Zenith Force

- Experts

- Jhonatan Rodrigo Reyes Ortega

- Version: 6.0

- Updated: 28 October 2024

- Activations: 10

Zenith Forcer

Is a powerful trading advisor that operates during news releases, reacting to the instant volatility in the EUR/USD pair. It utilizes a high-frequency strategy combined with strict risk management, incorporating a feature that adjusts position sizes based on a percentage of the account balance, enhancing profitability with a minimal deposit.

The EA leverages its high effectiveness in profitable positions to recalculate the lot size relative to the account balance, assuming greater risk but yielding higher returns.

Key Features

- Simplicity and Ease of Use: Zenith Forcer stands out for its easy setup and understanding, enabling any trader, regardless of their experience level, to quickly configure and grasp the underlying strategy. You don't need to be an expert in automated trading to benefit from this EA.

- Automatic Pending Orders: Places By Stop and Sell Stop orders at key points in the EUR/USD market, capturing significant movements without manual intervention.

- Advanced Risk Management: Customize lot sizes, Stop Loss, and Take Profit according to your preferences. With the new variable lot feature, the EA automatically adjusts the lot size based on a percentage of the account balance, improving risk control for each trade.

- Breakeven and Trailing Stop: Protect your profits by moving the Stop Loss to breakeven when the price moves in your favor. Additionally, the Trailing Stop adjusts dynamically to maximize potential profits in volatile markets.

- High-Frequency Strategy: The EA executes a high-frequency strategy designed to "capture" volatility caused by economic news. It reacts quickly to sudden market moves, closing positions at breakeven if the market reverses, protecting account capital.

- Margin Control and Order Validation: Monitors available margin and ensures all trades comply with the EUR/USD market limits, reducing the risk of operational errors.

- Adaptability to Multiple Markets: While this EA specializes in EUR/USD, its flexible strategy adapts to various market conditions within this pair.

- Trading Strategy

The Zenith Forcer strategy is based on the automatic placement of Buy Stop and Sell Stop pending orders at strategic points in the EUR/USD pair at a specific time. The EA manages open trades using customizable Stop Loss and Take Profit levels, along with a dynamic Trailing Stop that adjusts the Stop Loss as the price moves in favor of the trade.

The breakeven function ensures that the Stop Loss moves to breakeven once the trade reaches a certain profit level, protecting the gains. This strategy is designed to adapt to diverse market conditions, from volatile movements to prolonged trends in the EUR/USD pair.

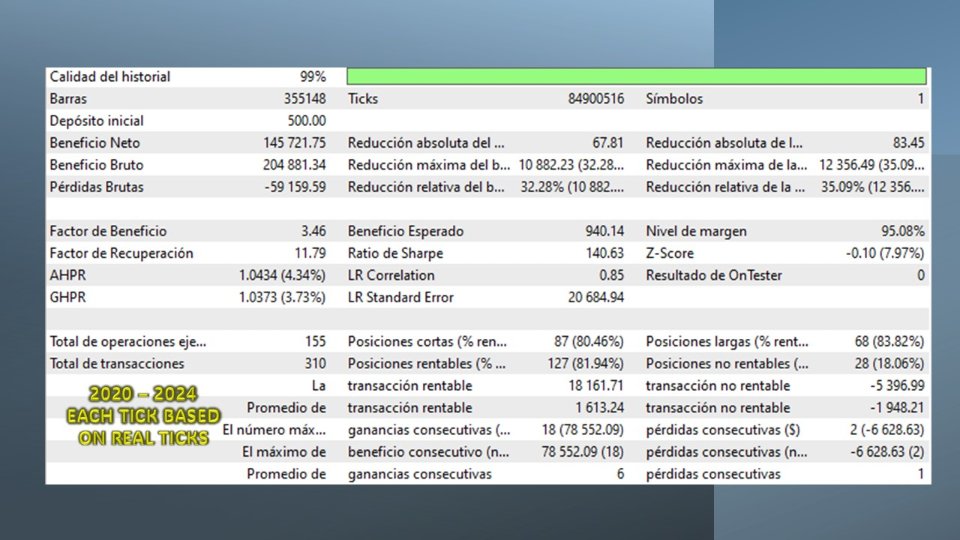

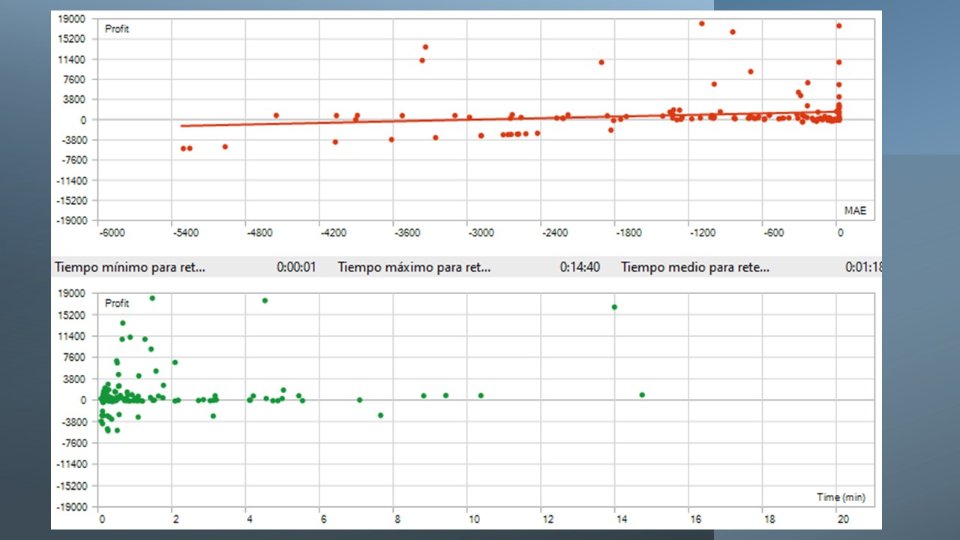

Backtesting Configuration Used

- Minimum Deposit: $200

- Risk Percent: The user should determine the desired risk; 95% was used in the shown results.

- Stop Loss: 110

- Trailing Stop: 60

- Trailing Step: 5

- Market Distance: 130

- Breakeven: 20

- Each trader should optimize the settings through quick optimization (genetic algorithm) from their MetaTrader 5 terminal to determine the best parameters for their broker.

Extensively Tested

Zenith Forcer has undergone rigorous stress and delay testing using historical data from 2010 to 2024 to verify the robustness and effectiveness of its strategy under various market conditions. These tests validate its ability to handle volatility, ensuring operational consistency.

| ZeinthPulse does not use ChatGPT, artificial intelligence, or any fictitious elements that some authors deliberately include in their descriptions. We recommend exercising caution against such misleading practices. This EA does not guarantee consistent profits nor ensures a 100% success rate. No system in the world can achieve this, and any claim suggesting otherwise has been manipulated. The developer operates exclusively with real accounts and systems, meaning it is normal to experience losses during certain periods. There is no intent to deceive users. To accurately assess the EA's performance, a 3 to 6-month observation period is recommended. |