Forty Five EA MT5

- Experts

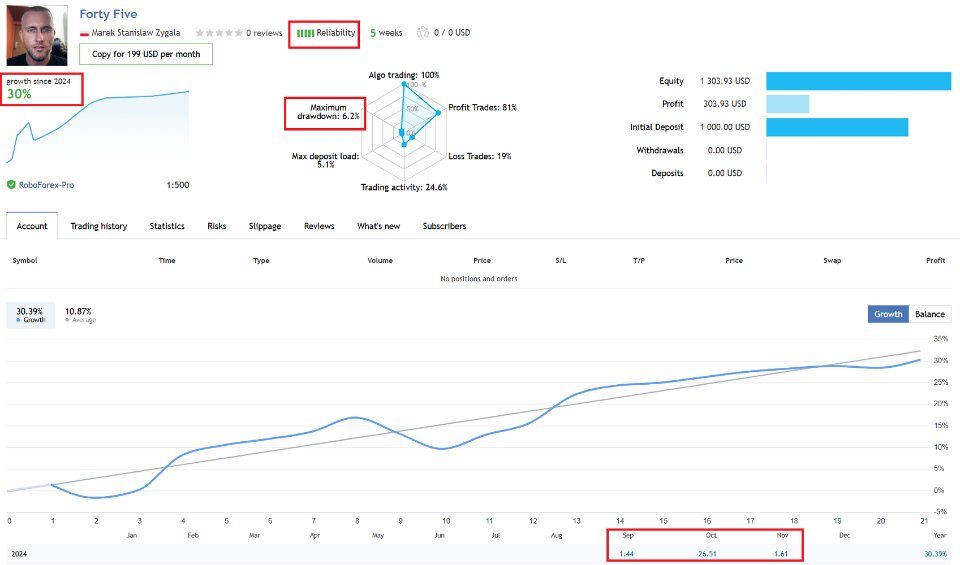

- Marek Stanislaw Zygala

- Version: 1.31

- Updated: 1 November 2024

- Activations: 20

My journey into developing the 45 Expert Advisor began with a profound appreciation for the power of mathematics in navigating the complexities of the financial markets. Inspired by the groundbreaking work of Jim Simons, I recognized that a purely quantitative approach could offer a level of precision and consistency that traditional trading methods often lack. In a world where news and events bombard traders from every direction, creating noise and fostering emotional decision-making, the need for a system that remains detached and analytical has never been more crucial. Simons demonstrated how leveraging advanced mathematical models and statistical analysis can uncover patterns and opportunities that remain invisible to the human eye. His success with Renaissance Technologies stands as a testament to the effectiveness of mathematical strategies in forex trading. However, I acknowledge that the specific trading methods and strategies employed by them are proprietary and not replicable, much like the secret recipe of Coca-Cola. While his strategies are legendary, I want to emphasize that 45 is a unique creation, born from my own insights, knowledge and experience. By adopting a mathematician's mindset, 45 operates with cold, calculated precision, ensuring that every trading decision is grounded in data and rigorous analysis rather than fleeting emotions or subjective interpretations. 45 is a sophisticated Forex trading system operating on a carefully selected basket of the following symbols: AUDJPY, AUDUSD, GBPAUD, GBPJPY, and NZDJPY. These pairs were strategically chosen not only for their diverse characteristics and market behaviors but also because they are particularly well-suited for a mathematical trading approach:

- USDJPY and NZDJPY offer exposure to the Japanese Yen, providing opportunities in a market known for its liquidity and volatility

- AUDUSD provides access to a commodity-linked currency pair, reflecting the economic activities of Australia and the United States

- GBPAUD and GBPJPY allow trading opportunities linked to the British Pound, offering unique movements due to geopolitical and economic factors

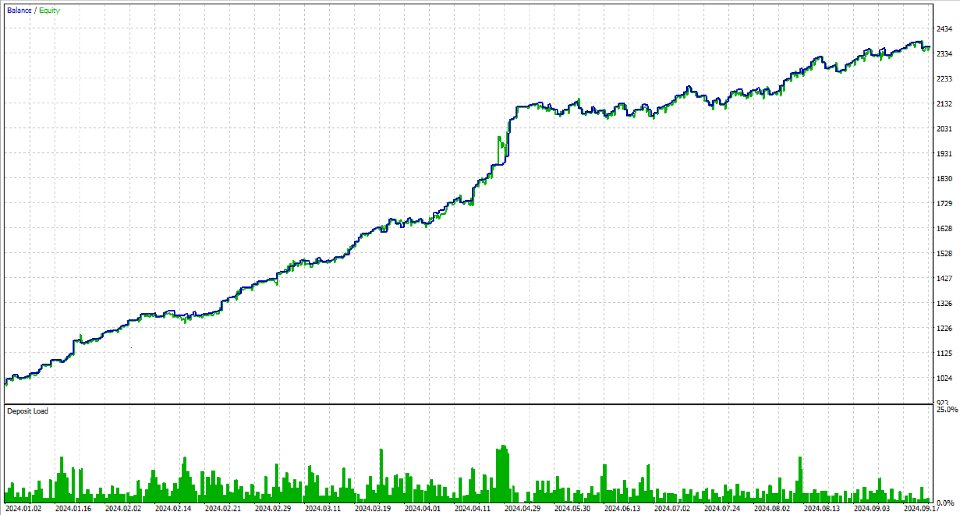

By employing this multi-symbol strategy, 45 adapts to diverse market conditions, utilizing a blend of advanced mathematical models and statistical analysis. The EA's strength lies in its ability to integrate trend-following, momentum, and mean-reversion strategies, each tailored to the specific characteristics of the traded pairs. It offers a dynamic approach to capturing market opportunities, with the flexibility to execute both quick scalps and multi-day positions as market conditions dictate. I believe 45 sets itself apart in the competitive world of algorithmic trading by providing a powerful combination of diversification and specialized trading tools, executing trades with precision and reliability. Its track record of maintaining reliable performance across multiple currency pairs makes it an attractive option for traders seeking a comprehensive and dependable automated trading solution. The robot has very simple and easy to understand inputs therefore there is no need for a manual.

Main Features:

- Tailored multi-pair strategy focusing on 5 specifically chosen currency pairs to maximize opportunities

- Customized mathematical models fine-tuned to the behavior and dynamics of each individual pair

- Comprehensive risk management system with precise control over trade exposure

- Flexible trading approach that adjusts to varying market conditions for optimized performance

- Designed to detect and leverage subtle market inefficiencies with a high degree of accuracy

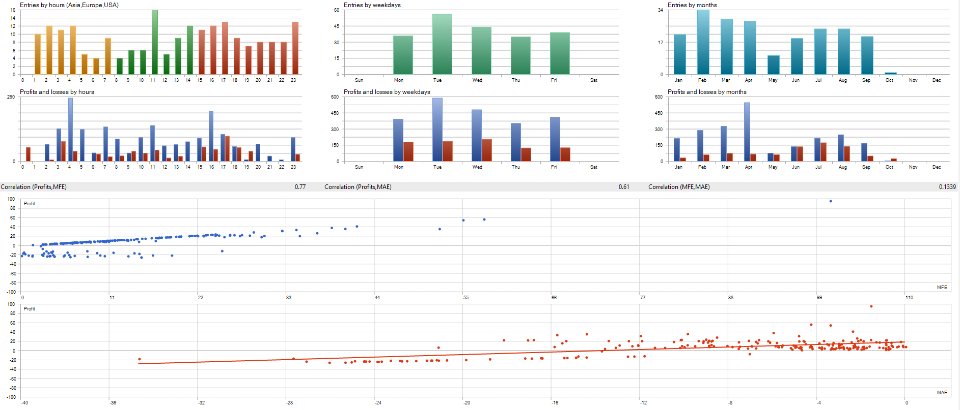

- Continuous engagement in all major trading sessions to ensure no opportunity is missed

Strategies Incorporated:

- AUDJPY: Utilizes quantitative trend analysis with exponential moving averages from Ichimoku, applying momentum and volatility thresholds derived from statistical analysis of RSI and ADX historical data

- AUDUSD: Combines trend detection via moving average crossovers, volatility assessment using Bollinger Band width, and mean reversion potential based on deviations from Fibonacci levels

- GBPAUD: Employs a momentum-driven model using statistical thresholds for Stochastic and RSI, combined with a trend strength filter derived from ADX, optimized through machine learning techniques

- GBPJPY: Features an adaptive trend-following system using dynamic time series analysis based on Ichimoku and moving averages, with volatility-adjusted position sizing informed by Bollinger Bands

- NZDJPY: Utilizes a mean-reversion model with statistical analysis of price deviations via Bollinger Bands and momentum oscillations through RSI, complemented by trend phase identification using MACD to optimize entry and exit points

Frequently Asked Questions:

Q: What chart should 45 be run on?

A: It is designed to be attached to a single chart - specifically, the AUDJPY H1 chart. All other symbols will be traded automatically.

Q: What type of account balance is recommended to start with 45?

A: While 45 can adapt to various account sizes, it is recommended to start with a balance that allows for adequate risk management, typically a few hundred dollars.

Q: Can 45 be used on a demo account before going live?

A: Yes, it is highly recommended to test 45 on a demo account to understand its behavior and performance before using it on a live account.

Q: Is there customer support available for 45 users?

A: Yes, I am available to assist users with setup, optimization, and any questions they may have about using 45.

Q: How does 45 handle different market conditions?

A: 45 employs adaptive strategies for each currency pair, allowing it to adjust to various market conditions and capitalize on opportunities as they arise.

Q: Will there be updates to 45?

A: Yes, regular updates are planned to ensure 45 remains effective and adapts to changing market conditions.

Additional Information:

While 45 is built on sophisticated mathematical models inspired by some of the most successful quantitative traders in history, please remember that past performance does not guarantee future results. Always trade responsibly and within your risk tolerance.

Still early days, but the backtest and demo results were good and the first week live has been profitable, exactly as expected. I hope it continues to perform this well for a long time. Very hard working and helpful developer!