Volumetric Order Blocks MT5 Multi Timeframe

- Indicators

- Duc Hoan Nguyen

- Version: 2.22

- Updated: 8 March 2025

- Activations: 10

New tools will be $30 for the first week or the first 3 purchases!

Trading Tools Channel on MQL5: Join my MQL5 channel to update the latest news from me

The Volumetric Order Blocks Multi Timeframe indicator is a powerful tool designed for traders who seek deeper insights into market behavior by identifying key price areas where significant market participants accumulate orders. These areas, known as Volumetric Order Blocks, can serve as potential zones of support and resistance, providing an essential edge for informed trading decisions.

See more MT4 version at: Volumetric Order Blocks MT4 Multi Timeframe

See more products at: https://www.mql5.com/en/users/ndhsfy/seller

Core Features

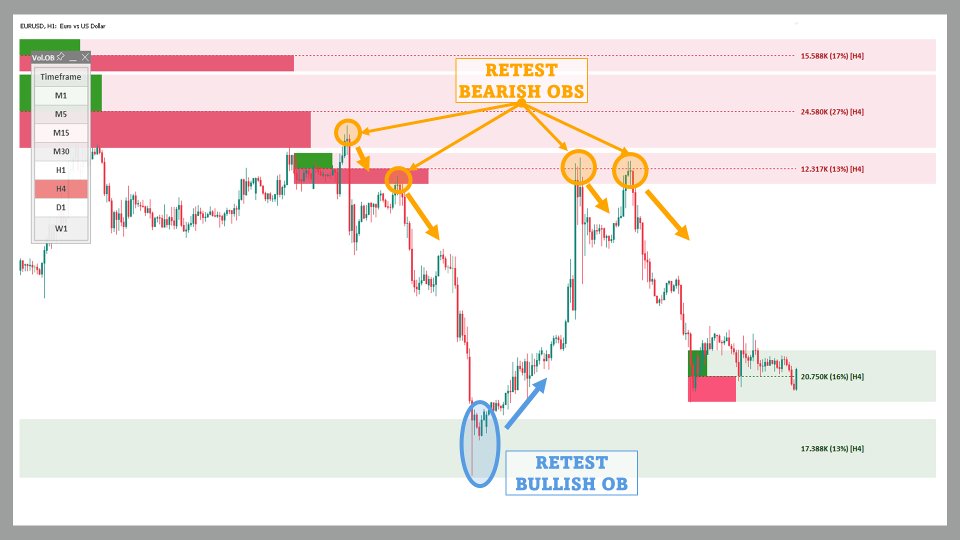

1. Automatic Detection of Volumetric Order Blocks

The indicator highlights significant price levels where buy or sell orders are accumulated, offering two distinct types:

- Bullish Volumetric Order Blocks: Typically located near swing lows and serve as potential support levels.

- Bearish Volumetric Order Blocks: Found near swing highs and act as potential resistance zones.

These highlighted areas disappear automatically once they are mitigated, streamlining the chart view and providing real-time clarity.

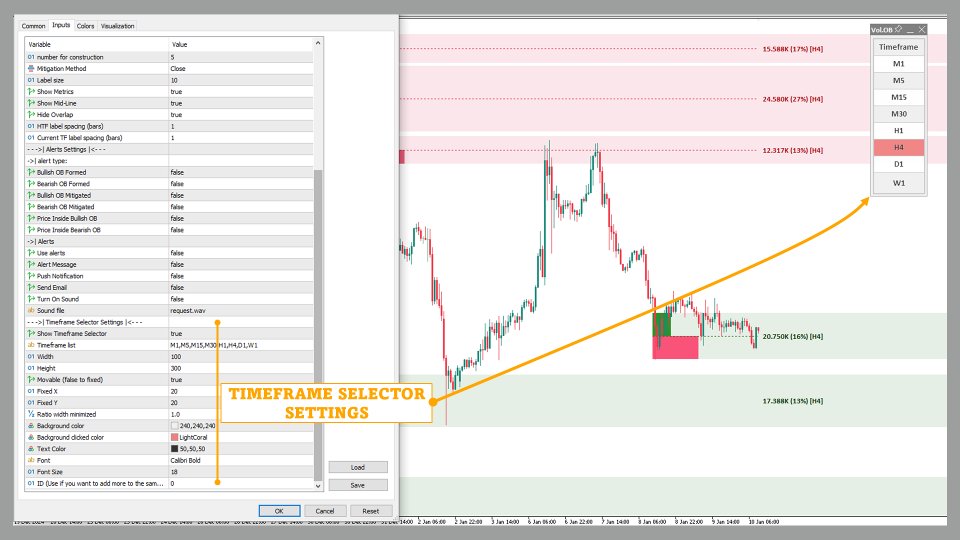

2. Customizable Settings for Advanced Users

- Length Setting: Users can display longer-term Volumetric Order Blocks by adjusting the Length setting, which controls the swing point detection lookback period.

- Hide Overlap: To maintain a clean chart, users can enable the Hide Overlap feature, ensuring that if two order blocks overlap, only the most recent one is displayed.

3. Breaker Blocks for Enhanced Analysis

Breaker Blocks are previous Volumetric Order Blocks that have been mitigated (broken by price). They remain on the chart to indicate potential support/resistance zones that could be revisited:

- Bullish Breaker Blocks: Disappear when the price moves above their upper boundary.

- Bearish Breaker Blocks: Disappear when the price moves below their lower boundary.

4. Internal Activity and Metrics for Deeper Insights

The indicator provides detailed information on internal market activity:

- Internal Activity Visualization: Highlights the bullish (green bars) and bearish (red bars) activity within the interval used to construct an order block. This helps users determine whether the activity aligns with the type of order block or if the market activity is balanced, signaling potential exhaustion points.

- Metrics Display: Positioned to the right of the order block, metrics indicate the total accumulated volume, helping traders assess the significance of an order block. A percentage display shows the volume contribution of each order block relative to the total volume on the chart, enabling quick identification of the most important zones.

5. Comprehensive Mitigation Methods

The Volumetric Order Blocks Multi Timeframe indicator allows users to select from different mitigation methods:

- Close: An order block is considered mitigated when the price closes beyond its extremities.

- Wick: Mitigation occurs when a price high (bearish block) or price low (bullish block) crosses the extremities.

- Average: The order block is mitigated when the price crosses its average level.

Built-in alerts notify users when an order block has been mitigated, providing timely updates for quick responses.

6. Multi-Timeframe Capabilities

The indicator supports displaying Volumetric Order Blocks from different timeframes on a single chart. For instance, traders can view 1-hour Volumetric Order Blocks on a 15-minute chart, maintaining the original price levels and volume data for accurate analysis.

The time location of Volumetric Order Blocks from different timeframes may vary when plotted on another chart. This behavior stems from how data is retrieved and displayed, allowing for comprehensive multi-timeframe analysis while acknowledging slight differences in visualization.

Conclusion

The Volumetric Order Blocks Multi Timeframe indicator is an essential tool for traders aiming to enhance their market analysis by pinpointing critical areas of order accumulation and understanding their potential impact on price movements. Its advanced features, such as breaker blocks, internal activity visualization, and multi-timeframe support, empower traders with the information needed to make confident trading decisions. Embrace this indicator to unlock a higher level of trading precision and insight.