allowing users to examine patterns across multiple timeframes, from intra-day to long-term perspectives. Note: To use this feature effectively, fully load tick data for your desired timeframe.

-

Reduces Subjectivity: Manual identification of patterns can be subjective, while JCP applies consistent criteria.

-

Improves Efficiency: JCP scans the chart automatically, allowing traders to stay focused on strategic decision-making.

-

Compatible with EAsiTrader EA: Provides signals to NTL EAsiTrader EA for automated trading.

Whether you are a novice or experienced trader, JCP provides a systematic approach to identifying and utilizing candlestick patterns, combining the insights of centuries-old techniques with the power of modern trading tools.

Installation and Settings

Installation

-

Installing the Indicator:

- Download the JCP indicator JCP.ex5 file and place it in the Indicators\NTL folder of your MQL5 platform directory. You may need to create folder NTL if it doesn’t already exist.

- The typical file path is Terminal -> MQL5 -> Indicators -> NTL . Once the file is in this folder, restart the platform to ensure it appears in the Navigator panel.

-

Applying JCP to the Chart:

- Open the chart of the symbol and timeframe on which you’d like to use the JCP indicator.

- Drag the JCP indicator from the Navigator panel (under Indicators\NTL) onto your chart.

- After adding JCP, you’ll see Inputs that allow you to customize how patterns are displayed, which patterns to include, and more.

-

Customizing Settings:

- Access input settings after dragging JCP onto a chart or by double-clicking on the indicator in the Navigator panel or selecting Properties after applying it to the chart.

- Choose Your Timeframe: Use the Timeframe setting to select the timeframe for pattern analysis. For example, if your chart timeframe is M30 but you set Timeframe to H1 , JCP will identify patterns based on hourly data but display them on the 30-minute chart. Selecting timeframes lower than the chart timeframe is not possible, e.g. M10 timeframe on a M30 timeframe chart.

- Select Patterns: In the input settings, enable or disable specific patterns based on your trading strategy. For example, if you focus on reversal signals, you might prioritize patterns like the Hammer or Engulfing patterns.

- Pattern Customization: If you have specific preferences for pattern definitions, such as stricter criteria for Doji or Hammer patterns, adjust the relevant parameters in the Standard Patterns Definition Settings section.

- Trend Confirmation Settings: For traders using trend-following strategies, the TrendConfirmation setting lets you filter patterns based on alignment with the ADX indicator. Adjust the ADXPeriod and ADXTrendLevel settings to fine-tune this feature.

-

Verifying JCP’s Functionality on the Chart:

- Once configured, observe how JCP displays patterns on the chart. Patterns appear with abbreviations or symbols, making it easy to spot key signals without clutter.

- Tip: Test different configurations and timeframes in a demo environment to find the setup that best complements your trading strategy.

-

Saving Your Custom JCP Template:

- To avoid reconfiguring JCP each time, save your preferred settings as a template. Right-click on the chart, select Template -> Save Template, and name it something descriptive, like JCP_Custom .

- You can load this template on other charts to quickly apply your JCP settings.

Settings

Timeframe

The Timeframe setting allows you to select the specific timeframe from which JCP will analyze candlestick patterns, regardless of the chart’s current timeframe. This feature is helpful if you want to analyze patterns on a higher timeframe than the one currently displayed, giving you a multi-timeframe perspective. Timeframe must be greater than or equal to the chart’s timeframe.

-

Example Use Case:

- Let’s say your chart’s timeframe is set to M15 (15 minutes), but you want to identify patterns based on hourly (H1) data. Set the Timeframe input to H1 . JCP will then scan the data of each completed H1 candle and display any detected patterns on the M15 chart.

-

Common Applications:

- Timeframe Analysis: Setting a higher timeframe (e.g., H4 on an H1 chart) can help capture more stable, long-term patterns that are less affected by noise.

-

Recommendation:

- Match the timeframe to your trading strategy. For instance, trend traders might prefer higher timeframes (H4, D1), while intraday traders may choose M15 or M30 for quicker signals.

Pattern Types (CSV List)

This setting is a powerful feature that lets you customize which patterns JCP will scan for and display. It accepts a comma-separated list of pattern types, enabling you to fine-tune the indicator based on your trading strategy and preferred signals.

-

Full Pattern List:

- AbandonedBabyBottom , AbandonedBabyTop , AscendingChannel , AscendingTriangle , BearishBeltHold , BearishCounterAttack , BearishEngulfing , BearishHarami , BearishHLinePin , BearishSeparating , BullishBeltHold , BullishCounterAttack , BullishEngulfing , BullishHarami , BullishHLinePin , BullishSeparating , DarkCloudCover , DescendingChannel , DescendingTriangle , Doji , DojiStar , DragonFlyDoji , EveningStar , FallingThreeMethod , FallingWindow , FlatLowerBody , FlatUpperBody , GravestoneDoji , Hammer , HangingMan , HighWave , InvertedHammer , LongLeggedDoji , LongLowerShadow , LongUpperShadow , Marubozu , MorningStar , Pennant , PiercingPattern , Rectangle , ResistanceLine , RisingThreeMethod , RisingWindow , ShavenBottom , ShavenHead , ShootingStar , SpinningTop , SupportLine , ThreeBlackCrows , ThreeWhiteSoldiers , TowerBottom , TowerTop , TweezerTop , TweezerBottom , UpsideGapTwoCrows .

-

Example Use Case:

- To limit the indicator to specific patterns, enter only the desired patterns in Pattern Type setting. For example, setting Hammer, Doji, BullishEngulfing means JCP will only scan for and display these three patterns.

-

Tips for Customization:

- Strategy-Specific Patterns:

- For reversal strategies, you might prioritize patterns like Hammer , ShootingStar , Engulfing , and Doji .

- For trend continuation, consider RisingThreeMethod , FallingThreeMethod , or Marubozu .

- Limit Pattern Quantity: Using fewer patterns can help reduce visual clutter on the chart and improve chart readability, especially on lower timeframes.

- Testing Different Combinations: Experiment with various pattern combinations to find setups that yield the most reliable signals for your trading style.

- Strategy-Specific Patterns:

By adjusting Timeframe and Pattern Types thoughtfully, you can better align JCP’s analysis with your trading approach, whether it’s short-term scalping or long-term trend trading.

Use Strict Criteria

Tightens criteria for identifying patterns (e.g., for Doji and Hammer).

Big Body

Defines a candle’s “Big Body” size in terms of a ratio of the candle’s average body height. The average body height is defined as the average height of a candle’s body over a 14 candle period.

Big Candle

Defines a candle’s “Big Candle” size in terms of a ratio of the candle’s average whole height. The average candle height is defined as the average height of a whole candle over a 14 candle period.

Doji Body

Defines the maximum body size of a Doji pattern in terms of a ratio of the candle’s average body height. The average body height is defined as the average height of a candle’s body over a 14 candle period.

Small Body

Defines a candle’s “Small Body” size in terms of a ratio of the candle’s average body height. The average body height is defined as the average height of a candle’s body over a 14 candle period.

Small Candle

Defines a candle’s “Small Candle” size in terms of a ratio of the candle’s average whole height. The average candle height is defined as the average height of a whole candle over a 14 candle period.

Window Min Gap

Defines the minimum gap for a Falling or Rising Window pattern in terms of a ratio of the candle’s average whole height. The average candle height is defined as the average height of a whole candle over a 14 candle period.

Complex Pattern Tolerances

Define tolerances for channels, rectangles, and triangles as percentages of candle body height.

Trend Confirmation

Displays only patterns that align with the ADX-based trend.

ADX Period

Sets the ADX calculation period for smoothing trend identification.

ADX Trend Level

Sets the minimum ADX threshold to validate trends.

Use Symbol Names

When this setting is true the pattern’s abbreviated name is shown above or below the pattern on the chart. When this setting is false the pattern’s full name is shown above or below the pattern on the chart.

Using the Indicator

The following candle patterns are listed showing their full name, followed by their abbreviated name. The signs have the following meaning:

- +: Bullish Pattern

- -: Bearish Pattern

- ++: Bullish Reversal Pattern

- –: Bearish Reversal Pattern

Standard Candle Patterns 1-2 (For a complete list see the online manual)

- Abandoned Baby Bottom (++ABB)

- Description: The Abandoned Baby Bottom is a rare bullish reversal pattern, often appearing at the end of a downtrend. It consists of three candles: a strong bearish candle, a small-bodied Doji with a gap down, and a bullish candle with a gap up.

- Pattern Criteria:

- The first candle is bearish, reflecting strong selling pressure.

- The second candle is a Doji with a gap below the first candle, signifying indecision in the market.

- The third candle is bullish and opens with a gap above the Doji, showing that buyers have stepped in.

- Trading Significance:

- This pattern suggests that a downtrend is potentially reversing as buyers regain control, often signaling a shift in momentum toward the upside.

- The two gaps (before and after the Doji) are key elements that strengthen the pattern’s reliability.

- Interpretation Tips:

- This pattern is most effective in strongly oversold markets where buying pressure is expected.

- Confirmation with additional indicators like RSI (indicating oversold conditions) or volume can improve signal reliability.

- Abandoned Baby Top (–ABT)

- Description: The Abandoned Baby Top is the bearish counterpart to the Abandoned Baby Bottom, typically appearing at the end of an uptrend. It signals a potential reversal to the downside.

- Pattern Criteria:

- The first candle is bullish, indicating strong buying momentum.

- The second candle is a Doji with a gap above the first candle, signaling indecision and potential exhaustion.

- The third candle is bearish and opens with a gap below the Doji, suggesting that sellers are regaining control.

- Trading Significance:

- This pattern often indicates a shift in sentiment from bullish to bearish, signaling that an uptrend may be ending.

- The gaps on either side of the Doji enhance its reliability as a reversal signal.

- Interpretation Tips:

- This pattern is particularly valuable in overbought conditions, where a correction is anticipated.

- Look for confirmation through volume analysis (increasing on the third candle) or with other trend indicators like ADX.

Complex Patterns 1-2 (For a complete list see the online manual)

- Ascending Channel (AC)

- Description: The Ascending Channel is a bullish continuation pattern formed by two parallel upward-sloping trendlines, encompassing a series of higher highs and higher lows. This pattern indicates that the price is trending upward within a defined range and often signals continuation until a breakout or breakdown occurs.

- Pattern Criteria:

- The pattern consists of two parallel trendlines sloping upward, with price moving between the lines.

- The price action includes a series of higher highs and higher lows, touching both the upper resistance and lower support trendlines.

- Trading Significance:

- This pattern is typically a bullish continuation signal, as the price gradually rises within the channel.

- A breakout above the upper trendline suggests an acceleration in the uptrend, while a breakdown below the lower trendline may signal a reversal.

- Interpretation Tips:

- Traders can enter long positions near the lower trendline (support) and take profits near the upper trendline (resistance).

- For confirmation of a breakout, watch for increased volume as the price moves above the upper trendline. If the price breaks below the lower trendline, it could signal a trend reversal.

- Ascending Triangle (AT)

- Description: The Ascending Triangle is a bullish continuation pattern that forms with a horizontal resistance line and an upward-sloping support line. It signifies that the price is being compressed, with buyers becoming increasingly aggressive, often leading to a breakout above the resistance level.

- Pattern Criteria:

- The pattern consists of a horizontal resistance level, indicating that sellers are holding the price at a consistent level.

- The support level slopes upward, showing that buyers are pushing the price higher, forming a series of higher lows.

- Trading Significance:

- The Ascending Triangle generally indicates a bullish continuation, as it shows building buying pressure against a static resistance level.

- A breakout above the resistance line suggests that buyers have overwhelmed sellers, potentially leading to a strong upward move.

- Interpretation Tips:

- Ascending Triangles are more effective within an uptrend, where they signal continuation.

- Volume often spikes on a breakout above the resistance level, adding strength to the bullish signal. Traders can enter on the breakout and set a target by measuring the height of the triangle and projecting it from the breakout point.

Advanced Usage and Strategy Integration

Indicator Buffers

- Buffer 0: Candle Pattern Data

- Bits 0-15: Pattern Type

- Bits 16-19: Pattern Width In Bars

- Buffer 1: Signal Flag values (Signal)

- If (PatternTrendType Is Bearish Or PatternTrendType Is TopReversal Or PatternTrendType Is MajorTopReversal) Then Signal = Bearish

- If (PatternTrendType Is Bullish Or PatternTrendType Is BottomReversal Or PatternTrendType Is MajorBottomReversal) Then Signal = Bullish

Strengthening Signals with Indicators

While Japanese Candlestick Patterns (JCP) can offer valuable insights into market psychology, their reliability and predictive power increase significantly when used in conjunction with other technical indicators. Each candlestick pattern provides a snapshot of market sentiment, but indicators like Moving Averages, RSI, and Bollinger Bands help confirm and strengthen these signals. By combining JCP with indicators, traders can reduce false signals, improve entry and exit timing, and make more informed decisions in both trending and volatile markets.

- Moving Averages (MA)

Moving Averages help smooth out price data and highlight trend direction. Here’s how to integrate them with candlestick patterns:

-

Bullish Crossover and Bullish Patterns: When a shorter-term MA (e.g., 10-period) crosses above a longer-term MA (e.g., 50-period), it signals potential upward momentum. If this crossover aligns with a bullish pattern like a Hammer or Engulfing Bullish, it strengthens the likelihood of a trend reversal.

-

Bearish Patterns Below MA: Bearish patterns such as the Shooting Star or Bearish Engulfing forming below the MA suggest continued downward pressure, especially if the price remains below both short and long MAs.

Example: In a downtrend, if the price briefly rises to test the 50-period MA and forms a Bearish Engulfing pattern, this combination can confirm a selling opportunity with higher confidence.

- Relative Strength Index (RSI)

RSI measures the strength of price changes and is especially useful for identifying overbought or oversold conditions, enhancing JCP patterns:

-

Overbought Conditions with Bearish Patterns: If RSI is above 70 and a bearish pattern like Evening Star forms, it suggests a strong potential for a price reversal.

-

Oversold Conditions with Bullish Patterns: Similarly, an RSI below 30 alongside a Morning Star or Hammer indicates that buyers may soon gain control, suggesting a buying opportunity.

Example: Suppose RSI has entered the oversold zone, and a Hammer pattern forms. This combination signals an opportune moment for a potential trend reversal, especially if it aligns with a support level.

- Bollinger Bands

Bollinger Bands help gauge volatility, with price movements near the bands often signaling potential reversals:

-

Reversal Patterns at Upper Band: When the price touches the upper band and forms a bearish pattern like Shooting Star or Bearish Engulfing, it suggests that the asset might be overextended, signaling a sell opportunity.

-

Reversal Patterns at Lower Band: Conversely, if the price reaches the lower band and forms a bullish pattern like Hammer or Bullish Engulfing, it signals a potential reversal upwards.

Example: During a period of high volatility, the price touches the upper Bollinger Band, followed by a Shooting Star. This often indicates a strong selling signal, especially if the price starts moving back toward the middle band.

Using JCP in combination with other indicators is essential for refining and validating trade signals. Indicators help filter out noise and reduce the impact of false signals that may appear from isolated patterns, thus providing a more holistic view of market conditions. This approach allows traders to make well-rounded decisions, improving the effectiveness of the JCP indicator as part of a comprehensive trading strategy.

Insights

Japanese Candlestick Patterns provide traders with nuanced insights into market psychology, yet some of their deeper interpretations are often overlooked. Here are advanced insights for applying JCP theory effectively:

-

Psychological Layers of Reversal Patterns

Reversal patterns like the Hammer and Shooting Star are more than mere entry signals; they reveal shifts in trader psychology. For instance, a Hammer forming after a downtrend indicates that buyers managed to regain control after a period of selling pressure, which might signal a bottom. Conversely, a Shooting Star shows buyer exhaustion at a peak, with sellers starting to dominate. Understanding the shift in momentum through these patterns allows traders to gauge when a trend may be reversing.- Example: In a downtrend, a Hammer forming near a key support level suggests a potential reversal. Combining this with oversold conditions (e.g., an RSI below 30) can provide a strong buy signal.

-

The Power of Context in Continuation Patterns

Continuation patterns like Rising Three Methods or Falling Three Methods suggest a temporary pause before the prevailing trend resumes. Observing these patterns in the context of trend strength can reveal the commitment of buyers or sellers. For example, the Rising Three Method in an uptrend reflects a momentary consolidation where sellers briefly control the market, but the trend resumes as buyers overpower them.- Example: If the Rising Three Method occurs after a period of high volume, it reinforces the likelihood of trend continuation, as the brief pause indicates that buyers are recharging before pushing prices higher.

-

Complex Patterns for Detecting Breakouts and Reversals

Patterns like Ascending Triangles or Descending Triangles provide unique opportunities by signaling a buildup of energy before a breakout. These patterns form as buyers and sellers become increasingly decisive, often leading to an explosive price move once a key level is breached.- Example: An Ascending Triangle forming in an uptrend near a resistance level with high volume is a strong signal of a breakout. Measuring the height of the triangle and projecting it from the breakout point offers a potential price target, allowing traders to set informed profit levels.

-

Volume as a Confirmation Tool

Volume plays a crucial role in confirming the reliability of candlestick patterns. Increased volume during the formation of a pattern—such as a Bearish Engulfing—can indicate stronger market commitment and enhance the signal’s reliability.- Example: A Bullish Engulfing pattern at a support level, accompanied by rising volume, signifies that buyers are taking control, increasing the likelihood of a reversal.

-

Multi-Timeframe Analysis for Higher Accuracy

Using candlestick patterns across multiple timeframes adds another dimension to their effectiveness. Patterns on higher timeframes, such as daily or weekly charts, often carry more weight, while shorter timeframes like 5-minute charts can fine-tune entry and exit points.- Example: A Bullish Engulfing on a daily chart signals a potential trend reversal. When confirmed by a smaller timeframe, like an hourly Hammer, it provides a more precise entry point with reduced risk.

By considering these advanced interpretations, traders can better leverage Japanese Candlestick Patterns as part of a holistic strategy, enhancing both the timing and reliability of trading decisions.