ATR Bands by tSageHuz

- Indicators

- Nguyen Trung Khiem

- Version: 1.0

Here's a clearer, more organized description for the indicator:

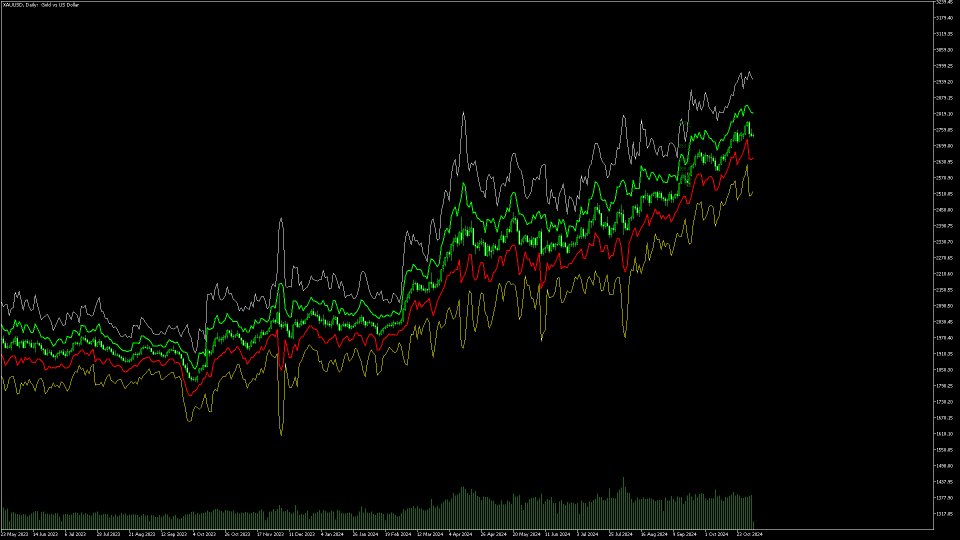

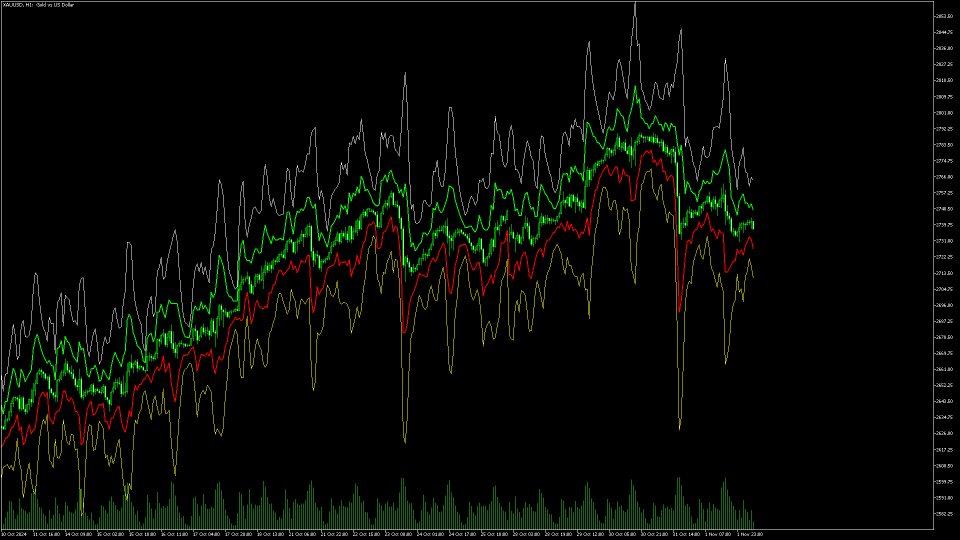

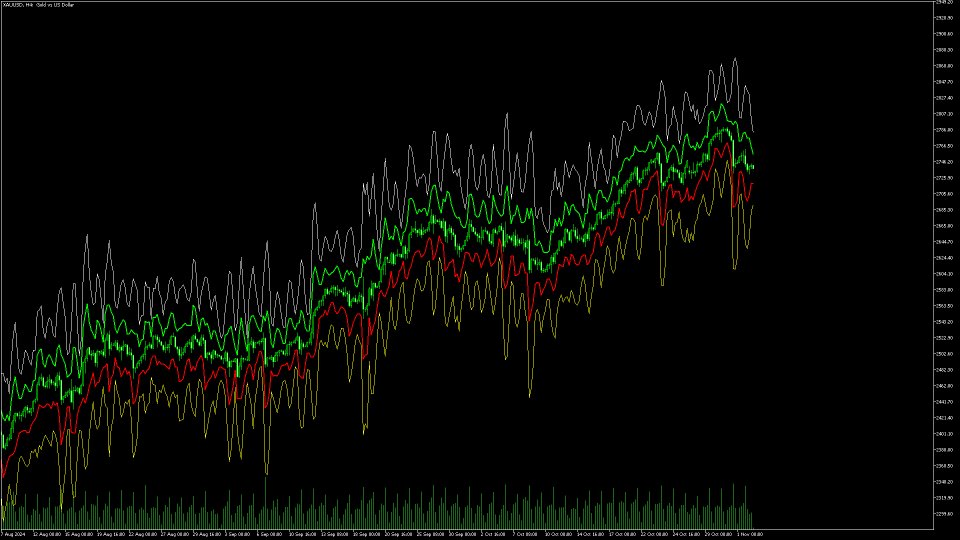

An enhanced ATR Bands indicator that provides flexible, configurable price bands based on Average True Range (ATR). While traditional ATR-based indicators often have limitations in their configurability and functionality, this version offers comprehensive features for both stop-loss and take-profit level calculations.

Key Features:

- Configurable source price (close, high, low) for ATR band calculations

- Adjustable scaling factors with decimal precision for fine-tuned bands

- Upper and lower bands displayed simultaneously

- Optional take-profit bands with independent scaling

- On-chart data table showing exact values and distances from close

- Compatible with non-chart timeframes

- Organized settings with helpful tooltips and common value suggestions

The indicator can help identify potential support/resistance zones, particularly during consolidation periods. When price breaks and closes outside the ATR bands, it often signals a significant move in that direction, making it useful for both standalone signals and confluence with other indicators.

Default Settings:

- ATR Period: 3 (updated from 14)

- Band Scaling Factor: 2.5 (updated from 2.0)

Based on the original work by AlexanderTeaH, with significant enhancements to improve usability and technical analysis capabilities.

Input Parameters:

- ATRPeriod (default = 3): Number of periods for ATR calculation

- ATRMultiplier (default = 2.5): Multiplier for ATR bands width

- ShowTPBands (default = false): Enable/disable Take-Profit bands

- TPScaleFactor (default = 1.5): Multiplier for Take-Profit bands Colors and Visualization:

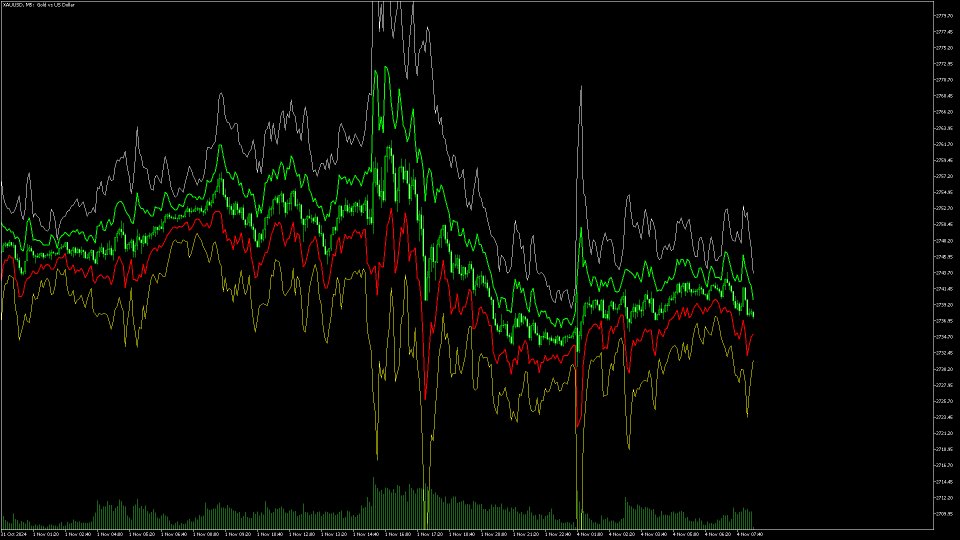

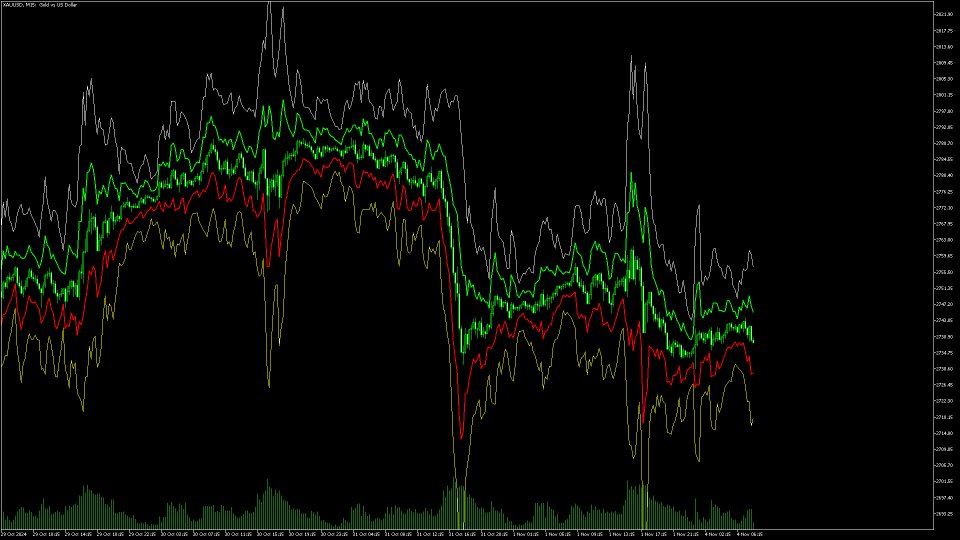

- Upper ATR Band: Green line (width 2) - Lower ATR Band: Red line (width 2)

- Upper TP Band: White line (width 1)

- only if ShowTPBands is true

- Lower TP Band: Yellow line (width 1)

- only if ShowTPBands is true

Basic Usage:

1. The ATR bands show volatility-based support and resistance levels

2. Upper Band (Green) = Potential resistance/short entry

3. Lower Band (Red) = Potential support/long entry

Trading Scenarios:

a) Long Position:

- Entry: When price approaches the Lower ATR Band (red line)

- Stop Loss: Below the Lower ATR Band

- Take Profit: At the Upper TP Band (if enabled)

b) Short Position:

- Entry: When price approaches the Upper ATR Band (green line)

- Stop Loss: Above the Upper ATR Band

- Take Profit: At the Lower TP Band (if enabled)

Common Settings:

- For less volatile pairs: Try ATRPeriod = 14, ATRMultiplier = 2.0

- For more volatile pairs: Try ATRPeriod = 3, ATRMultiplier = 2.5

- For aggressive trading: Lower ATRMultiplier (e.g., 1.5)

- For conservative trading: Higher ATRMultiplier (e.g., 3.0)

1. Combine with other indicators:

- Trend indicators (Moving Averages, MACD)

- Momentum indicators (RSI, Stochastic)

- Support/Resistance levels

2. Risk Management:

- Don't rely solely on the bands for entries/exits

- Always use proper position sizing

- Consider market conditions and news events

3. Optimization:

- Use the Strategy Tester to find optimal settings for your trading style

- Test different ATRPeriod and ATRMultiplier combinations

- Keep track of which settings work best for different market conditions