SupportResistance MT5

- Indicators

- MASTERBROK NEXUS SRL

- Version: 1.0

- Activations: 5

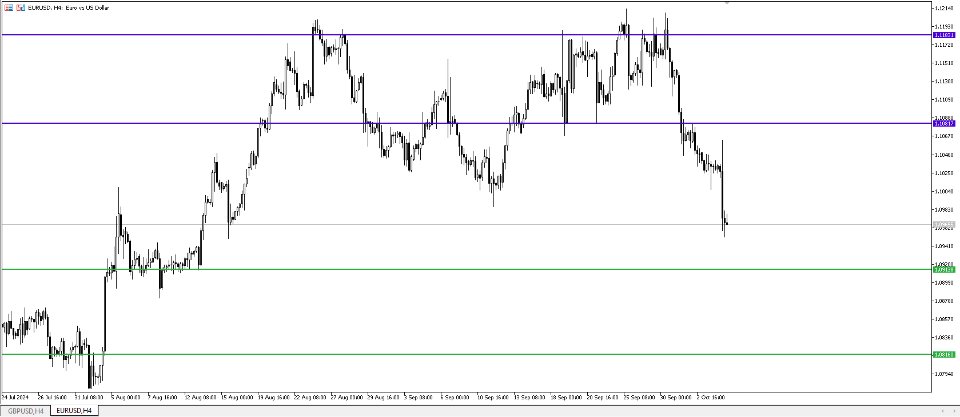

Support Resistance Indicator

The "Support Resistance" indicator is a versatile tool designed to help traders identify key support and resistance levels based on an underlying algorithm. These levels indicate price points where an asset historically experiences buying (support) or selling (resistance) pressure. The indicator allows traders to visualize these levels on their charts, making it easier to make informed decisions.

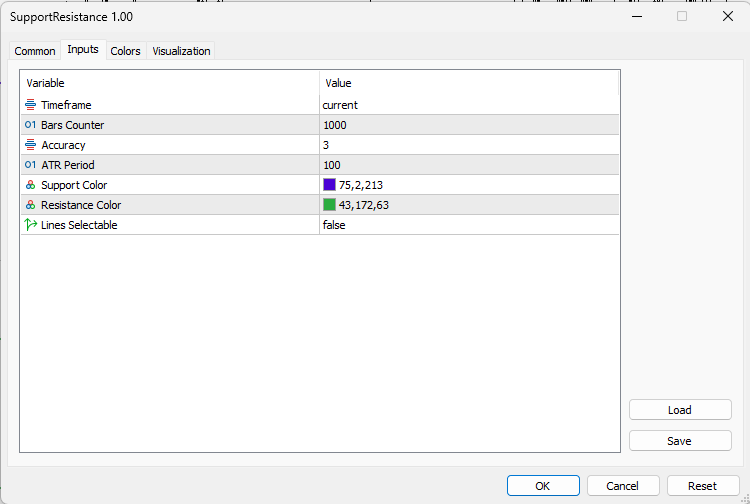

PARAMETERS:

-

Timeframe:

Users can select the desired timeframe for the support and resistance levels. The indicator will adjust accordingly, allowing traders to analyze multiple timeframes for better decision-making. -

Bars Counter:

Specifies the number of bars used to calculate the support and resistance levels. This parameter allows flexibility in how far back the algorithm considers price action data. -

Accuracy:

Traders can adjust the accuracy of the support and resistance levels using a scale from 1 to 5. A setting of 1 provides lower accuracy with broader levels, while a setting of 5 gives highly precise levels based on stricter conditions. -

ATR Period:

The Average True Range (ATR) is used within the algorithm to assess market volatility. The ATR period parameter lets users define the period for this calculation, which impacts how sensitive the support and resistance levels are to market movements. -

Support and Resistance Colors:

Customizable colors for support and resistance lines allow users to differentiate them clearly on their charts. Choose any color that fits your preference or chart theme. -

Lines Selectable:

This option determines whether the support and resistance lines are selectable (true) or non-selectable (false). When lines are selectable, traders can interact with them on the chart, providing more flexibility in adjusting or analyzing levels.

This indicator is ideal for traders looking to identify critical levels of price action where reversals or breakouts could occur. It combines flexibility with powerful algorithmic insights to enhance technical analysis and decision-making.