The Moving Average EA

- Experts

- Israel Pelumi Abioye

- Version: 1.0

- Activations: 10

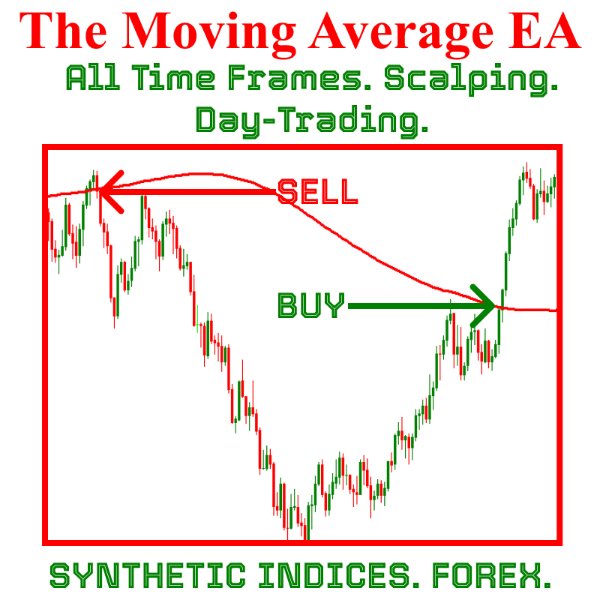

Introducing The Moving Average EA

The Moving Average EA is a flexible trading tool designed specifically for synthetic indices, while also working effectively with forex and other asset classes. Unlike many EAs that rely on fixed moving average settings, this EA allows users to fully customize their moving average parameters without needing any coding skills. Due to this flexibility, users can perform detailed backtests across different timeframes to identify the optimal settings that work well for each instrument.

The EA intelligently determines where to place the stop-loss based on market conditions, while allowing users to specify the Risk-Reward Ratio (RRR) for the take-profit level. It also allows users to set the percentage of their account balance they wish to trade per trade, offering even more precise control over risk management.

Additionally, users can control the number of trades within a specified period using the period separator feature in MT5. The period separator is determined by the selected timeframe. For timeframes from M1 to H2, the bars between two-period separators represent one day. Timeframes from H3 to H12 represent one week. On the D1 timeframe, the bars represent one month, and on any timeframe greater than D1, they represent one year. This feature allows traders to limit the number of trades within specific timeframes, ensuring more precise control over trade frequency. More explanations about this will be added to the video.

Benefits of the Moving Average EA

-

Avoids Choppy Markets

The EA limits you to specify the number of trades within a specified time period, helping you avoid trading in choppy market conditions that are unfavorable for Moving Average strategies. -

Precise Stop Loss Placement

It accurately determines where to set the stop loss, enhancing trade safety and risk management. -

Consistent Percentage Risk

Users can specify the percentage of their account balance to risk per trade, ensuring consistency in risk management despite fluctuations in the number of pips. -

Customizable Risk-Reward Ratio

The EA allows users to choose their desired risk-reward ratio, enabling tailored trading strategies that fit individual risk preferences.

Parameters:

- MA Mode: You can choose between different methods such as Exponential Moving Average (EMA), Simple Moving Average (SMA), Smoothed, or Linear Weighted.

- MA Price: Specifies which price point is used for the MA calculation, such as the closing price, opening price, high, low, etc.

- MA Period: The number of periods used in the Moving Average calculation. A higher number smooths out short-term fluctuations, while a lower number makes the MA more reactive to price changes.

- MA Time Frame: Allows users to select the time frame on which the Moving Average is applied, for example, M1 (1 minute), H1 (1 hour), or D1 (1 day).

- Total Trades: Determines the maximum number of trades that can occur between two period separators within the selected timeframe.

- Account Balance: Sets the account balance value that the EA will use when calculating the lot size and managing risk for each trade.

- Percentage to Risk: Allows users to specify the percentage of the account balance to risk per trade, helping to manage risk in a systematic way.

- Do you allow risk modification?: Enables the option for the EA to modify the risk parameters during live trading, giving flexibility in trade management.

- Do you allow trades to close for a new period separator?

- Unique Number: A unique identifier for trades placed by this EA, making it easier to distinguish between trades from different EAs or manual trades. you should make sure the unique number is different if you are to use it for the same symbol/asset but different timeframes. you can also change the unique number to refresh the EA.

- Risk-Reward Ratio (rrr): Defines the risk-to-reward ratio for each trade, impacting how the EA sets take-profit levels relative to the stop-loss, based on user-defined risk preferences.

- Max Profit: The Max Profit parameter works with the Period Separator to control trade entries based on the profit from closed trades within the defined time period. Once the EA is activated, it monitors the total profit of closed trades during that period. If the total profit from closed trades reaches or exceeds the target set by the Max Profit (e.g., $10), the EA will not enter any new trades for that period, regardless of whether the period has ended or not. Importantly, the EA does not consider the profit of any currently open trades when making this decision.

Recommendations:

- It is highly recommended to use a MT5-VPS to ensure the EA operates continuously 24/7, and to avoid missing winning trades.

- It is highly recommended to risk a maximum of 2% per trade.

- It is highly recommended to have different Unique Number for different EA settings.

- After innitializing the EA, it is recommended to manually add the moving average indicator using the same ea setting as used for the EA on you MT5 to monitor the EA effectively.

- During backtesting with the MT5 strategy tester, make sure the time frame for the strategy tester is the same with the " MA Time Frame" parameter.