Dobiforex AI Service

- Utilities

- Fazel Ghasem Rezaei

- Version: 1.2

- Updated: 28 September 2024

- Activations: 5

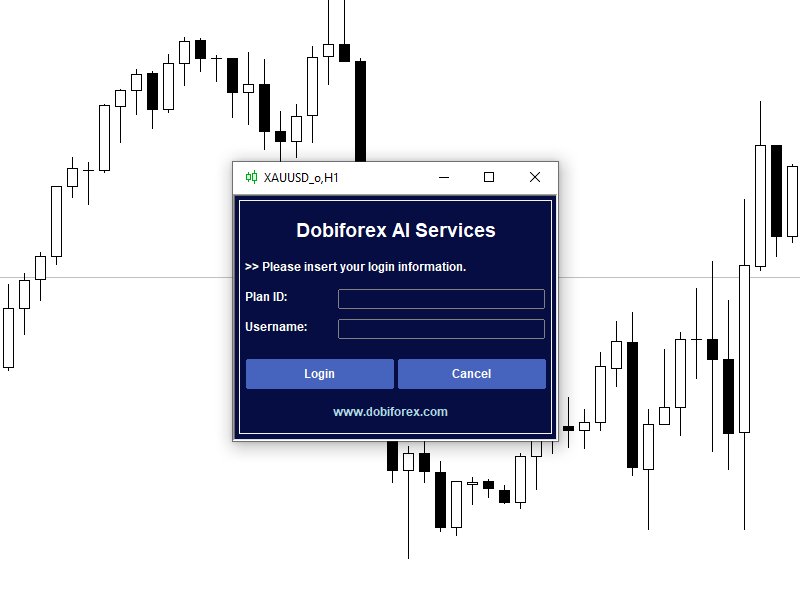

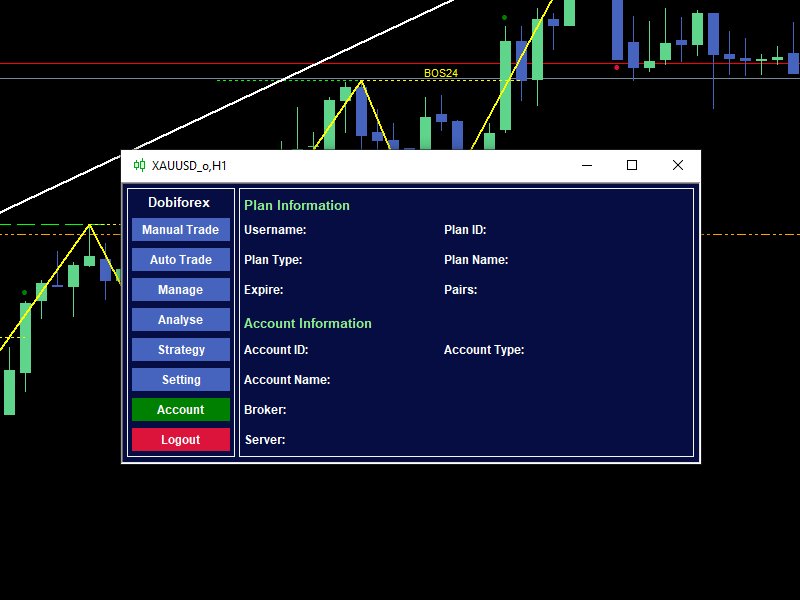

Dobiforex AI Service is a specialized platform offering smart trading assistance for forex traders. This assistant leverages advanced real-time market analysis to help traders make more informed decisions in their trading strategies. By signing up on the Dobiforex website and accessing their dedicated panel, users can integrate this intelligent service into their trading platform. Dobiforex, using advanced algorithms and machine learning, processes market data in real-time, delivering accurate and reliable trading signals. This powerful tool enables traders to capitalize on market fluctuations smartly while optimizing their trading risks.

Powered by AWS Amazon

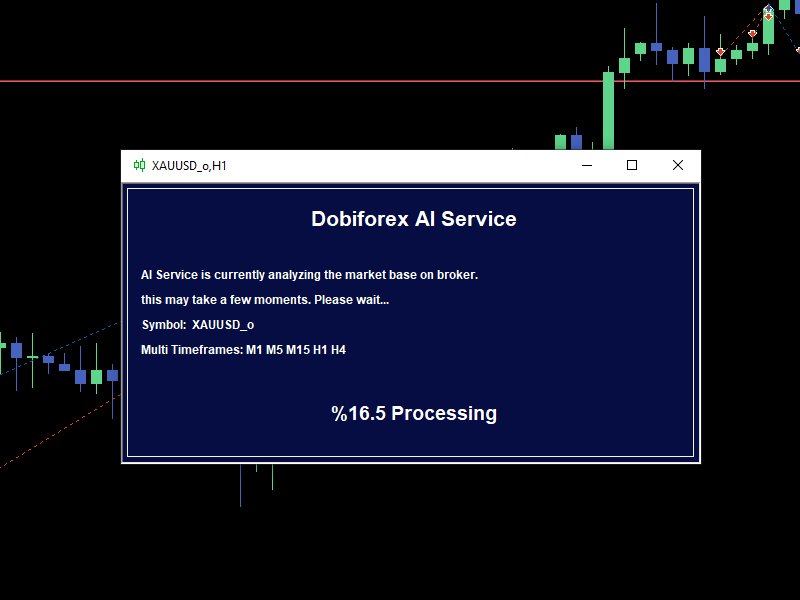

This trading assistant, powered by Amazon's AWS cloud services, utilizes advanced computational infrastructure to process and analyze trading data in real-time. By leveraging AWS, this tool can handle large-scale financial market data with high accuracy and speed. One of the standout features of this trading assistant is its use of real-time machine learning techniques. This technology enables the system to quickly identify hidden patterns in the data and, using sophisticated algorithms, provide highly accurate predictions of market movements. With each new analysis and data input, the machine learning models continuously improve, optimizing performance in delivering trading signals. This allows traders to make smarter, real-time decisions and enhance their trading strategies for better results.

What is AI service?

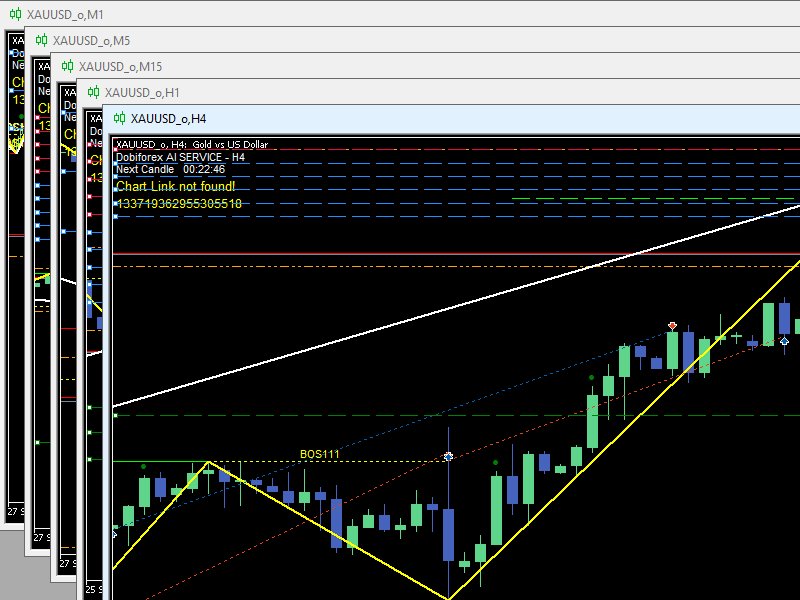

A trang assistant from DobiForex is an Expert Advisor (EA) designed to run on the MetaTrader 5 (MT5) platform on users' personal systems. This EA includes multiple menus and submenus, enabling users to perform advanced market analysis and execute trades in the Forex market. It’s important to note that DobiForex is not a broker or financial service provider, but rather a smart software solution offering advanced trading tools, helping traders make more precise and efficient decisions in the financial markets.

Why should we use a trading assistant?

Using a trading assistant in trading offers numerous benefits that help traders improve their performance and reduce risks. Some key reasons for using a trading assistant include:

Quick and Accurate Analysis

Trading assistants can quickly analyze market data using advanced algorithms, providing traders with reliable signals. This saves time and improves the accuracy of decision-making.

Eliminating Emotional Trading

One of the biggest challenges for traders is letting emotions like fear or greed influence decisions. Trading assistants operate purely based on data and predefined strategies, preventing emotional decision-making.

Automated Trade Execution

With a trading assistant, trades can be executed automatically based on set strategies, even when the trader is not actively monitoring the market. This ensures trades are executed efficiently and on time.

Optimized Risk Management

Trading assistants offer advanced tools for managing risk, such as setting precise stop losses and take profits, helping traders minimize potential losses.

Access to Advanced Strategies

Many traders lack the time or experience to implement complex strategies. Trading assistants enable users to apply sophisticated strategies without needing deep expertise.

Real-time Market Response

Markets change rapidly, and traders may struggle to keep up. Trading assistants continuously monitor the market and can quickly respond to changes.

In summary, using a trading assistant allows traders to manage their trades more efficiently, accurately, and without emotional interference.

AI Service Sections:

- Manual Trading

This section of the DobiForex assistant is designed specifically for executing manual trades, where users can easily place their orders based on the analyzed data and suggestions provided by the assistant. Additionally, this section allows users to modify and customize their trade settings. Users can adjust various parameters such as trade volume, take profit, stop loss, and other settings according to their personal strategy and preferences, enabling them to manage trades with greater precision. This feature offers traders more flexibility to implement their own strategies alongside the intelligent recommendations of the assistant.

The assistant offers the ability to configure trades in both long and short positions, as well as for medium-term and short-term strategies. It also supports 8 practical and advanced trading methods, providing professional tools for a variety of trading styles. The manual trade offers the ability to configure trades in both long and short positions, as well as for medium-term and short-term strategies. It also supports 8 practical and advanced trading methods, providing professional tools for a variety of trading styles.

Single Entry (SE) Multiple Entry Fix Stop (MF) Reverse Martingle (RM) Hedge (HD) Trailing Open (TO) Multiple Entry Step Stop (MS) Continuse Martingle (CM) Hedge Trail Open (HT)

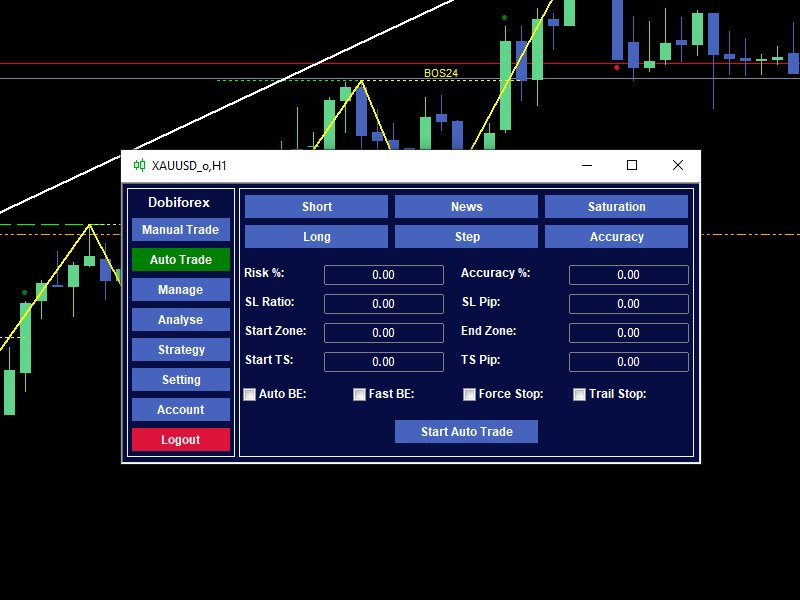

Automated Trading

In addition to its advanced manual trading capabilities, the DobiForex assistant also offers automated trading, designed specifically for short-term or scalping trades. When the Market Analyzer provides trade suggestions, the assistant automatically fills in the required parameters. Users can also customize these settings based on their strategies and preferences. This feature allows even less-experienced traders to benefit from real-time analysis, enabling them to execute short-term trades with greater accuracy and speed. Activating automated trading is quite simple, requiring the user to select a few key settings:

Trade Type: Choose between short or long positions based on market direction.Trade Entry Method: Define the entry method, such as key economic news, market exhaustion, price steps, or precise market zones.

- Management

This section is designed for group and manual management of orders or positions. Here, you can select specific orders or positions using various filters and then apply the desired management actions to them. Positions refer to open trades that are currently active, while Orders are pending trades that have not yet been triggered. Thus, positions involve ongoing trades, and orders are instructions waiting to be activated. Please note that certain operations, such as trailing stop-loss, can only be applied to active positions and not to pending orders. The Ticket Number of the selected orders and positions is displayed in the Experts tab at the bottom of the Metatrader screen in the Toolbox section.

Change Stop-Loss: Adjust the stop-loss level for selected trades.Change Target: Modify the take-profit target for active trades.Set Target Percentage: Adjust the percentage of the target based on the trade size or profit goal.Trend Martingale: Apply a martingale strategy based on market trends.Classic Trailing Stop: Enable a trailing stop that follows the price movements at a set distance.Instant Break-Even: Immediately move the stop-loss to the entry price, securing a no-loss position.Automatic Break-Even: Automatically shift the stop-loss to break-even when a certain profit threshold is reached.PNL Break-Even: Set the stop-loss to break-even based on profit and loss calculations.Step-Based Break-Even: Move the stop-loss to break-even according to price movement steps.Step-Based Trailing Stop: Enable a trailing stop that adjusts based on step movements in the market.Close Trades: Close selected open positions instantly.

Analysis

This section is dedicated to the market analyzer and is designed to process critical market data using artificial intelligence and powerful servers. Through advanced algorithms, technical patterns, support and resistance levels, the DobiForex assistant identifies the best trading zones and shows the user where the optimal entry signal is currently located. The analysis section includes two main parts:

Independent Analysis of Multiple Timeframes: This part analyzes the market trends and key levels from different timeframes, providing insights such as market direction (bullish, bearish, or neutral), entry and exit points, and the timing of new candle formations. It allows traders to assess the market from various angles to make informed decisions.Trading Signals for Short, Medium, and Long-Term Perspectives: Signals are generated based on different timeframes, market movements, and precise price levels. These signals allow traders to adapt their strategy for various market conditions and time horizons.

Strategy

This section allows traders to customize algorithms, chart patterns, structures, and levels so that the artificial intelligence in DobiForex can analyze the market based on these settings. The configurations in this section enable traders to implement their strategies according to specific needs or personal trading styles. Some functions are set as defaults and are mandatory, while others are utilized to enhance accuracy and rigor in confirmations and trade management. For example, traders can select which chart patterns (such as head and shoulders, triangles, etc.) and analytical algorithms (like moving averages, Elliott Wave, etc.) should be involved in market analysis. To visually display these strategies on the chart, you can activate their visibility through the settings menu during analysis. For a complete understanding of each of these methods, please refer to the tutorials section on the DobiForex website.

AI Fundamental Strategy Price Action ICT Strategy Wedge & Triangle Pattern double & tripple B/T Pattern Wave|Trend|CHOCH|BOS Range Movement Step Levels Smart Money Concept Strategy CScalp Strategy Pennant & Flag Pattern Rounding B/T Pattern Imbalance Triggers Range Pivot Point Levels Price Action Al Brooks Strategy FootPrint Strategy Cup & Handle Pattern Island Reversal Pattern Liquidity Profile Levels Doji & Long Bar Range Price Action Lance Strategy Volume fix range Channal Pattern Normal/Invert Hammer Pattern Order|Breaker Block Range Ichimoko & Parabolic SAR Range Price Action Woods Strategy OrderBook Strategy Rectangle Pattern Hanging Man Pattern Reg|Hid|Exa Divergence Range MA|RSI|AO|OBV|MACD Levels Price Action RTM Strategy Elliot Wave Strategy Head and Sholders Pattern Shooting star Pattern Mitigation & Inefficiency Range Percentage Price OSC Range

Settings

This section is designed for personalizing and configuring the needs of DobiForex. It includes default values that users can adjust according to their preferences and broker conditions.Currency Pair Settings: These settings assist traders in managing their trades more accurately based on the broker's conditions and market dynamics.

Risk Control: This is an essential part of the DobiForex settings, providing parameters that help traders manage their trading risks accurately and reliably.

Show/Hide: This section includes tools and indicators displayed on the chart, allowing users to activate or deactivate their visibility as needed.

Important Note:

You must download the main file through the official website. The listed price here is for the Essential plan. To access additional features and discounts, please visit the main website.