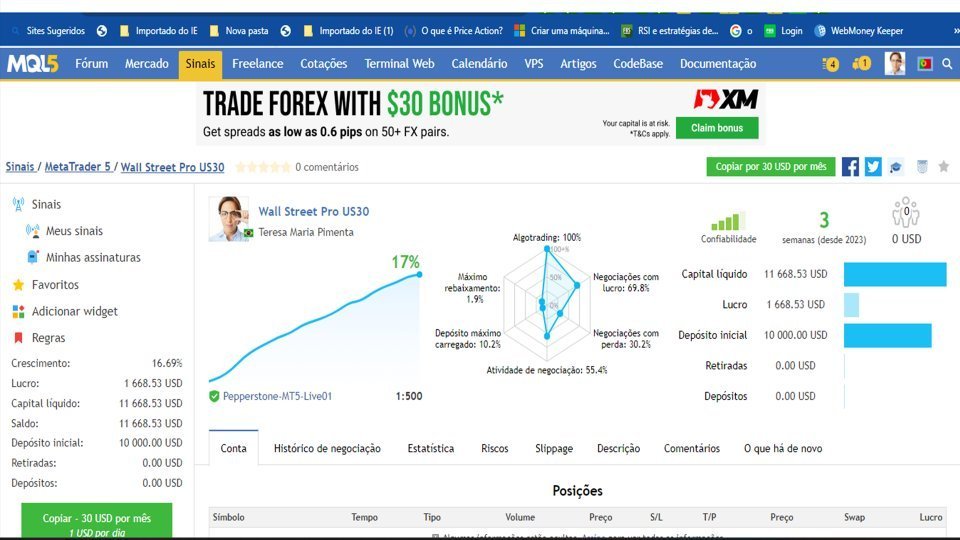

WAllstreet us30 Super Scalping

- Experts

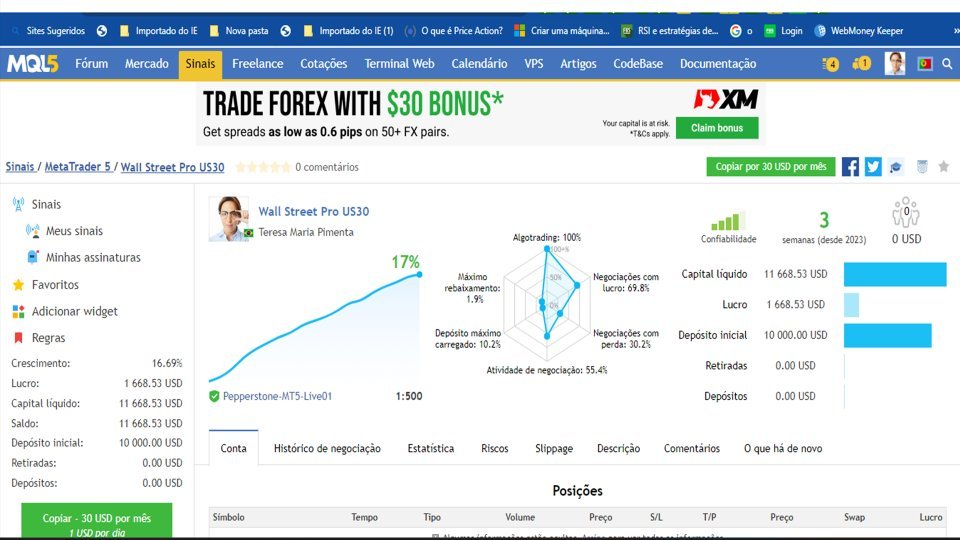

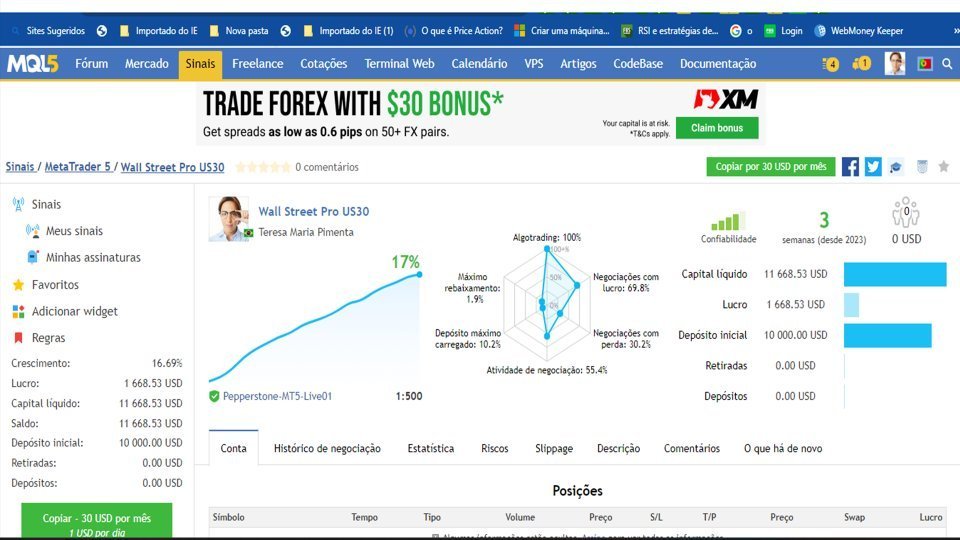

- Teresa Maria Pimenta

- Version: 1.0

- Activations: 10

Attention: Only Pepperstone Broker Hedge Account!

ONLY THIS BLACKFRIDAY

DE:2500 USD Por:950USD

OBS : If you have any problems doing the backtest, please contact us at check and we will help you configure an optimized setup for your OBS broker

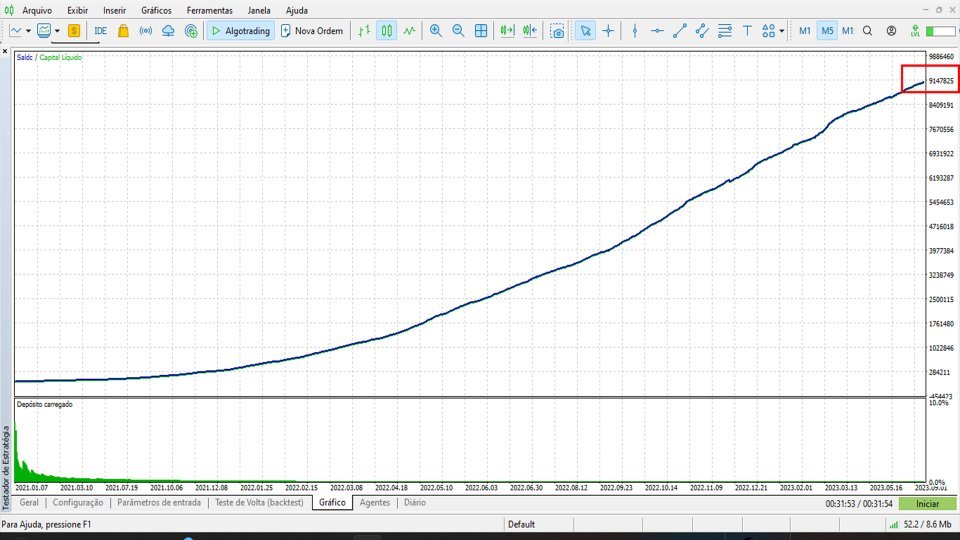

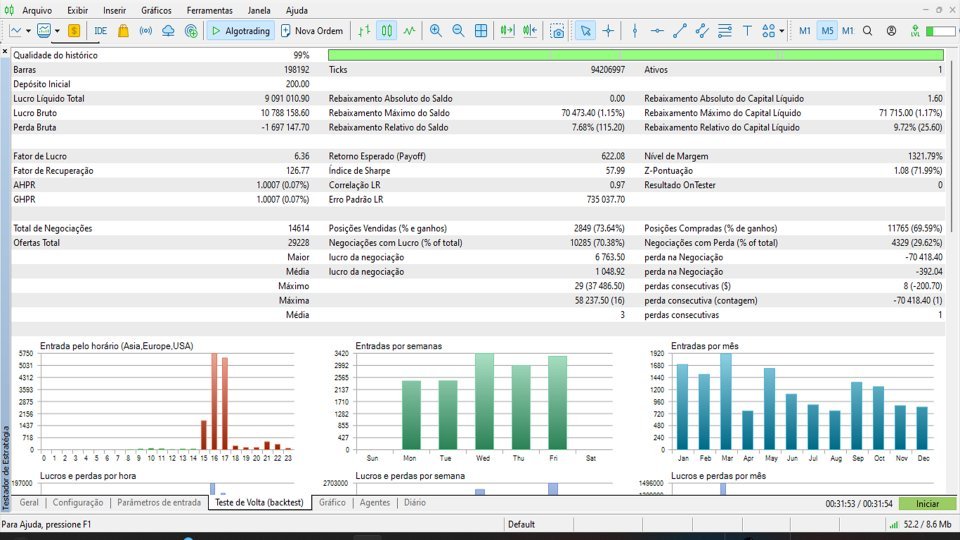

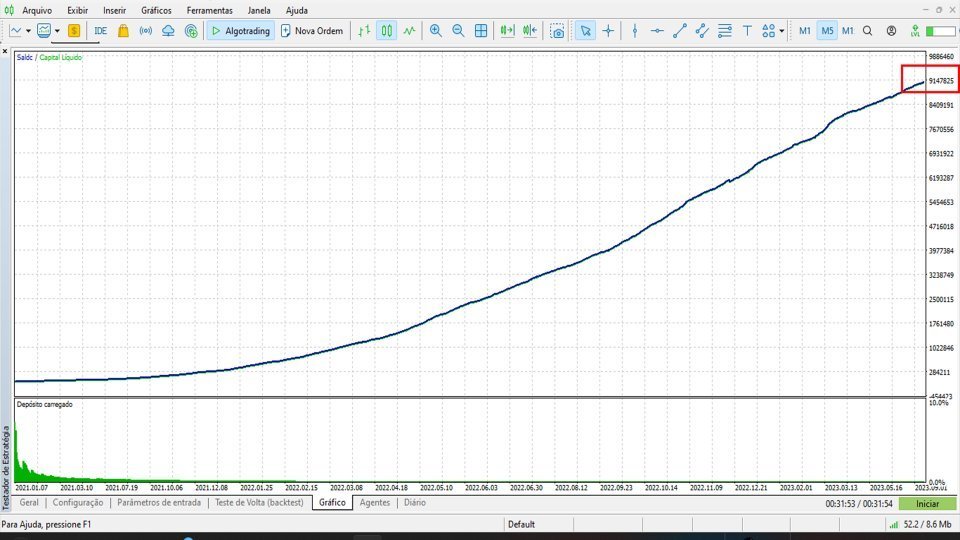

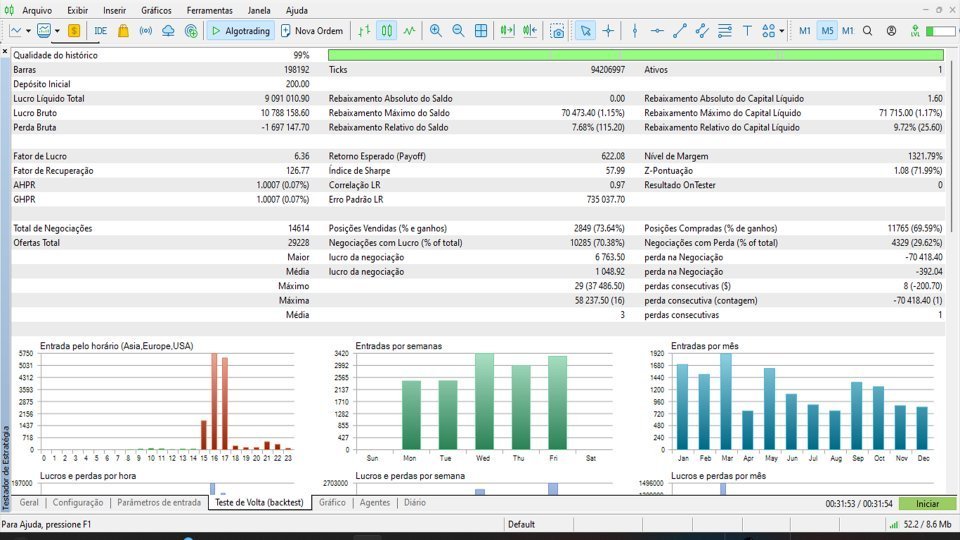

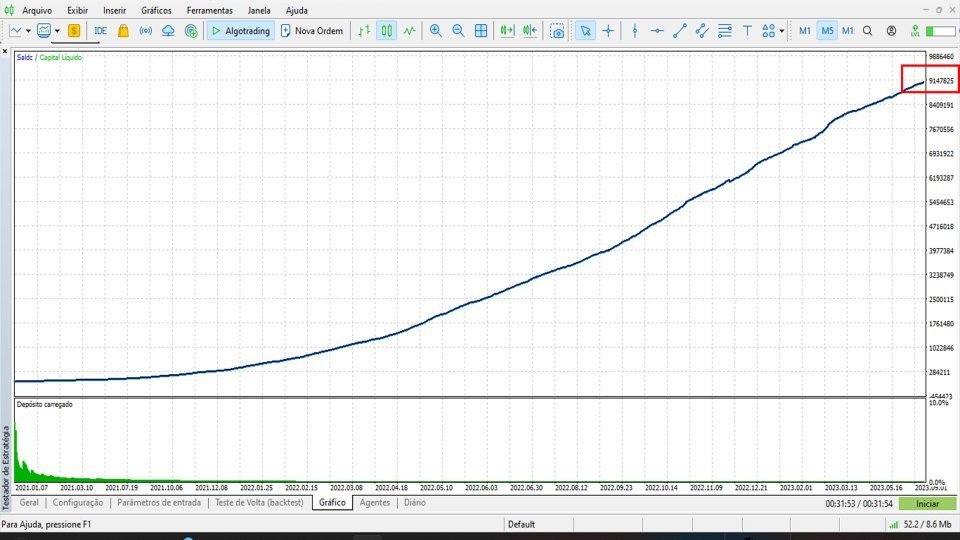

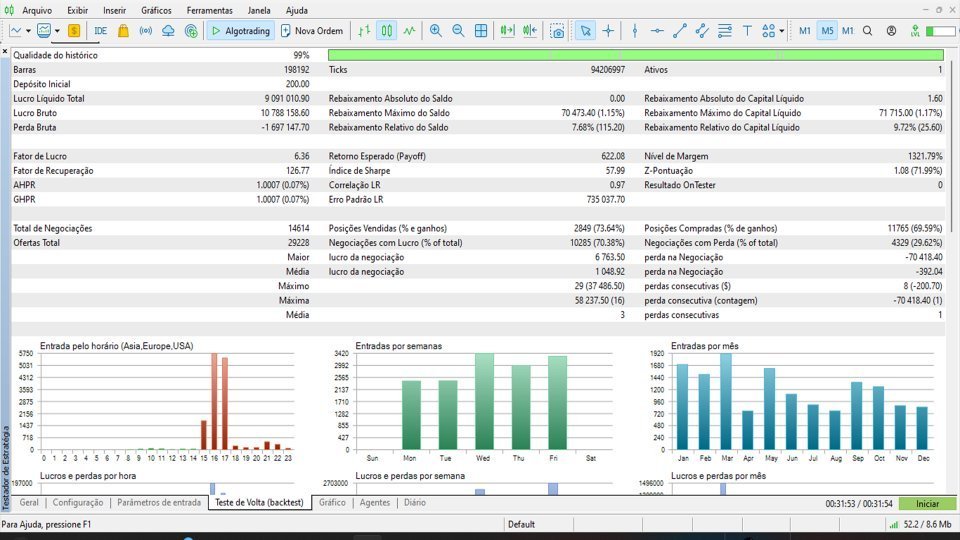

This expert is an experienced trader in the Wall Street US30 asset, who has a well-defined trading method and specific strategies to manage risk and maximize profit. He uses spread filters to find the best market entry and exit opportunities, as well as time filters to avoid trading during periods of higher volatility. Additionally, he uses custom indicators developed based on his own experience and knowledge to identify trends and trend reversal points. Risk management is a fundamental part of his trading method, and he uses stop-loss and take-profit orders to protect his investments and ensure that his profits are maximized. He also has a well-defined capital management plan, where he limits the size of his trades relative to his available capital, avoiding unnecessary risks.

The Wall Street Index US30 Expert Advisor is an automated trading system designed to exclusively trade the US30 asset on brokers with low spreads and low commissions. It utilizes neural networks to automatically adjust its smart pending orders, optimizing its results and covering stops and spreads. This system is a scalper, meaning it seeks small price variations to achieve consistent profits.

Ryan Jones Ratio:

The expert uses Ryan Jones Ratio rules as a risk management technique in his trading strategy. The Ryan Jones Ratio is a formula that helps determine the ideal position size for a trade based on the trading account size and desired risk level. This risk management technique can help limit losses and maximize profits by establishing a proper balance between position size and the associated risk level. The Ryan Jones Ratio is one of many tools that a trader can use to manage risks and improve profitability.

The conditions for using the Wall Street Index US30 Expert Advisor are as follows:

Recommended Broker: Pepperstone Account Type: Hedge Recommended Spread: between 20 and 30 Date Filter: optional Hourly Sessions Filter: optional, with adjustable start and end times Recover and Smarts Orders: used to adjust pending orders Virtual Stop: used to limit losses Neural Networks: used to optimize stop and spread coverage, with options for high or conservative risk Recommended Initial Balance: $1000 USD Time frames: M1 or M5 Highly Recommended:

It is highly recommended that users run the Wall Street Index US30 Expert Advisor on a demo account before using it on a real trading account. This is because each broker has its own rules for spreads and points, which can affect the system's accuracy. By running the system on a demo account, the neural networks can adapt to the specific asset conditions on the chosen broker, allowing the user to make adjustments to maximize the system's accuracy.

Using the demo account, the user can experiment with different settings and adjustments to optimize the system's performance according to the specific conditions of the chosen broker. This can help minimize risks and increase the security of their investments when they start using the system on a real trading account.

The Wall Street Index US30 Expert Advisor is a complete system designed for user capital safety, with features such as Recover and Smarts orders, virtual stop, and adaptable neural networks that help minimize risk and optimize results. By using the system on a demo account first, users can ensure they are using the system more accurately and safely before putting their money at risk in a real account.

Additional Information:

The Wall Street Index US30 Expert Advisor is a complete automated trading system that uses two different neural networks to help optimize results and manage risks. Each neural network has a different purpose and can be used for different risk profiles.

The first neural network is used to generate "Smarts" pending orders and optimize the trading results. This neural network helps determine the best time to place pending orders, automatically adjusting the price and size of orders according to market conditions. This helps maximize profits and minimize losses.