DCA CycleMax

- Experts

- Jin Sangun

- Version: 2.1

- Updated: 2 November 2024

- Activations: 8

Introduction to DCA CYCLEMAX

Live Signal MT4: 여기를 클릭하세요

Overview

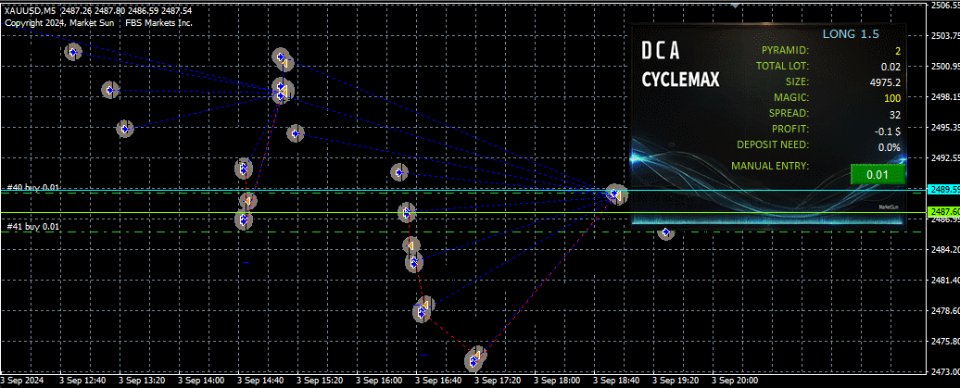

DCA CYCLEMAX is a powerful semi-automatic grid trading program (EA) optimized for assets that exhibit strong directional trends in the market.

It is especially effective for assets with high volatility and a steady directional trend, such as Gold (GOLD), Nasdaq 100 (NS100), and cryptocurrencies.

Using the DCA (Dollar-Cost Averaging) strategy, it manages loss risks over time while overseeing asset management.

This EA strategically designs entry intervals, opening multiple grid positions while the trend continues. It includes manual entry and manual take profit options as part of the process, automatically closing when the set target is reached.

For sideway markets, the DCA CycleMax EA can be used together with the DCA CycleMax Hedge EA, which operates in the opposite direction, for effective application.

DCA CYCLEMAX advances the grid trading system with specific entry counts, custom lot settings, and a hedging function to counterbalance short-term positions. This provides an enhanced solution beyond the usual DCA strategy.

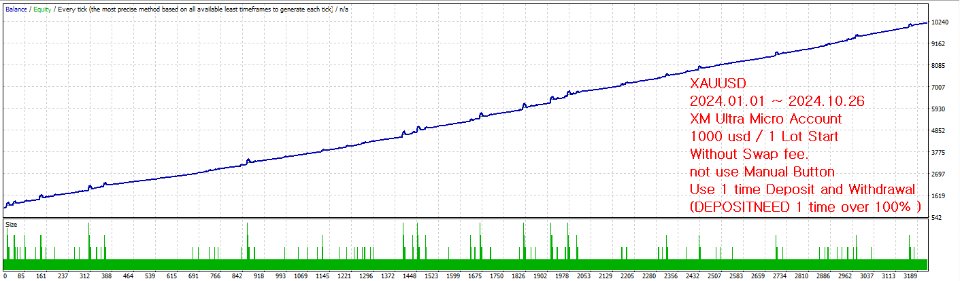

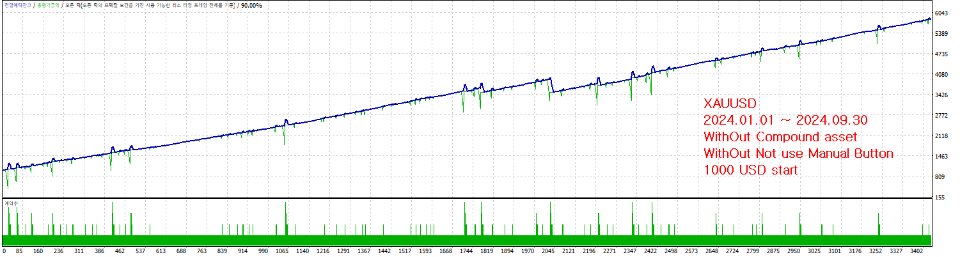

Gold, a high-volatility asset that tends to move in one direction over extended periods, is well-suited to the DCA CYCLEMAX's "DEPOSIT NEED" feature, which manages account assets and maintains positions continuously.

When price moves significantly in one direction, it rebalances assets and adjusts the average price, ensuring profits at the optimal timing.

The focus is on how frequently MAGIC is assigned to manage assets.

The calculations are set to limit MAGIC assignments to a maximum of 3; hence, drawdown in backtests is not of major significance.

Settings Guide

DCA CYCLEMAX offers a user-friendly interface and settings, making it easy for users with minimal EA experience to utilize effectively. Key settings include:

- Magic Number: A unique identifier for distinguishing positions managed by the EA. Multiple MAGIC settings allow for secondary and tertiary configurations.

- Lot Setting: Allows for lot size adjustment at each entry stage. For instance, initial lot size and subsequent entries can be customized to manage volatility.

- Entry Gap Setting: Sets the price gap between entry points, allowing fine adjustments to match asset volatility.

- Maximum Entry Count: Specifies the maximum number of entries based on asset risk and trading strategy, preventing excessive risk exposure.

- Hedge: After a specific round, this option automatically opens counter-positions to diversify risk and provide additional opportunities.

- DEPOSIT NEED: When risk reaches approximately 100%, this feature allows for additional funding, waiting for the best timing to take profits. Manage DEPOSIT NEED carefully to take advantage of repeated opportunities with the DCA strategy.

Recommended assets: GOLD, Nasdaq, Bitcoin

Timeframe: 5-minute chart

Recommended broker: Swap-free or micro account

Key Features

- Enhanced DCA Strategy: Based on the DCA strategy, DCA CYCLEMAX applies grid trading with entries at regular price intervals. This strategy effectively responds to temporary market reversals.

- Customizable Entry Lot and Staging: Each entry level can be set with different lot sizes, enabling progressive risk management from the first entry through the final entry.

- Hedging Strategy with Counter-Positions: After a certain number of rounds, the EA automatically opens counter-positions, minimizing loss and capturing opportunities, even in sudden market reversals.

- Target Price Setting: Automatically takes profit when reaching the target price set by the user, with additional opportunities for profit as the trend continues.

- Risk Management Functions: By setting the maximum number of entries, the EA prevents excessive position exposure, adjusting each lot size to finely manage risk.

- Manual Entry Integration: Merges automatic trading with manual intervention, allowing users to adjust or close positions manually if needed, aligning with the EA's automatic flow.

Benefits

- Effective Fund Management: The DCA strategy’s strength lies in lowering the average price by adding positions when prices fall, realizing profits faster when trends reverse.

- Time-Saving Automated Trading: Even without manual intervention, this EA maintains 24-hour automated trading, with additional options for managed manual entries.

- Applicable to Multiple Assets: Beyond trending assets like Gold, Nasdaq 100, and cryptocurrencies, it can also be applied easily to other preferred markets.

Ideal Users

- Beginner Traders: Simple to set up and operate, even for those with minimal trading experience, and does not require complex asset management knowledge.

- Professional Traders: A suitable tool for professionals looking to enhance asset allocation strategies and risk management, automating DCA to save time and resources.

- Trend-Focused Traders: Especially beneficial for those who prefer trading on assets with clear trends and high volatility, suitable for maximizing usage in trending assets.

Conclusion

DCA CYCLEMAX EA provides a solution for those seeking an automated trading system tailored to trend-following assets while incorporating manual control for enhanced risk management.

It’s easy to set up and run, and its customizable strategy meets the trading needs of each user, offering a tailored trading experience.

User didn't leave any comment to the rating